This version of the form is not currently in use and is provided for reference only. Download this version of

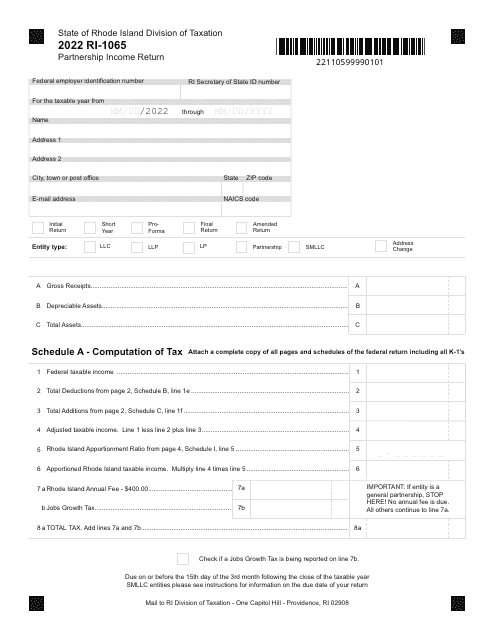

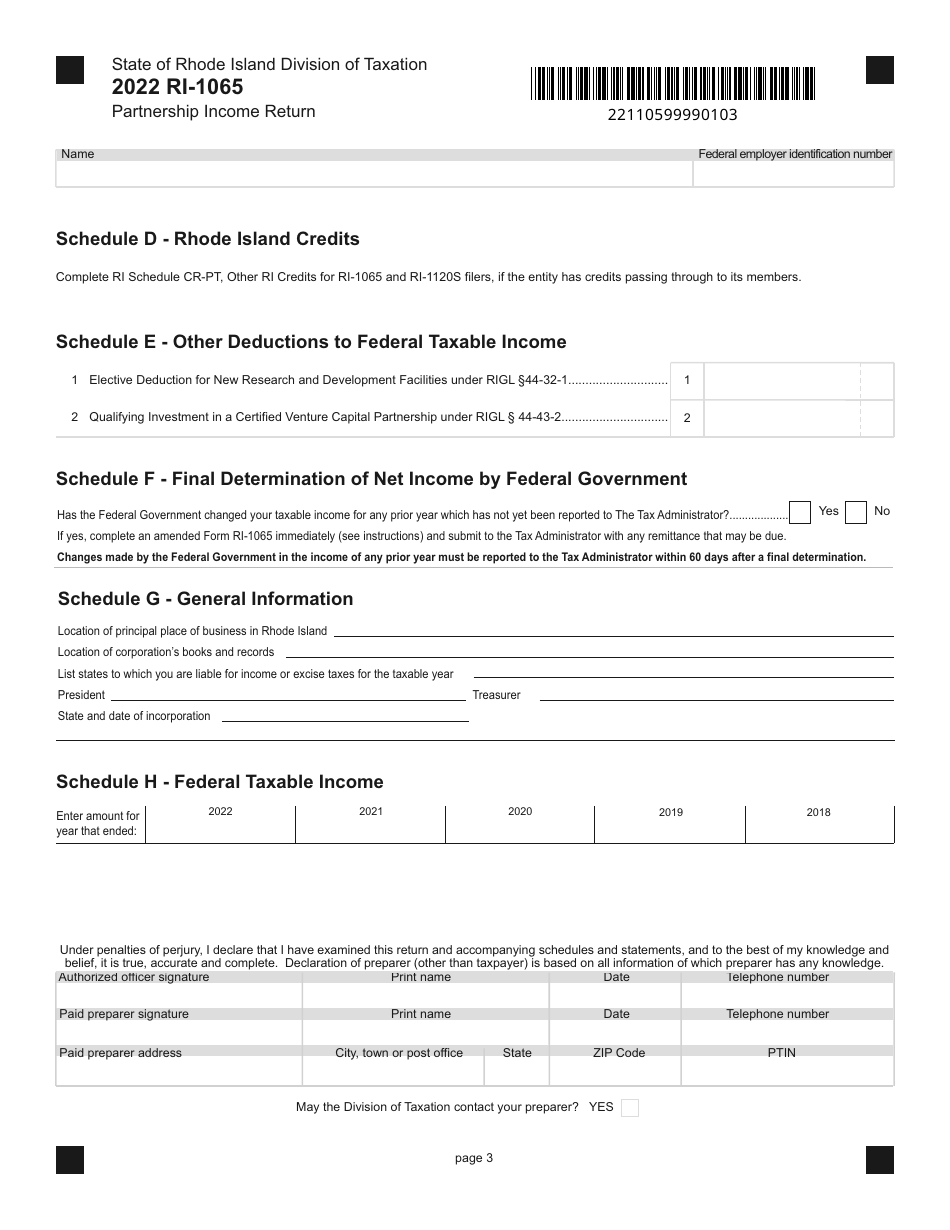

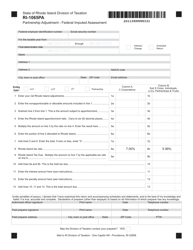

Form RI-1065

for the current year.

