This version of the form is not currently in use and is provided for reference only. Download this version of

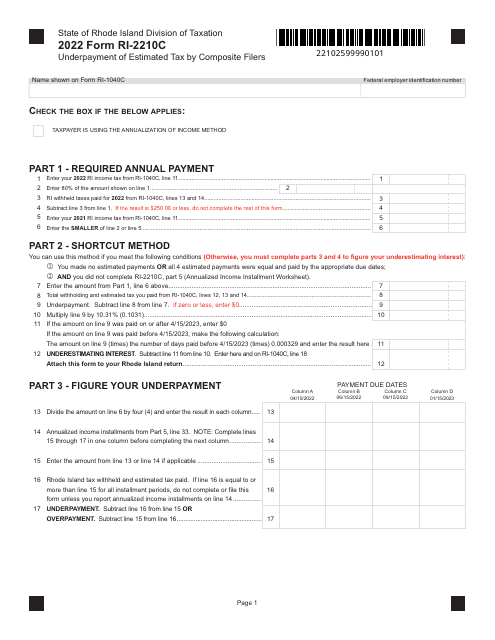

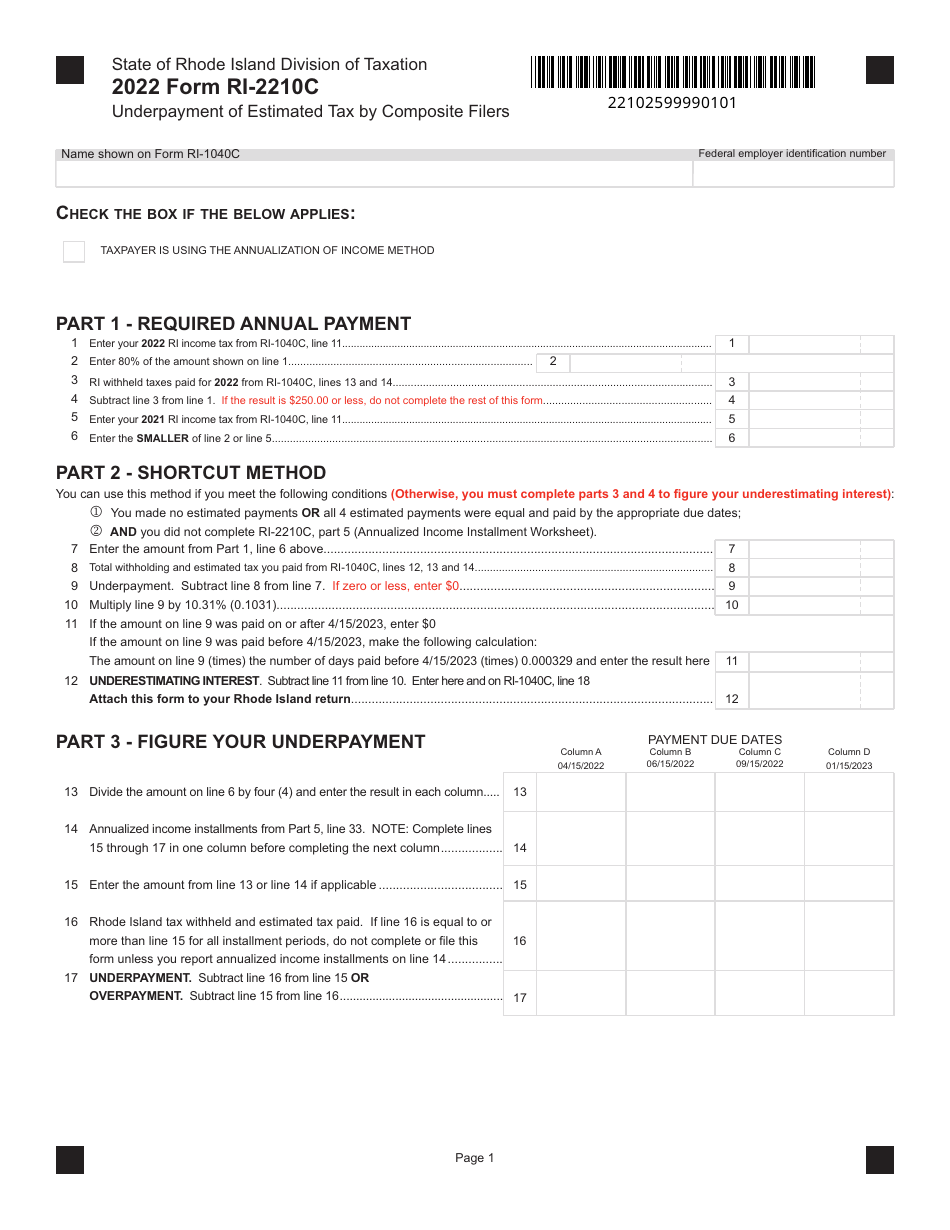

