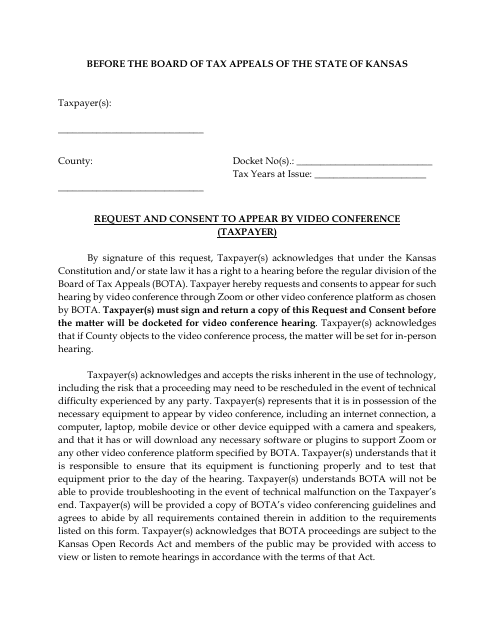

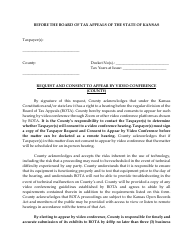

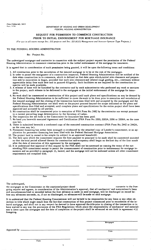

Request and Consent to Appear by Video Conference (Taxpayer) - Kansas

Request and Consent to Appear by Video Conference (Taxpayer) is a legal document that was released by the Kansas Board of Tax Appeals - a government authority operating within Kansas.

FAQ

Q: What is the Request and Consent to Appear by Video Conference?

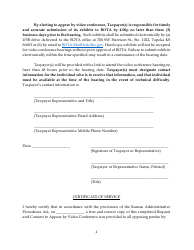

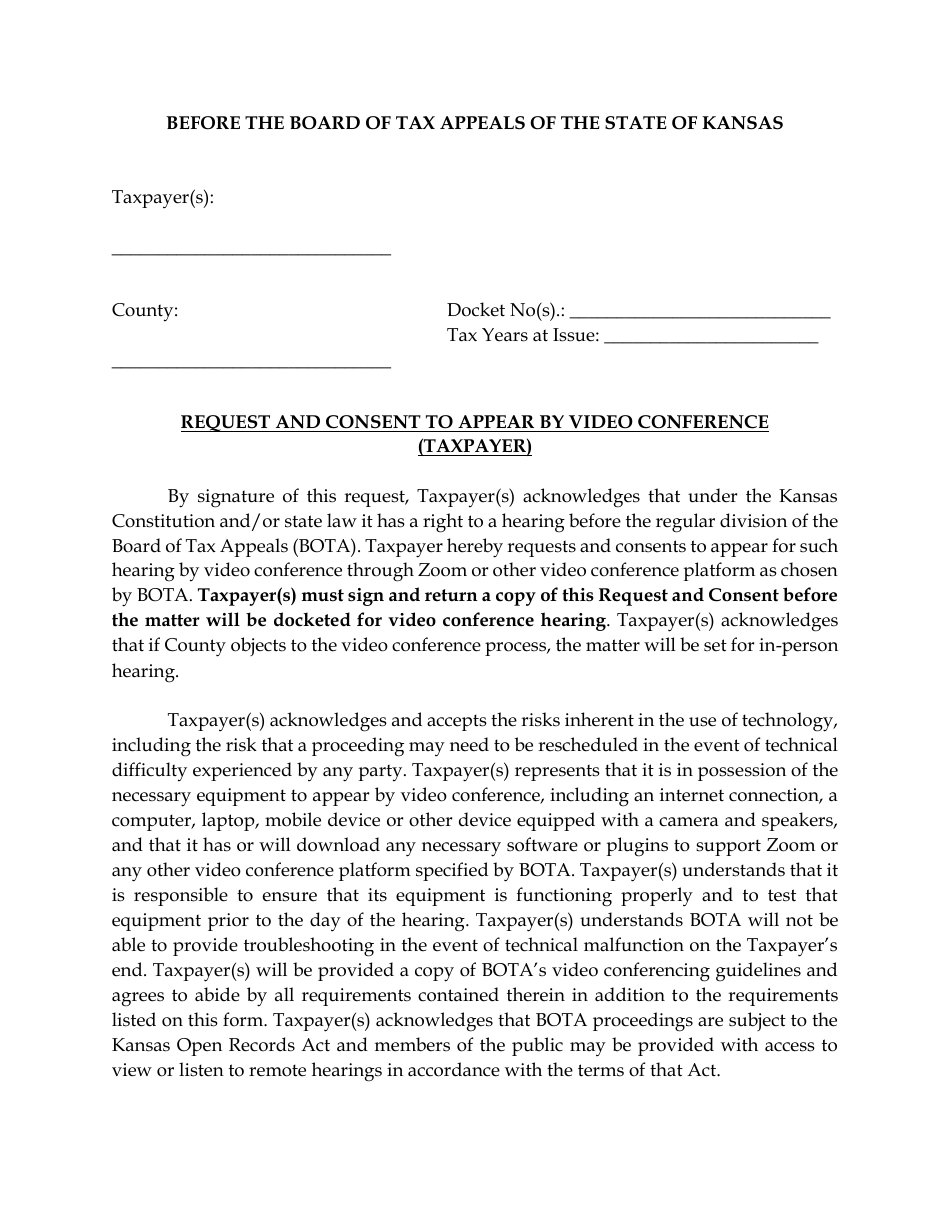

A: The Request and Consent to Appear by Video Conference is a form used in Kansas for taxpayers to request permission to appear at a hearing or examination through video conference instead of appearing in person.

