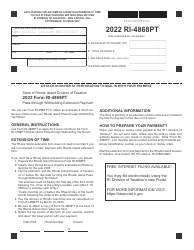

This version of the form is not currently in use and is provided for reference only. Download this version of

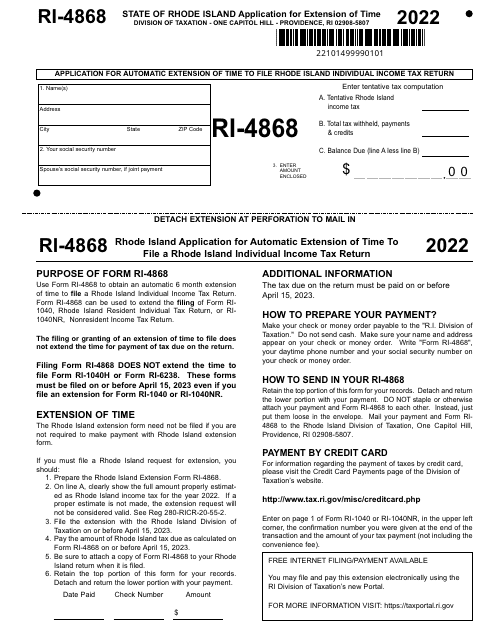

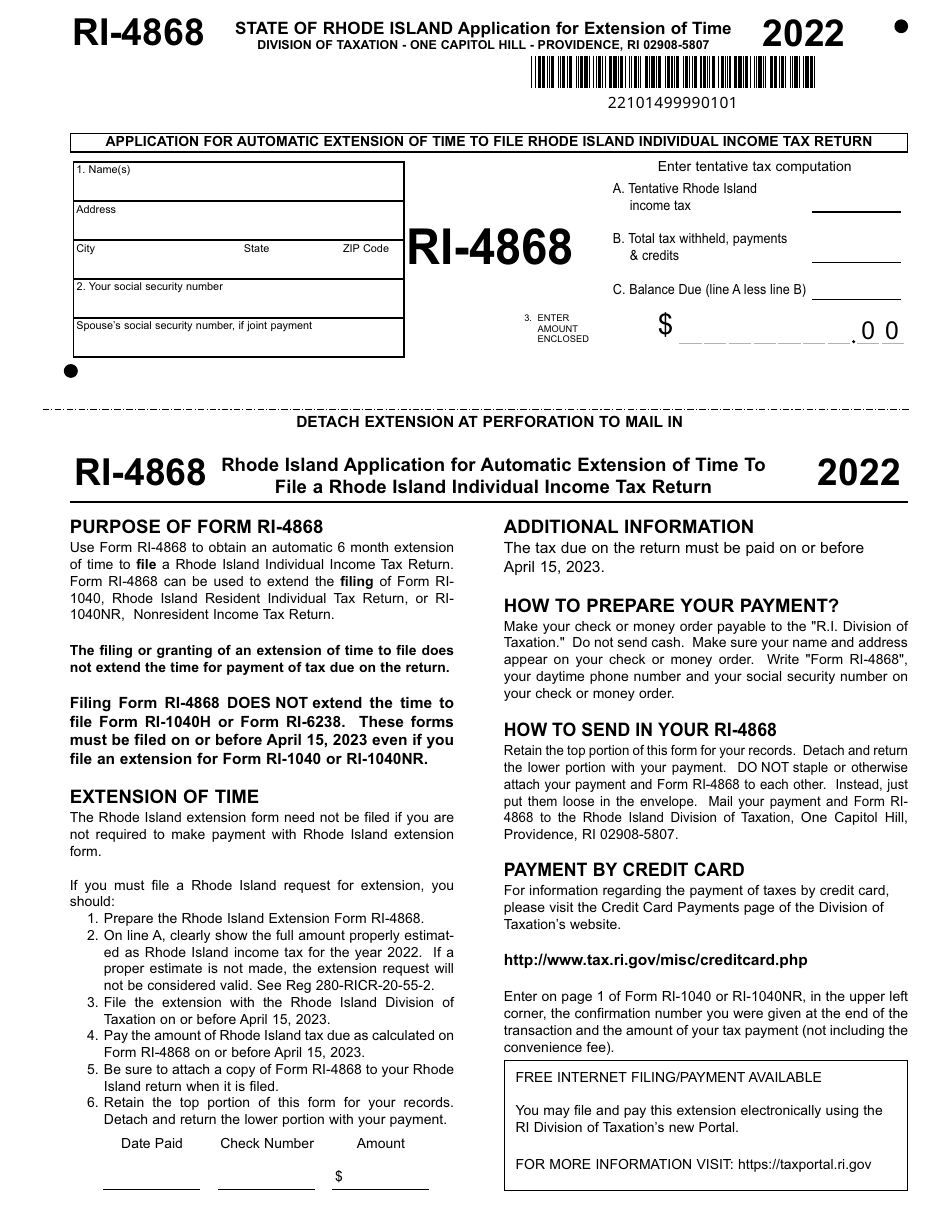

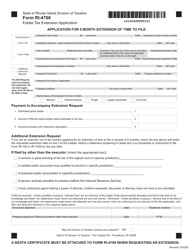

Form RI-4868

for the current year.

Form RI-4868 Application for Automatic Extension of Time to File Rhode Island Individual Income Tax Return - Rhode Island

What Is Form RI-4868?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-4868?

A: Form RI-4868 is an application for an automatic extension of time to file your Rhode Island Individual Income Tax Return.

Q: Why would I need to file Form RI-4868?

A: You would need to file Form RI-4868 if you are unable to file your Rhode Island Individual Income Tax Return by the original due date, which is usually April 15th.

Q: What is the deadline for filing Form RI-4868?

A: The deadline for filing Form RI-4868 is usually April 15th, which is the same as the original due date for the Rhode Island Individual Income Tax Return.

Q: How much time does Form RI-4868 give me to file my tax return?

A: Form RI-4868 grants an automatic extension of time to file your Rhode Island Individual Income Tax Return for an additional 6 months.

Q: Do I need to pay any taxes when filing Form RI-4868?

A: Yes, you must estimate your tax liability and pay any taxes due when filing Form RI-4868.

Q: What happens if I file Form RI-4868 but don't pay the taxes owed?

A: If you file Form RI-4868 but fail to pay the taxes owed, you may be subject to penalties and interest charges.

Q: Can I file Form RI-4868 if I am requesting an extension for my federal tax return?

A: Yes, you can file Form RI-4868 even if you are also requesting an extension for your federal tax return.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-4868 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.