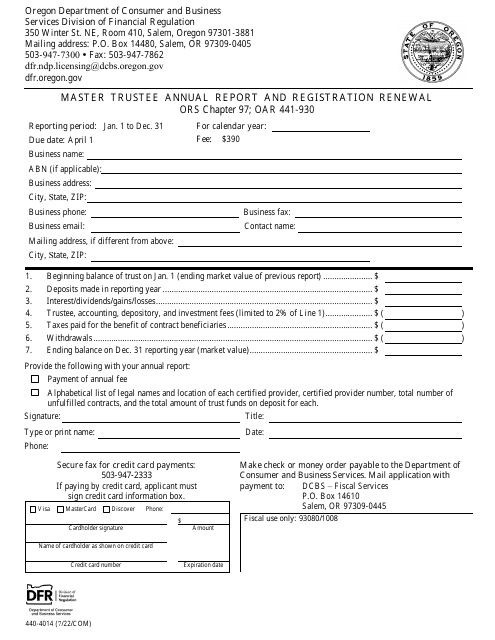

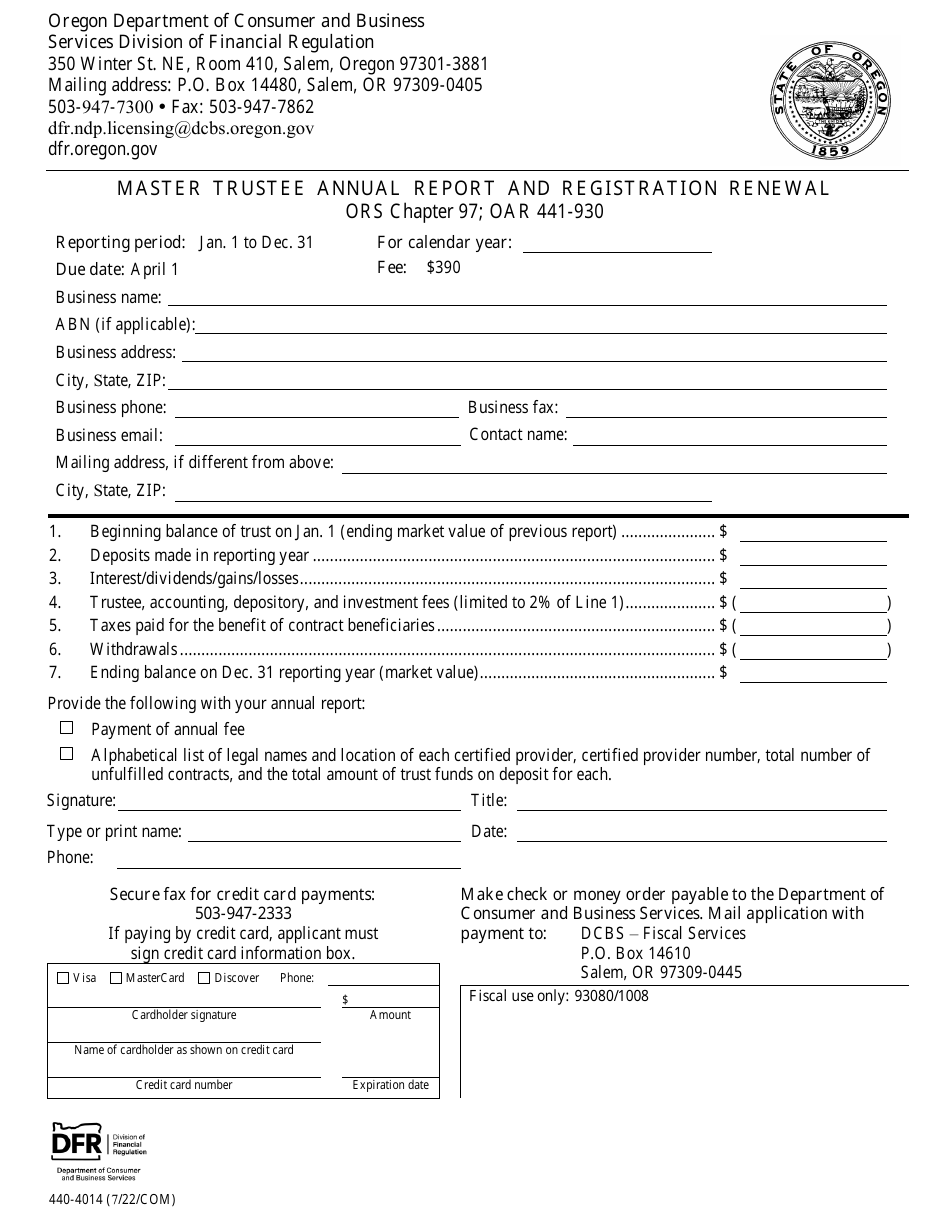

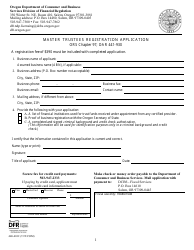

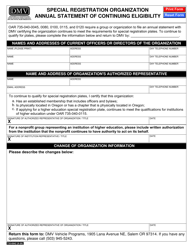

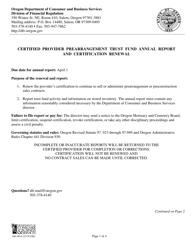

Form 440-4017 Master Trustee Annual Report and Registration Renewal - Oregon

What Is Form 440-4017?

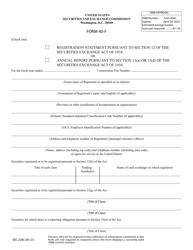

This is a legal form that was released by the Oregon Department of Consumer and Business Services - Division of Financial Regulations - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 440-4017?

A: Form 440-4017 is the Master Trustee Annual Report and Registration Renewal form in Oregon.

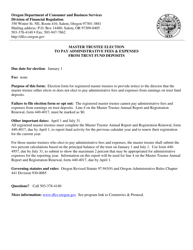

Q: Who needs to file Form 440-4017?

A: Master trustees of trusts operating in Oregon are required to file Form 440-4017.

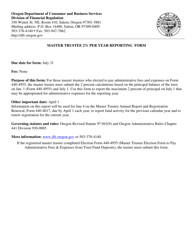

Q: What is the purpose of Form 440-4017?

A: The purpose of Form 440-4017 is for master trustees to report trust financial information and renew their registration in Oregon.

Q: When is Form 440-4017 due?

A: Form 440-4017 is due on or before the last day of the fourth month following the close of the trust's fiscal year.

Q: Are there any filing fees for Form 440-4017?

A: Yes, there is a $200 filing fee for submitting Form 440-4017.

Q: Can Form 440-4017 be filed electronically?

A: Yes, Form 440-4017 can be filed electronically through the Oregon eCorp system.

Q: What happens if I fail to file Form 440-4017?

A: Failure to file Form 440-4017 may result in penalties and potential suspension or revocation of the master trustee's registration.

Q: Is there a penalty for late filing of Form 440-4017?

A: Yes, there is a late filing penalty of $25 per day for each day the form is late, up to a maximum of $1,000.

Q: Who can I contact for more information about Form 440-4017?

A: For more information about Form 440-4017, you can contact the Oregon Department of Consumer and Business Services.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 440-4017 by clicking the link below or browse more documents and templates provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations.