This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

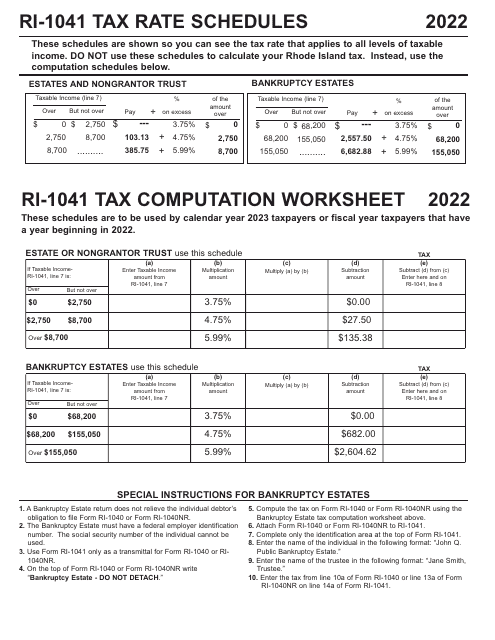

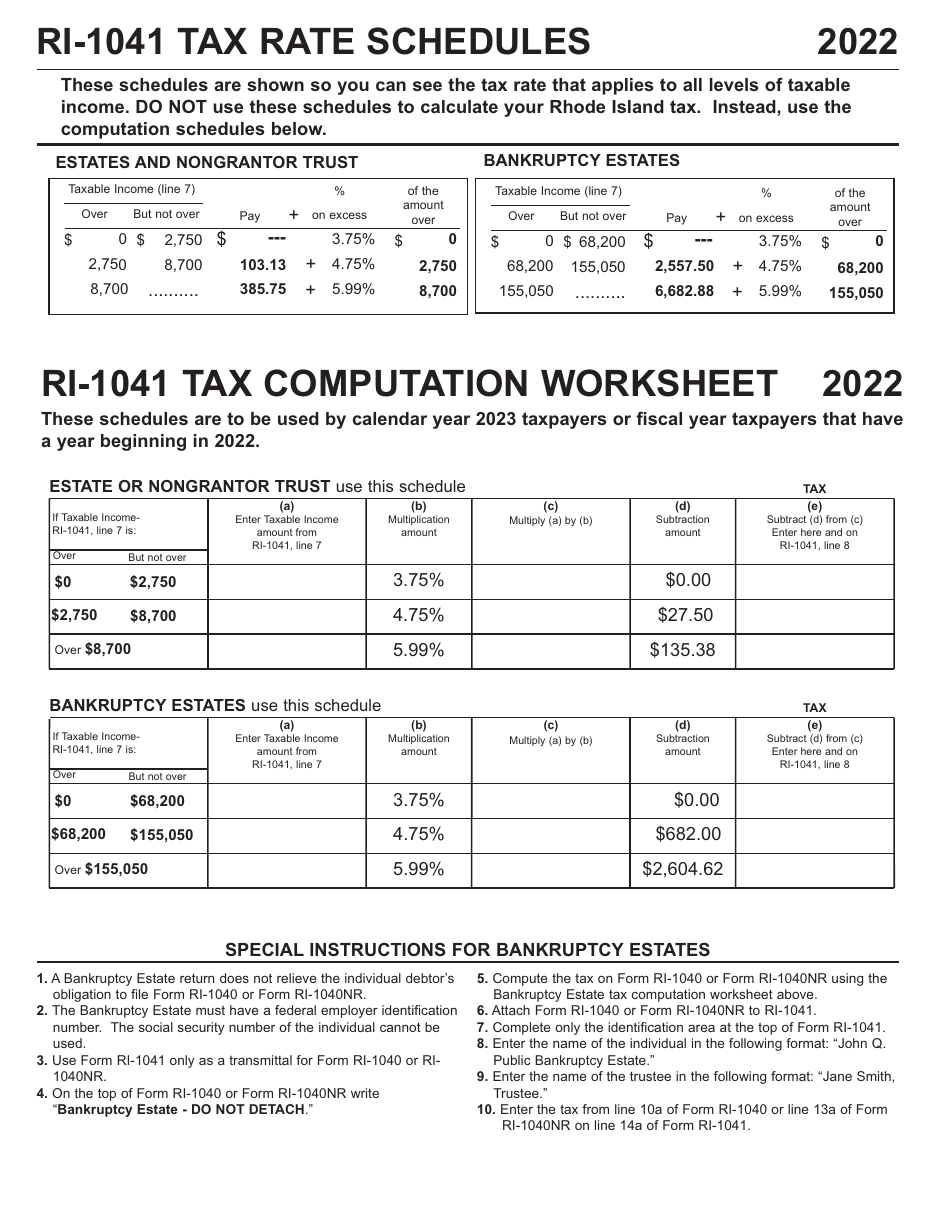

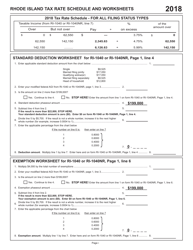

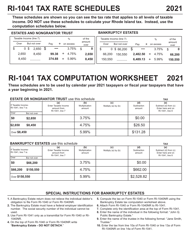

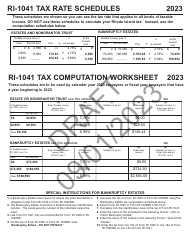

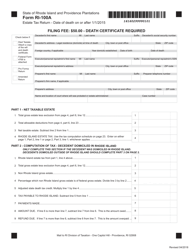

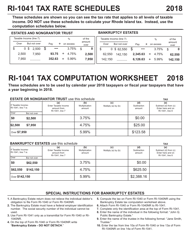

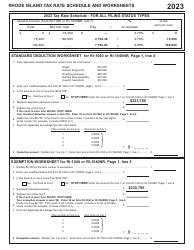

Ri-1041 Tax Rate Worksheet and Schedules - Rhode Island

Ri-1041 Tax Rate Worksheet and Schedules is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the Ri-1041 tax rate worksheet and schedules?

A: The Ri-1041 tax rate worksheet and schedules is a set of documents used for calculating tax rates in the state of Rhode Island.

Q: Who needs to use the Ri-1041 tax rate worksheet and schedules?

A: Residents of Rhode Island who need to calculate their tax rates for filing their state taxes need to use the Ri-1041 tax rate worksheet and schedules.

Q: How do I use the Ri-1041 tax rate worksheet and schedules?

A: To use the Ri-1041 tax rate worksheet and schedules, you need to follow the instructions provided in the documents and input the necessary information based on your individual tax situation.

Q: What is the purpose of the Ri-1041 tax rate worksheet and schedules?

A: The purpose of the Ri-1041 tax rate worksheet and schedules is to help Rhode Island residents determine their tax rates accurately and ensure they pay the right amount of state taxes.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.