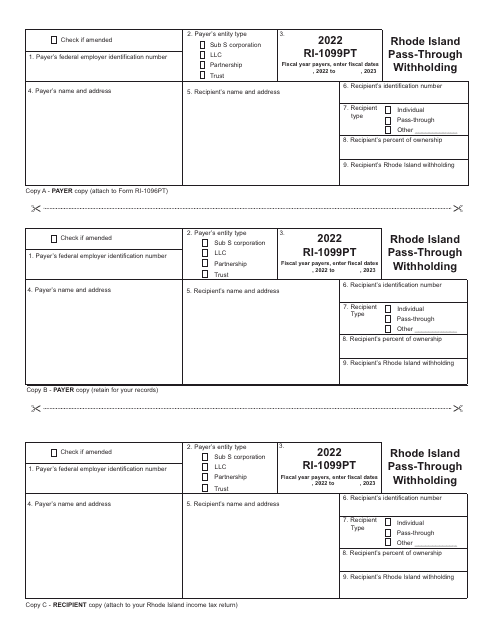

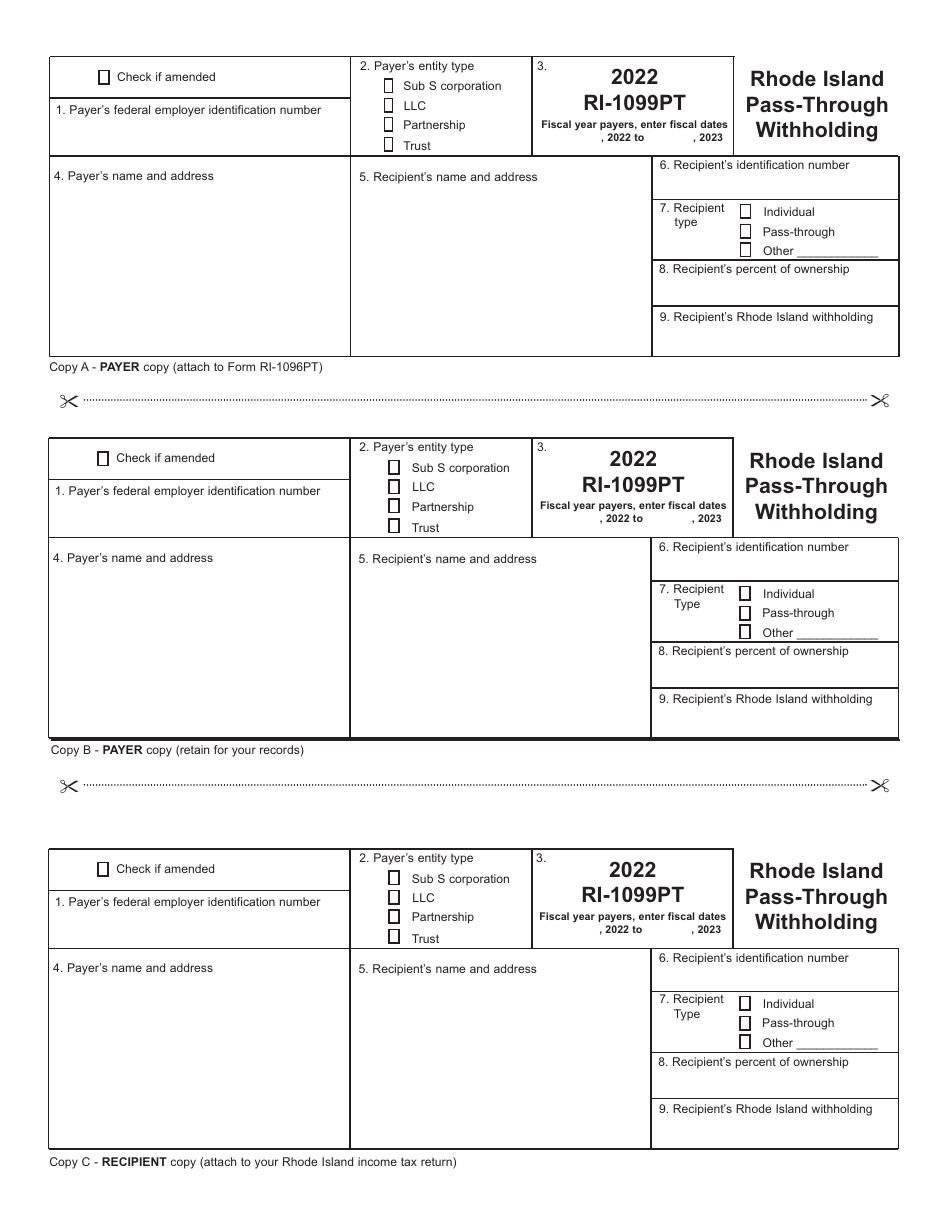

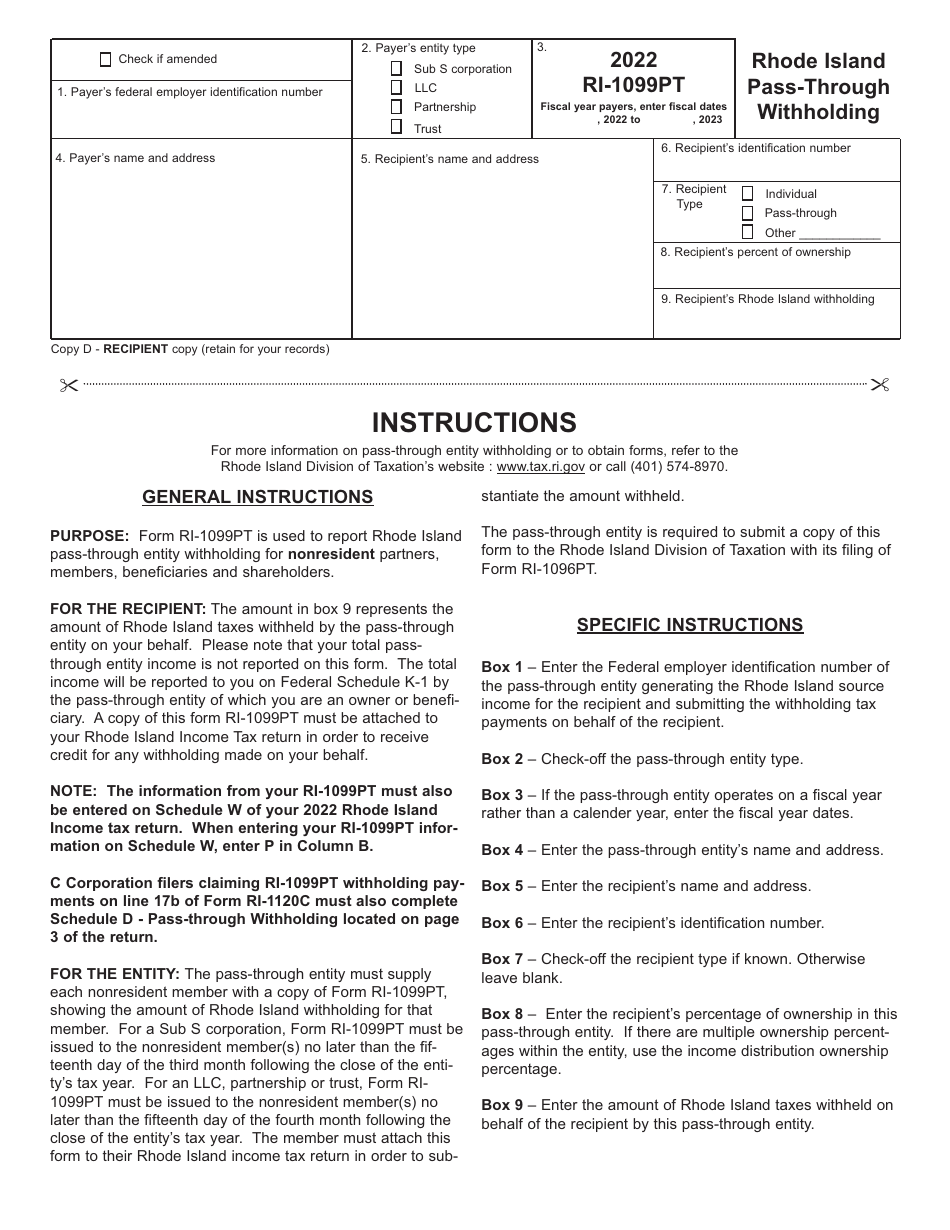

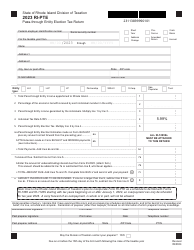

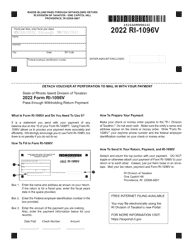

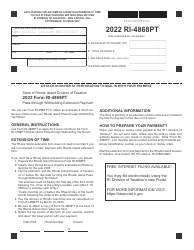

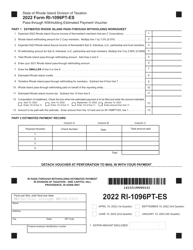

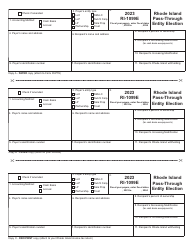

Form RI-1099PT Rhode Island Pass-Through Withholding - Rhode Island

What Is Form RI-1099PT?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1099PT?

A: Form RI-1099PT is the Rhode Island Pass-Through Withholding form.

Q: What is Rhode Island Pass-Through Withholding?

A: Rhode Island Pass-Through Withholding is a tax collected on certain pass-through entity payments.

Q: Who needs to file Form RI-1099PT?

A: Anyone who is required to withhold Rhode Island income tax from payments made to non-residents needs to file Form RI-1099PT.

Q: What information is required on Form RI-1099PT?

A: Form RI-1099PT requires information about the pass-through entity making the payment and the recipient of the payment.

Q: When is Form RI-1099PT due?

A: Form RI-1099PT is due on or before January 31st of the following year in which the payment was made.

Q: Are there any penalties for late filing of Form RI-1099PT?

A: Yes, there are penalties for late filing of Form RI-1099PT. The penalty amount depends on the number of payments and the delay in filing.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1099PT by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.