This version of the form is not currently in use and is provided for reference only. Download this version of

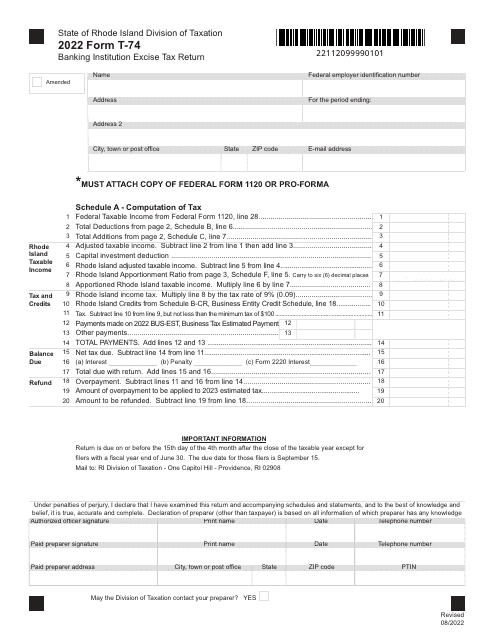

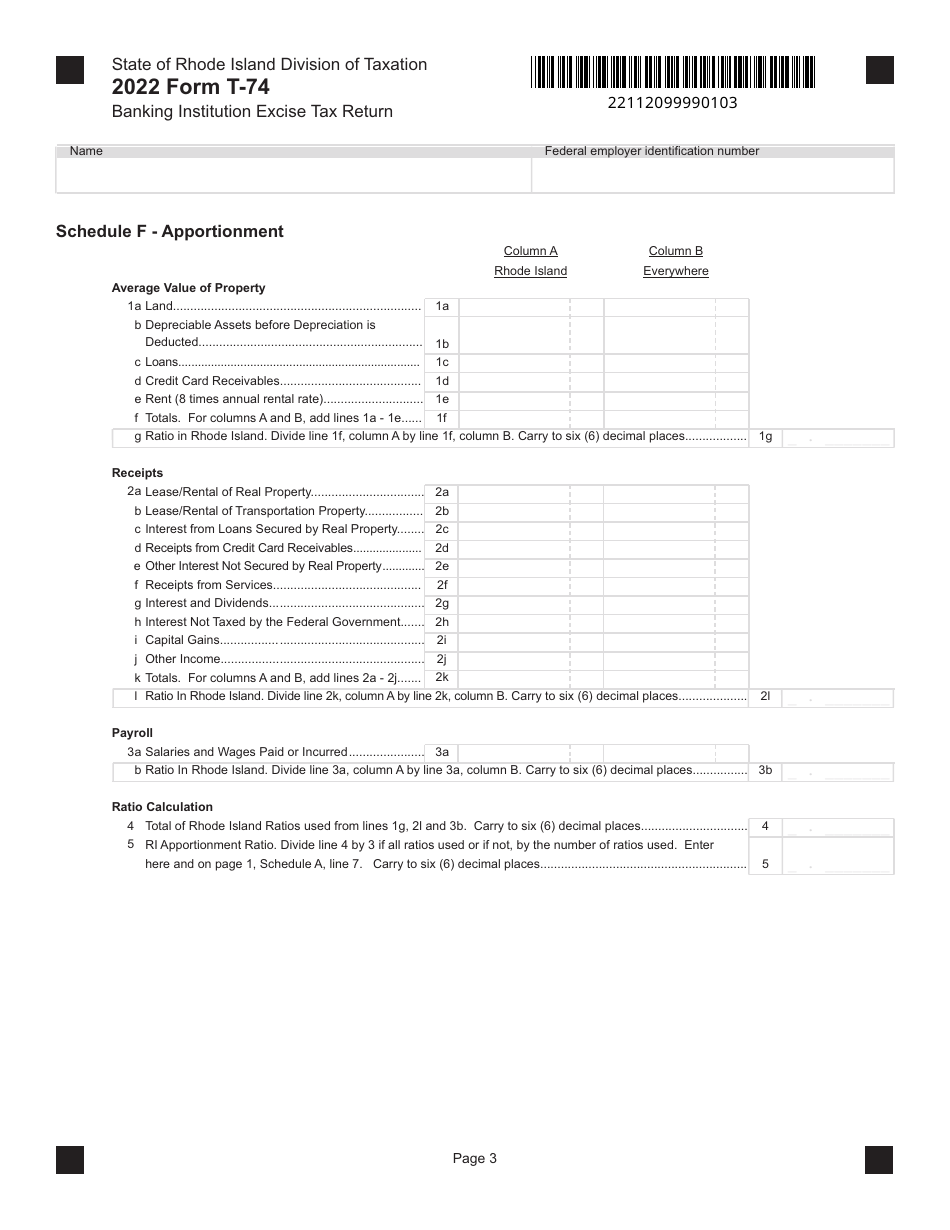

Form T-74

for the current year.

