This version of the form is not currently in use and is provided for reference only. Download this version of

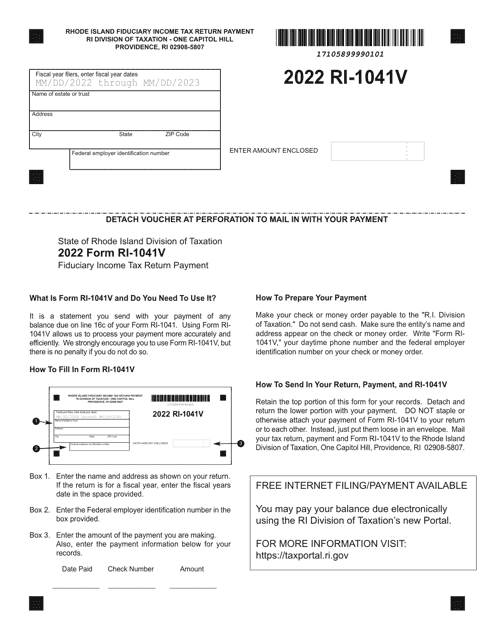

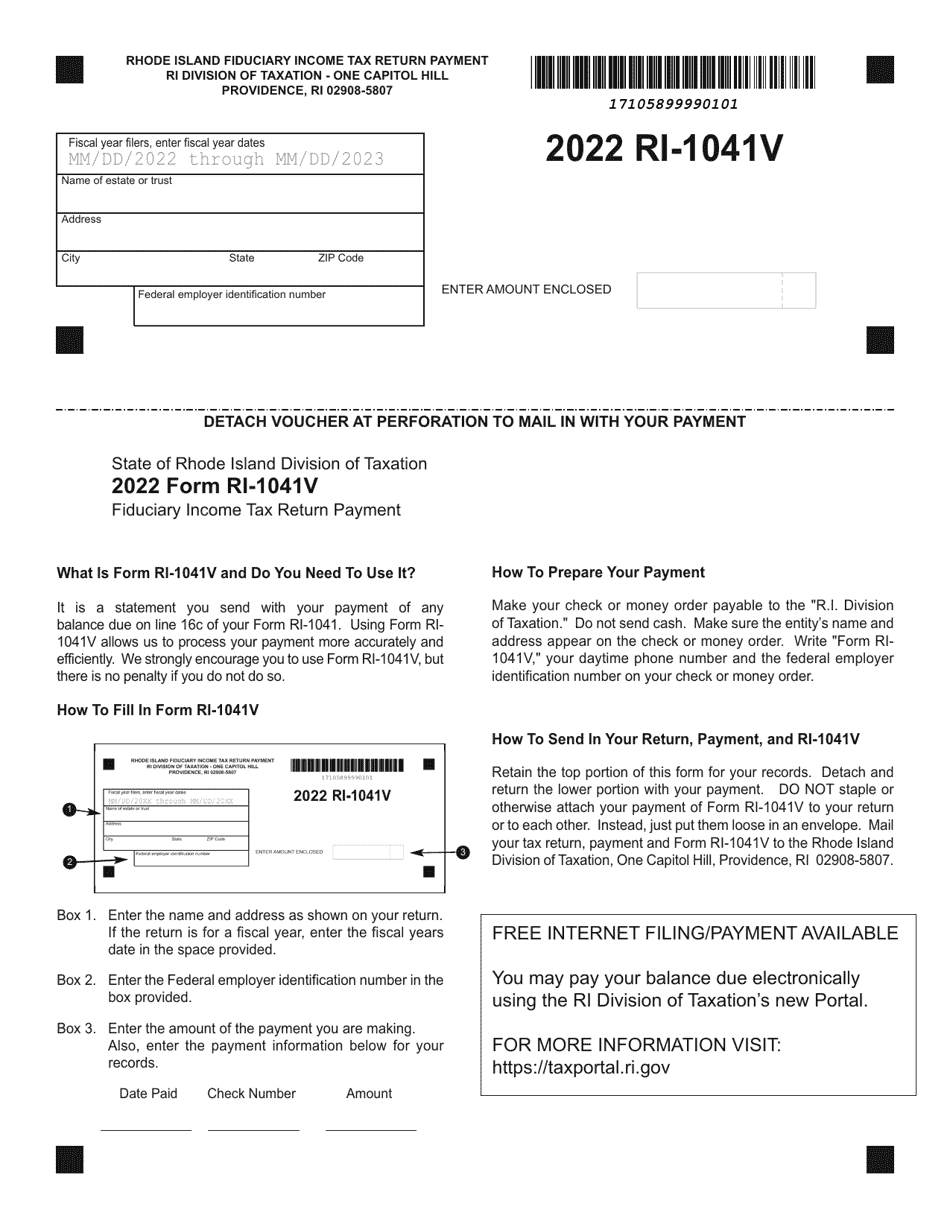

Form RI-1041V

for the current year.

Form RI-1041V Fiduciary Income Tax Return Payment - Rhode Island

What Is Form RI-1041V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1041V?

A: Form RI-1041V is the payment voucher for the Rhode Island Fiduciary Income Tax Return.

Q: What is a Fiduciary Income Tax Return?

A: A Fiduciary Income Tax Return is a tax return filed by a fiduciary, such as an executor or trustee, on behalf of an estate or trust.

Q: Who needs to file Form RI-1041V?

A: Anyone who is filing a Rhode Island Fiduciary Income Tax Return and needs to make a payment should file Form RI-1041V.

Q: What is the purpose of Form RI-1041V?

A: The purpose of Form RI-1041V is to provide a means for individuals to make payments towards their Rhode Island Fiduciary Income Tax liability.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1041V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.