This version of the form is not currently in use and is provided for reference only. Download this version of

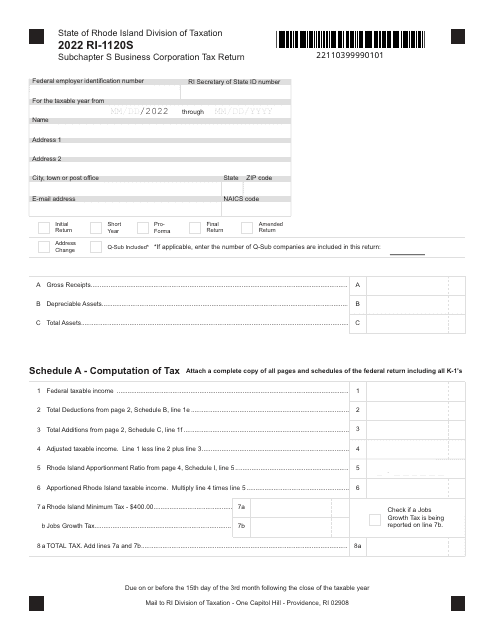

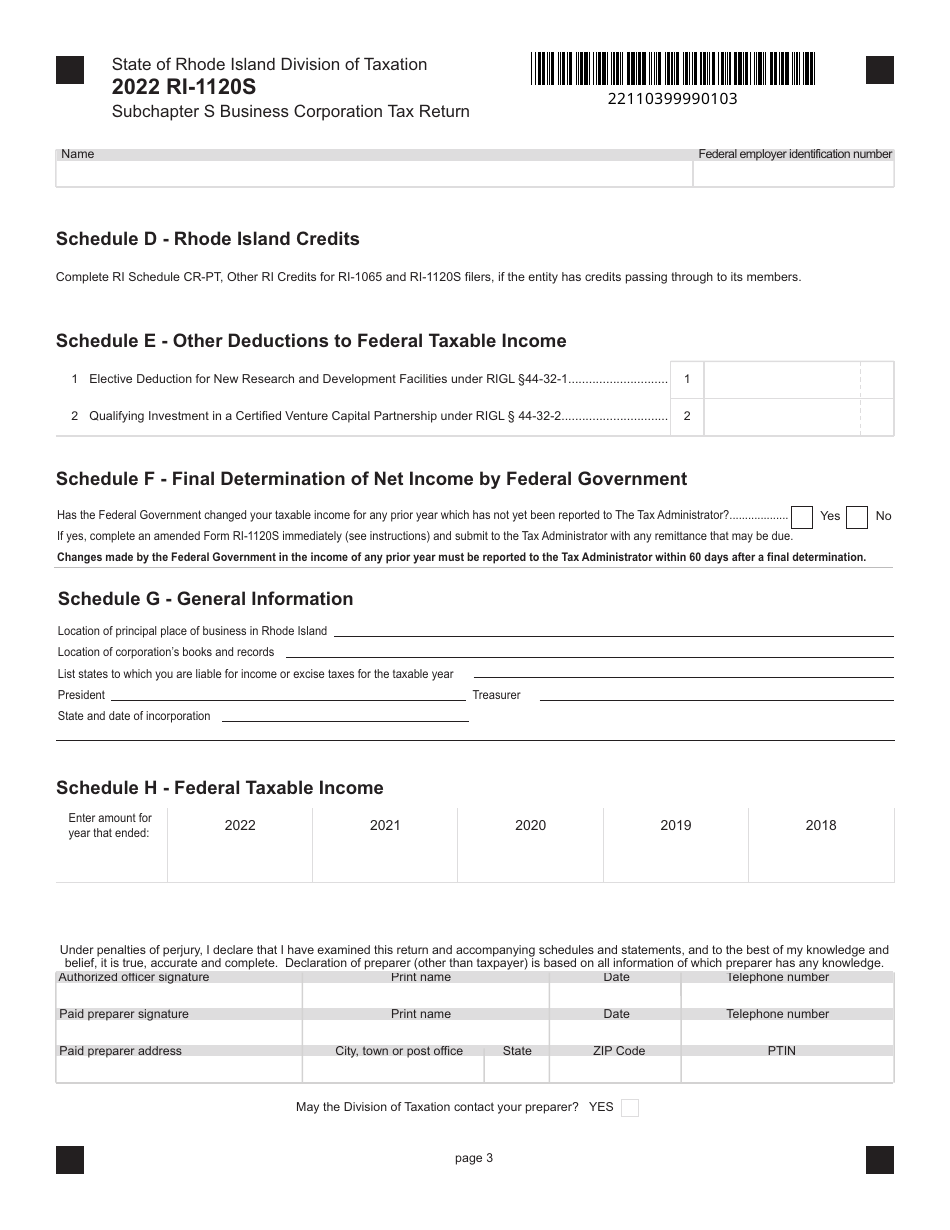

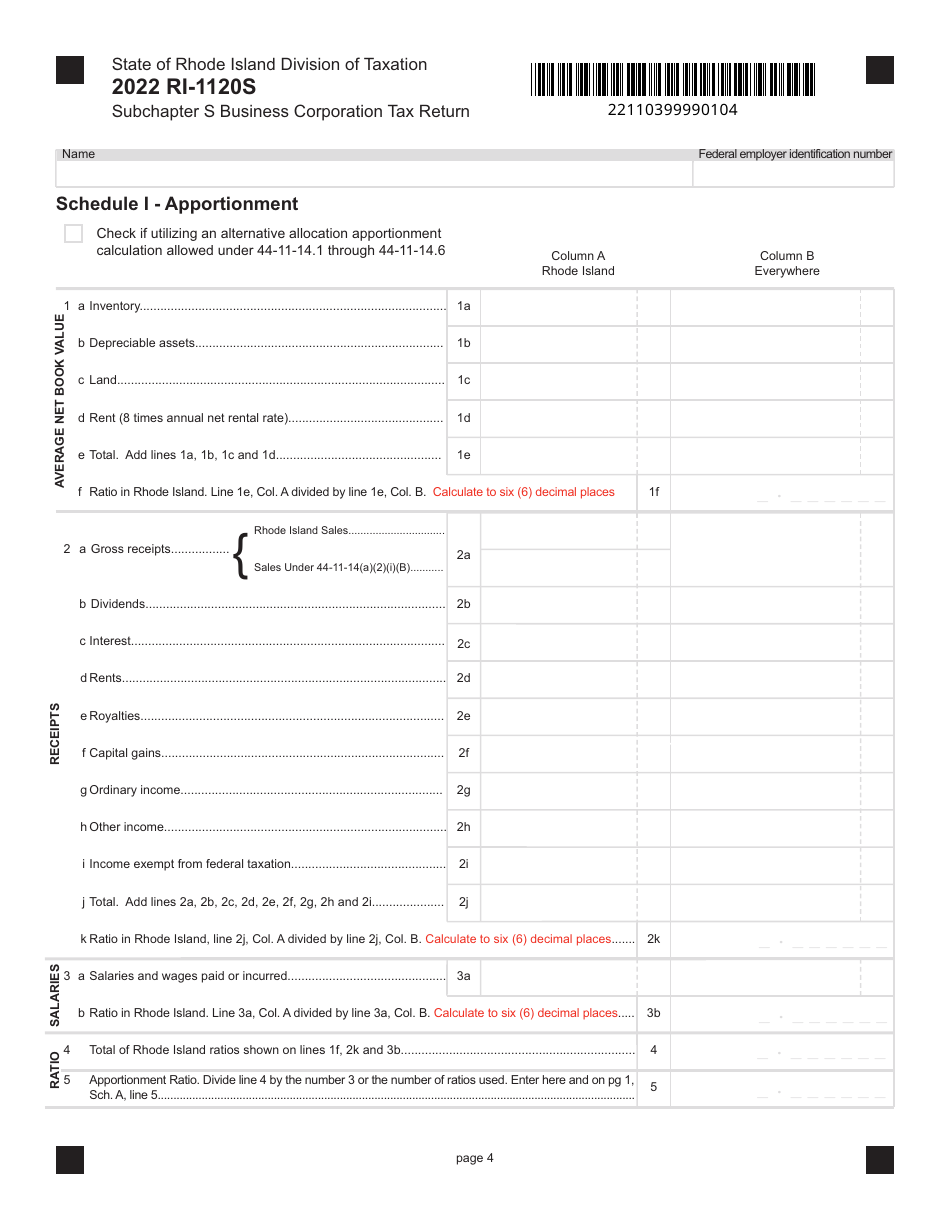

Form RI-1120S

for the current year.

Form RI-1120S Subchapter S Business Corporation Tax Return - Rhode Island

What Is Form RI-1120S?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1120S?

A: Form RI-1120S is the Rhode Island Subchapter S Business Corporation Tax Return.

Q: Who needs to file Form RI-1120S?

A: Rhode Island Subchapter S corporations need to file Form RI-1120S.

Q: What is a Subchapter S corporation?

A: A Subchapter S corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

Q: What is the purpose of Form RI-1120S?

A: Form RI-1120S is used to report Rhode Island state income taxes for Subchapter S corporations.

Q: When is the deadline to file Form RI-1120S?

A: The deadline to file Form RI-1120S is the same as the federal tax deadline, which is usually April 15th.

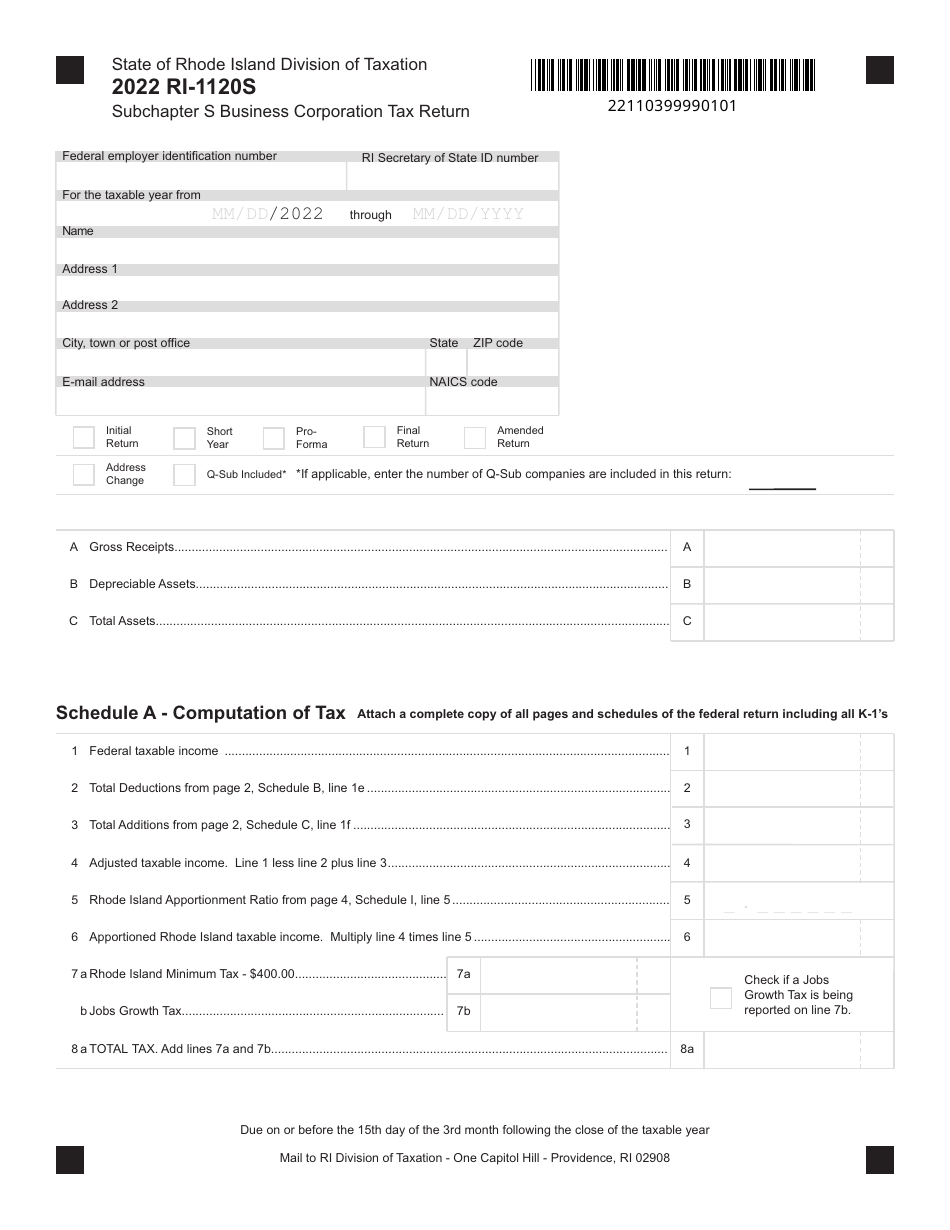

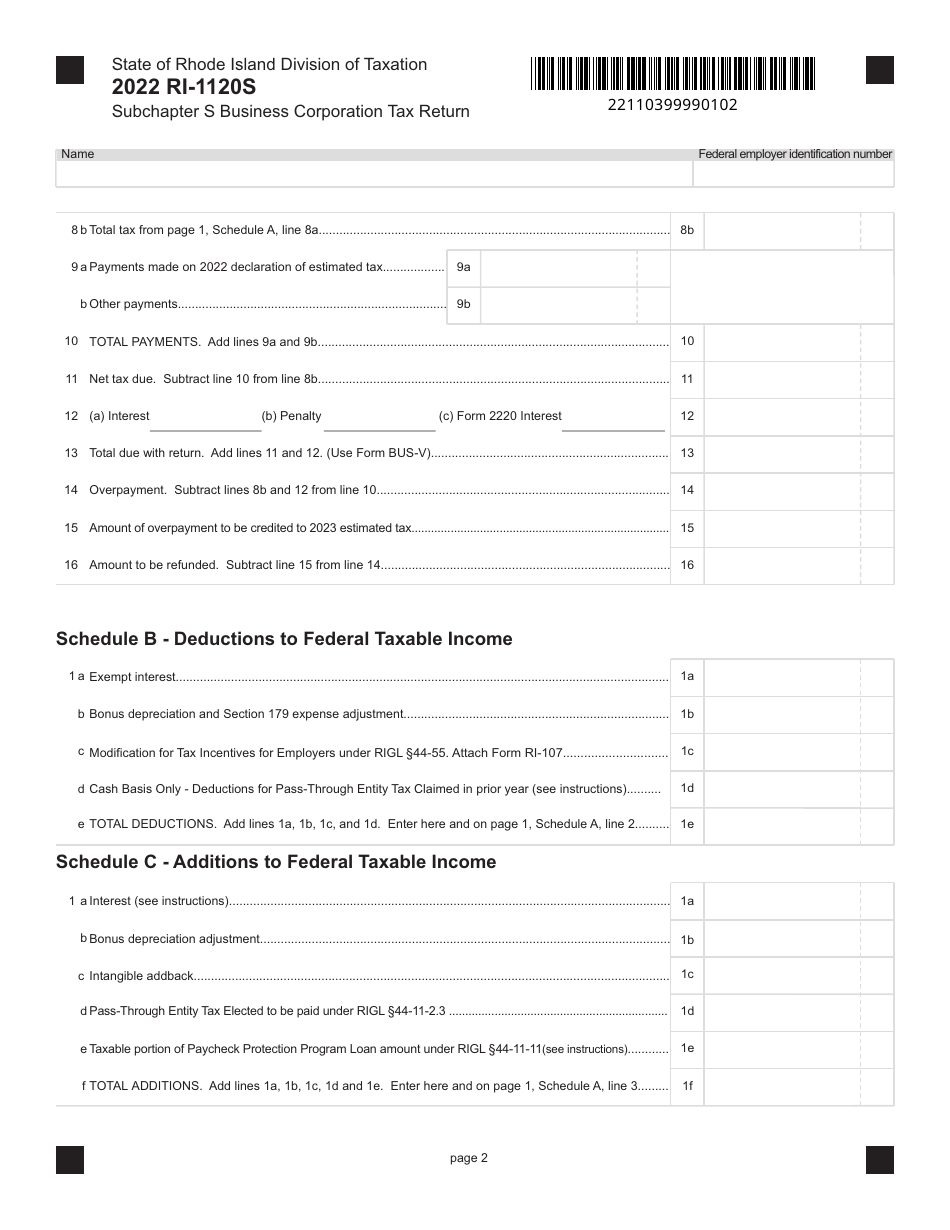

Q: Are there any penalties for filing Form RI-1120S late?

A: Yes, there may be penalties for filing Form RI-1120S late. It's important to file and pay any taxes owed by the deadline to avoid penalties and interest.

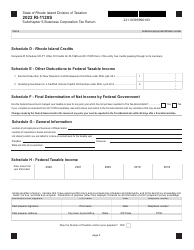

Q: Do I need to include any attachments with Form RI-1120S?

A: Yes, you may need to include certain attachments with Form RI-1120S, such as schedules and supporting documentation.

Q: Can I e-file Form RI-1120S?

A: Yes, Rhode Island allows for e-filing of Form RI-1120S.

Q: Who can I contact for more information about Form RI-1120S?

A: For more information about Form RI-1120S, you can contact the Rhode Island Division of Taxation.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120S by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.