This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

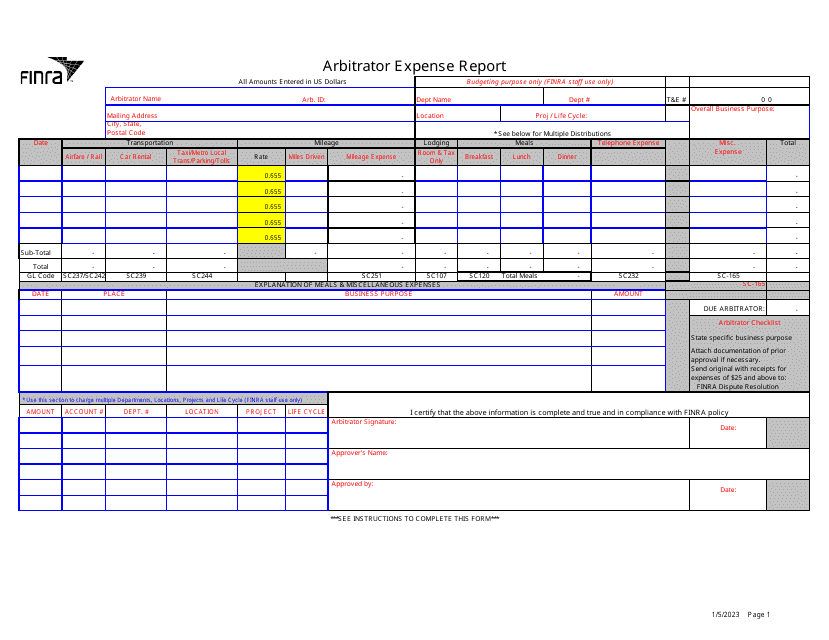

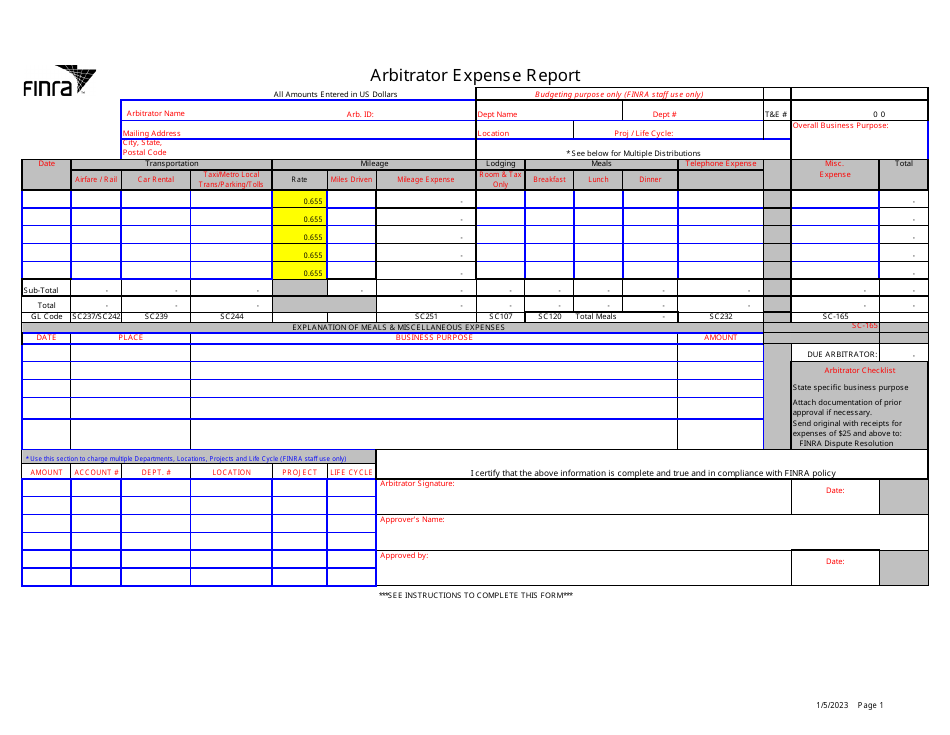

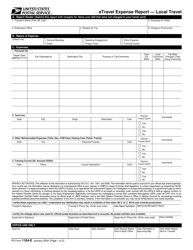

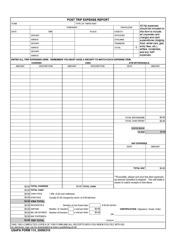

Arbitrator Expense Report

Arbitrator Expense Report is a 1-page legal document that was released by the Financial Industry Regulatory Authority (FINRA) on January 5, 2023 and used nation-wide.

FAQ

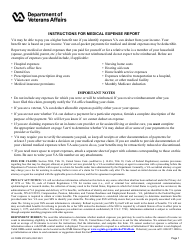

Q: What is an arbitrator expense report?

A: An arbitrator expense report is a document used to track and reimburse expenses incurred by an arbitrator during the arbitration process.

Q: Who is responsible for submitting an arbitrator expense report?

A: The arbitrator is responsible for submitting an expense report to the appropriate entity, such as the arbitration organization or the parties involved.

Q: What kind of expenses are typically included in an arbitrator expense report?

A: Expenses included in an arbitrator expense report can vary, but commonly include travel costs, accommodation expenses, meal allowances, and any other authorized expenses related to the arbitration.

Q: How are arbitrator expenses reimbursed?

A: Arbitrator expenses are generally reimbursed by the party or organization that appointed the arbitrator, based on the agreed-upon reimbursement policy and any applicable limits.

Q: Are there any specific guidelines or requirements for preparing an arbitrator expense report?

A: Specific guidelines and requirements for preparing an arbitrator expense report can vary depending on the arbitration organization or the terms of the arbitration agreement. It is important for the arbitrator to follow any guidelines and provide necessary supporting documentation for the expenses claimed.

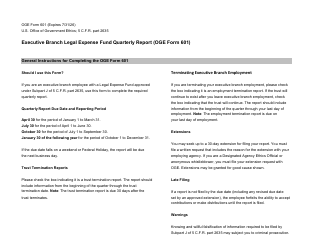

Q: What happens after an arbitrator expense report is submitted?

A: After an arbitrator expense report is submitted, it is typically reviewed by the responsible entity, such as the arbitration organization or the parties involved. Once approved, the arbitrator is reimbursed for the eligible expenses.

Q: Can an arbitrator be reimbursed for all expenses claimed in the expense report?

A: The reimbursement of expenses claimed in an arbitrator expense report is subject to the agreed-upon reimbursement policy and any applicable limits. Some expenses may not be eligible for reimbursement.

Q: Can an arbitrator expense report be audited or challenged?

A: Yes, an arbitrator expense report can be audited or challenged by the responsible entity or the parties involved. It is important for the arbitrator to keep proper documentation and provide necessary evidence to support the expenses claimed in the report.

Q: Is there a deadline for submitting an arbitrator expense report?

A: The deadline for submitting an arbitrator expense report is typically specified in the arbitration agreement or the guidelines of the arbitration organization. It is important for the arbitrator to submit the report within the specified timeframe to ensure timely reimbursement.

Q: Are arbitrator expenses tax-deductible?

A: Whether arbitrator expenses are tax-deductible or not depends on the jurisdiction and the specific circumstances. It is recommended for the arbitrator to consult with a tax professional or accountant to determine the tax implications of their expenses.

Form Details:

- The latest edition currently provided by the Financial Industry Regulatory Authority (FINRA);

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.