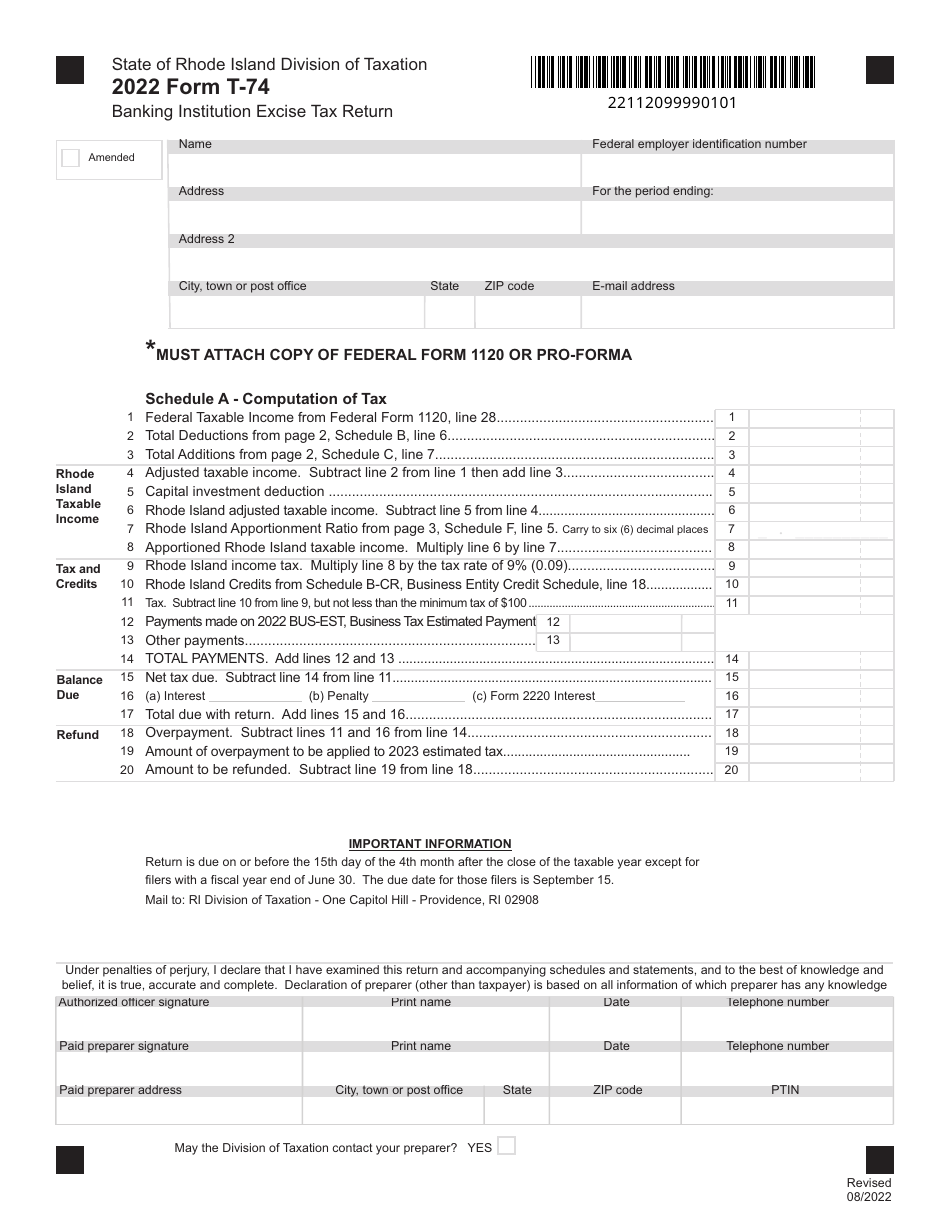

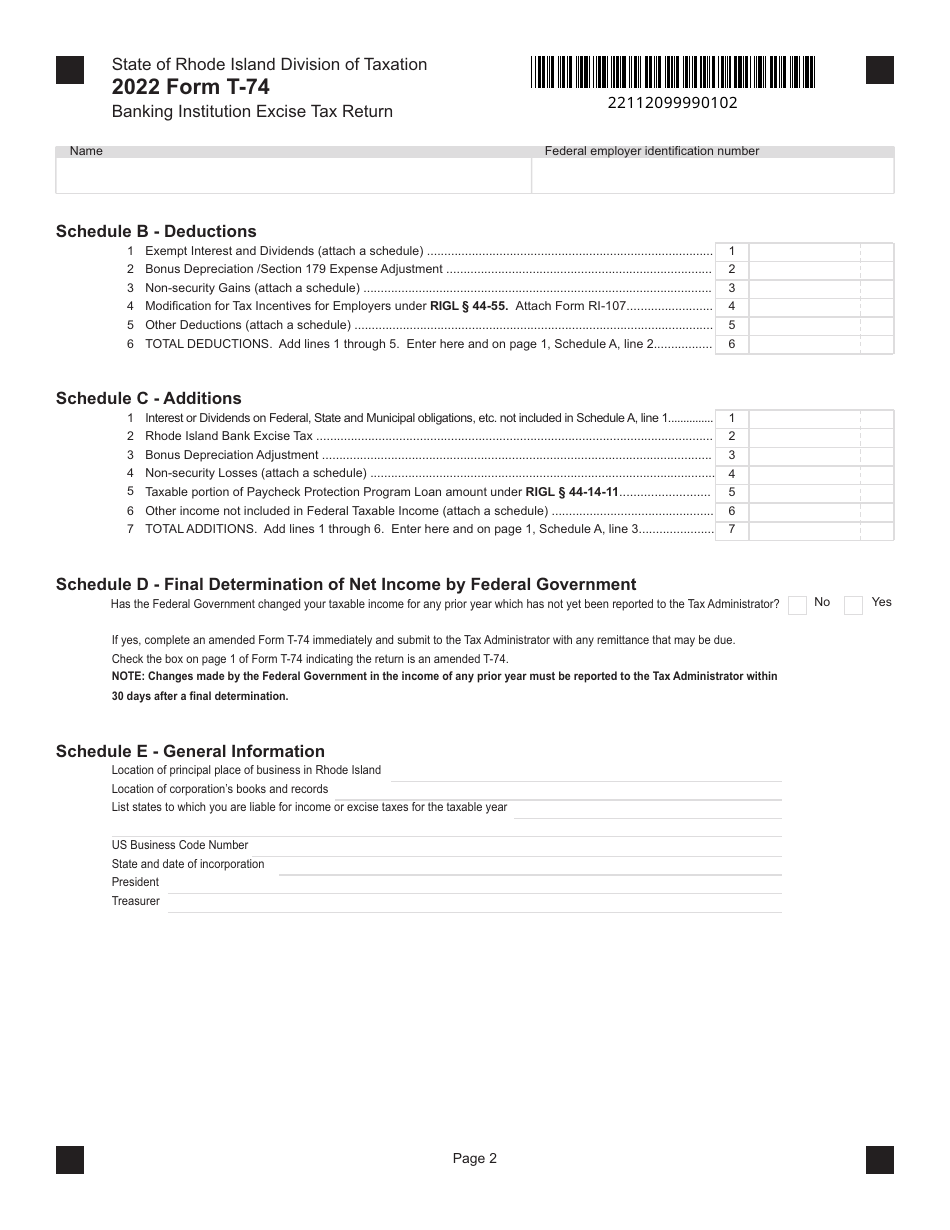

Form T-74 Banking Institution Excise Tax Return - Rhode Island

What Is Form T-74?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form T-74?

A: Form T-74 is the Banking InstitutionExcise Tax Return in Rhode Island.

Q: Who needs to file Form T-74?

A: Banking institutions in Rhode Island need to file Form T-74.

Q: What is the purpose of Form T-74?

A: Form T-74 is used to calculate the excise tax owed by banking institutions in Rhode Island.

Q: When is the due date for filing Form T-74?

A: The due date for filing Form T-74 is on or before the last day of the fourth month following the close of the tax year.

Q: Are there any penalties for late filing of Form T-74?

A: Yes, there are penalties for late filing of Form T-74. It is important to file the form by the due date to avoid penalties.

Q: Is there a minimum tax liability for banking institutions in Rhode Island?

A: Yes, banking institutions in Rhode Island have a minimum tax liability regardless of their income.

Q: What should I do if I have questions or need assistance with Form T-74?

A: If you have questions or need assistance with Form T-74, you can contact the Rhode Island Division of Taxation for guidance.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-74 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.