This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

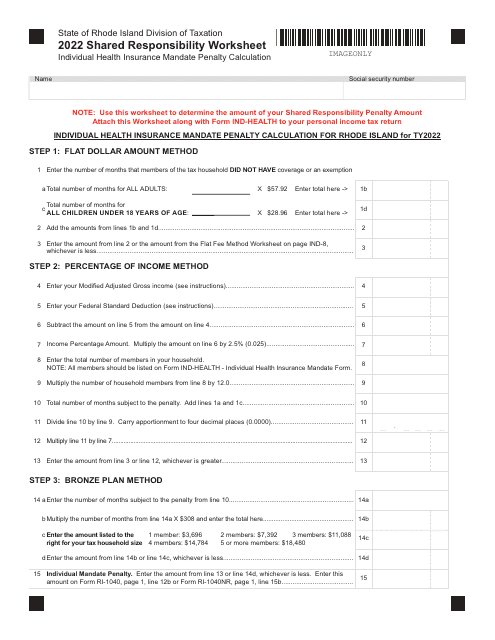

Shared Responsibility Worksheet - Individual Health Insurance Mandate Penalty Calculation - Rhode Island

Shared Responsibility Worksheet - Individual Health Insurance Mandate Penalty Calculation is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the Individual Health Insurance Mandate Penalty?

A: The Individual Health Insurance Mandate Penalty is a financial penalty imposed on individuals who do not have health insurance coverage.

Q: What is the purpose of the Individual Health Insurance Mandate Penalty?

A: The purpose of the Individual Health Insurance Mandate Penalty is to encourage individuals to have health insurance coverage to ensure access to affordable healthcare services.

Q: Is the Individual Health Insurance Mandate Penalty applicable in Rhode Island?

A: Yes, the Individual Health Insurance Mandate Penalty is applicable in Rhode Island.

Q: How is the Individual Health Insurance Mandate Penalty calculated?

A: The Individual Health Insurance Mandate Penalty is calculated based on a shared responsibility worksheet that takes into account various factors such as income and family size.

Q: Who is required to pay the Individual Health Insurance Mandate Penalty?

A: Individuals who do not have health insurance coverage and do not qualify for an exemption may be required to pay the Individual Health Insurance Mandate Penalty.

Q: Are there any exemptions from the Individual Health Insurance Mandate Penalty?

A: Yes, there are exemptions available for individuals who meet certain criteria, such as financial hardship or religious beliefs.

Q: What happens if someone fails to pay the Individual Health Insurance Mandate Penalty?

A: If someone fails to pay the Individual Health Insurance Mandate Penalty, they may face penalties and collection efforts by the state.

Q: Is there any assistance available for individuals to obtain health insurance coverage and avoid the penalty?

A: Yes, there are programs and subsidies available to help individuals obtain health insurance coverage and potentially avoid the Individual Health Insurance Mandate Penalty.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.