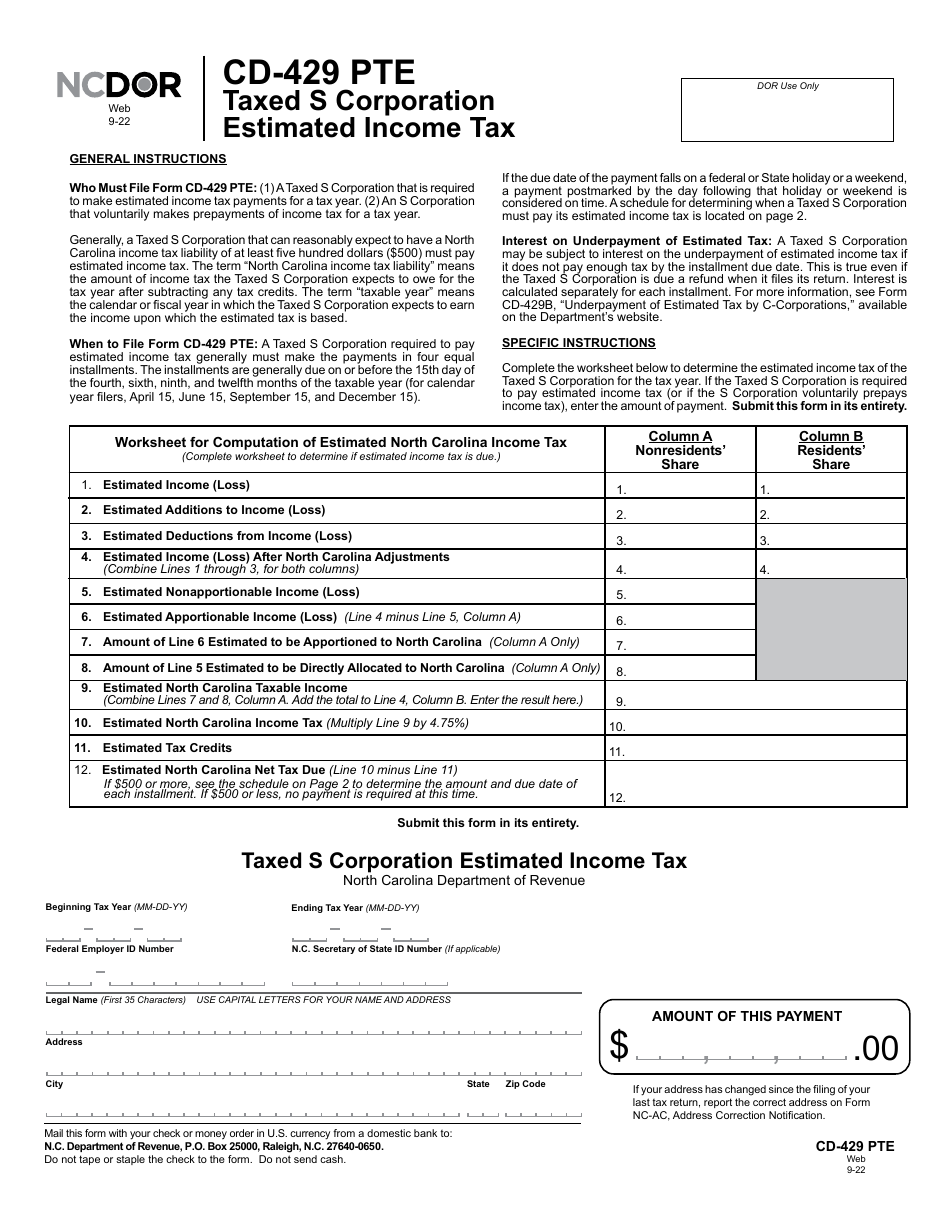

Form CD-429 PTE Taxed S Corporation Estimated Income Tax - North Carolina

What Is Form CD-429 PTE?

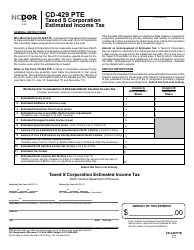

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CD-429?

A: Form CD-429 is the PTE Taxed S Corporation Estimated Income Tax form for North Carolina.

Q: Who should file Form CD-429?

A: S corporations that are subject to PTE (Pass-Through Entity) tax in North Carolina should file Form CD-429.

