This version of the form is not currently in use and is provided for reference only. Download this version of

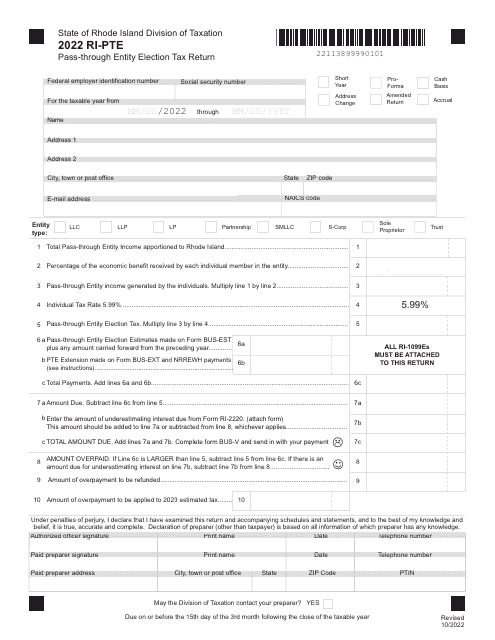

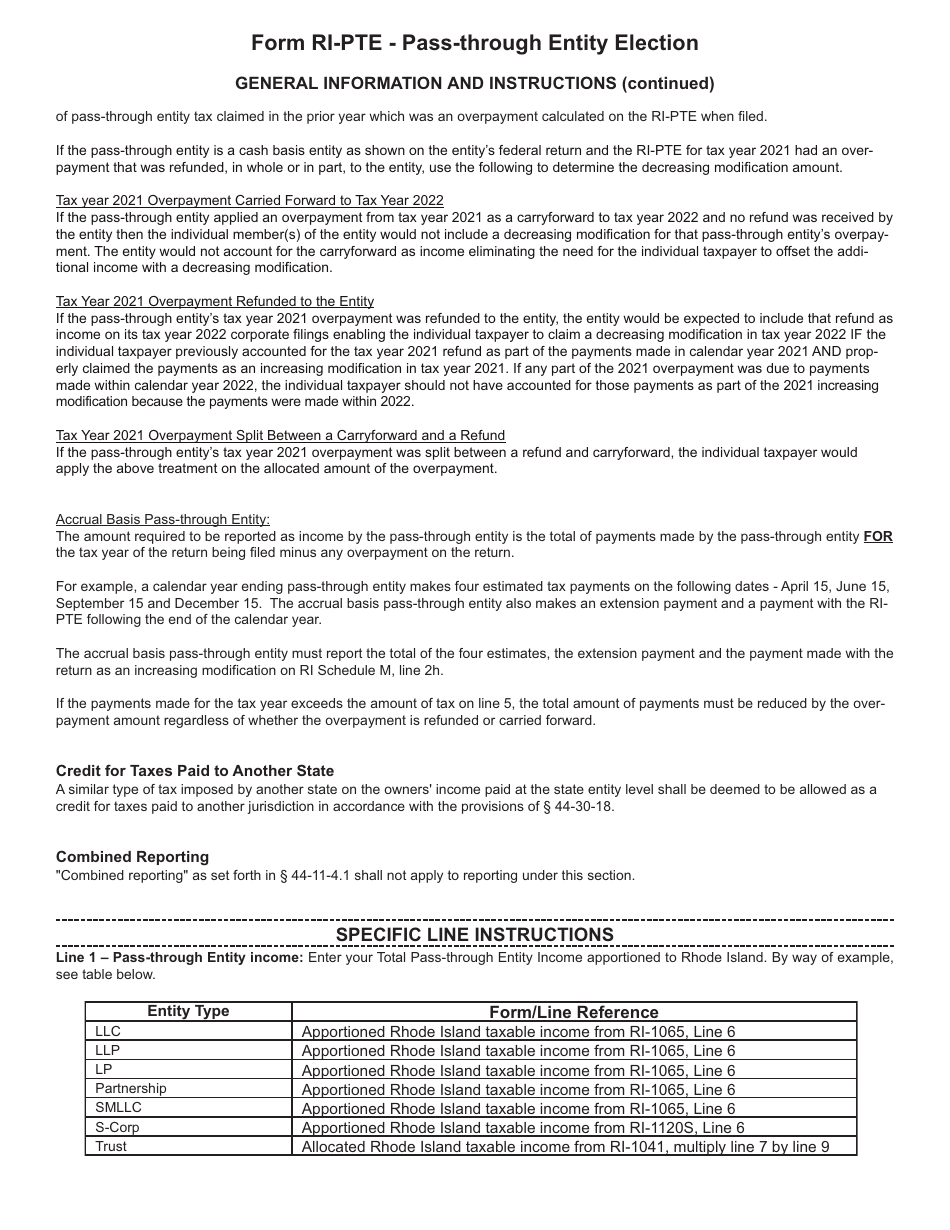

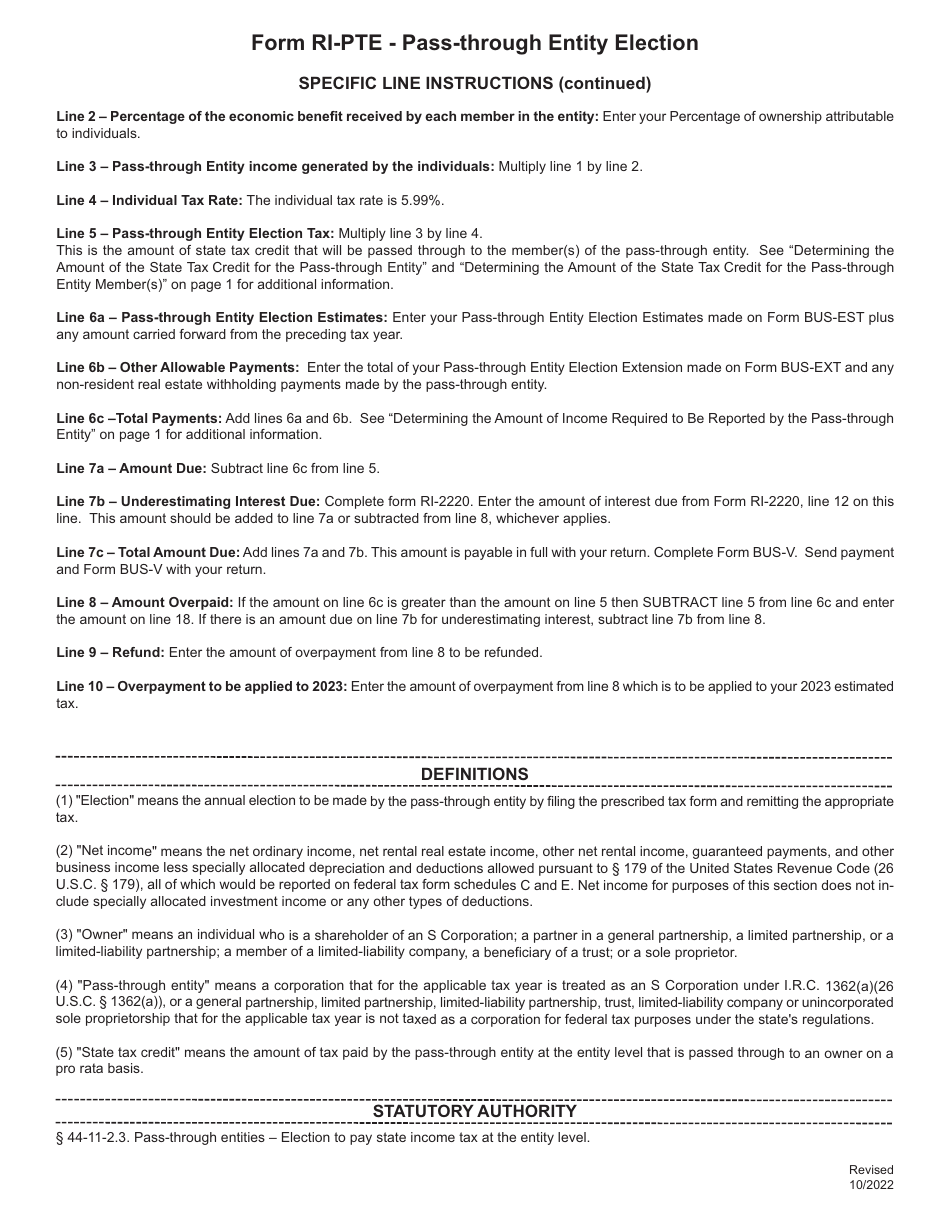

Form RI-PTE

for the current year.

Form RI-PTE Pass-Through Entity Election Tax Return - Rhode Island

What Is Form RI-PTE?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RI-PTE Pass-Through Entity Election Tax Return?

