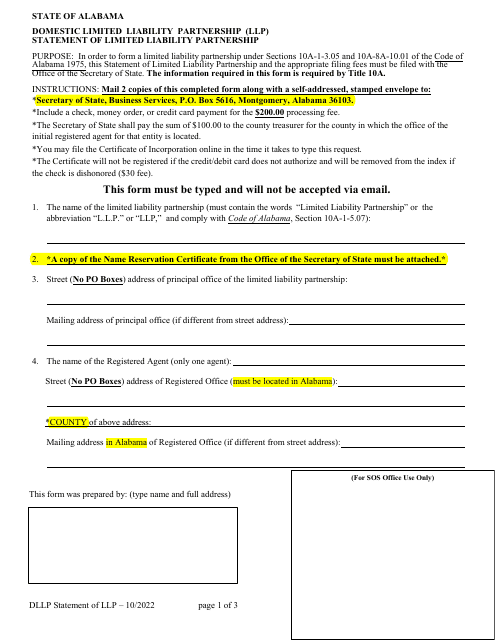

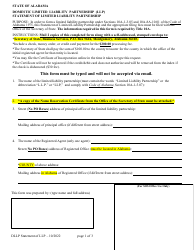

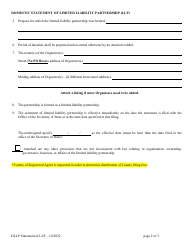

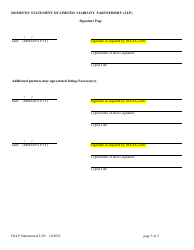

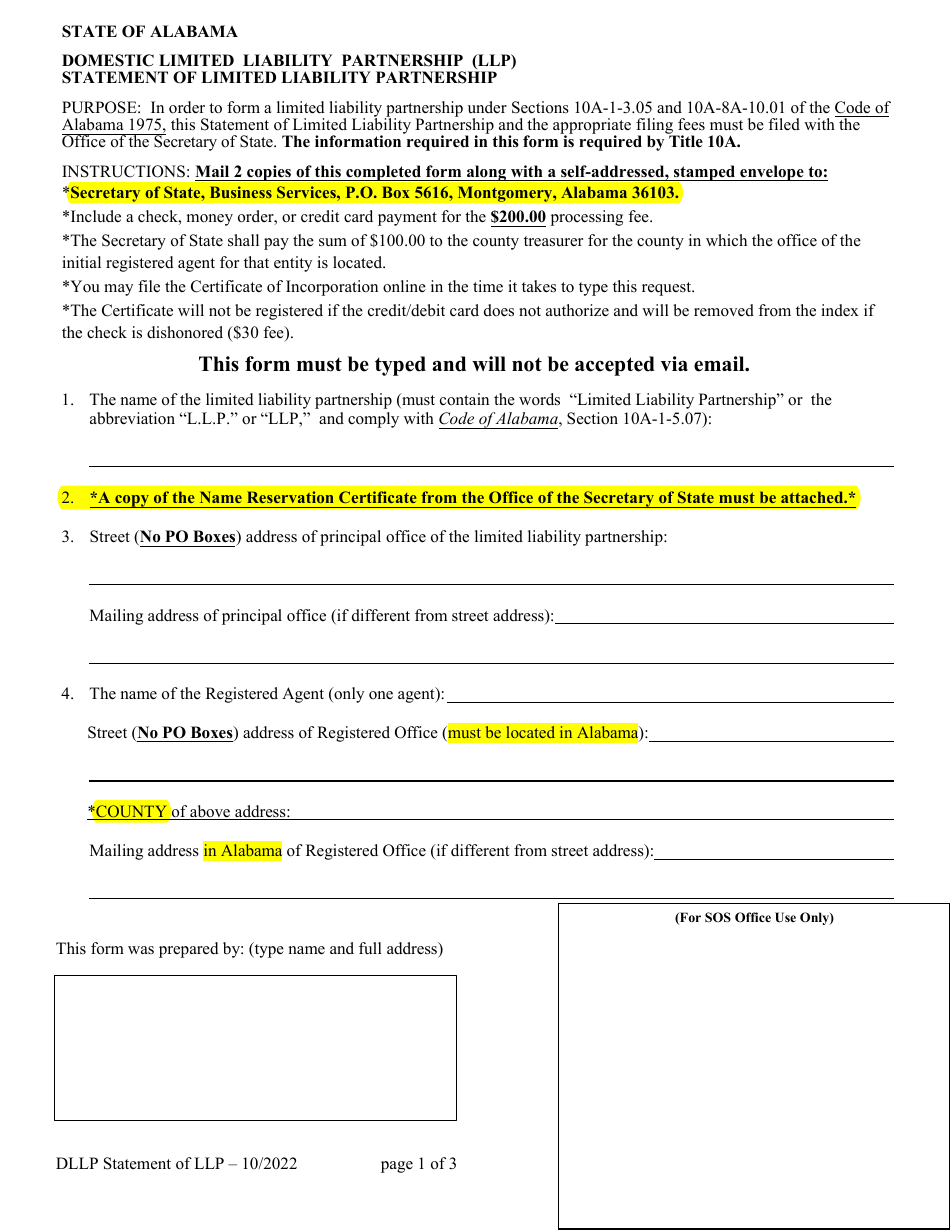

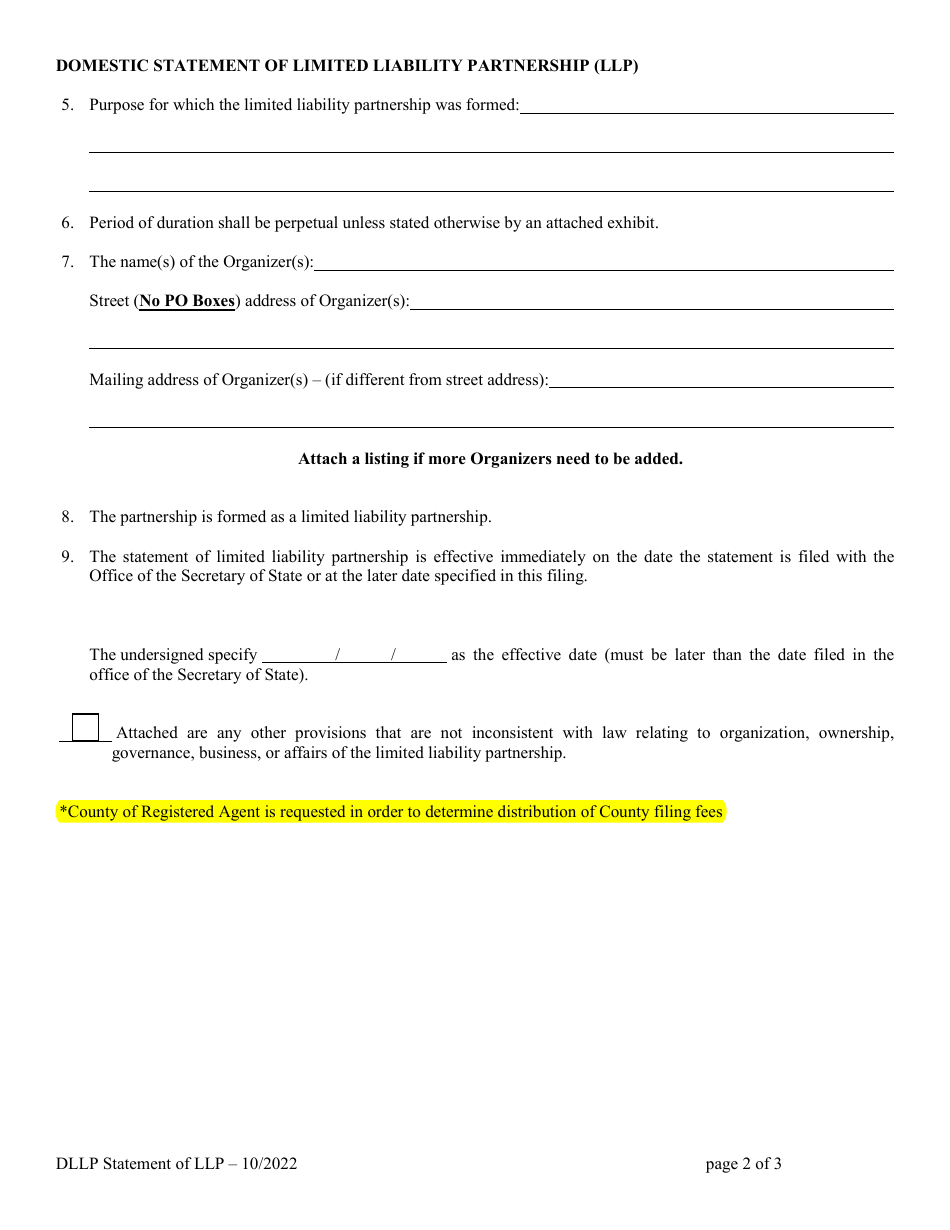

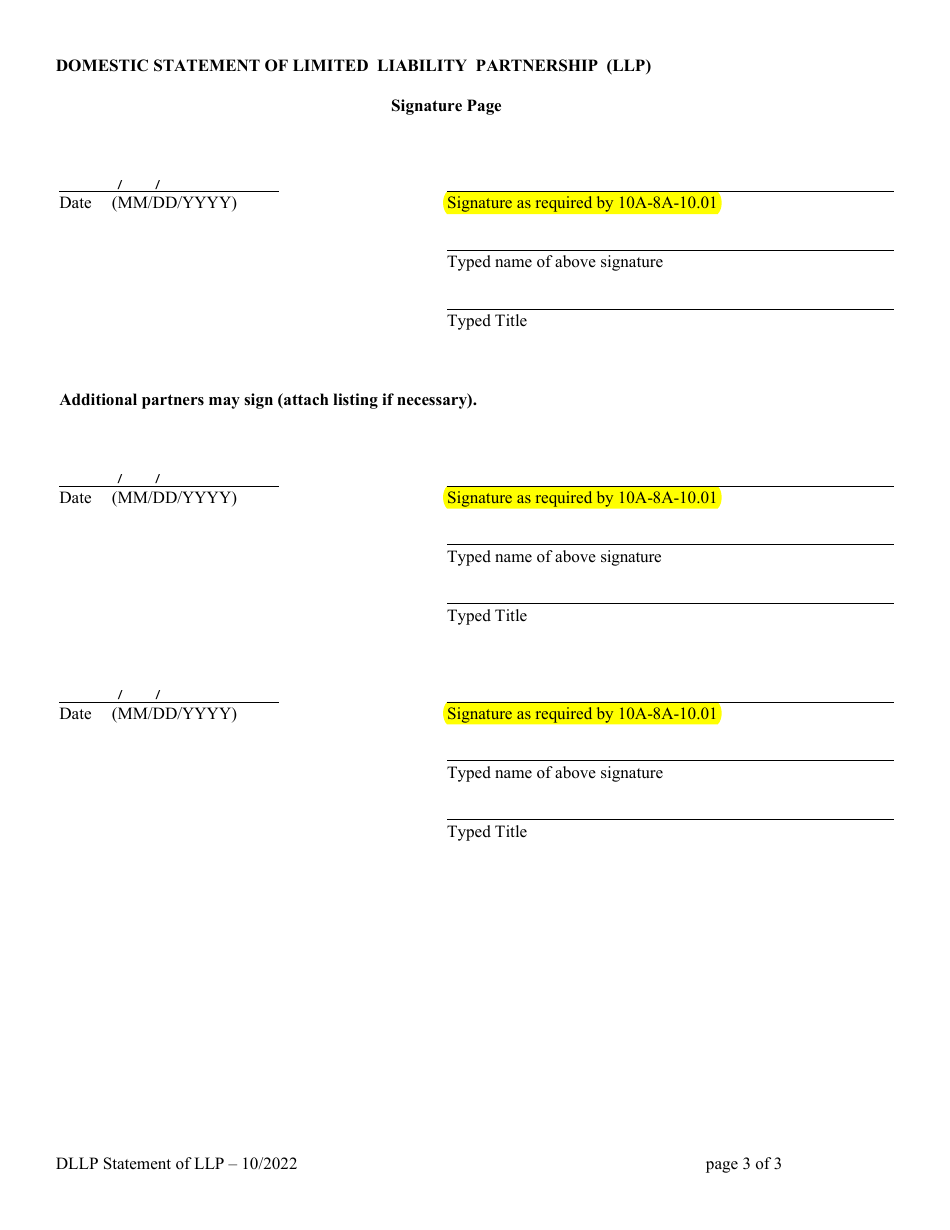

