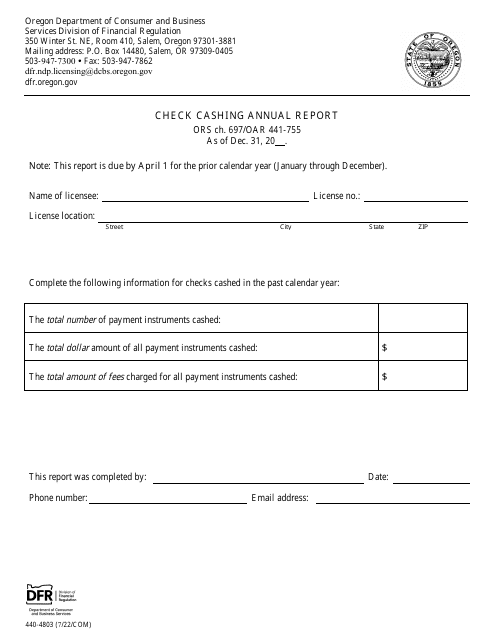

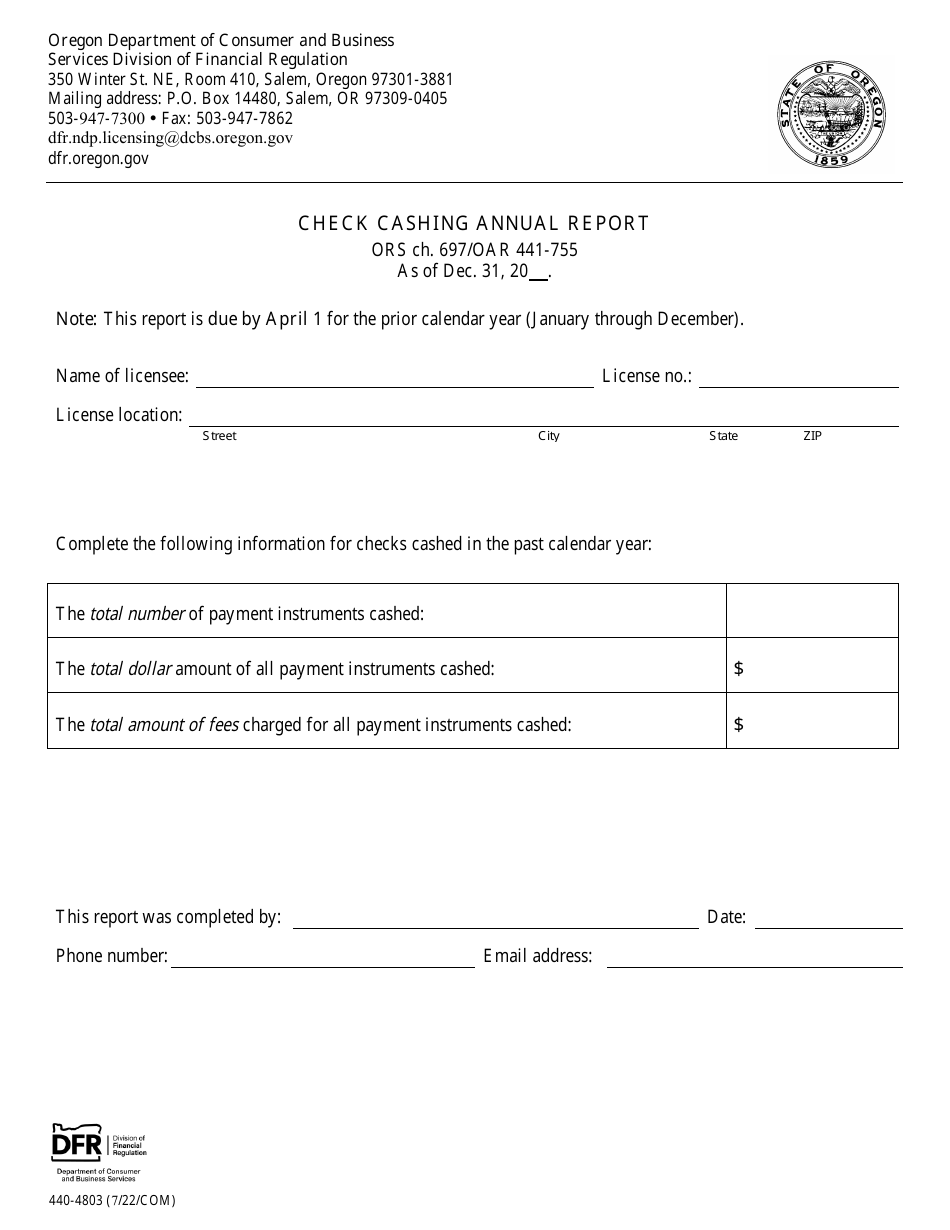

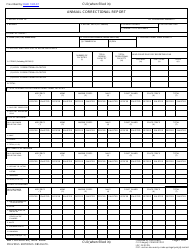

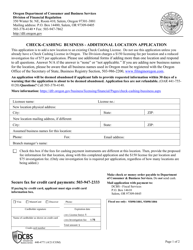

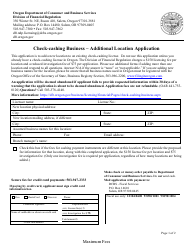

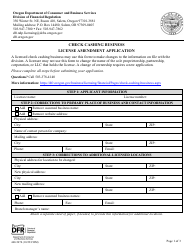

Form 440-4803 Check Cashing Annual Report - Oregon

What Is Form 440-4803?

This is a legal form that was released by the Oregon Department of Consumer and Business Services - Division of Financial Regulations - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 440-4803?

A: Form 440-4803 is the Check Cashing Annual Report for Oregon.

Q: Who needs to file Form 440-4803?

A: Check cashing businesses in Oregon need to file Form 440-4803.

Q: What is the purpose of Form 440-4803?

A: The purpose of Form 440-4803 is to report the annual operation details of check cashing businesses in Oregon.

Q: When is Form 440-4803 due?

A: Form 440-4803 is due on or before March 31st each year.

Q: Is there a fee for filing Form 440-4803?

A: Yes, there is a fee for filing Form 440-4803. The fee amount may vary.

Q: What information do I need to provide on Form 440-4803?

A: You need to provide details about your check cashing business, including financial information and number of transactions.

Q: What happens if I don't file Form 440-4803?

A: If you don't file Form 440-4803, you may face penalties and consequences as per Oregon state laws.

Q: Are there any exemptions to filing Form 440-4803?

A: There may be exemptions available for certain check cashing businesses. It's best to consult the Oregon Secretary of State for specific details.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 440-4803 by clicking the link below or browse more documents and templates provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations.