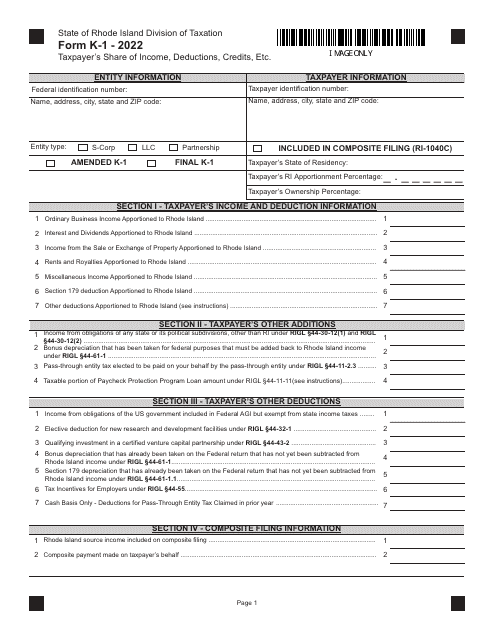

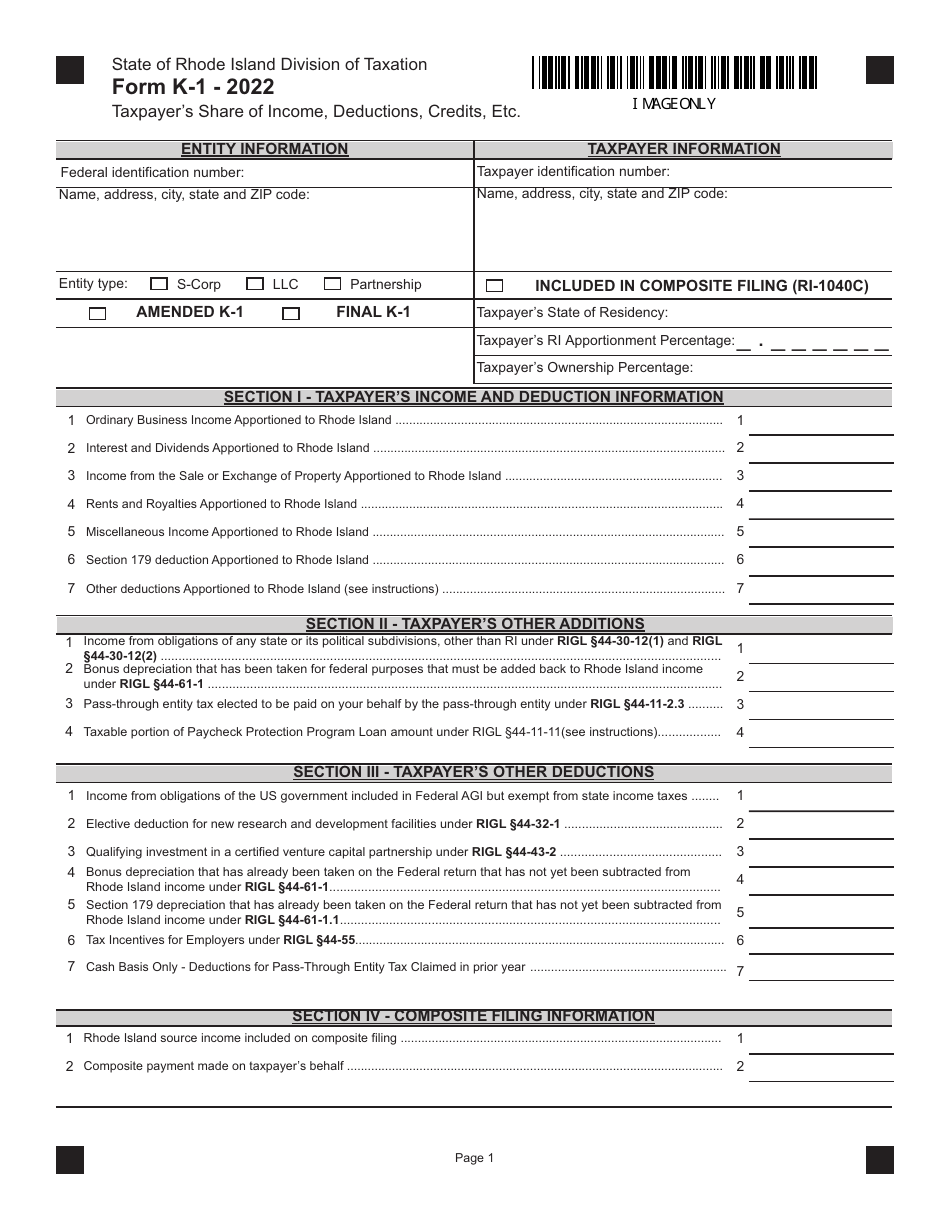

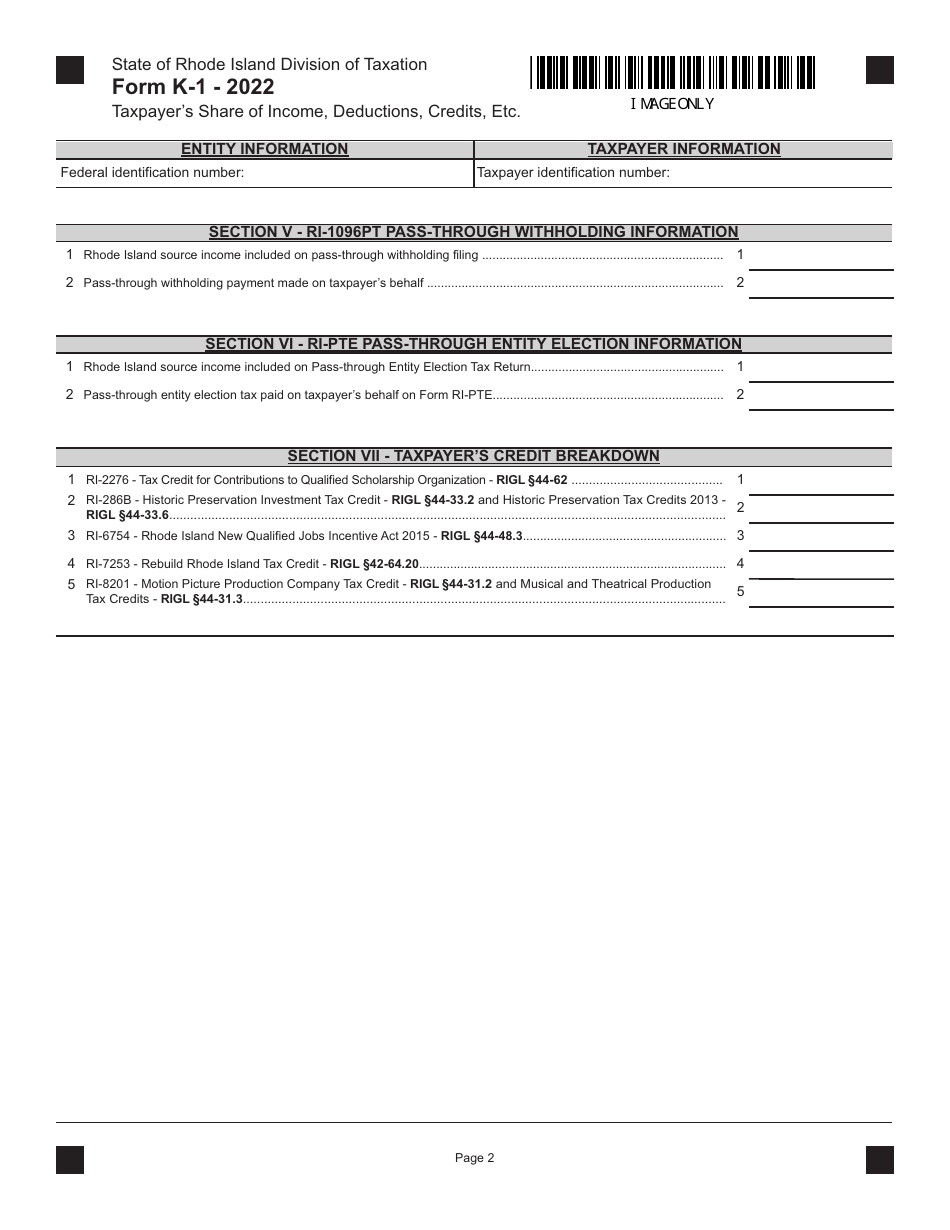

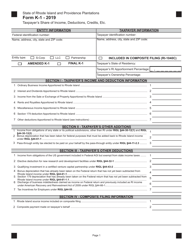

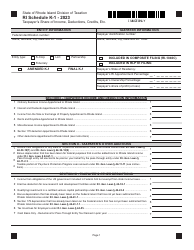

Form K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island

What Is Form K-1?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form K-1?

A: Form K-1 is a tax form used to report a taxpayer's share of income, deductions, credits, etc.

Q: What is the purpose of Form K-1?

A: The purpose of Form K-1 is to accurately report the taxpayer's share of income, deductions, credits, etc. from partnerships, S corporations, estates, and trusts.

Q: Who is required to file Form K-1?

A: Partnerships, S corporations, estates, and trusts are required to file Form K-1.

Q: What information is reported on Form K-1?

A: Form K-1 reports the taxpayer's share of income, deductions, credits, etc. It includes details such as partnership or S corporation income, rental real estate income, and capital gains or losses.

Q: What is the deadline for filing Form K-1?

A: The deadline for filing Form K-1 is usually April 15th, or the 15th day of the fourth month following the end of the fiscal year for partnerships and S corporations.

Q: Do I need to include Form K-1 with my individual tax return?

A: Yes, if you receive a Form K-1, you generally need to include it with your individual tax return (Form 1040) to accurately report your share of income, deductions, credits, etc.

Q: Are there any specific instructions for completing Form K-1?

A: Yes, the IRS provides specific instructions (Form 1065, Schedule K-1 instructions) on how to complete Form K-1 based on the taxpayer's situation.

Q: Can I e-file Form K-1?

A: Yes, it is possible to electronically file Form K-1, but it must be done by the entity that is required to file the form (partnership, S corporation, estate, or trust).

Q: What happens if I receive a corrected Form K-1?

A: If you receive a corrected Form K-1 after you have already filed your tax return, you may need to file an amended tax return (Form 1040X) to reflect the changes.

Q: Do I need to pay taxes on the income reported on Form K-1?

A: Yes, you may need to pay taxes on the income reported on Form K-1, depending on your individual tax situation and applicable tax laws.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.