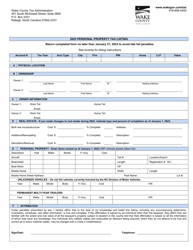

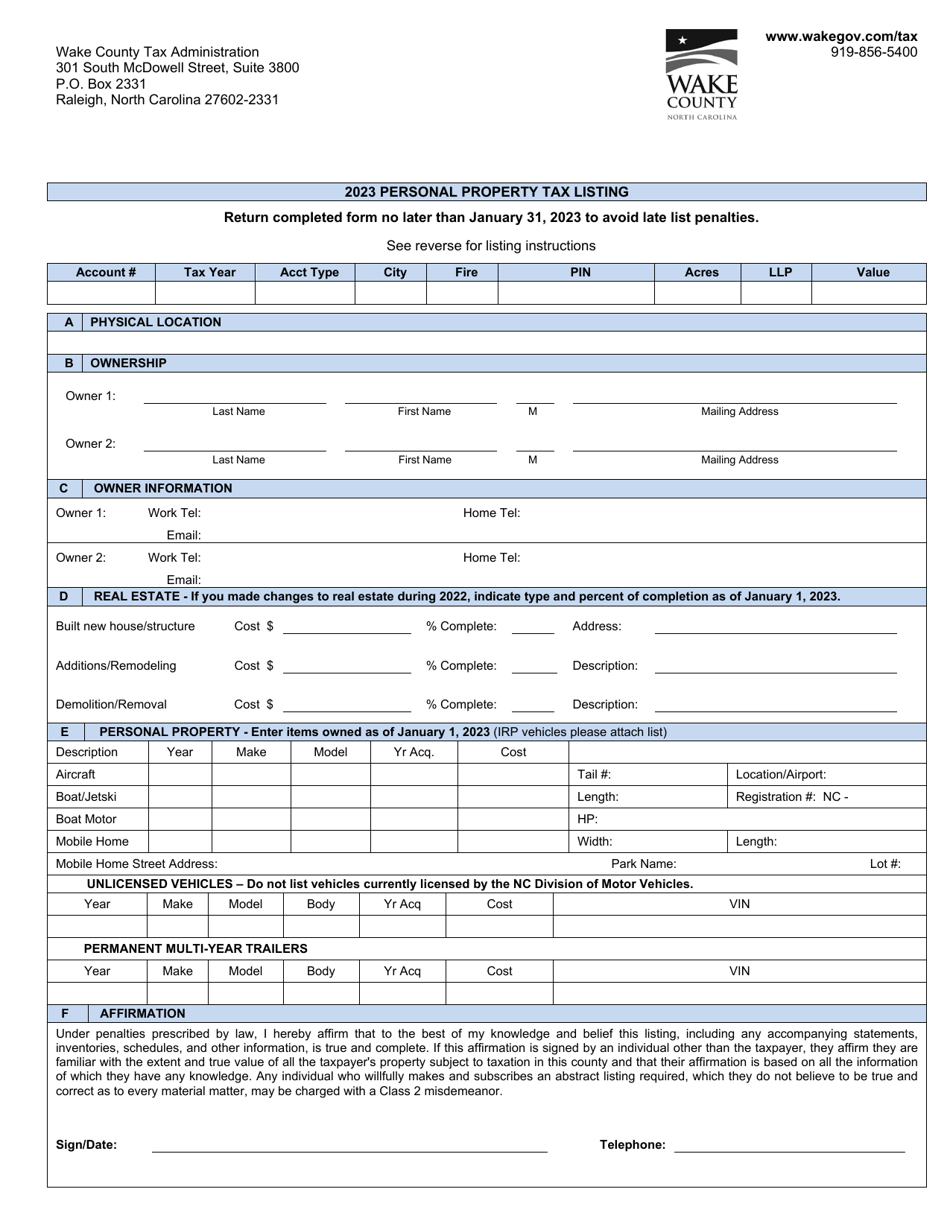

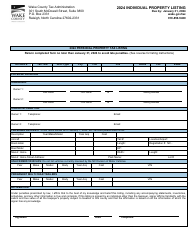

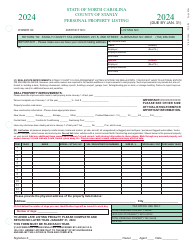

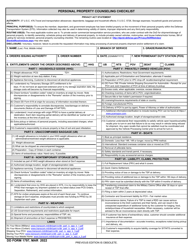

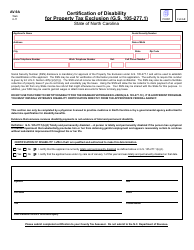

Personal Property Tax Listing - North Carolina

Personal Property Tax Listing is a legal document that was released by the Department of Tax Administration - Wake County, North Carolina - a government authority operating within North Carolina.

FAQ

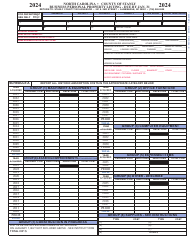

Q: What is a personal property tax?

A: Personal property tax is a tax imposed on certain tangible assets that individuals and businesses own.

