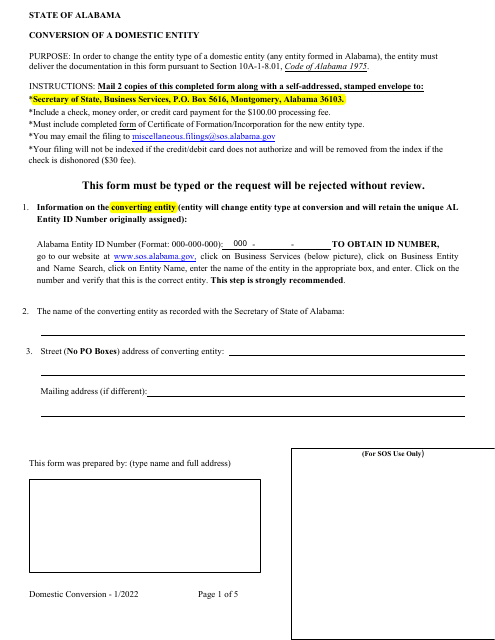

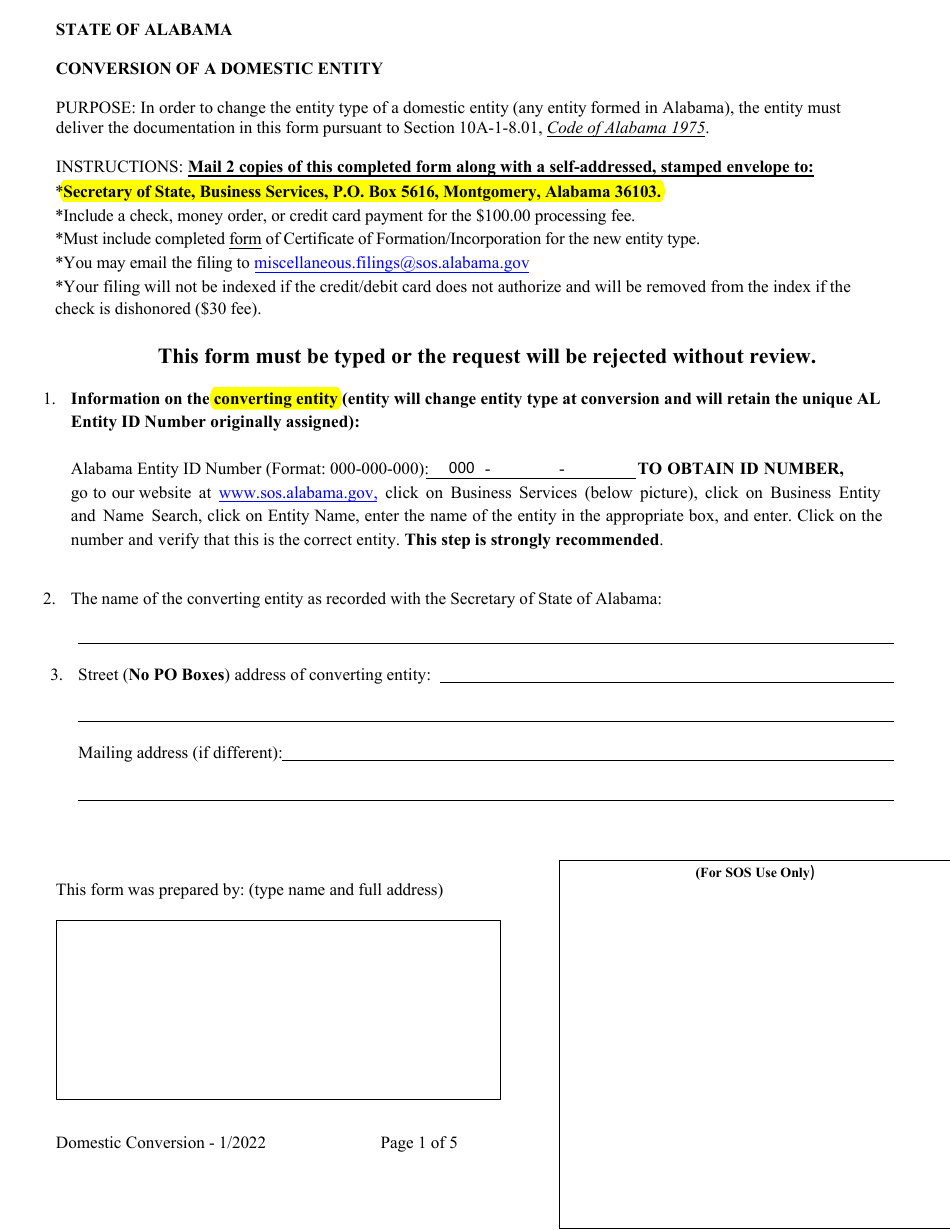

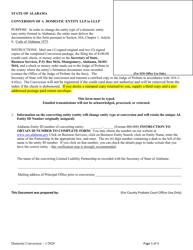

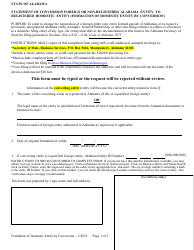

Conversion of a Domestic Entity - Alabama

Conversion of a Domestic Entity is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a domestic entity in Alabama?

A: A domestic entity in Alabama is a business that is formed or registered in the state of Alabama.

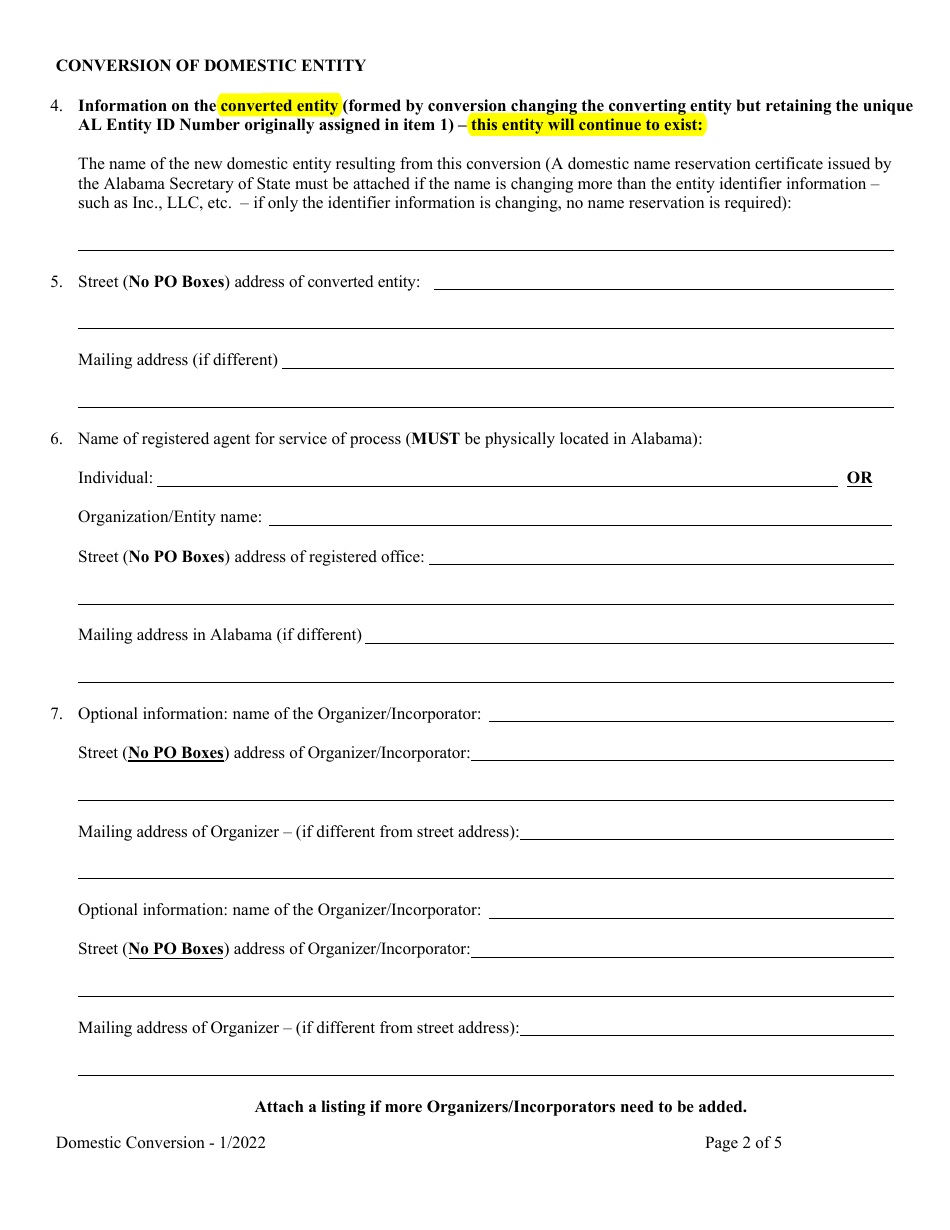

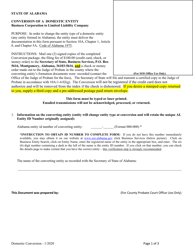

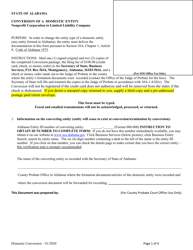

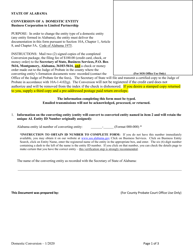

Q: What is a conversion of a domestic entity?

A: A conversion of a domestic entity in Alabama is the process of changing the legal structure or type of a business.