Form RI-1065 Partnership Income Return - Rhode Island

What Is Form RI-1065?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a Form RI-1065?

A: Form RI-1065 is a tax return form for reporting partnership income in the state of Rhode Island.

Q: Who needs to file Form RI-1065?

A: Partnerships operating in Rhode Island are required to file Form RI-1065.

Q: When is the deadline for filing Form RI-1065?

A: The deadline for filing Form RI-1065 is April 15th, or the 15th day of the fourth month following the close of the taxable year.

Q: Can Form RI-1065 be filed electronically?

A: Yes, Form RI-1065 can be filed electronically.

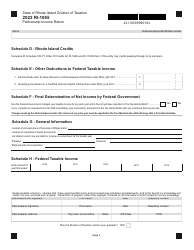

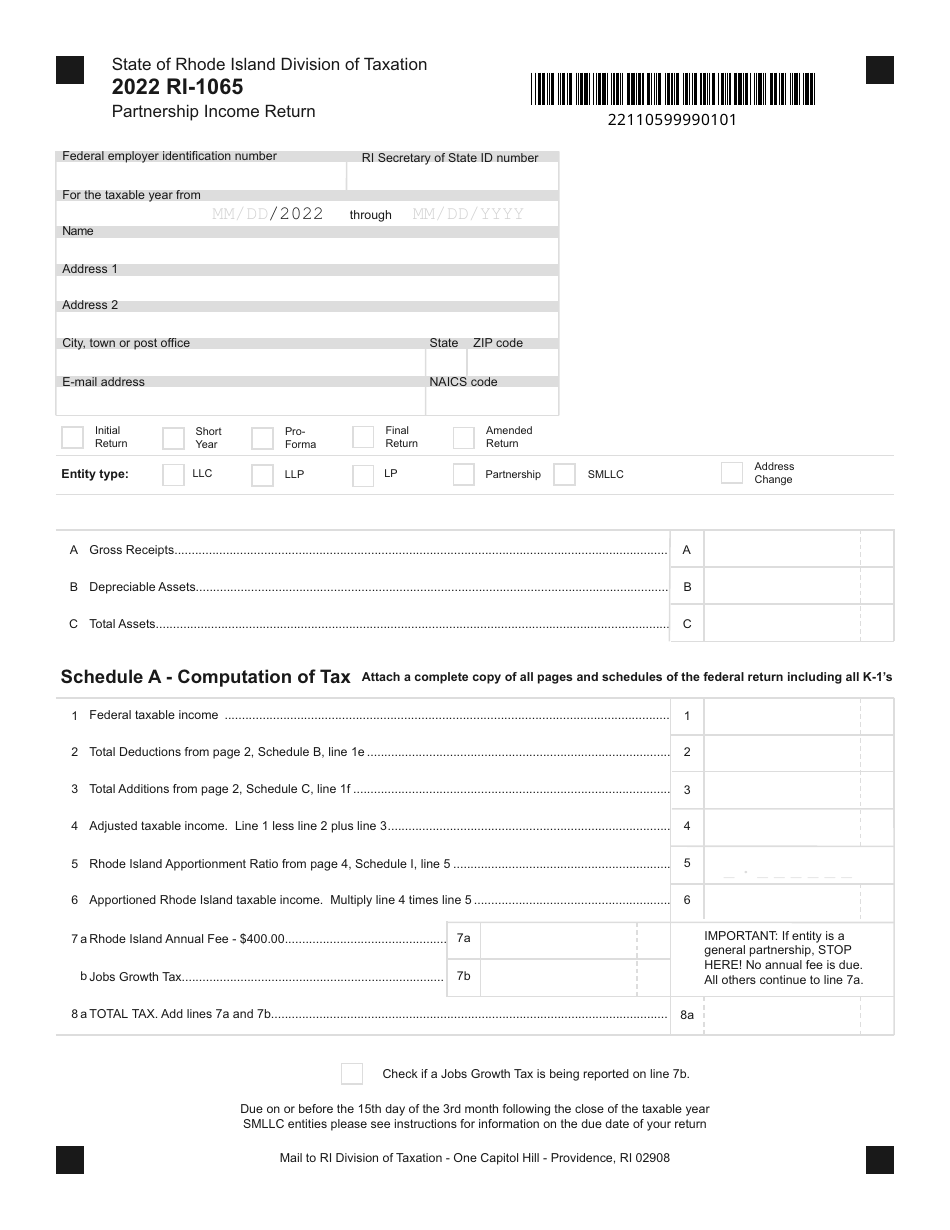

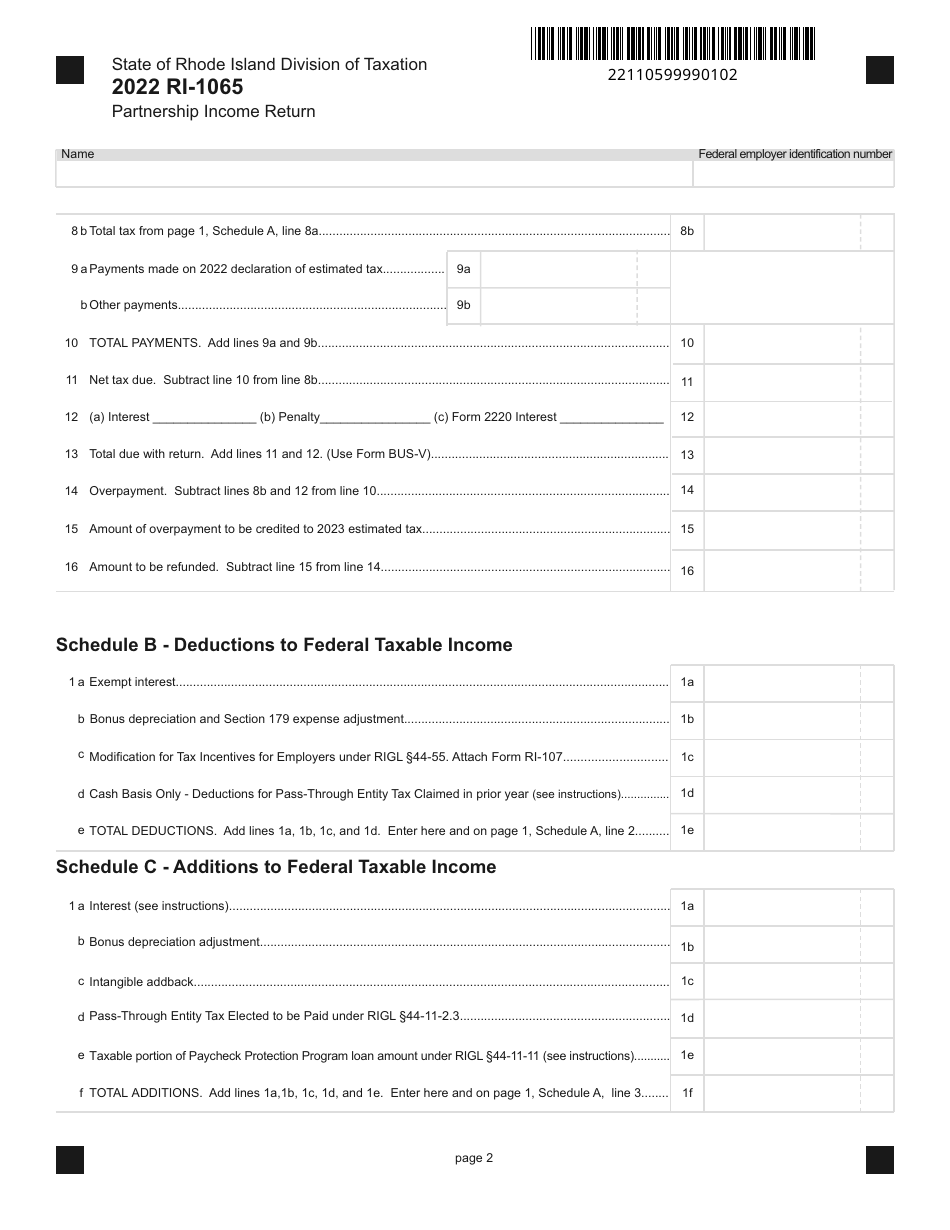

Q: What information is required to complete Form RI-1065?

A: Some of the information required to complete Form RI-1065 includes partnership income and deductions, partner information, and tax payment details.

Q: Are there any penalties for late filing of Form RI-1065?

A: Yes, there are penalties for late filing of Form RI-1065. The penalty amount depends on the duration of the delay.

Q: Can I get an extension to file Form RI-1065?

A: Yes, you can request an extension to file Form RI-1065. The extension request must be submitted on or before the original due date of the return.

Q: Do I need to include a copy of federal Form 1065 with Form RI-1065?

A: Yes, you must include a copy of federal Form 1065 with Form RI-1065.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1065 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.