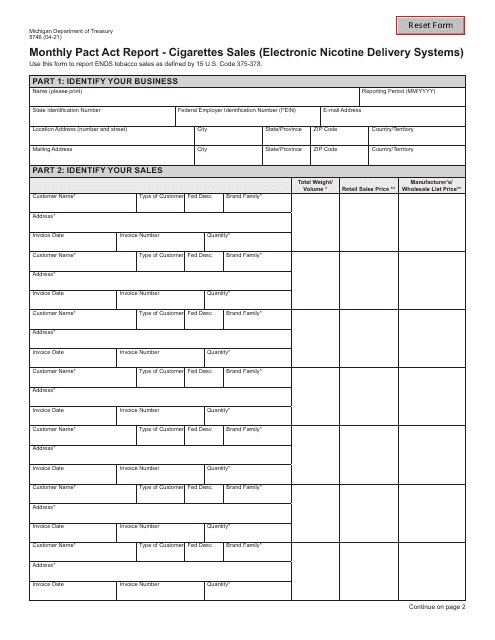

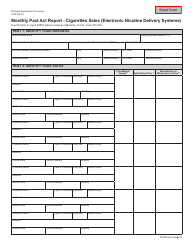

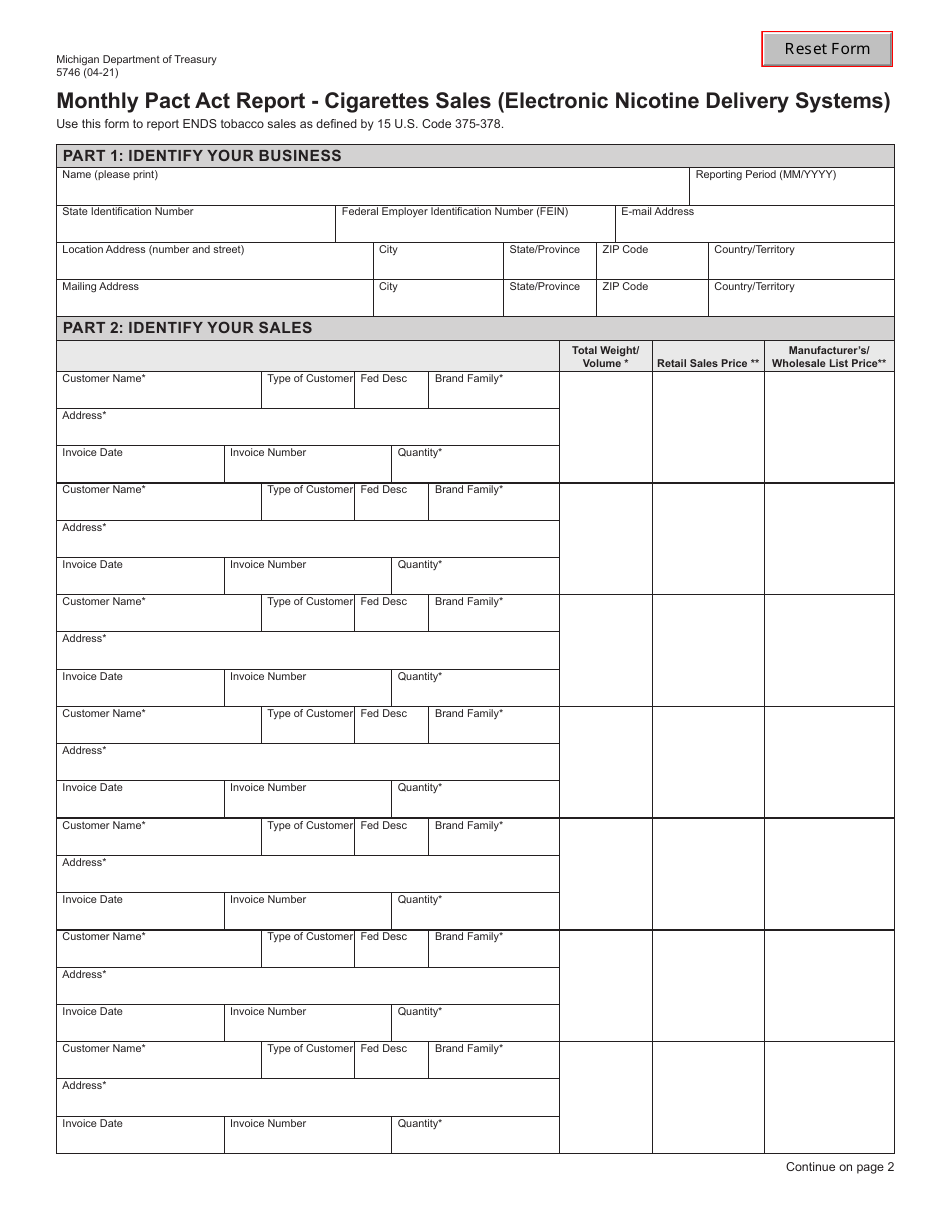

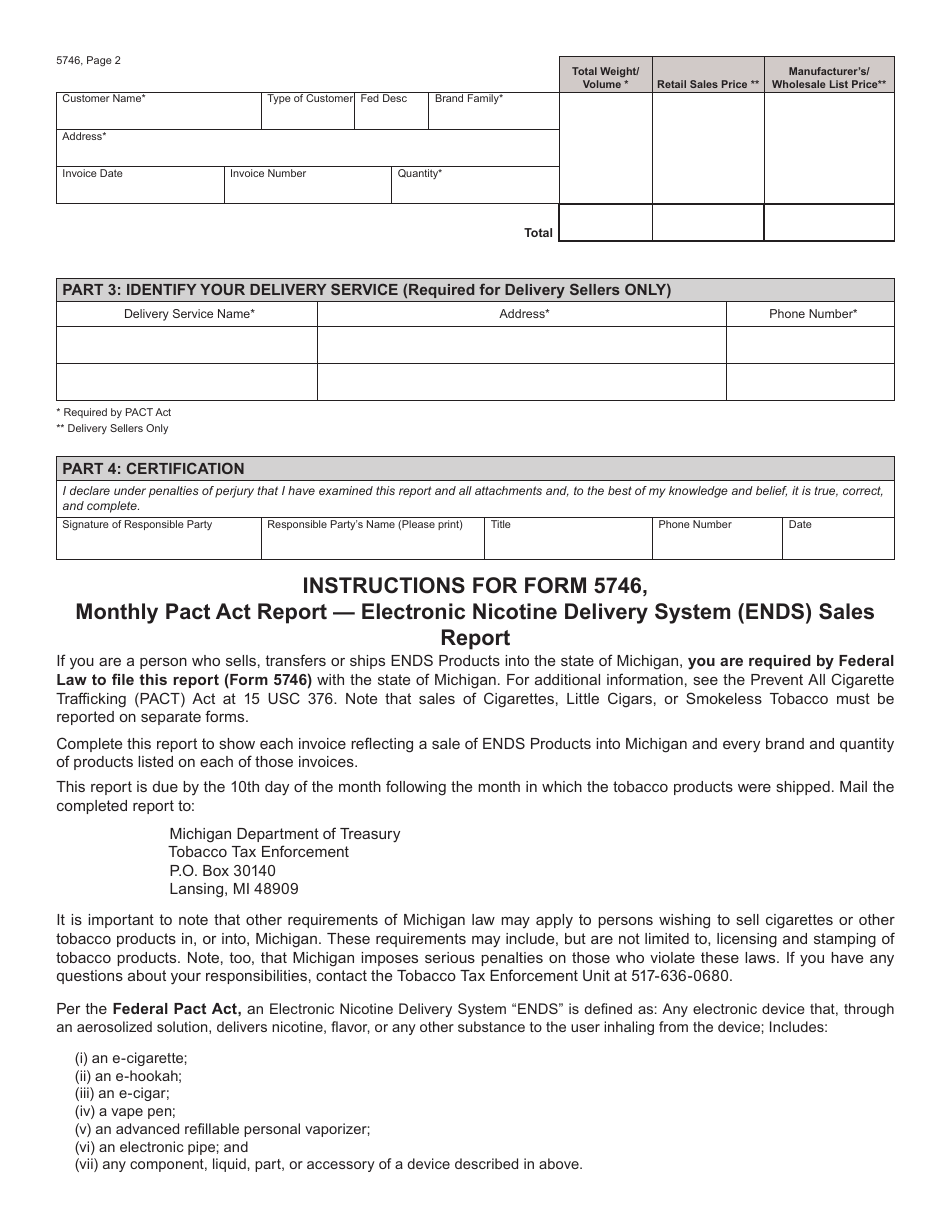

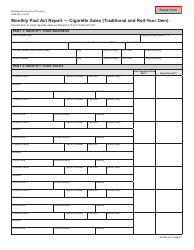

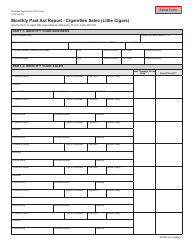

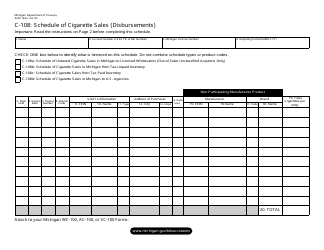

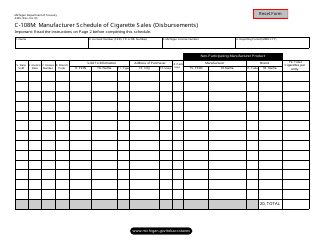

Form 5746 Monthly Pact Act Report - Cigarettes Sales (Electronic Nicotine Delivery Systems) - Michigan

What Is Form 5746?

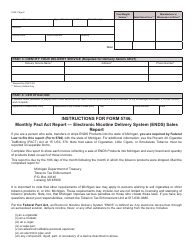

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5746?

A: Form 5746 is the Monthly Pact Act Report for Cigarettes Sales of Electronic Nicotine Delivery Systems in Michigan.

Q: What does the Monthly Pact Act Report cover?

A: The Monthly Pact Act Report covers the sales of cigarettes and electronic nicotine delivery systems in Michigan.

Q: Who needs to file Form 5746?

A: Any entity engaged in the sales of cigarettes and electronic nicotine delivery systems in Michigan needs to file Form 5746.

Q: How often should Form 5746 be filed?

A: Form 5746 should be filed monthly.

Q: What information is required on Form 5746?

A: Form 5746 requires information about the sales of cigarettes and electronic nicotine delivery systems, including quantities sold and taxes paid.

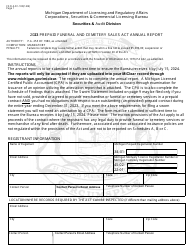

Q: Are there any penalties for not filing Form 5746?

A: Yes, failure to file Form 5746 or filing false information may result in penalties imposed by the Michigan Department of Treasury.

Q: Is Form 5746 specific to Michigan only?

A: Yes, Form 5746 is specific to the state of Michigan and its requirements for reporting cigarette and electronic nicotine delivery system sales.

Q: What is the purpose of the Monthly Pact Act Report?

A: The purpose of the Monthly Pact Act Report is to monitor and regulate the sales of cigarettes and electronic nicotine delivery systems in Michigan, ensuring compliance with tax laws and regulations.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5746 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.