This version of the form is not currently in use and is provided for reference only. Download this version of

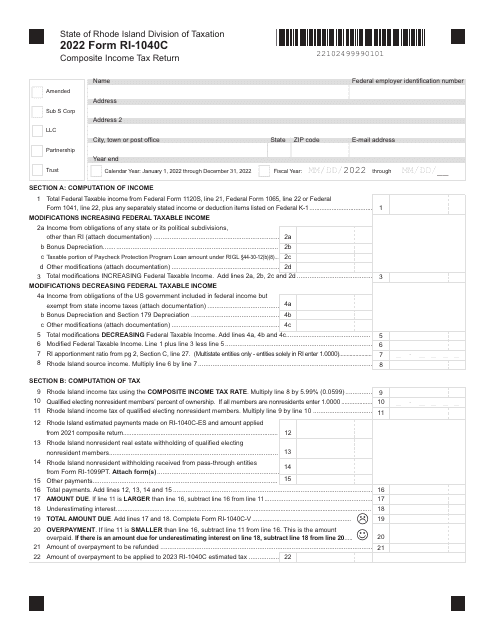

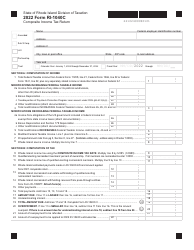

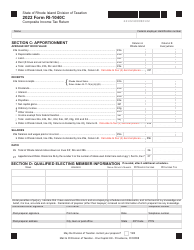

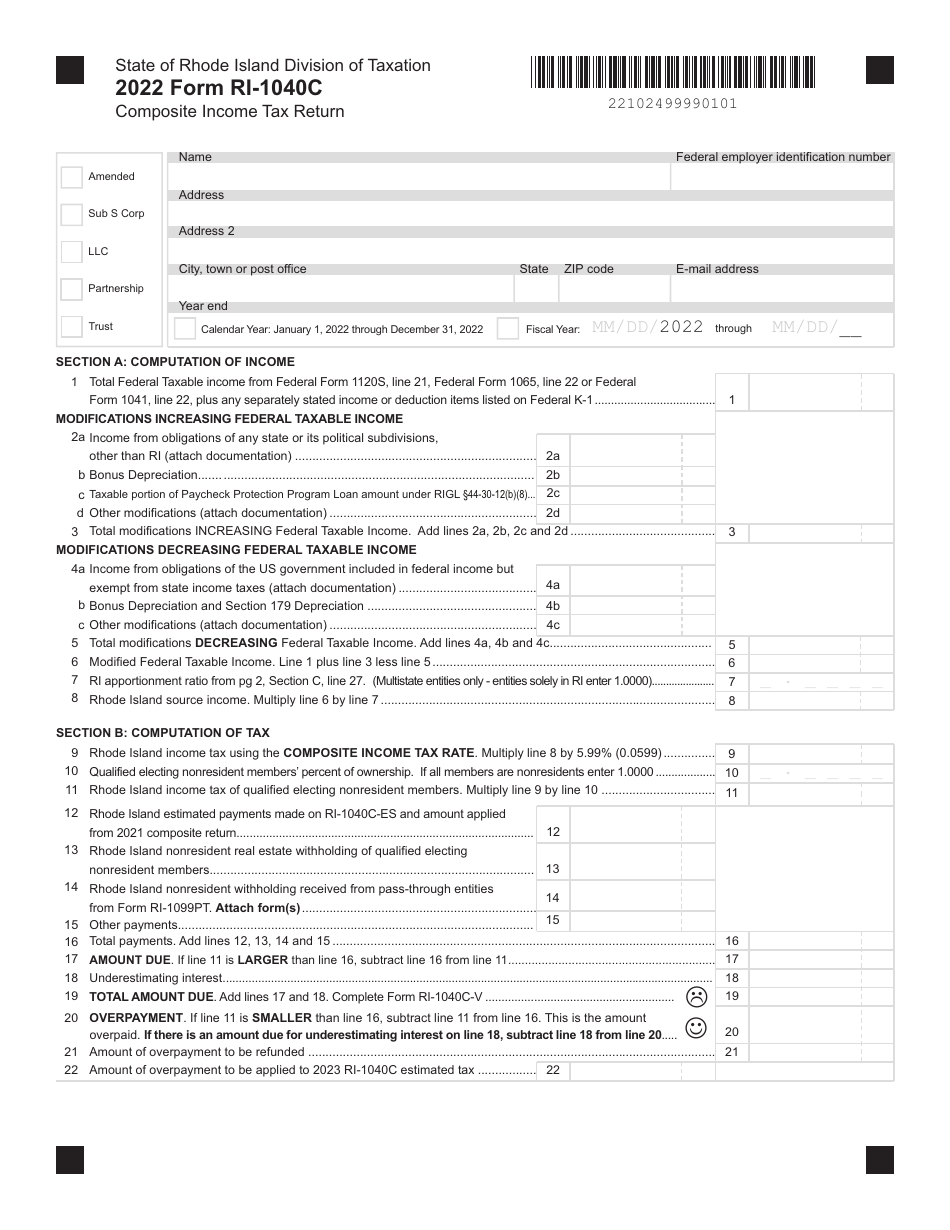

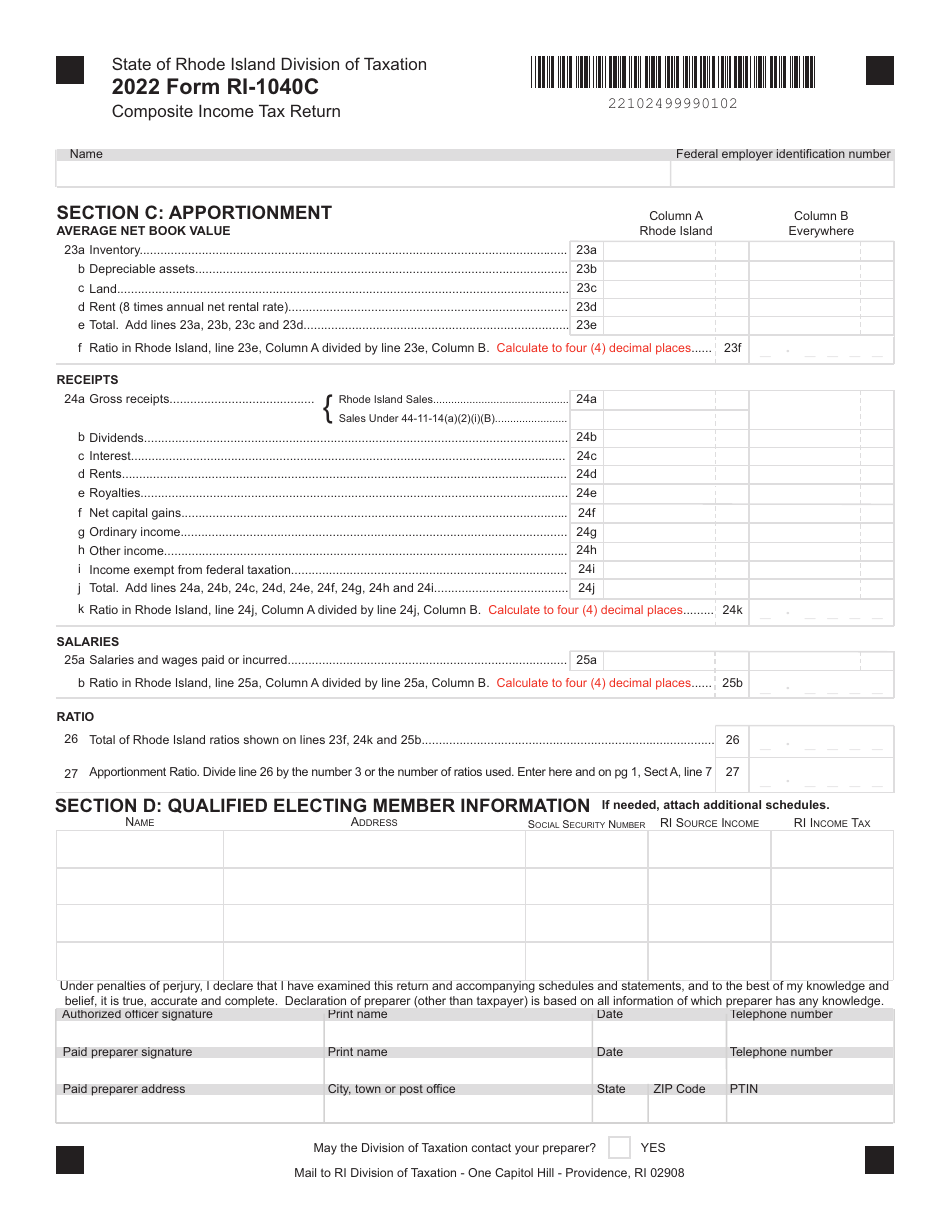

Form RI-1040C

for the current year.

Form RI-1040C Composite Income Tax(return - Rhode Island

What Is Form RI-1040C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1040C?

A: Form RI-1040C is the Composite Income Tax Return for Rhode Island.

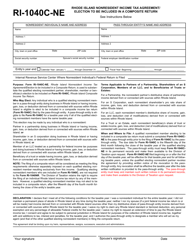

Q: Who needs to file Form RI-1040C?

A: Form RI-1040C needs to be filed by pass-through entities that have nonresident and/or part-year resident members.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that passes its income and losses through to its owners or members.

Q: What is a nonresident member?

A: A nonresident member is a member of a pass-through entity who is not a resident of Rhode Island.

Q: What is a part-year resident member?

A: A part-year resident member is a member of a pass-through entity who was a resident of Rhode Island for only part of the tax year.

Q: What are the filing requirements for Form RI-1040C?

A: Pass-through entities with nonresident and/or part-year resident members must file Form RI-1040C if they have Rhode Island source income or if any of their members are subject to Rhode Island personal income tax.

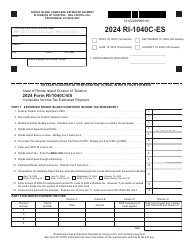

Q: When is Form RI-1040C due?

A: Form RI-1040C is due on or before the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. The penalty is 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.