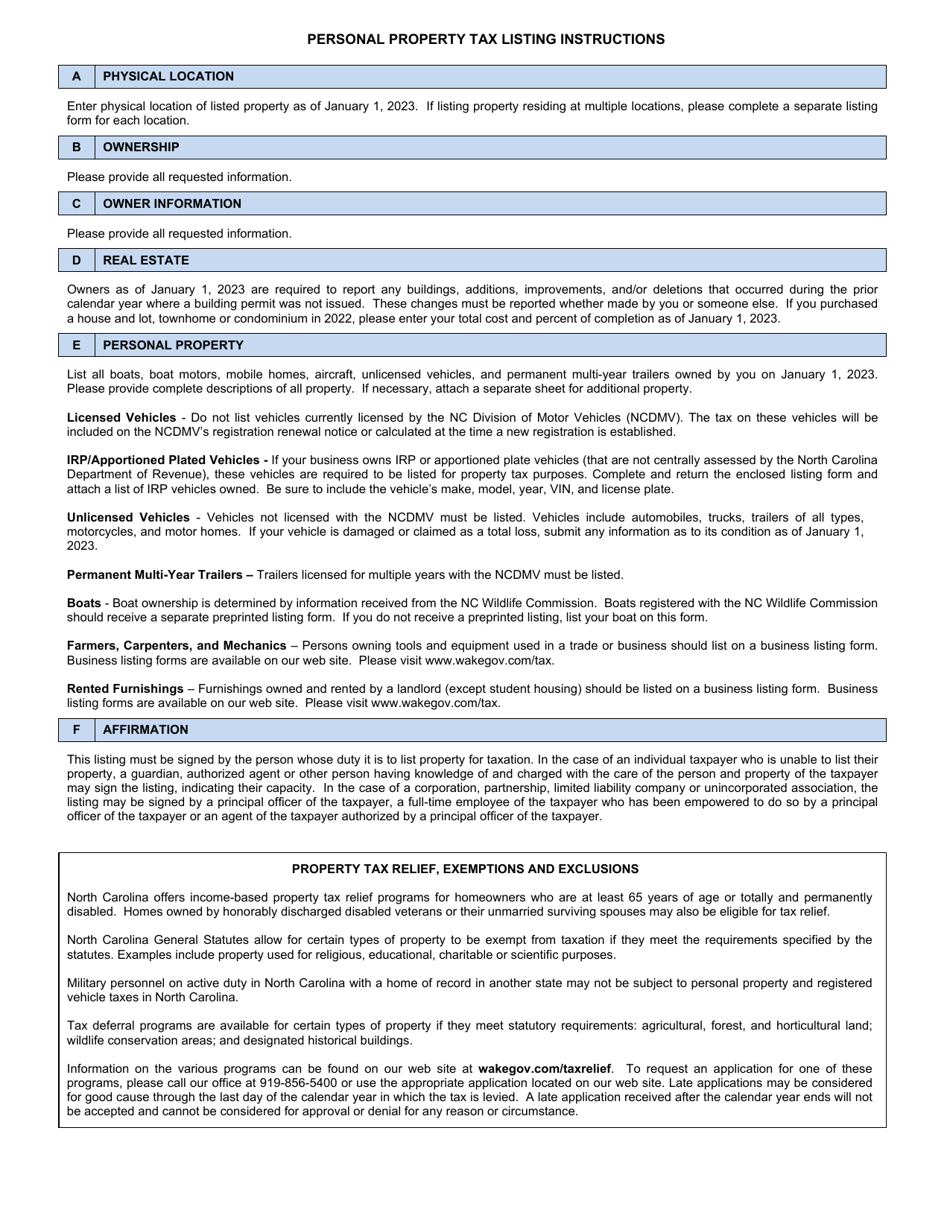

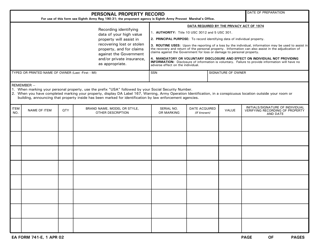

Q: What are examples of personal property?

A: Examples of personal property include vehicles, boats, mobile homes, furniture, machinery, and equipment.

Q: How is personal property tax calculated in North Carolina?

A: In North Carolina, the personal property tax is calculated by multiplying the assessed value of the property by the tax rate set by the local government.

Q: Who is responsible for paying personal property tax?

A: The owner of the personal property is responsible for paying the personal property tax.

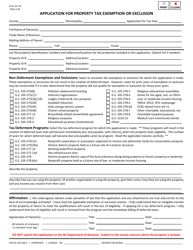

Q: Are there any exemptions or exclusions for personal property tax?

A: Yes, certain types of personal property may be exempt from personal property tax, such as property used for religious, educational, or charitable purposes.

Q: When is the deadline to file the personal property tax listing in North Carolina?

A: The deadline to file the personal property tax listing in North Carolina is typically January 31st of each year.

Q: What happens if I fail to file or pay my personal property taxes in North Carolina?

A: Failure to file or pay personal property taxes in North Carolina may result in penalties and interest being assessed on the unpaid taxes.

Form Details:

- The latest edition currently provided by the Department of Tax Administration - Wake County, North Carolina;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Tax Administration - Wake County, North Carolina.