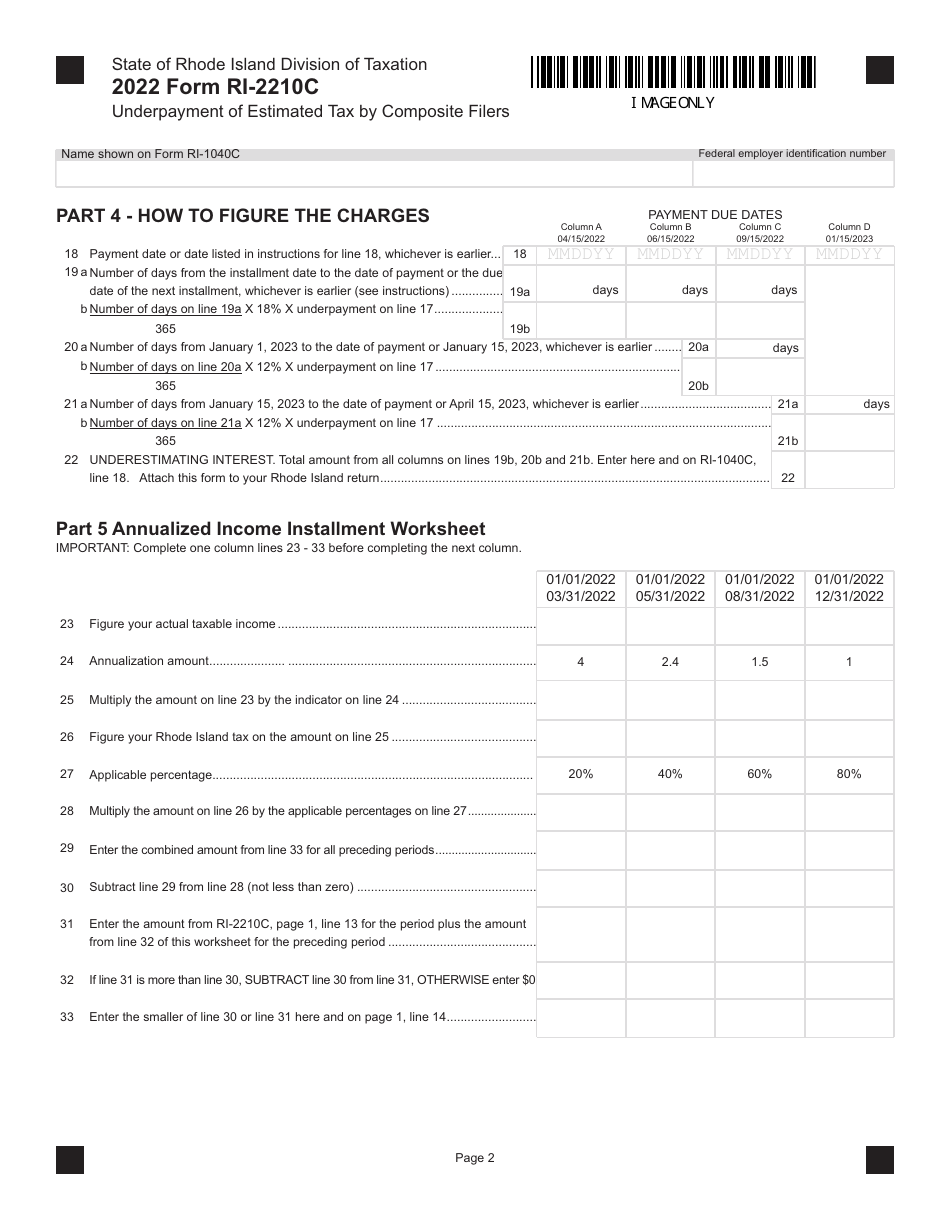

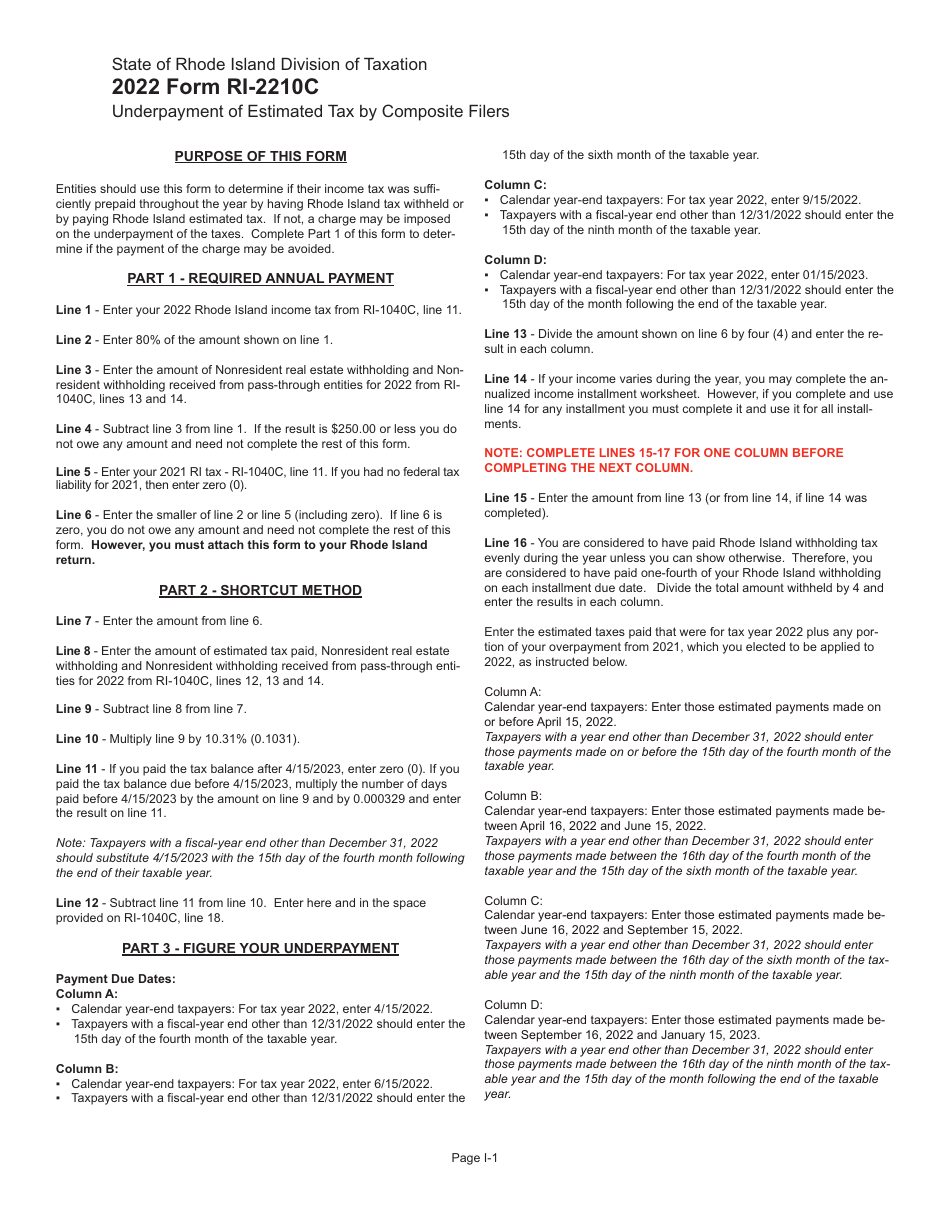

Form RI-2210C

for the current year.