Q: Why would a taxpayer request to appear by video conference?

A: A taxpayer may request to appear by video conference if they are unable to travel to the hearing or examination location due to distance or other circumstances.

Q: How does a taxpayer request to appear by video conference?

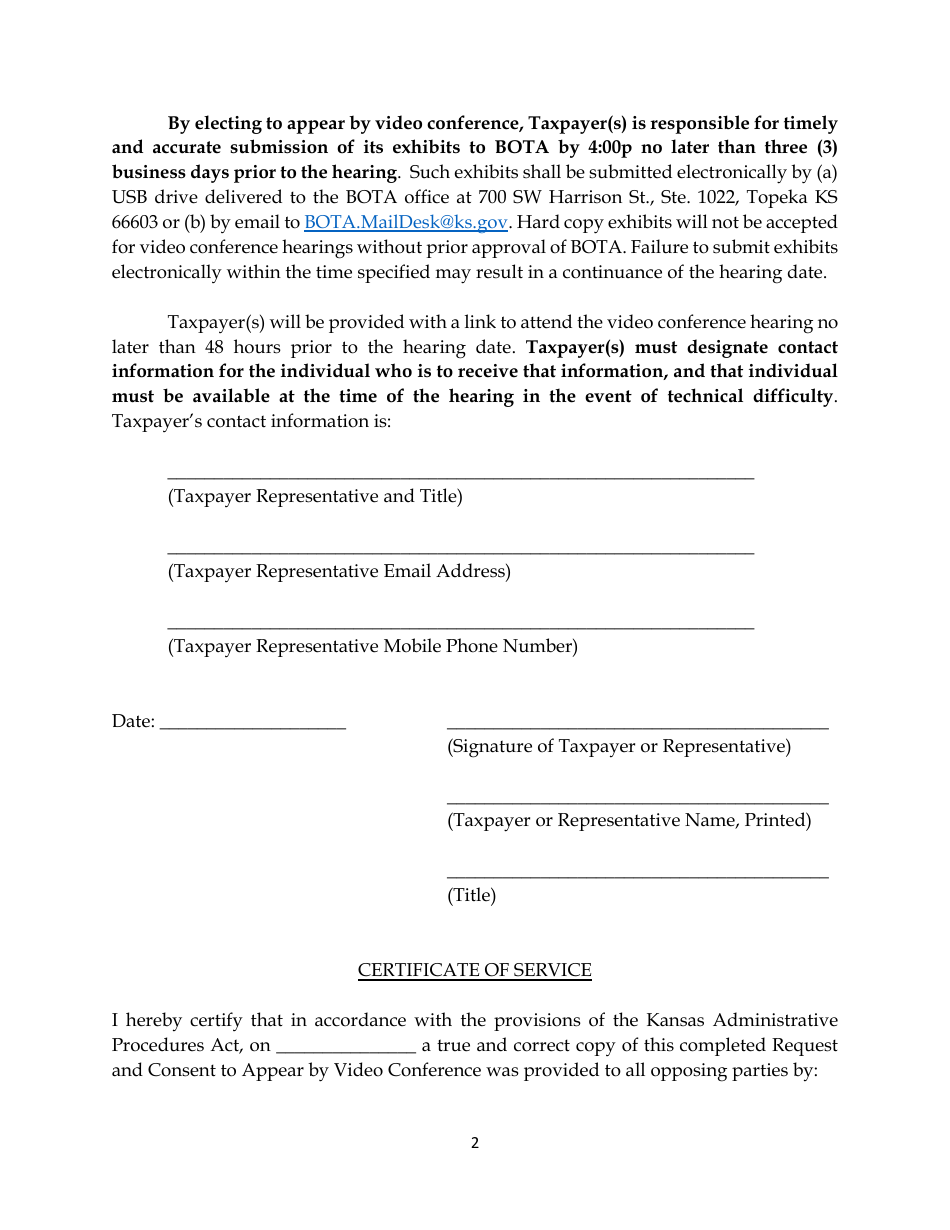

A: The taxpayer should complete the Request and Consent to Appear by Video Conference form and submit it to the appropriate tax authority.

Q: Is there a fee to request to appear by video conference?

A: There is no specific fee mentioned for the request, but there may be associated costs for setting up and conducting the video conference.

Q: What happens after the taxpayer submits the request?

A: After the taxpayer submits the request, the tax authority will review the request and make a decision on whether to grant permission for the taxpayer to appear by video conference.

Q: Can the tax authority deny the request to appear by video conference?

A: Yes, the tax authority has the discretion to deny the request if they determine that appearing by video conference would not be appropriate or if they have other reasons for requiring an in-person appearance.

Q: Is appearing by video conference the same as appearing in person?

A: While appearing by video conference allows the taxpayer to participate remotely, they are still expected to comply with all applicable rules and procedures as if they were appearing in person.

Q: Can the taxpayer change their mind after requesting to appear by video conference?

A: The taxpayer can withdraw their request to appear by video conference at any time before a decision has been made by the tax authority.

Q: What should the taxpayer do if they need technical assistance for the video conference?

A: The taxpayer should contact the tax authority for guidance on technical requirements and any assistance needed for the video conference.

Form Details:

- The latest edition currently provided by the Kansas Board of Tax Appeals;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Board of Tax Appeals.