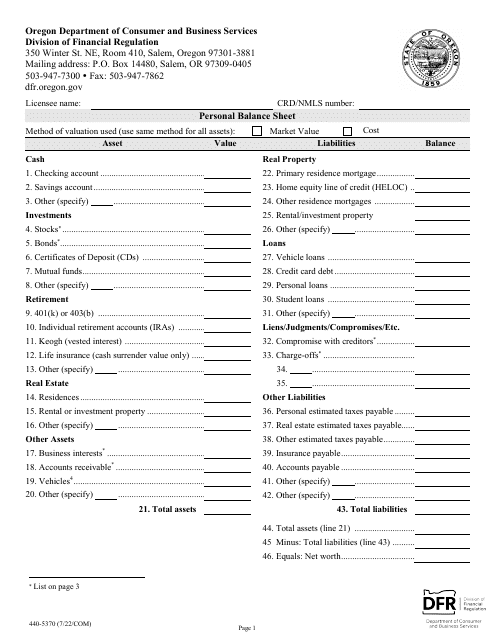

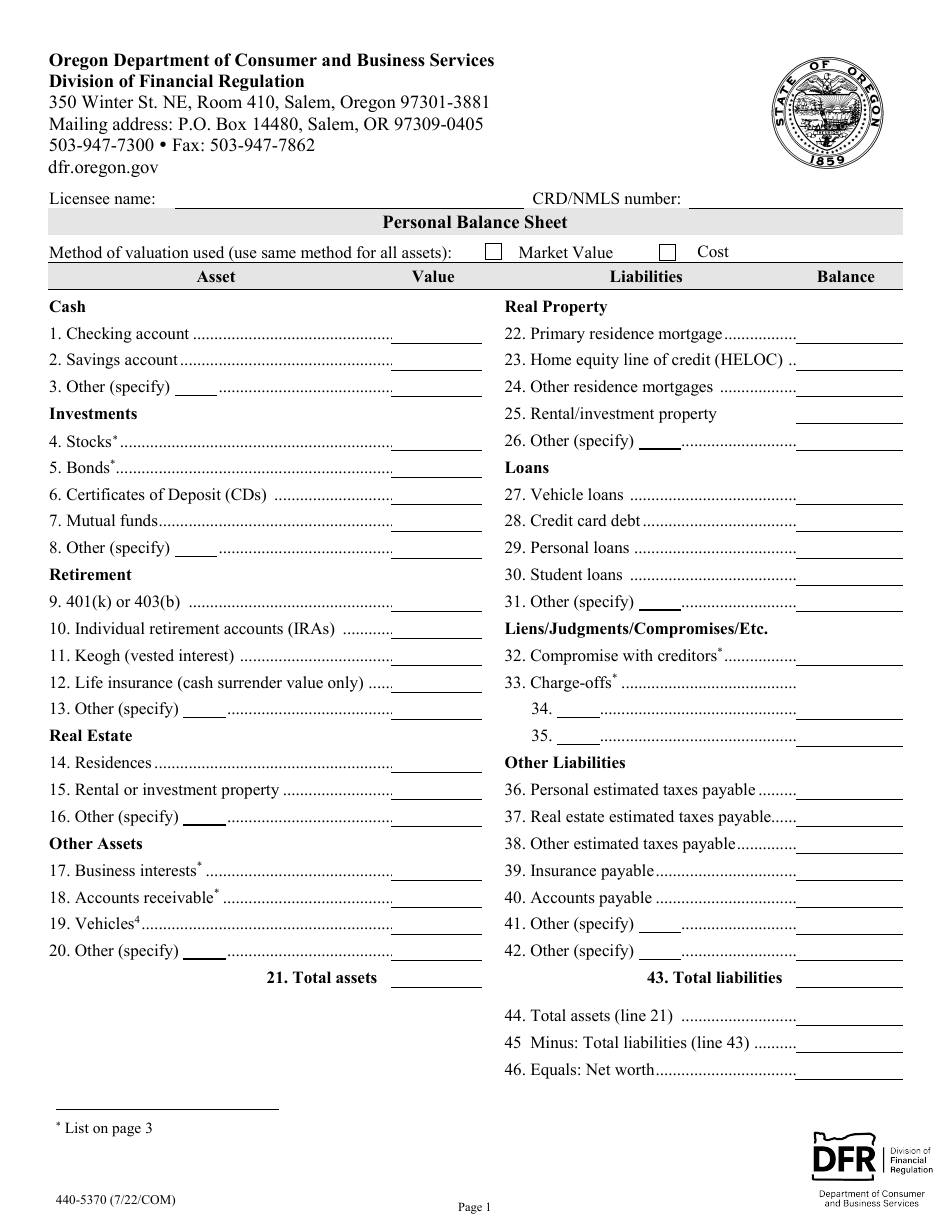

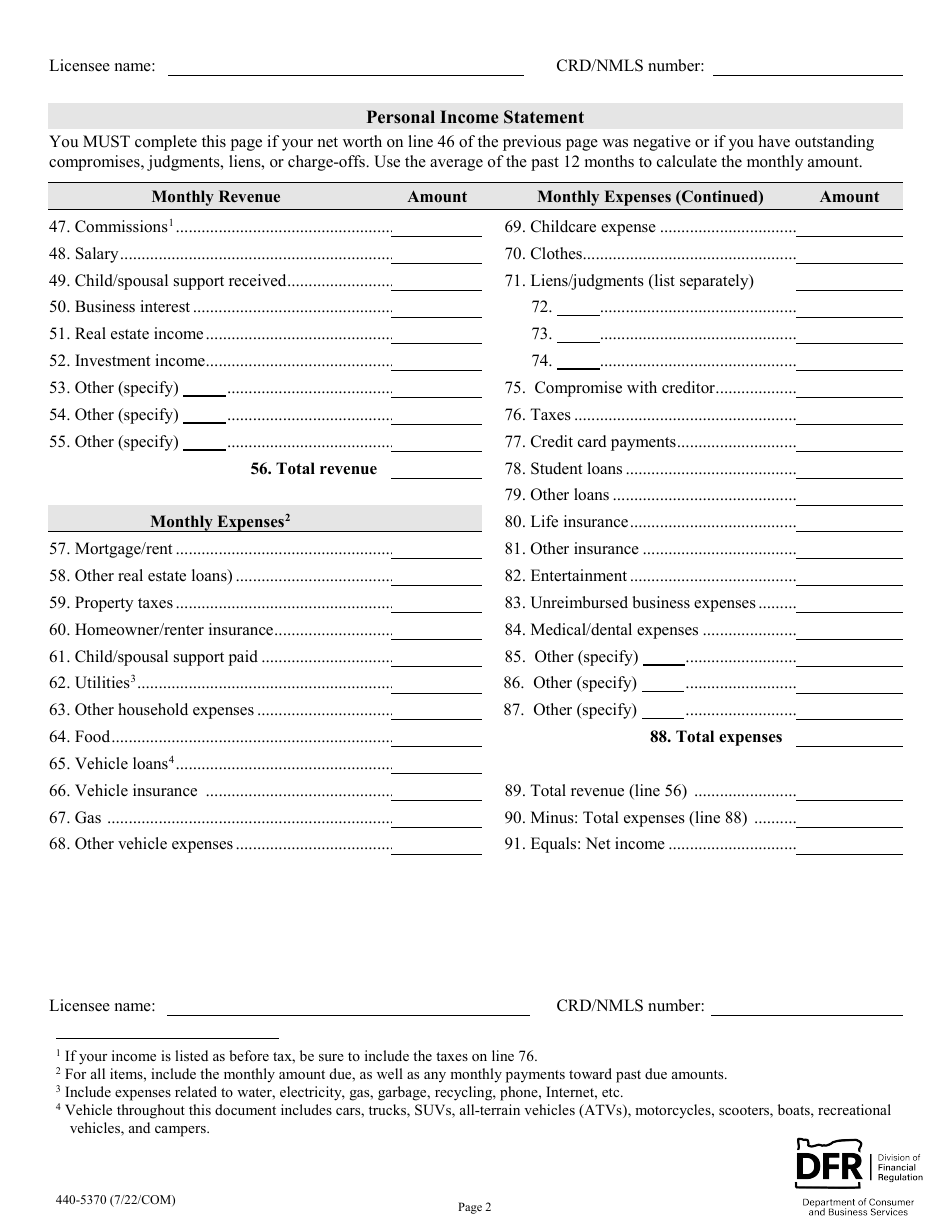

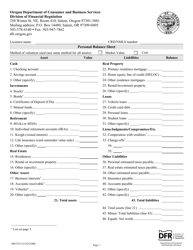

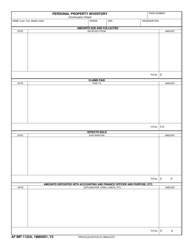

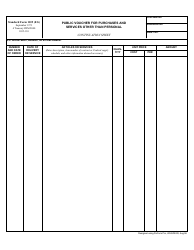

Form 440-5370 Personal Balance Sheet - Oregon

What Is Form 440-5370?

This is a legal form that was released by the Oregon Department of Consumer and Business Services - Division of Financial Regulations - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 440-5370?

A: Form 440-5370 is a Personal Balance Sheet.