Q: What is the purpose of Form CD-429?

A: The purpose of Form CD-429 is to estimate and pay the income tax owed by a PTE Taxed S Corporation in North Carolina.

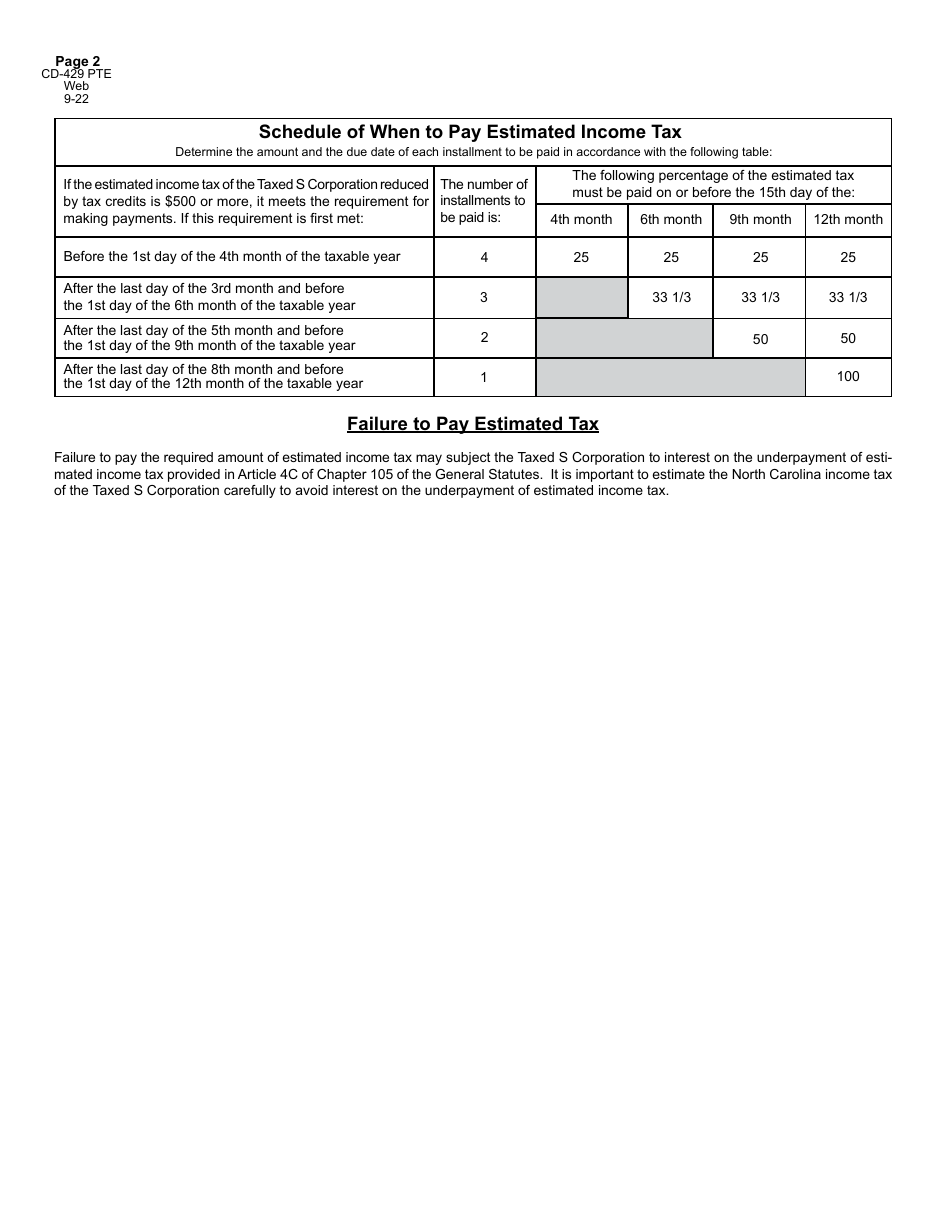

Q: When is Form CD-429 due?

A: Form CD-429 is due on or before the 15th day of the 3rd month following the close of the taxable year.

Q: Are there any penalties for late filing of Form CD-429?

A: Yes, there are penalties for late filing of Form CD-429. It is important to file the form on time to avoid penalties and interest charges.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CD-429 PTE by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.