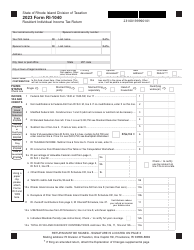

This version of the form is not currently in use and is provided for reference only. Download this version of

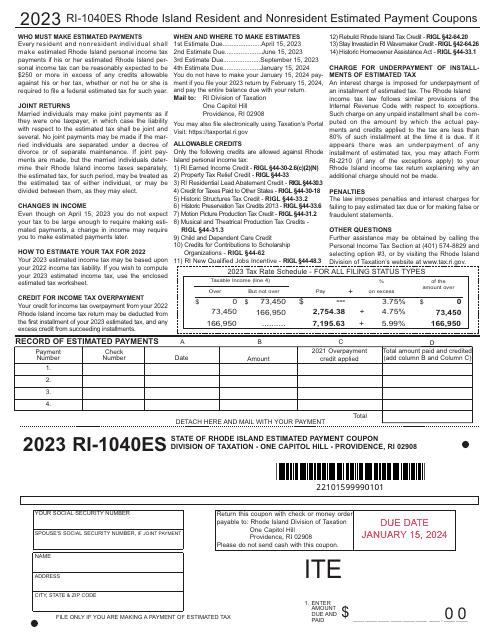

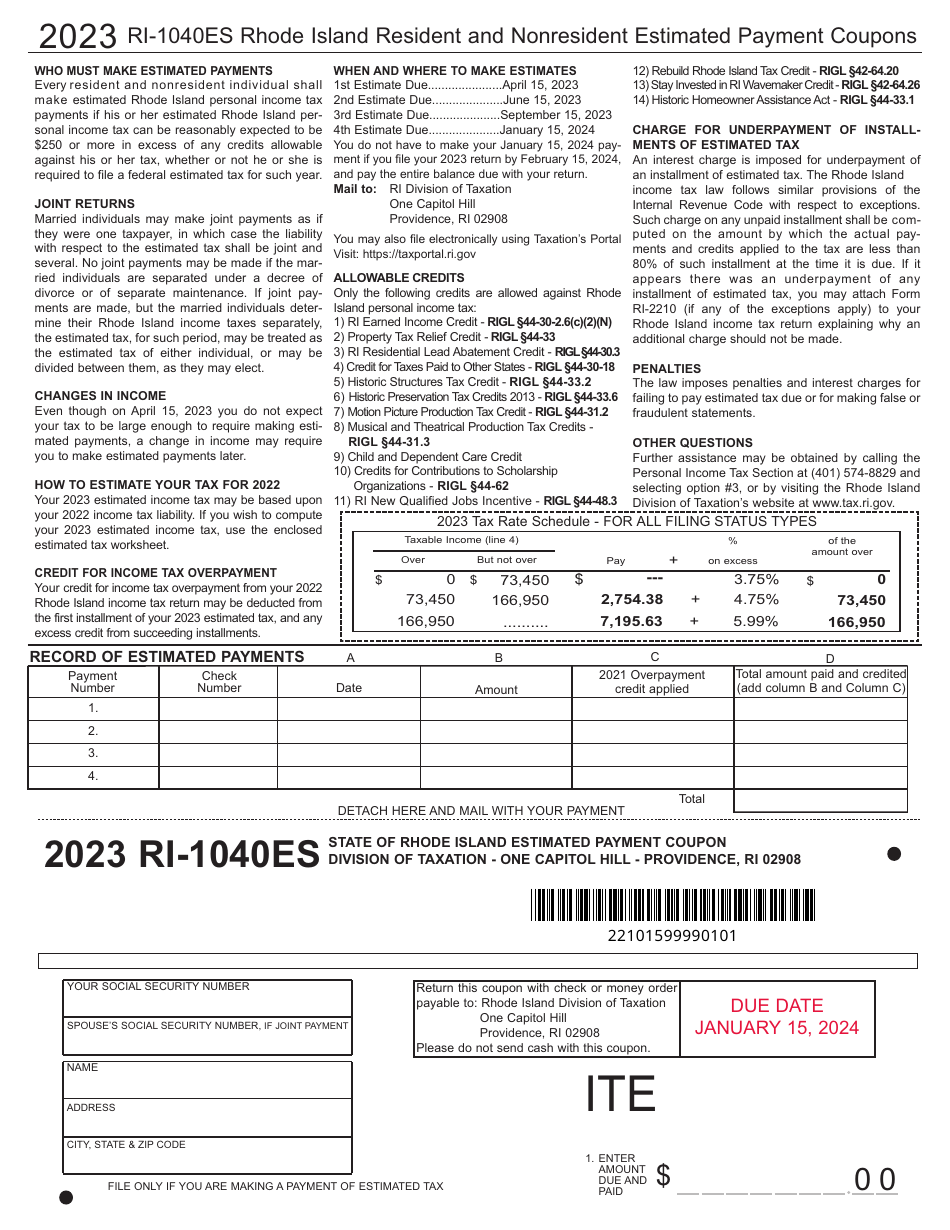

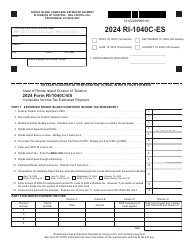

Form RI-1040ES

for the current year.

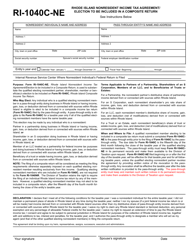

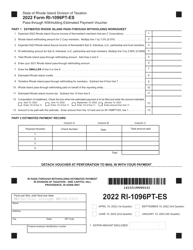

Form RI-1040ES Rhode Island Resident and Nonresident Estimated Payment Coupons - Rhode Island

What Is Form RI-1040ES?

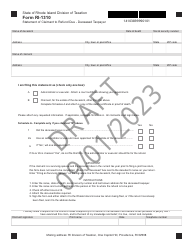

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1040ES?

A: Form RI-1040ES is a payment coupon used by Rhode Island residents and nonresidents to make estimated tax payments.

Q: Who needs to use Form RI-1040ES?

A: Rhode Island residents and nonresidents who are required to make estimated tax payments need to use Form RI-1040ES.

Q: What are estimated tax payments?

A: Estimated tax payments are periodic payments made to the state to cover taxes owed on income that is not subject to withholding.

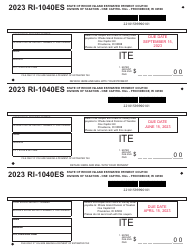

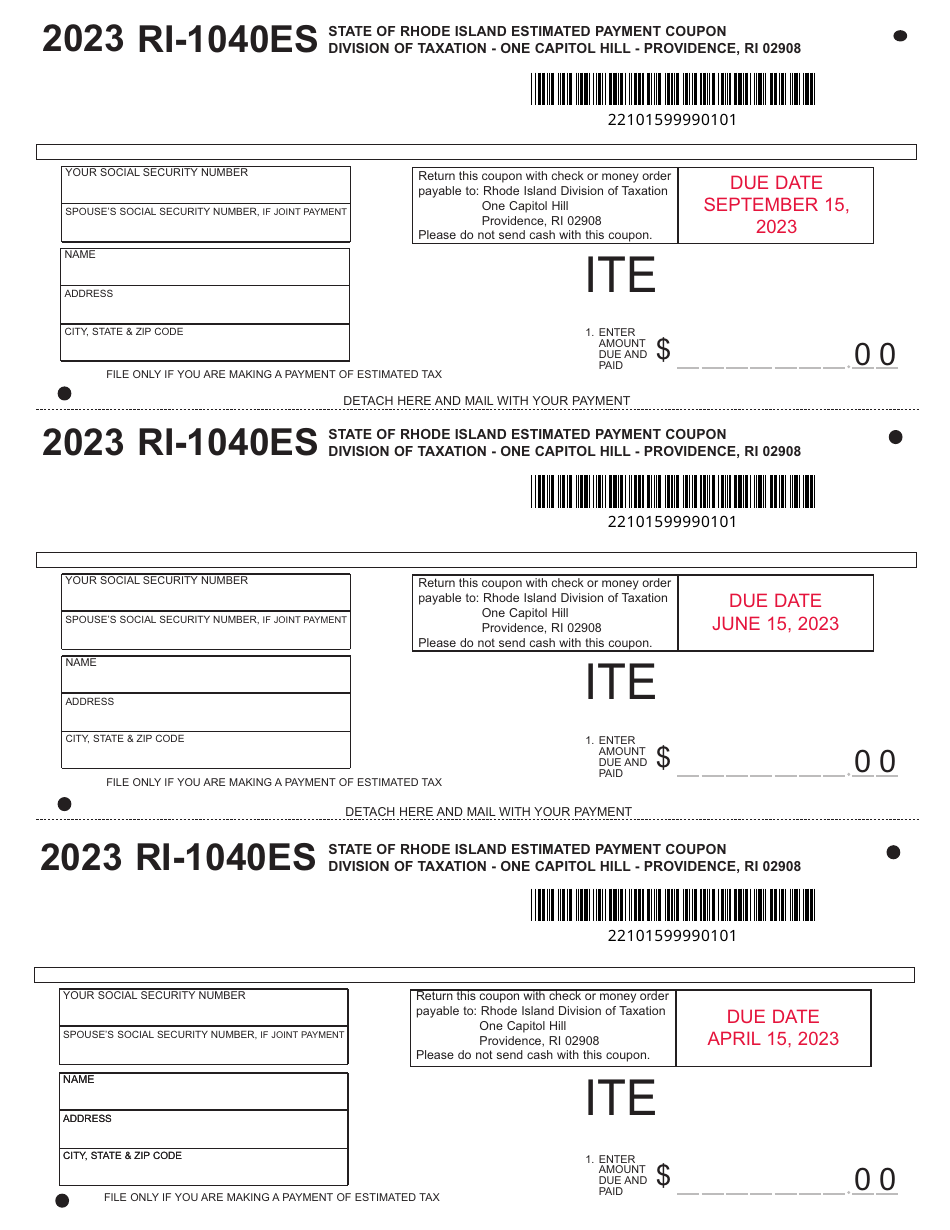

Q: When are estimated tax payments due?

A: Estimated tax payments are due on a quarterly basis. The due dates for these payments are April 15th, June 15th, September 15th, and January 15th of the following year.

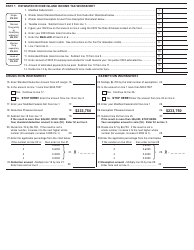

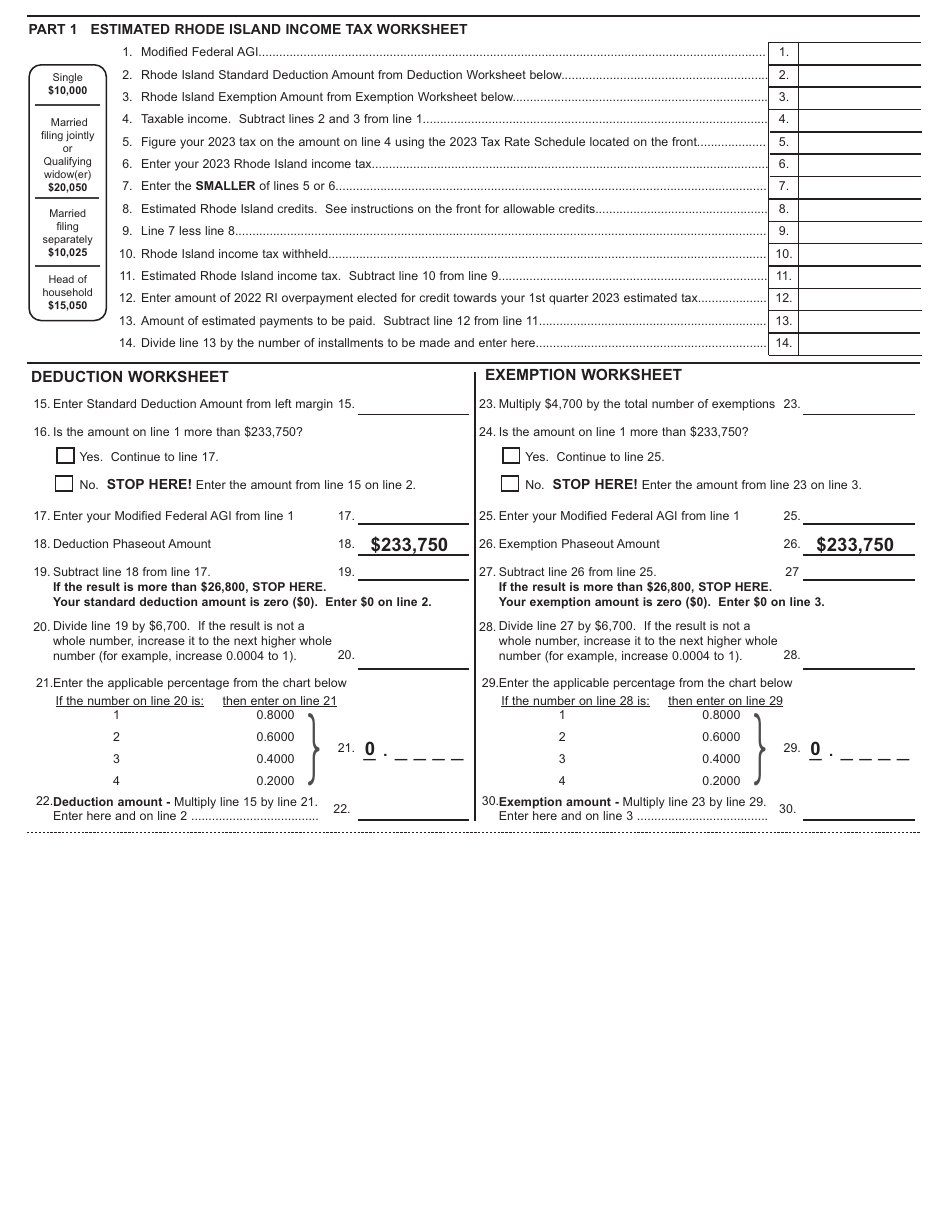

Q: How do I fill out Form RI-1040ES?

A: You will need to provide your personal information, estimate your annual income, calculate your estimated tax liability, and fill out the payment voucher with the payment amount.

Q: Are there penalties for not making estimated tax payments?

A: Yes, if you are required to make estimated tax payments and fail to do so, you may be subject to penalties and interest on the unpaid amount.

Q: Can I make changes to my estimated tax payments?

A: Yes, if you need to make changes to your estimated tax payments, you can file an amended Form RI-1040ES.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040ES by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.