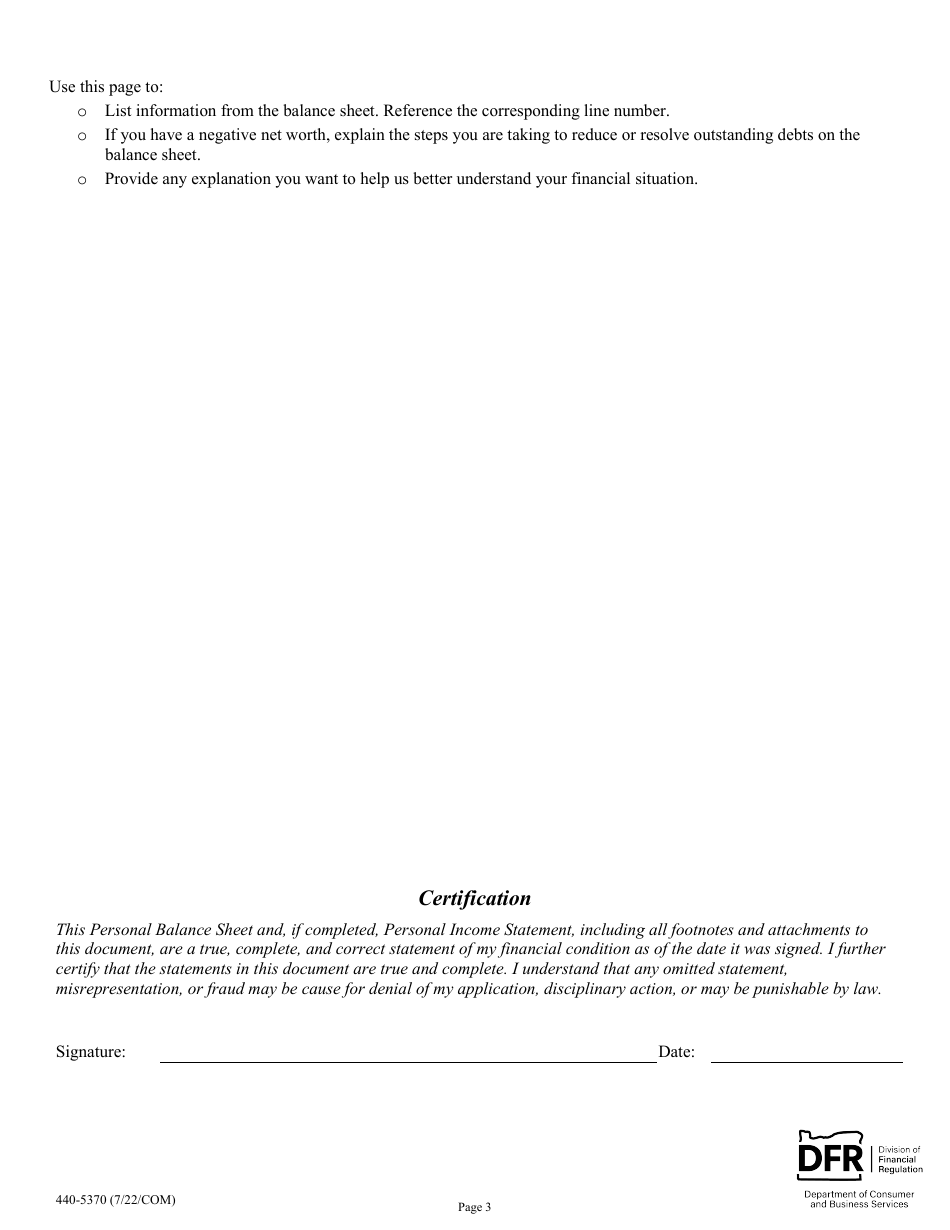

Q: What is a Personal Balance Sheet?

A: A Personal Balance Sheet is a financial statement that provides an overview of an individual's assets, liabilities, and net worth.

Q: Who needs to fill out Form 440-5370?

A: Individuals in Oregon who want to assess their financial position or apply for certain financial services may need to fill out Form 440-5370.

Q: Is Form 440-5370 specific to Oregon?

A: Yes, Form 440-5370 is specific to Oregon and is not used in other states.

Q: What information do I need to fill out Form 440-5370?

A: You will need to gather information about your assets, liabilities, and debts in order to fill out Form 440-5370 accurately.

Q: Is there a fee for submitting Form 440-5370?

A: No, there is no fee for submitting Form 440-5370.

Q: Do I need to file Form 440-5370 with my taxes?

A: No, Form 440-5370 is not required to be filed with your taxes.

Q: Can I use Form 440-5370 for business purposes?

A: No, Form 440-5370 is specifically designed for personal financial assessments and should not be used for business purposes.

Q: How often should I update my Personal Balance Sheet?

A: It is recommended to update your Personal Balance Sheet annually or whenever there are significant changes in your financial situation.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 440-5370 by clicking the link below or browse more documents and templates provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations.