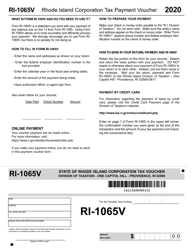

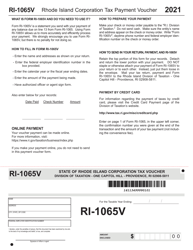

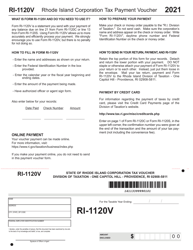

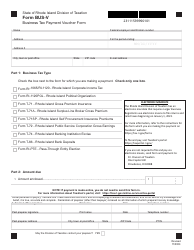

This version of the form is not currently in use and is provided for reference only. Download this version of

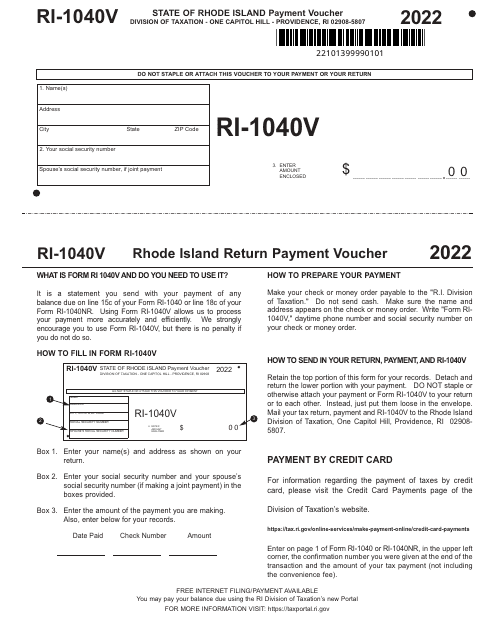

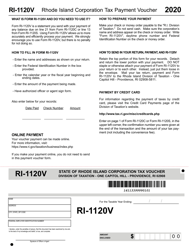

Form RI-1040V

for the current year.

Form RI-1040V Personal Income Tax Payment Voucher - Rhode Island

What Is Form RI-1040V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1040V?

A: Form RI-1040V is a personal income tax payment voucher for residents of Rhode Island.

Q: Who needs to file Form RI-1040V?

A: Residents of Rhode Island who are making a payment towards their personal income tax liability need to file Form RI-1040V.

Q: What is the purpose of Form RI-1040V?

A: The purpose of Form RI-1040V is to serve as a voucher for taxpayers to submit their payment for their Rhode Island personal income tax.

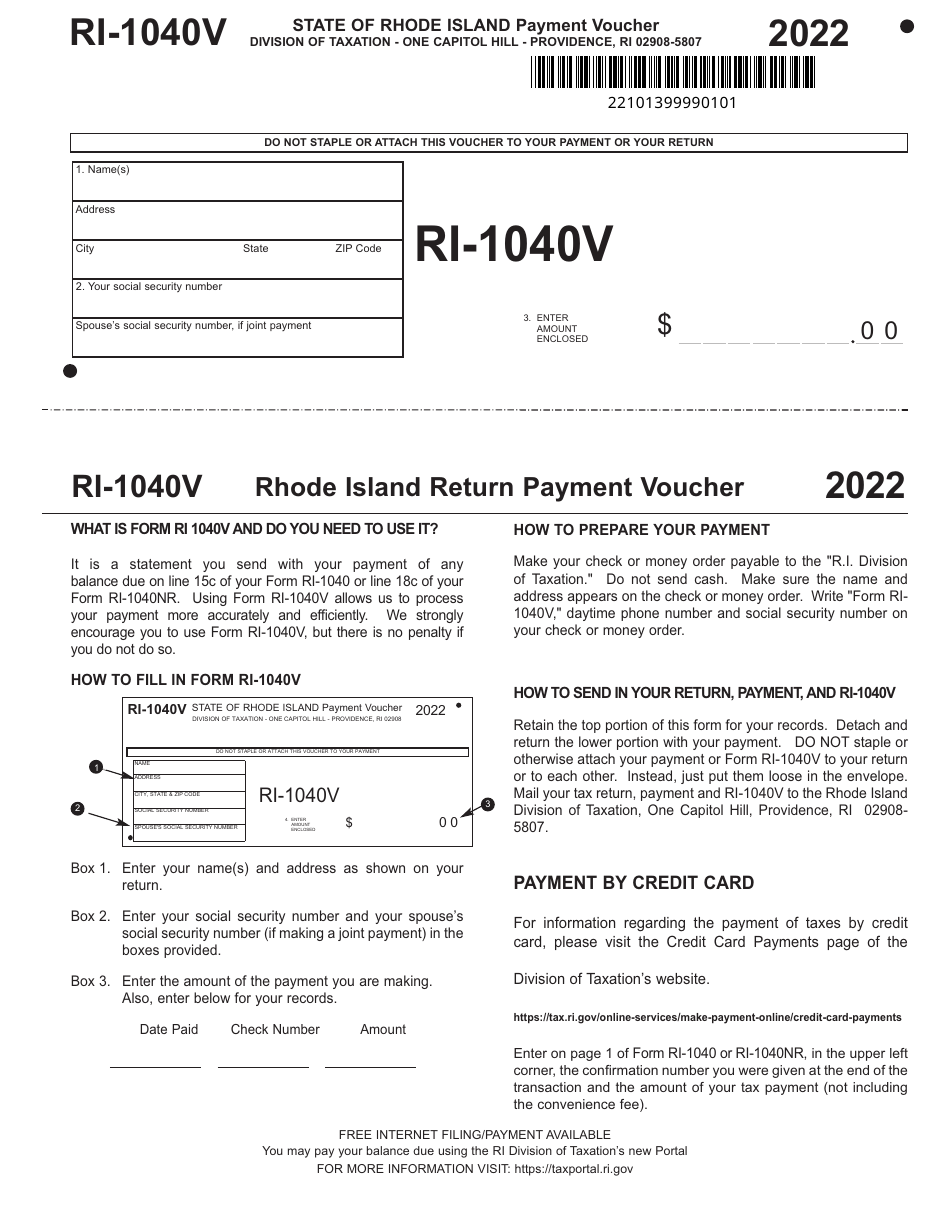

Q: How do I fill out Form RI-1040V?

A: To fill out Form RI-1040V, you will need to enter your name, address, Social Security number, the tax year you are making the payment for, and the payment amount.

Q: When is Form RI-1040V due?

A: Form RI-1040V is due on or before the same deadline as your Rhode Island personal income tax return, which is typically April 15th.

Q: What happens if I do not file Form RI-1040V?

A: If you have a personal income tax liability and do not file Form RI-1040V or make a payment, you may be subject to penalties and interest charges.

Q: Can I request an extension to file Form RI-1040V?

A: Yes, you can request an extension to file your Rhode Island personal income tax return by filing Form RI-4868. However, any tax payment is still due by the original deadline.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.