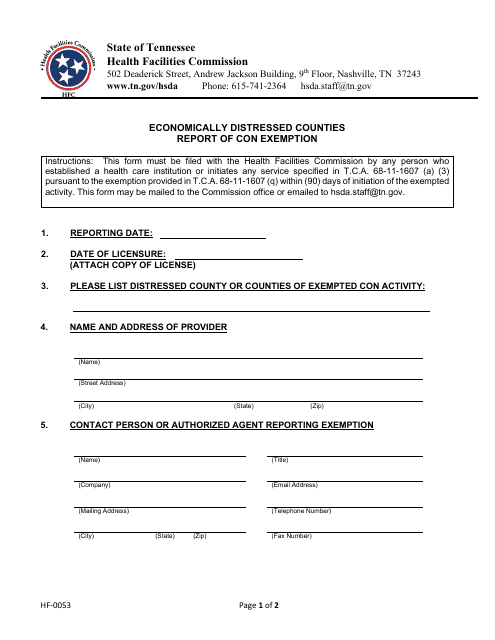

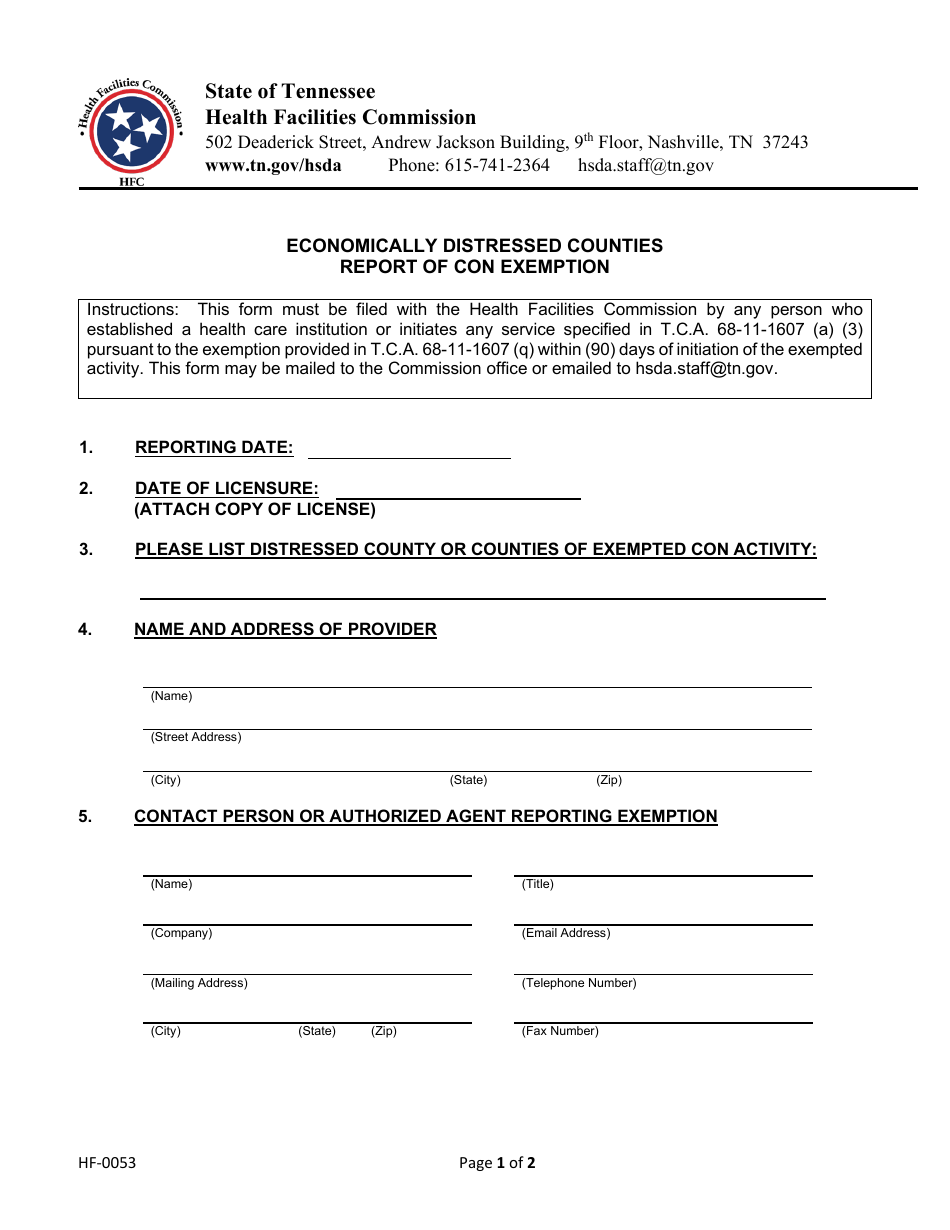

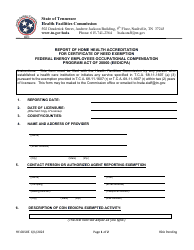

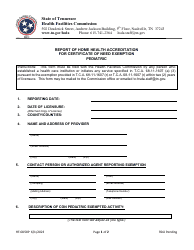

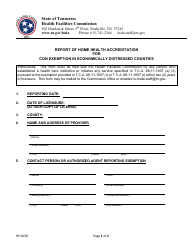

Form HF-0053 Economically Distressed Counties Report of Con Exemption - Tennessee

What Is Form HF-0053?

This is a legal form that was released by the Tennessee Health Facilities Commission - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HF-0053?

A: Form HF-0053 is the Economically Distressed Counties Report of Con Exemption form.

Q: What is the purpose of Form HF-0053?

A: The purpose of Form HF-0053 is to report the Con Exemption for economically distressed counties in Tennessee.

Q: What is the Con Exemption?

A: The Con Exemption is a program that exempts certain construction projects in economically distressed counties from sales and use taxes.

Q: Which counties are considered economically distressed in Tennessee?

A: The Tennessee Department of Economic and Community Development determines the economically distressed counties.

Q: Who should fill out Form HF-0053?

A: Anyone seeking the Con Exemption for a construction project in an economically distressed county in Tennessee should fill out Form HF-0053.

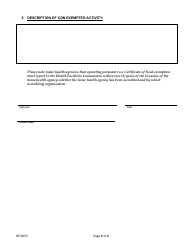

Q: Are there any documentation requirements for Form HF-0053?

A: Yes, Form HF-0053 requires supporting documentation to be submitted along with the form.

Q: What is the deadline for filing Form HF-0053?

A: The deadline for filing Form HF-0053 is determined by the Tennessee Department of Revenue and may vary each year.

Q: Are there any fees associated with filing Form HF-0053?

A: No, there are no fees associated with filing Form HF-0053.

Form Details:

- The latest edition provided by the Tennessee Health Facilities Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HF-0053 by clicking the link below or browse more documents and templates provided by the Tennessee Health Facilities Commission.