This version of the form is not currently in use and is provided for reference only. Download this version of

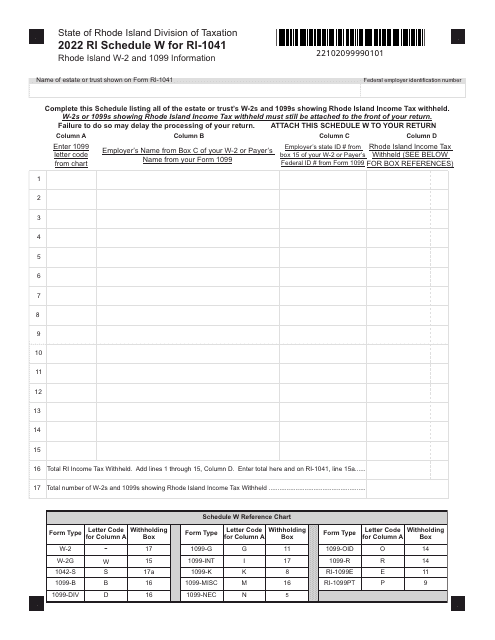

Form RI-1041 Schedule W

for the current year.

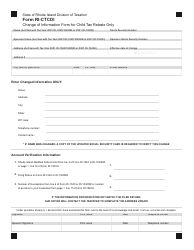

Form RI-1041 Schedule W Rhode Island W-2 and 1099 Information - Rhode Island

What Is Form RI-1041 Schedule W?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1041, Fiduciary Income Tax Return - Draft. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041 Schedule W?

A: Form RI-1041 Schedule W is a tax form used in Rhode Island to report W-2 and 1099 information.

Q: What is the purpose of Form RI-1041 Schedule W?

A: The purpose of Form RI-1041 Schedule W is to provide information on wages and income earned through W-2 and 1099 forms in Rhode Island.

Q: Who needs to file Form RI-1041 Schedule W?

A: Anyone who has received wages or income through W-2 and 1099 forms in Rhode Island needs to file Form RI-1041 Schedule W.

Q: What information is required on Form RI-1041 Schedule W?

A: Form RI-1041 Schedule W requires information such as the name and address of the employer, the employee's Social Security number, and the amount of wages earned.

Q: When is the deadline to file Form RI-1041 Schedule W?

A: The deadline to file Form RI-1041 Schedule W is typically April 15th, or the same deadline as your federal income tax return.

Q: Is there an extension available for filing Form RI-1041 Schedule W?

A: Yes, you can request an extension for filing Form RI-1041 Schedule W by submitting Form RI-4868 Application for Extension of Time to File the RI-1041 Schedule W.

Q: Are there any penalties for not filing Form RI-1041 Schedule W?

A: Yes, if you fail to file Form RI-1041 Schedule W or provide incorrect information, you may be subject to penalties and interest charges.

Q: Do I need to include copies of my W-2 and 1099 forms with Form RI-1041 Schedule W?

A: No, you do not need to include copies of your W-2 and 1099 forms with Form RI-1041 Schedule W. However, you should keep them for your records.

Q: Can I e-file Form RI-1041 Schedule W?

A: Yes, you can e-file Form RI-1041 Schedule W if you use approved tax software or hire a tax professional who offers e-filing services.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041 Schedule W by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.