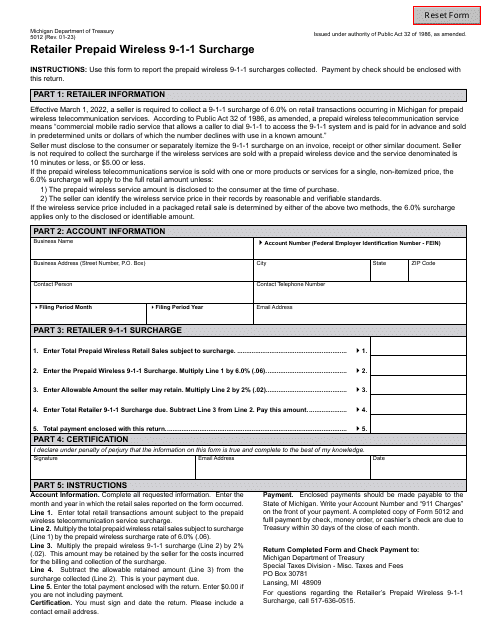

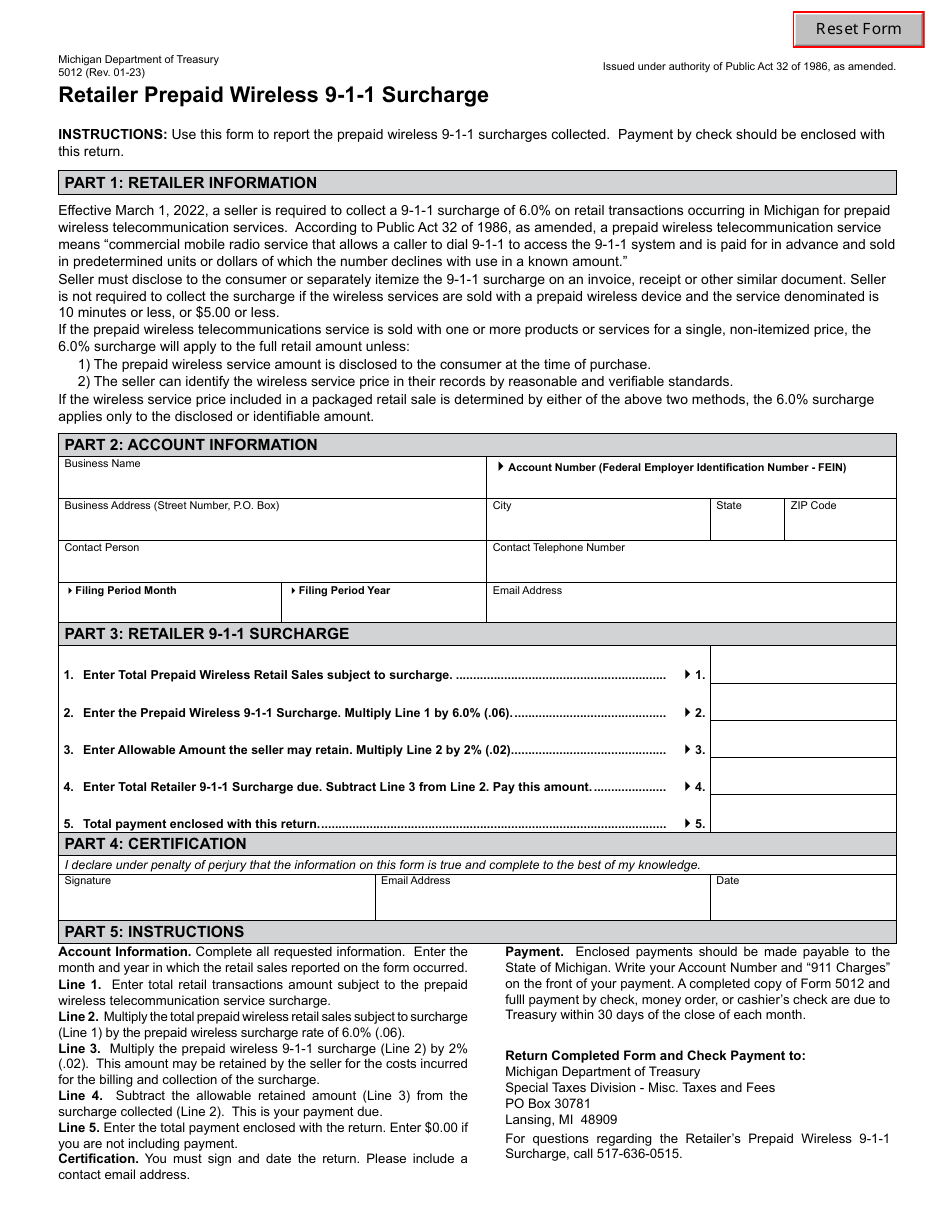

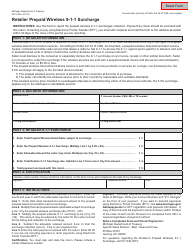

Form 5012 Retailer Prepaid Wireless 9-1-1 Surcharge - Michigan

What Is Form 5012?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5012?

A: Form 5012 is a document used by retailers in Michigan to report the prepaid wireless 9-1-1 surcharge.

Q: Who needs to file Form 5012?

A: Retailers in Michigan who sell prepaid wireless services are required to file Form 5012.

Q: What is the purpose of Form 5012?

A: The purpose of Form 5012 is to report and remit the prepaid wireless 9-1-1 surcharge collected by retailers in Michigan.

Q: What is the prepaid wireless 9-1-1 surcharge?

A: The prepaid wireless 9-1-1 surcharge is a fee collected from customers who purchase prepaid wireless services in Michigan. It is used to fund emergency 9-1-1 services.

Q: How often should Form 5012 be filed?

A: Form 5012 should be filed on a quarterly basis, with the due date falling on the last day of the month following the end of the quarter.

Q: Are there any penalties for not filing Form 5012?

A: Yes, there are penalties for not filing Form 5012. Retailers who fail to file or pay the surcharge on time may be subject to penalties and interest.

Q: Is Form 5012 specific to Michigan?

A: Yes, Form 5012 is specific to retailers in Michigan who sell prepaid wireless services.

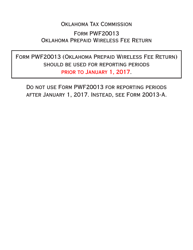

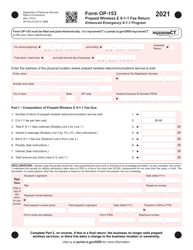

Q: Is the prepaid wireless 9-1-1 surcharge applicable in other states?

A: The prepaid wireless 9-1-1 surcharge may be applicable in other states, but the specific requirements and forms may vary.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5012 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.