This version of the form is not currently in use and is provided for reference only. Download this version of

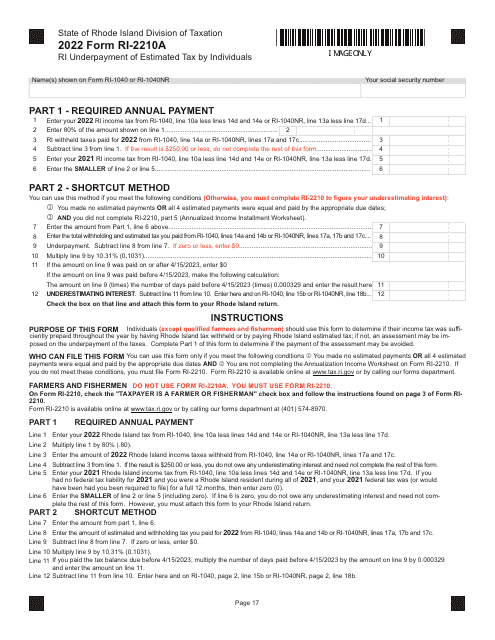

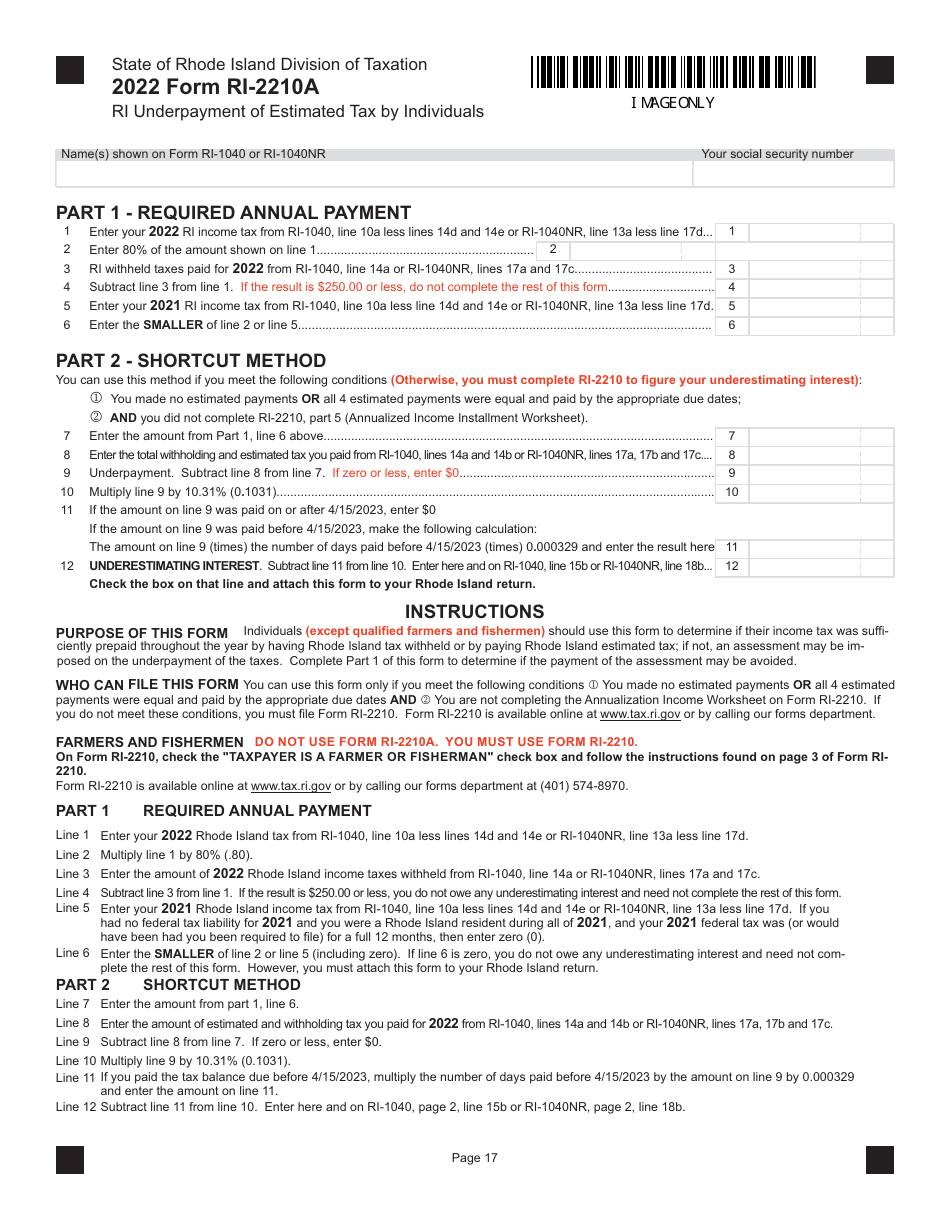

Form RI-2210A

for the current year.

Form RI-2210A Ri Underpayment of Estimated Tax by Individuals - Rhode Island

What Is Form RI-2210A?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-2210A?

A: Form RI-2210A is a form used by individuals in Rhode Island to calculate and pay any underpayment of estimated tax.

Q: Who needs to file Form RI-2210A?

A: Individuals in Rhode Island who have underpaid their estimated tax throughout the year may need to file Form RI-2210A.

Q: What is the purpose of Form RI-2210A?

A: The purpose of Form RI-2210A is to determine if an individual owes any underpayment penalties for not paying enough estimated tax throughout the year.

Q: How do I complete Form RI-2210A?

A: To complete Form RI-2210A, you will need to fill in your personal information, calculate your underpayment, and determine if you owe any penalties.

Q: When is Form RI-2210A due?

A: Form RI-2210A is due on the same date as your Rhode Island income tax return, which is typically April 15th.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.