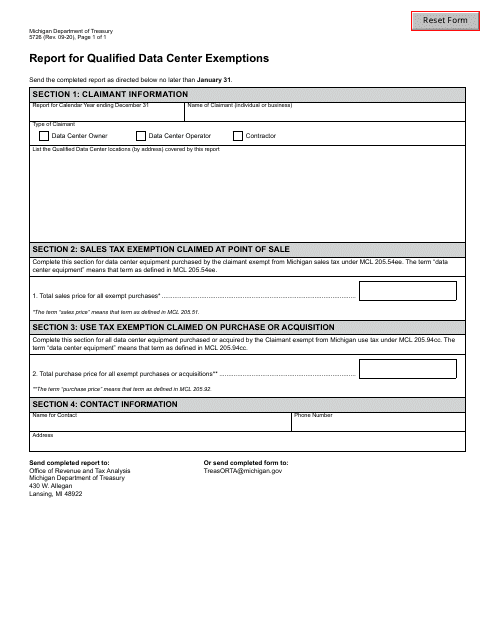

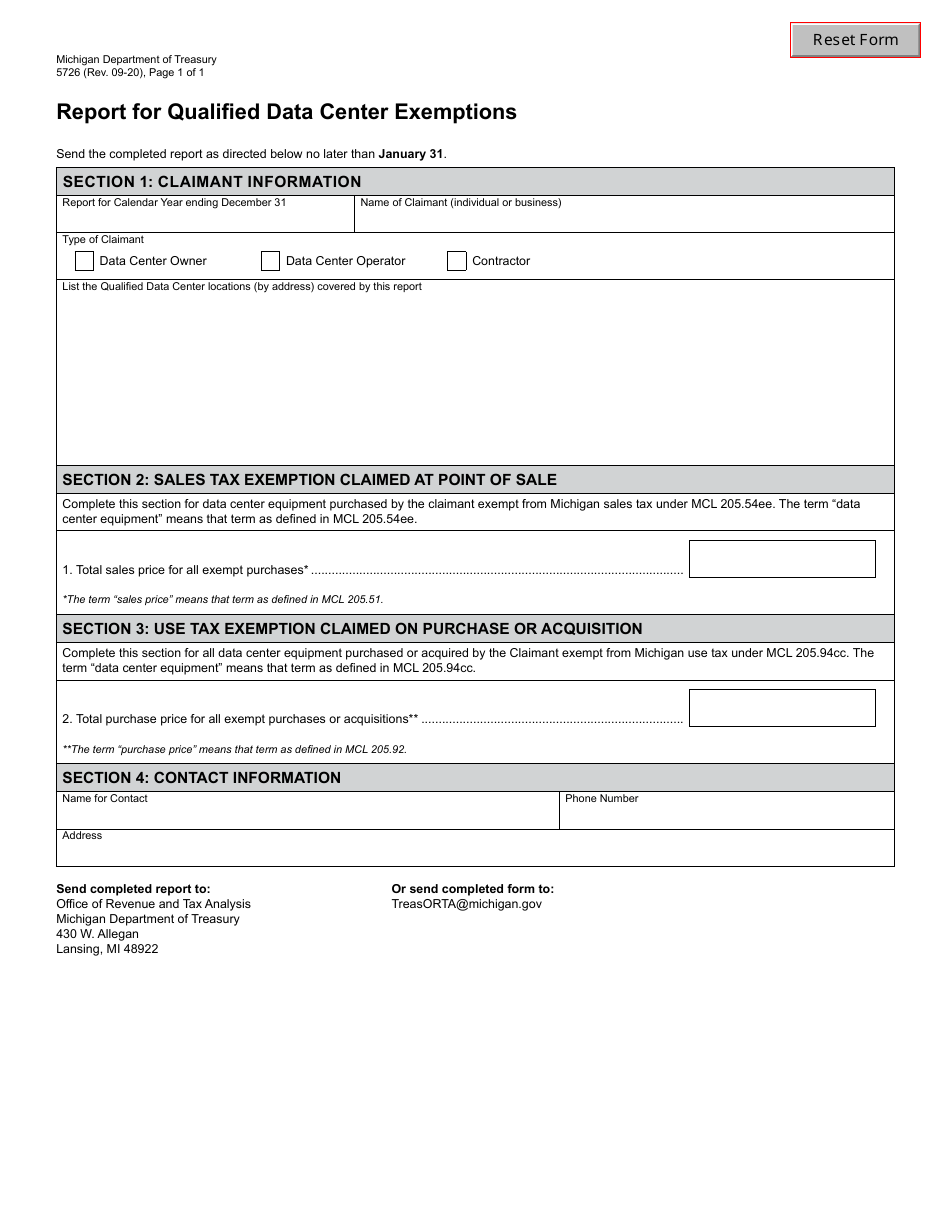

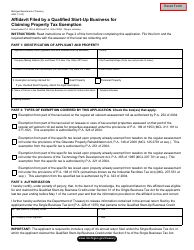

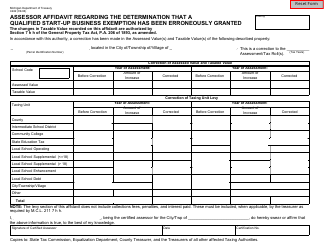

Form 5726 Report for Qualified Data Center Exemptions - Michigan

What Is Form 5726?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5726 Report for Qualified Data Center Exemptions?

A: Form 5726 Report for Qualified Data Center Exemptions is a document used in Michigan to report exemptions related to qualified data centers.

Q: Who needs to file Form 5726 Report for Qualified Data Center Exemptions?

A: Entities operating qualified data centers in Michigan may need to file Form 5726 to report their exemptions.

Q: What is a qualified data center?

A: A qualified data center is a facility that meets certain criteria specified by the state of Michigan, making it eligible for tax exemptions.

Q: What exemptions can be reported on Form 5726?

A: Form 5726 can be used to report exemptions related to property tax, sales and use tax, and other applicable taxes for qualified data centers.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5726 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.