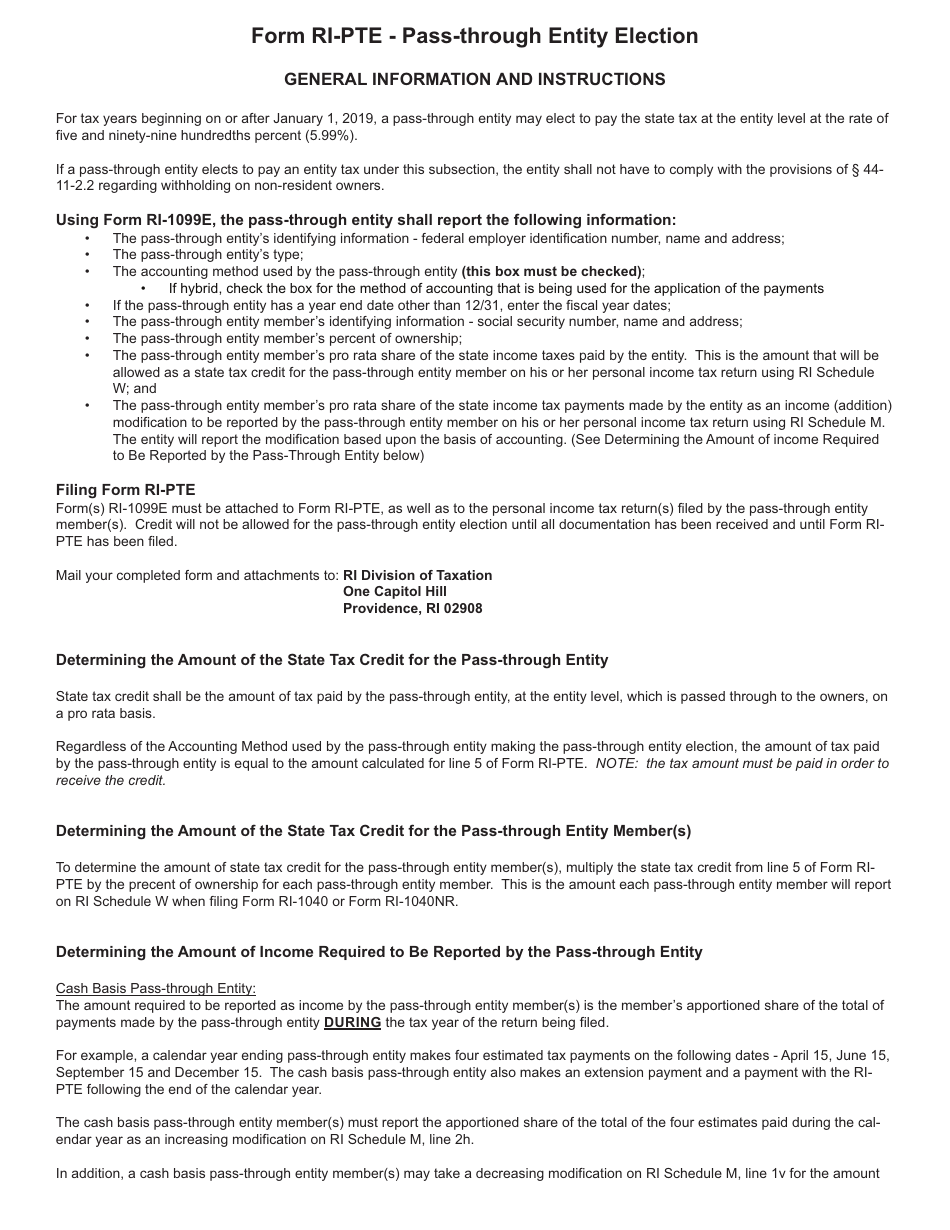

A: RI-PTE Pass-Through Entity Election Tax Return is a tax return form used by pass-through entities in Rhode Island to make an election to pay tax at the entity level.

Q: Who needs to file the RI-PTE Pass-Through Entity Election Tax Return?

A: Pass-through entities in Rhode Island that want to make an election to pay tax at the entity level need to file the RI-PTE Pass-Through Entity Election Tax Return.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity whose income is passed through to its owners or members, who then report it on their individual tax returns.

Q: What is the purpose of making an election to pay tax at the entity level?

A: Making an election to pay tax at the entity level allows pass-through entities to pay tax on their income at the entity level, rather than having the income pass through to the owners or members.

Q: Is the RI-PTE Pass-Through Entity Election Tax Return required for all pass-through entities in Rhode Island?

A: No, the RI-PTE Pass-Through Entity Election Tax Return is only required for pass-through entities that want to make an election to pay tax at the entity level.

