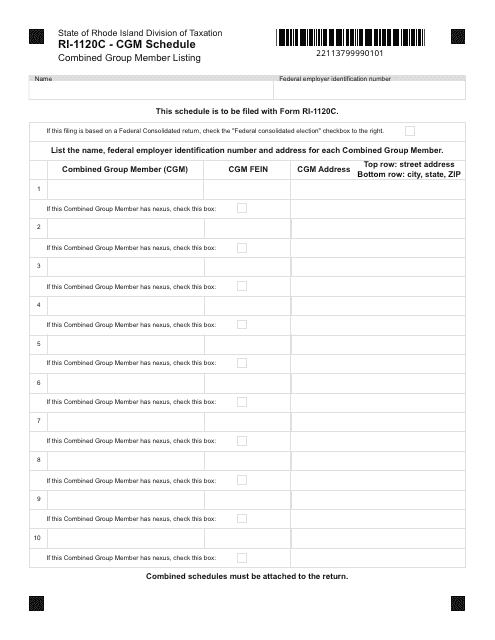

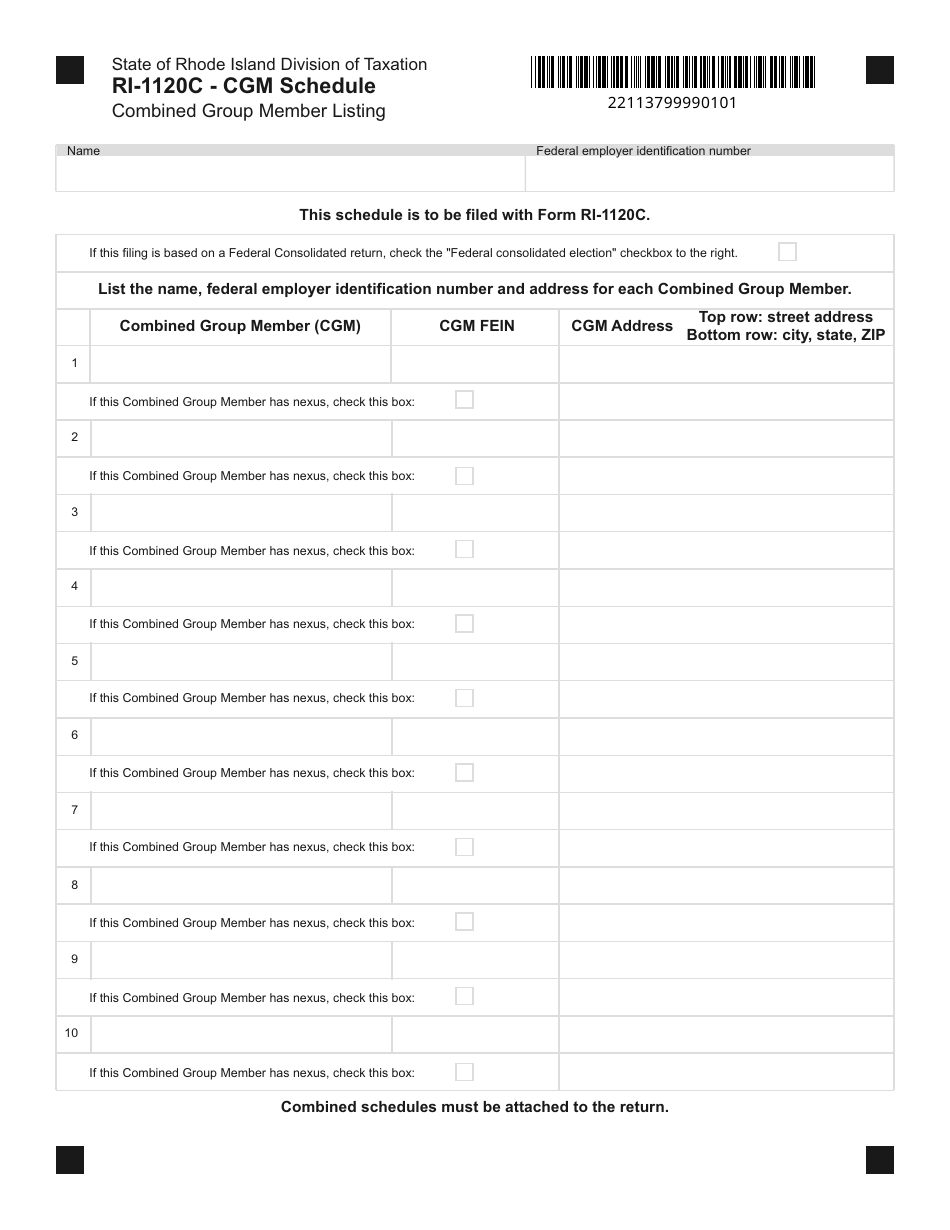

Form RI-1120C Schedule CGM Combined Group Member Listing - Rhode Island

What Is Form RI-1120C Schedule CGM?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1120C Schedule CGM?

A: Form RI-1120C Schedule CGM is a tax form used in Rhode Island to report the combined group member listing.

Q: Who needs to file Form RI-1120C Schedule CGM?

A: All combined group members in Rhode Island must file Form RI-1120C Schedule CGM.

Q: What information is required on Form RI-1120C Schedule CGM?

A: Form RI-1120C Schedule CGM requires the listing of all combined group members, including their names, addresses, and assigned group numbers.

Q: When is the deadline to file Form RI-1120C Schedule CGM?

A: The deadline to file Form RI-1120C Schedule CGM is generally the same as the deadline to file the Rhode Island corporate income tax return, which is usually March 15th.

Q: Are there any penalties for late filing of Form RI-1120C Schedule CGM?

A: Yes, there may be penalties for late filing of Form RI-1120C Schedule CGM. It is important to file the form by the deadline to avoid any penalties or interest charges.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120C Schedule CGM by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.