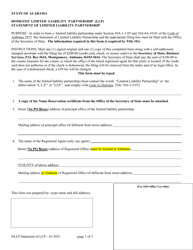

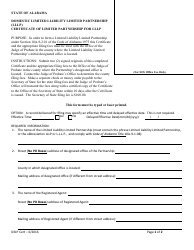

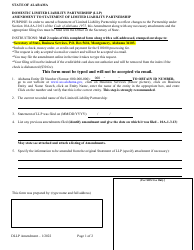

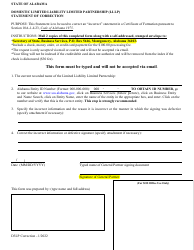

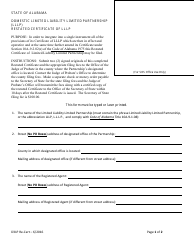

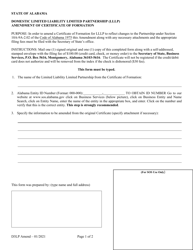

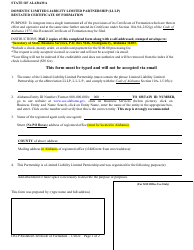

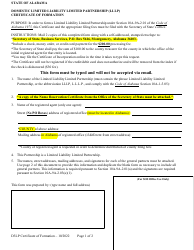

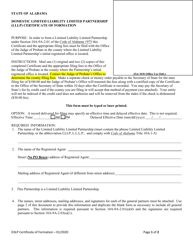

Domestic Statement of Limited Liability Partnership (LLP ) - Alabama

Domestic Statement of Limited Liability Partnership (LLP ) is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a Limited Liability Partnership (LLP)?

A: A Limited Liability Partnership (LLP) is a type of business structure that combines the limited liability protection of a corporation with the flexibility and tax benefits of a partnership.

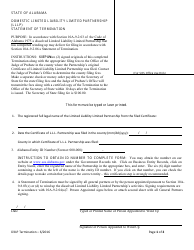

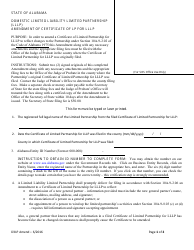

Q: How do I form a Domestic Limited Liability Partnership (LLP) in Alabama?

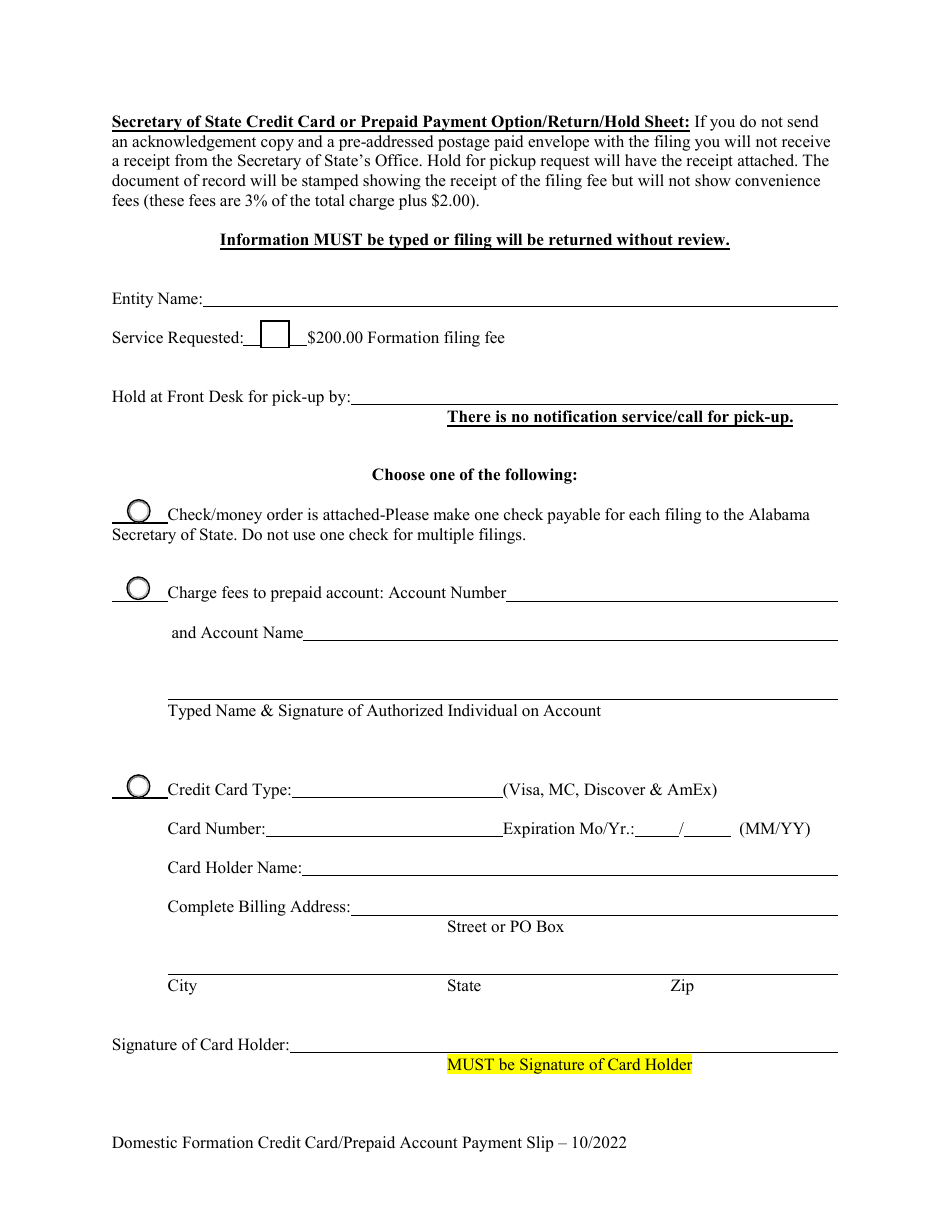

A: To form a Domestic Limited Liability Partnership (LLP) in Alabama, you need to file a completed Certificate of Formation with the Secretary of State and pay the required filing fee.

Q: What are the advantages of forming an LLP?

A: Some advantages of forming a Limited Liability Partnership (LLP) include limited liability protection for partners, pass-through taxation, and flexibility in management and decision-making.

Q: What are the disadvantages of forming an LLP?

A: Some disadvantages of forming a Limited Liability Partnership (LLP) include the requirement to file additional paperwork and pay annual fees, potential personal liability for certain partner actions, and restrictions on ownership and transferability of partnership interests.

Q: What is the difference between an LLP and an LLC?

A: The main difference between a Limited Liability Partnership (LLP) and a Limited Liability Company (LLC) is that an LLP is typically used by professional service providers, such as lawyers or accountants, while an LLC is used by a wide range of businesses.

Q: Do I need to have a registered agent for my LLP in Alabama?

A: Yes, every Domestic Limited Liability Partnership (LLP) in Alabama is required to have a registered agent who is available during business hours to receive legal and other important documents on behalf of the LLP.

Q: Do LLPs have to pay taxes?

A: No, LLPs themselves do not pay taxes. Instead, the profits and losses of the LLP are "passed through" to the individual partners, who report them on their personal tax returns.

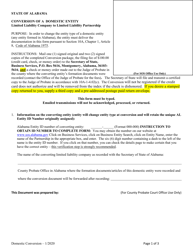

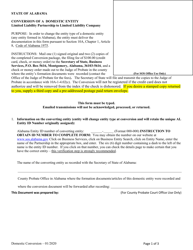

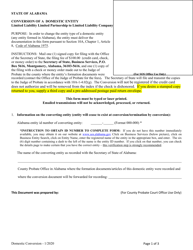

Q: Can an LLP be converted to a different business structure?

A: Yes, in most states including Alabama, an LLP can be converted to a different business structure, such as a corporation or LLC, by filing the necessary conversion documents with the Secretary of State.

Q: Are there any annual maintenance requirements for LLPs in Alabama?

A: Yes, LLPs in Alabama are required to file an Annual Report with the Secretary of State and pay the associated fee by the due date each year.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

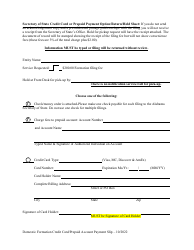

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.