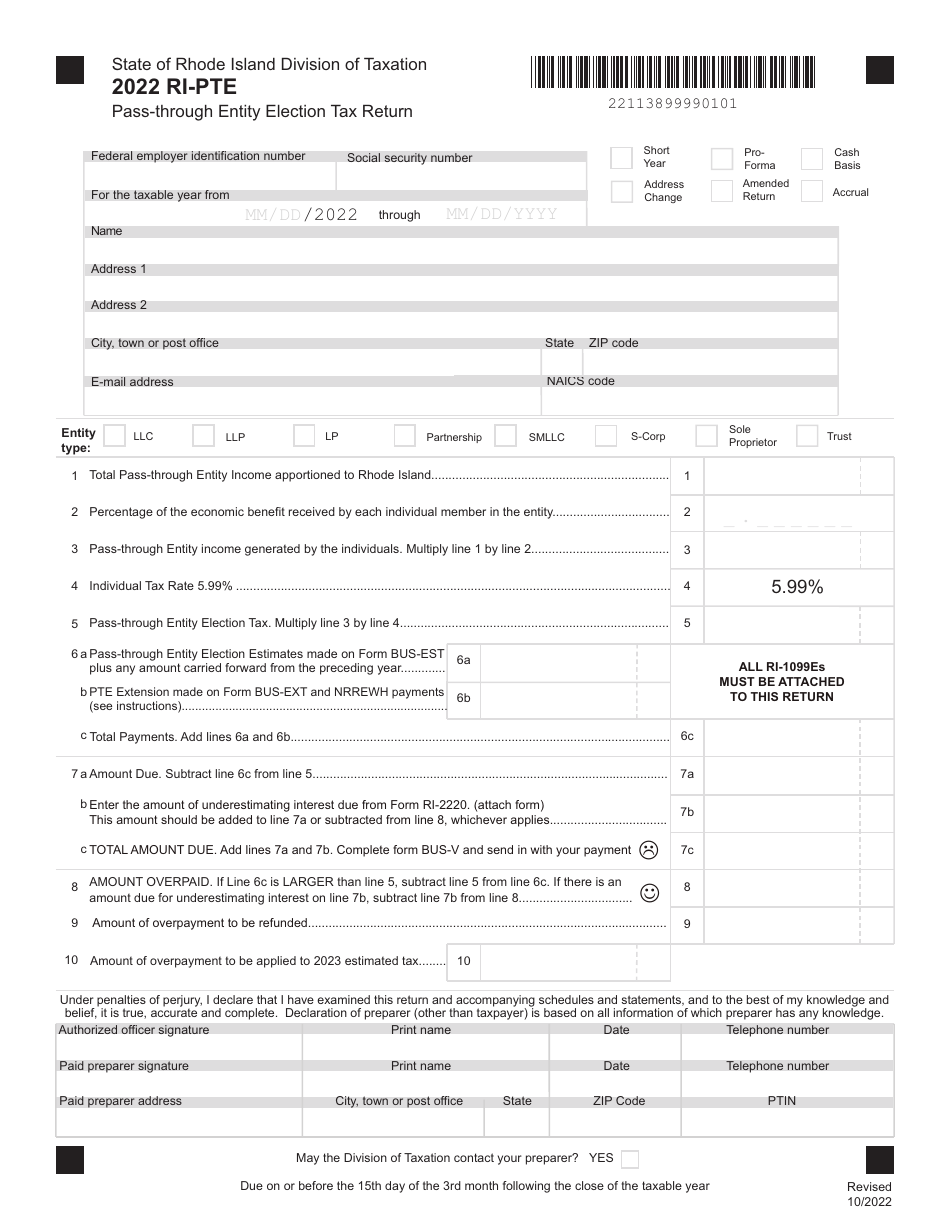

Q: When is the deadline to file the RI-PTE Pass-Through Entity Election Tax Return?

A: The deadline to file the RI-PTE Pass-Through Entity Election Tax Return is the same as the deadline for filing the entity's federal income tax return, which is generally March 15 for calendar year entities.

Q: Are there any penalties for not filing the RI-PTE Pass-Through Entity Election Tax Return?

A: Yes, there are penalties for not filing the RI-PTE Pass-Through Entity Election Tax Return, including potential loss of the election to pay tax at the entity level.

Q: Can I amend the RI-PTE Pass-Through Entity Election Tax Return?

A: Yes, you can file an amended RI-PTE Pass-Through Entity Election Tax Return within the applicable statute of limitations if you need to make changes or corrections to the original return.

Form Details:

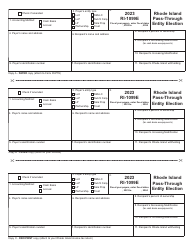

- Released on October 1, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-PTE by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.