This version of the form is not currently in use and is provided for reference only. Download this version of

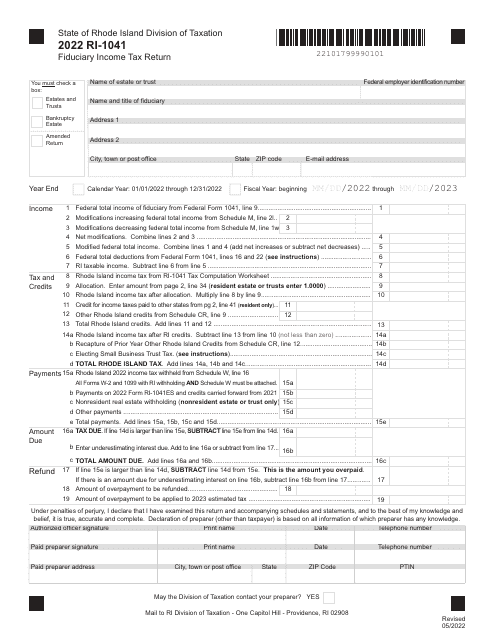

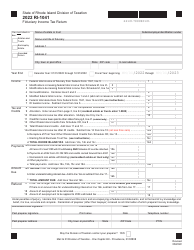

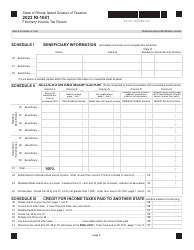

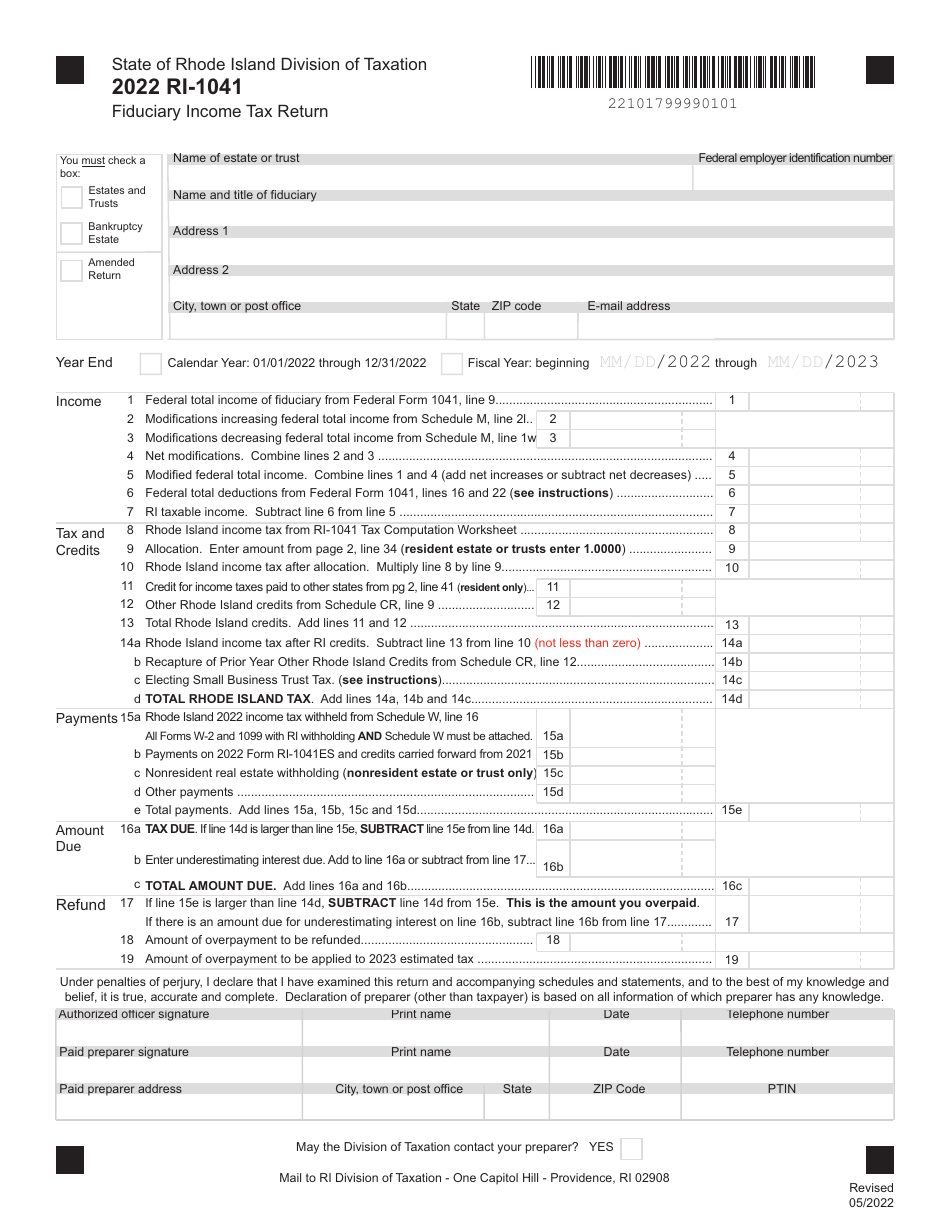

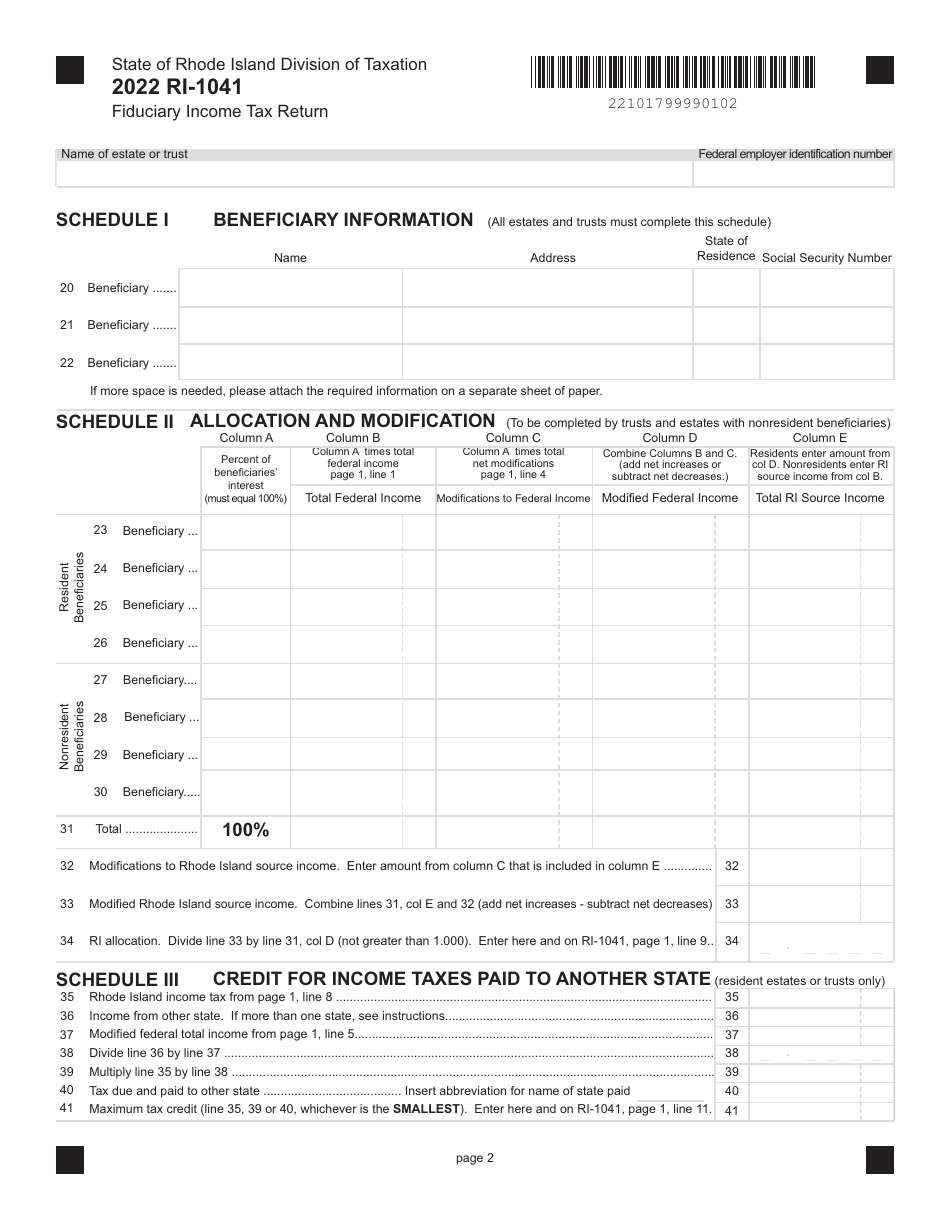

Form RI-1041

for the current year.

Form RI-1041 Fiduciary Income Tax Return - Rhode Island

What Is Form RI-1041?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1041?

A: Form RI-1041 is the Rhode Island Fiduciary Income Tax Return.

Q: Who should file Form RI-1041?

A: Form RI-1041 should be filed by fiduciaries who are responsible for reporting the income, deductions, and credits of an estate or trust that is subject to Rhode Island income tax.

Q: When is Form RI-1041 due?

A: Form RI-1041 is due on or before the 15th day of the fourth month following the close of the tax year. For example, for a tax year ending on December 31, the due date is April 15.

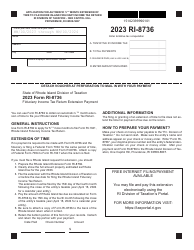

Q: Are there any filing extensions available for Form RI-1041?

A: Yes, there is an automatic extension of 6 months to file Form RI-1041. However, any tax due must still be paid by the original due date to avoid penalties and interest.

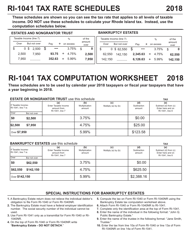

Q: What are some common attachments to Form RI-1041?

A: Some common attachments to Form RI-1041 include Schedule A, which provides details of the fiduciary's income and deductions, and Schedule B, which reports the beneficiaries' shares of income and deductions.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.