Form RI-2210C Underpayment of Estimated Tax by Composite Filers - Rhode Island

What Is Form RI-2210C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

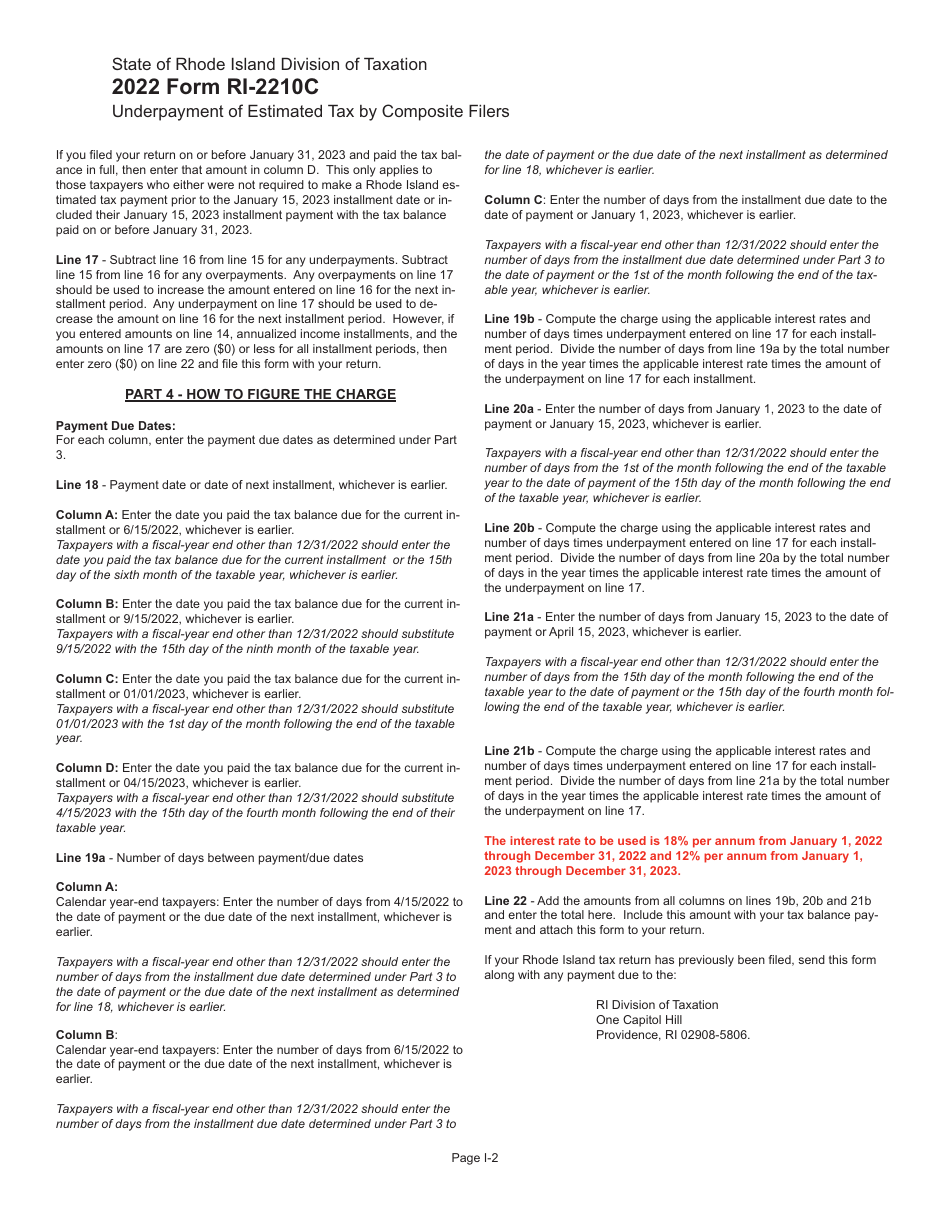

Q: What is form RI-2210C?

A: Form RI-2210C is a tax form used by composite filers in Rhode Island to calculate the underpayment of estimated tax.

Q: Who needs to file form RI-2210C?

A: Composite filers in Rhode Island need to file form RI-2210C if they have underpaid their estimated tax.

Q: What is considered underpayment of estimated tax?

A: Underpayment of estimated tax occurs when a taxpayer has not paid enough in estimated tax throughout the year.

Q: How is the underpayment penalty calculated?

A: The underpayment penalty is calculated using form RI-2210C based on the amount of underpayment and the length of time it was underpaid.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.