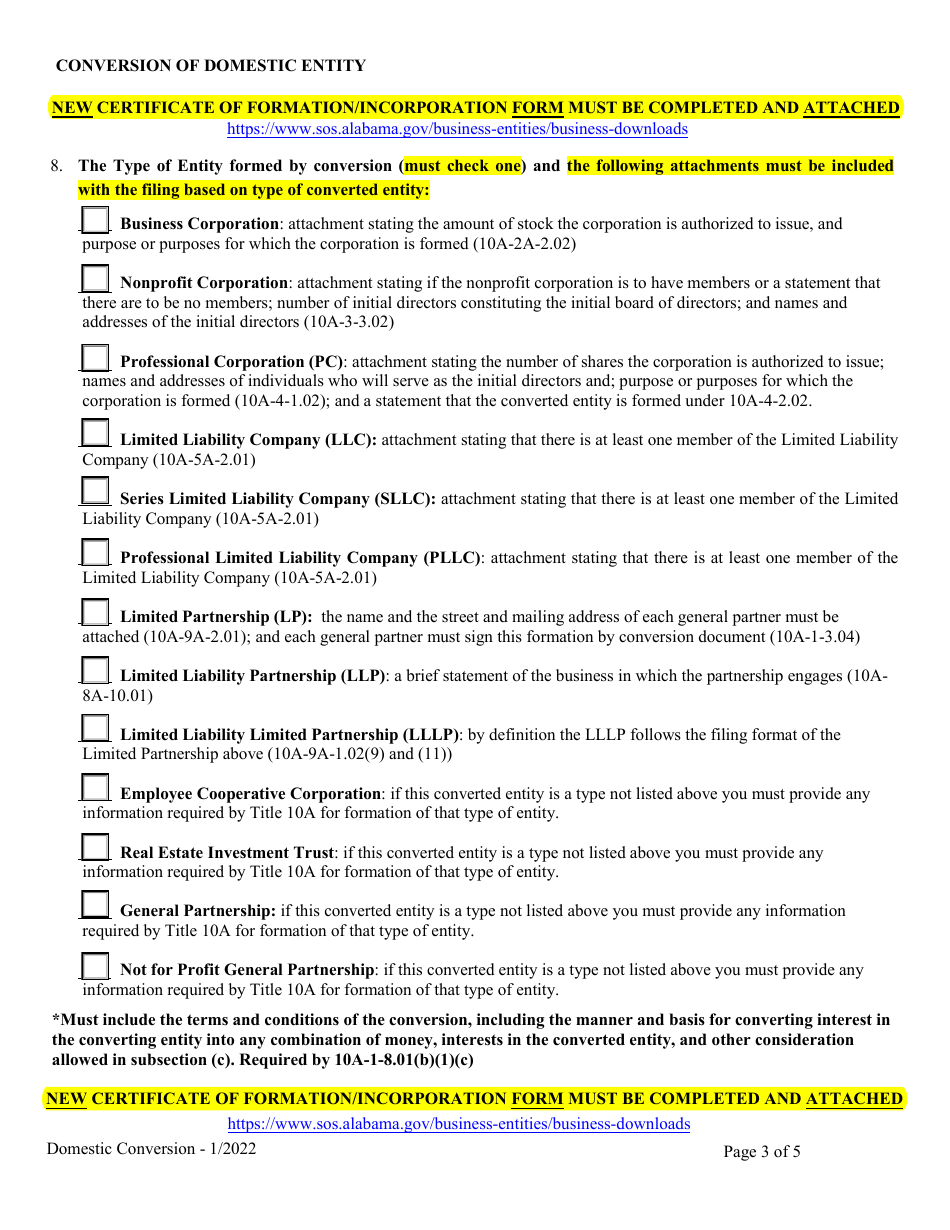

Q: What types of businesses can be converted in Alabama?

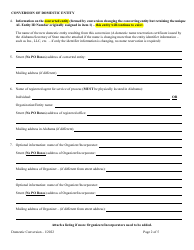

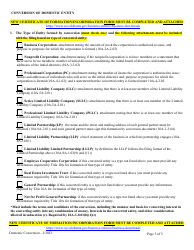

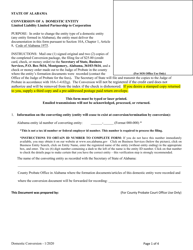

A: Various types of businesses, such as corporations, limited liability companies (LLCs), partnerships, and business trusts, can be converted in Alabama.

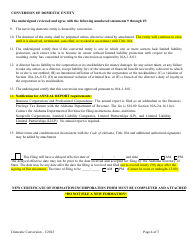

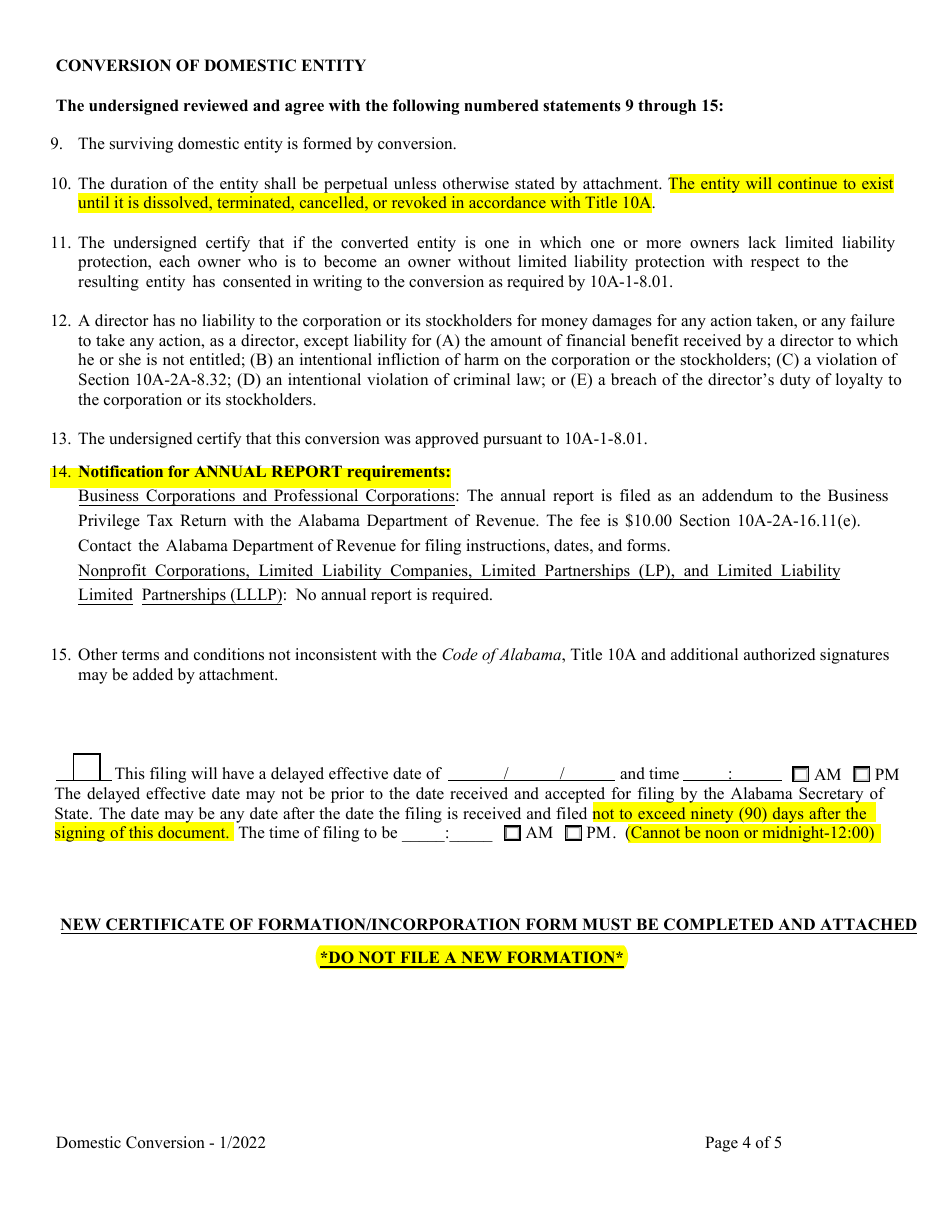

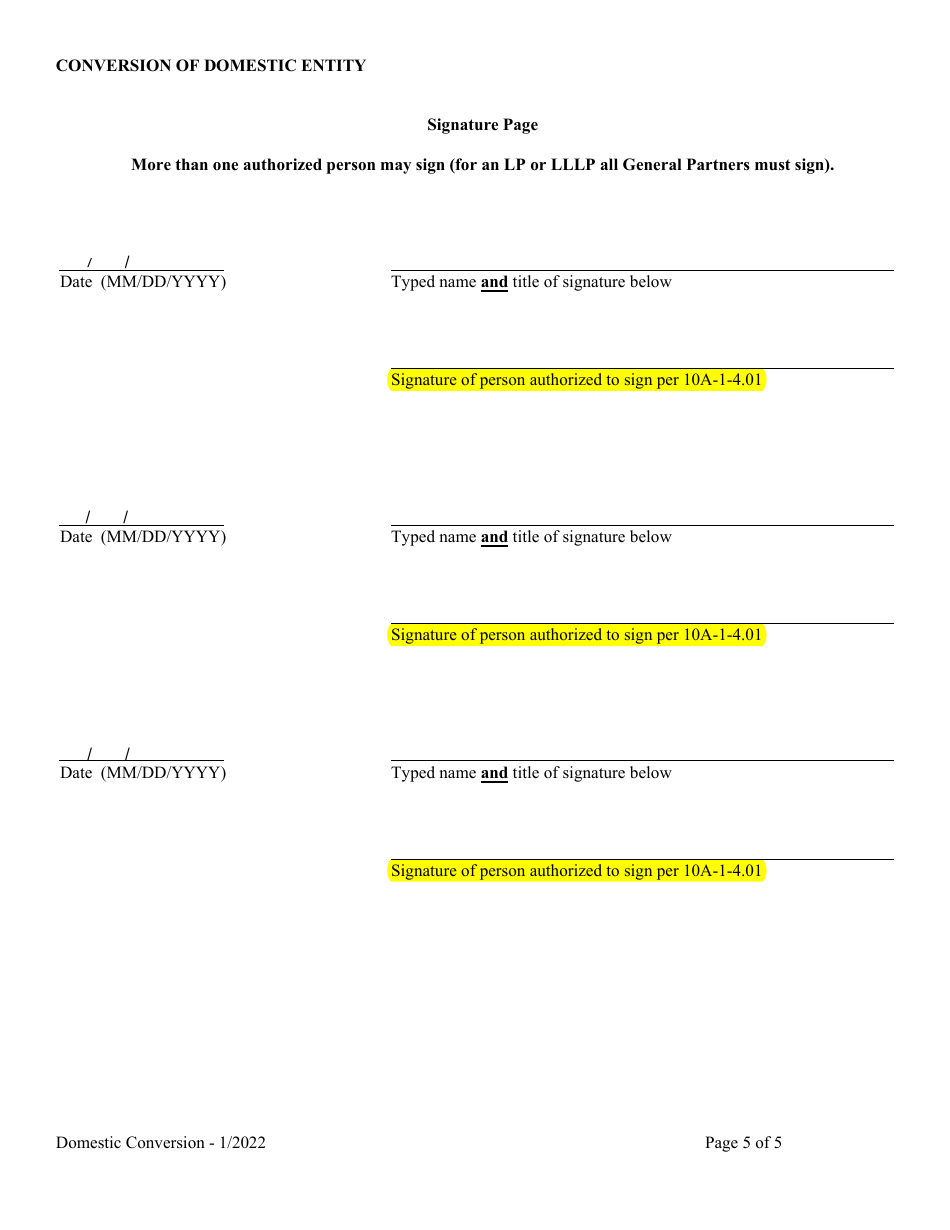

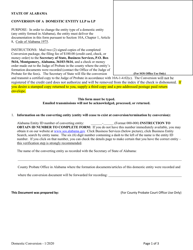

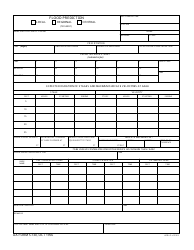

Q: What are the steps to convert a domestic entity in Alabama?

A: The specific steps for converting a domestic entity in Alabama may vary depending on the type of business, but generally involve filing conversion documents with the Alabama Secretary of State.

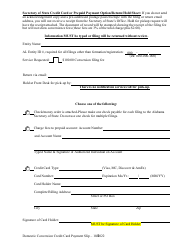

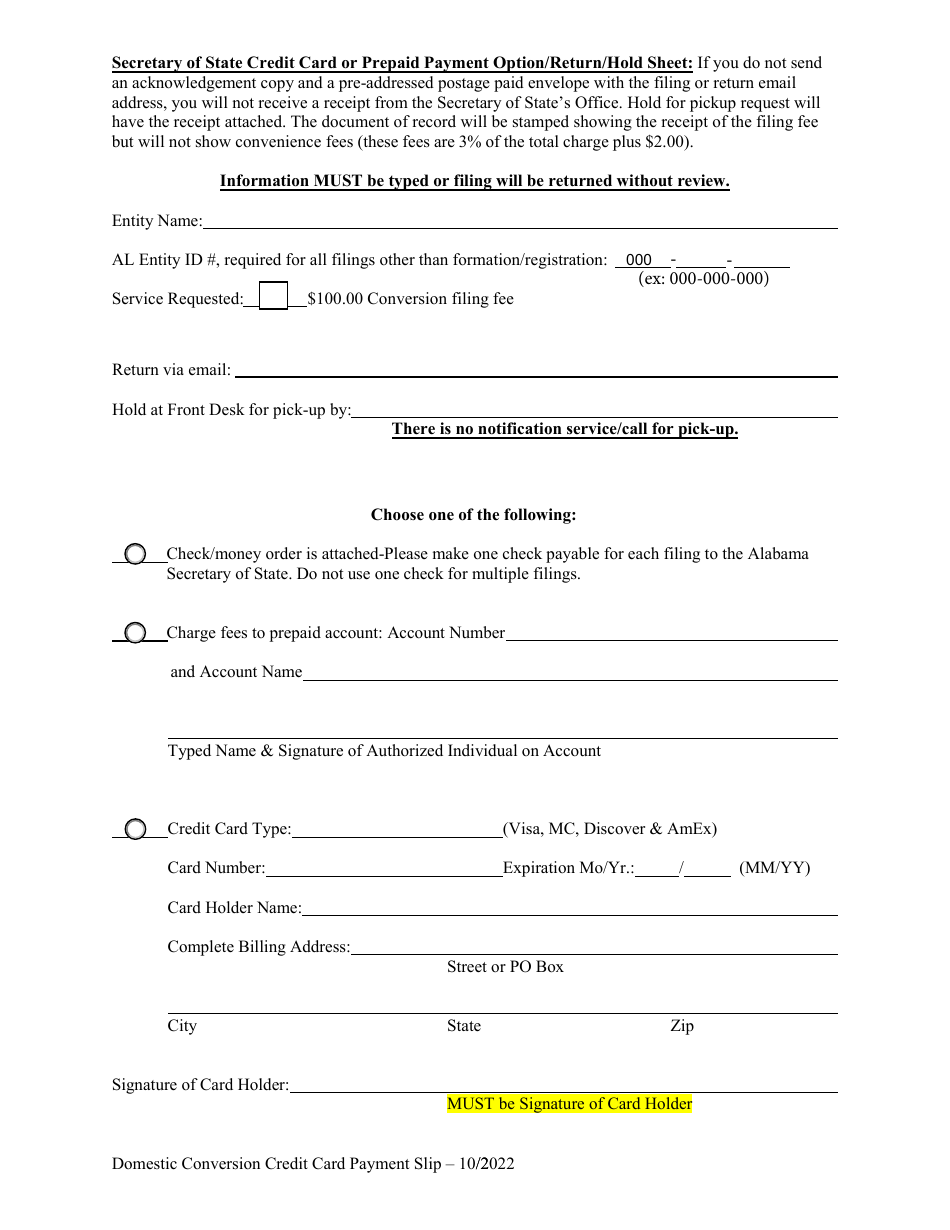

Q: Are there any fees associated with conversion of a domestic entity in Alabama?

A: Yes, there are fees associated with the conversion of a domestic entity in Alabama. The exact fees depend on the type of business and the specific circumstances of the conversion.

Q: Is it necessary to notify stakeholders about the conversion of a domestic entity in Alabama?

A: Yes, it is generally necessary to notify stakeholders, such as shareholders, members, partners, and creditors, about the conversion of a domestic entity in Alabama.

Q: Can a domestic entity be converted into a different type of business entity in Alabama?

A: Yes, a domestic entity in Alabama can be converted into a different type of business entity, such as converting from a corporation to an LLC or vice versa.

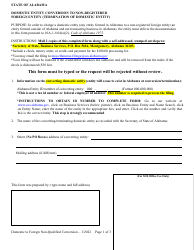

Q: Can a domestic entity be converted into a foreign entity in Alabama?

A: No, a domestic entity in Alabama cannot be converted into a foreign entity. However, it may be possible to create a new foreign entity and transfer the assets or membership interests of the domestic entity to the new foreign entity.

Q: Is it necessary to obtain any approvals or consents for conversion of a domestic entity in Alabama?

A: Yes, obtaining certain approvals or consents may be required for the conversion of a domestic entity in Alabama. These may include shareholder approvals, partner approvals, or creditor consents, depending on the circumstances.

Q: Can the conversion of a domestic entity in Alabama have tax implications?

A: Yes, the conversion of a domestic entity in Alabama may have tax implications. It is advisable to consult with a tax professional or accountant to understand the potential tax consequences of the conversion.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.