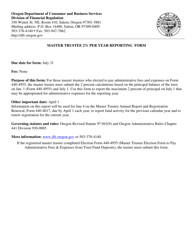

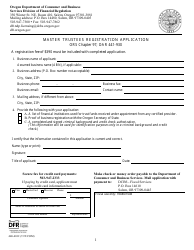

Form 440-4957 Master Trustee 2 Percent Per Year Reporting Form - Oregon

What Is Form 440-4957?

This is a legal form that was released by the Oregon Department of Consumer and Business Services - Division of Financial Regulations - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 440-4957 Master Trustee 2 Percent Per Year Reporting Form - Oregon?

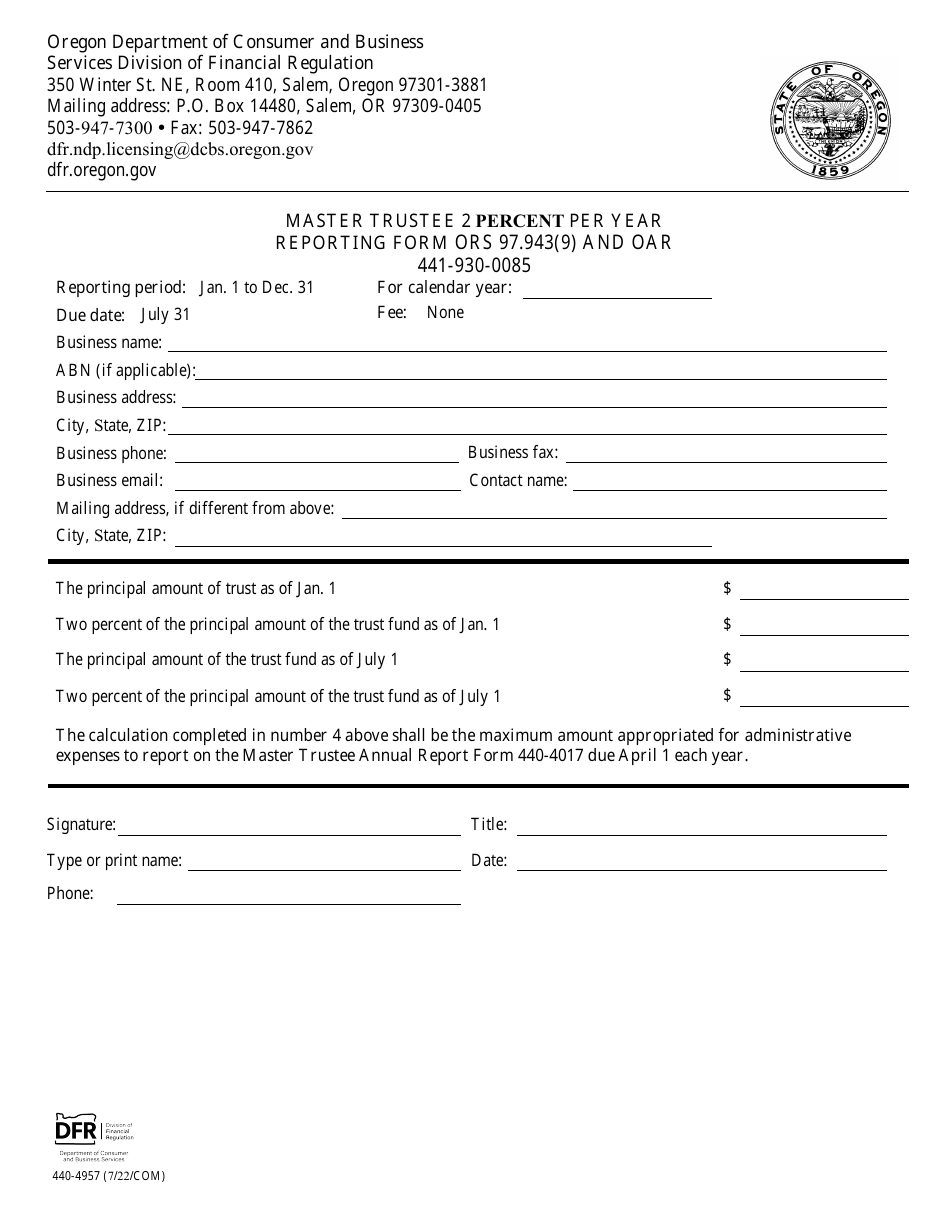

A: Form 440-4957 is a reporting form that is used in Oregon by a master trustee to report a 2 percent per year fee on all income received by the trustee for the benefit of the trust.

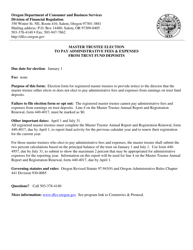

Q: Who needs to file Form 440-4957?

A: Master trustees in Oregon who have income from a trust and charge a 2 percent fee on that income are required to file Form 440-4957.

Q: When is Form 440-4957 due?

A: Form 440-4957 must be filed annually with the Oregon Department of Revenue by the due date, which is typically April 15th of each year.

Q: Are there any penalties for not filing Form 440-4957?

A: Failure to file Form 440-4957 or filing it late may result in penalties and interest charges, so it's important to file the form on time.

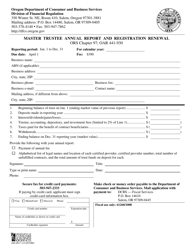

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 440-4957 by clicking the link below or browse more documents and templates provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations.