This version of the form is not currently in use and is provided for reference only. Download this version of

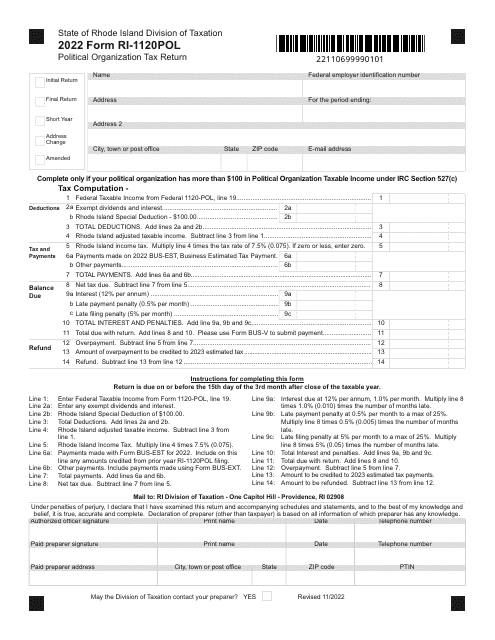

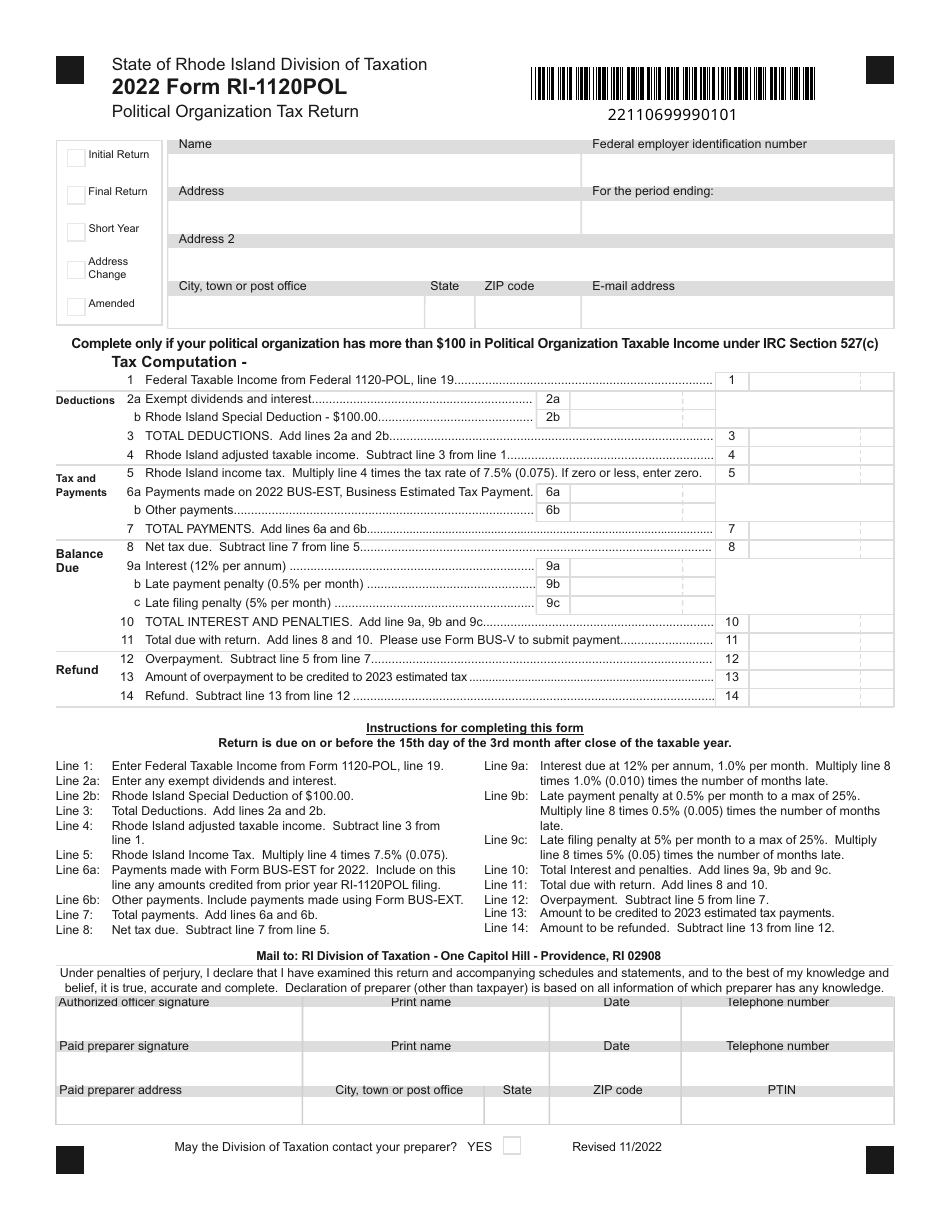

Form RI-1120POL

for the current year.

Form RI-1120POL Political Organization Tax Return - Rhode Island

What Is Form RI-1120POL?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1120POL?

A: Form RI-1120POL is the Political Organization Tax Return for the state of Rhode Island.

Q: Who needs to file Form RI-1120POL?

A: Political organizations operating in Rhode Island need to file Form RI-1120POL.

Q: When is Form RI-1120POL due?

A: Form RI-1120POL is due on the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form RI-1120POL?

A: Yes, there are penalties for late filing or failure to file Form RI-1120POL. It is important to file the return on time to avoid these penalties.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120POL by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.