This version of the form is not currently in use and is provided for reference only. Download this version of

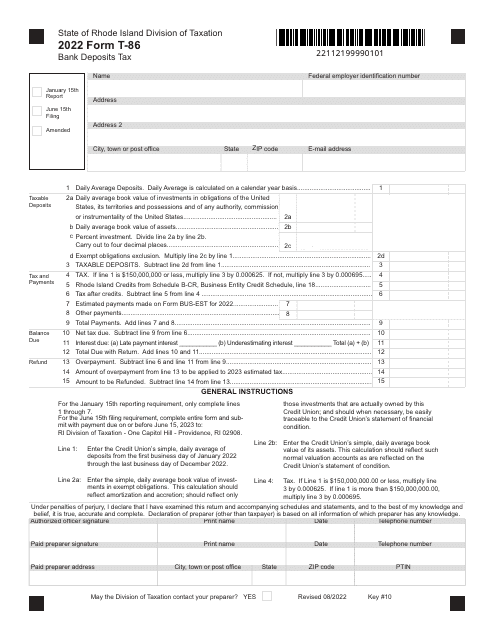

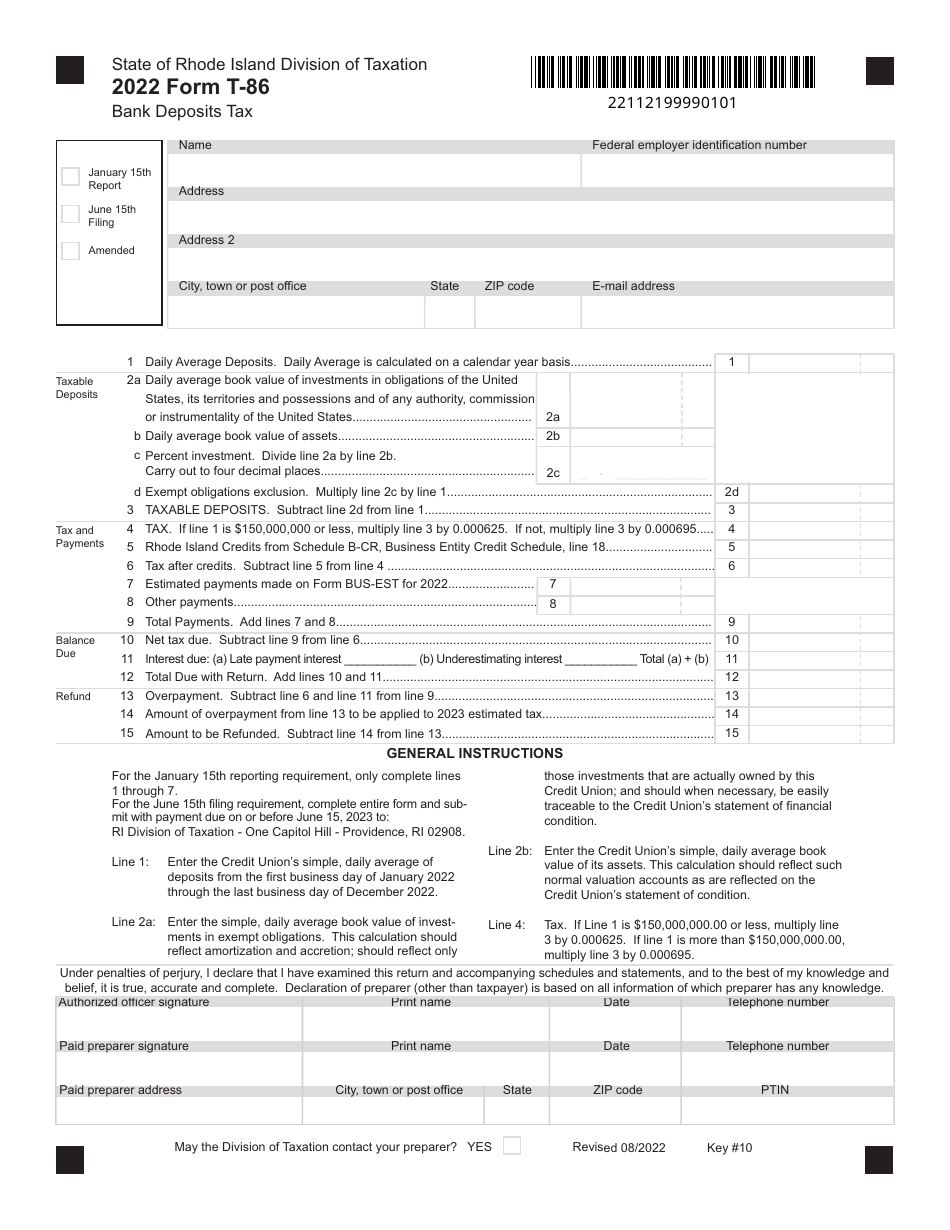

Form T-86

for the current year.

Form T-86 Bank Deposits Tax - Rhode Island

What Is Form T-86?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-86?

A: Form T-86 is a tax form used to report bank deposits for tax purposes in Rhode Island.

Q: Who needs to file Form T-86?

A: Individuals and businesses who are required to pay taxes in Rhode Island and have qualifying bank deposits need to file Form T-86.

Q: What are bank deposits for tax purposes?

A: Bank deposits for tax purposes refer to the total amount of money deposited into a taxpayer's bank account during a specific tax year.

Q: What information is required to fill out Form T-86?

A: To fill out Form T-86, you will need to provide your personal or business information, including your name, address, and taxpayer identification number, as well as details about your bank deposits.

Q: When is Form T-86 due?

A: Form T-86 is generally due on April 15th of the following year, in line with the deadline for filing federal income tax returns.

Q: Are there any penalties for not filing Form T-86?

A: Failure to file Form T-86 or filing it late may result in penalties and interest charges imposed by the Rhode Island Division of Taxation.

Q: Can I e-file Form T-86?

A: As of now, Rhode Island does not offer electronic filing options for Form T-86. It must be filed by mail.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-86 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.