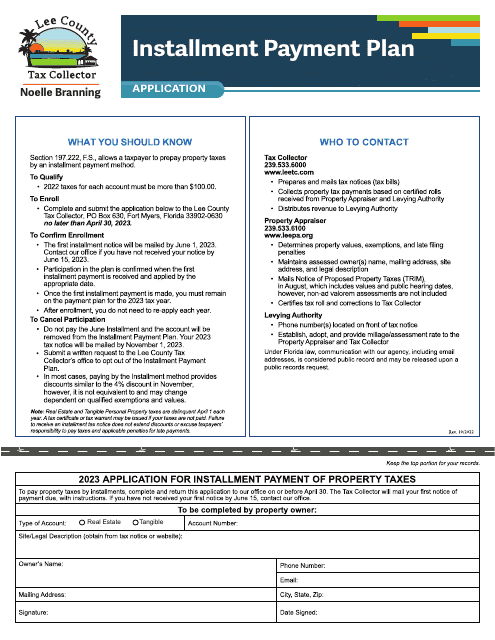

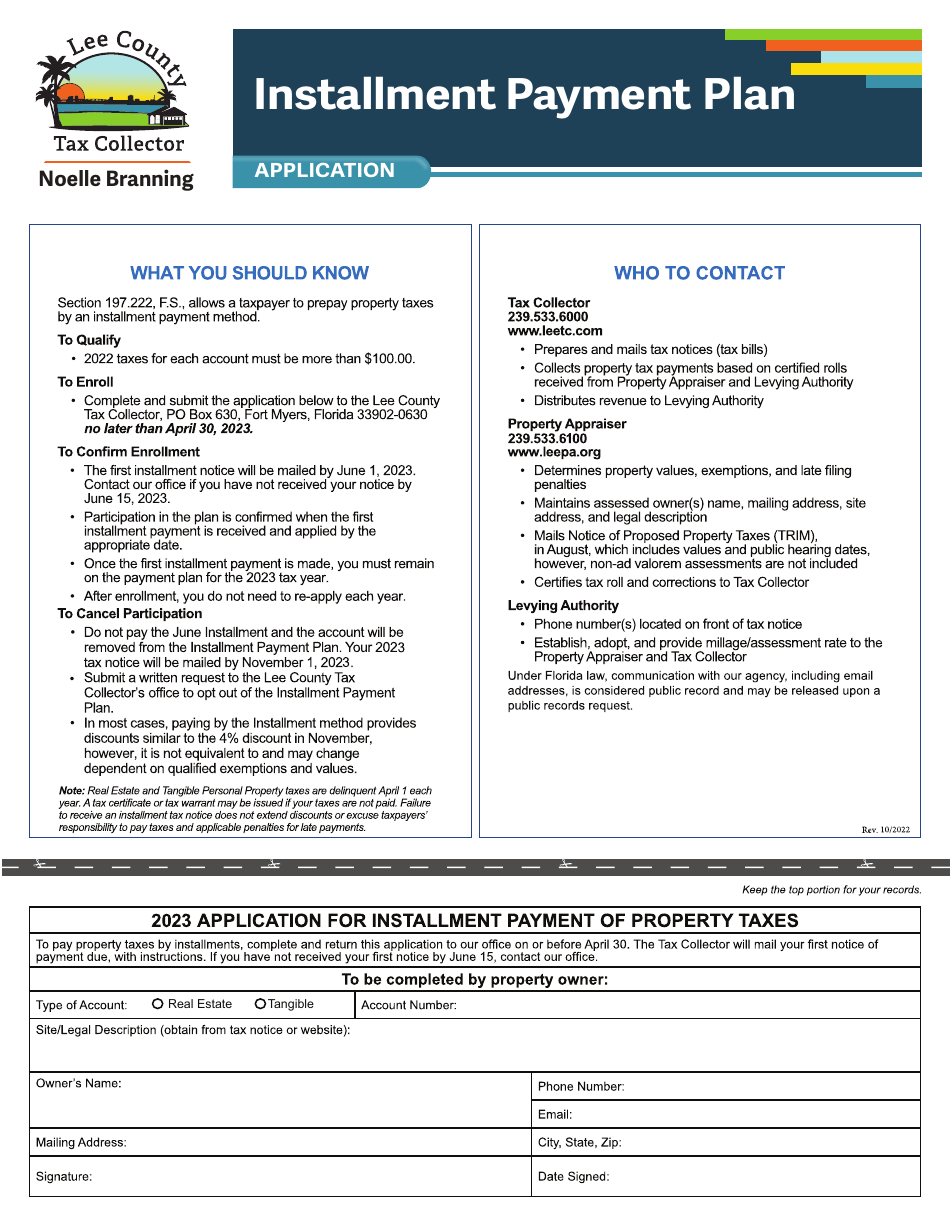

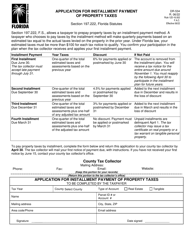

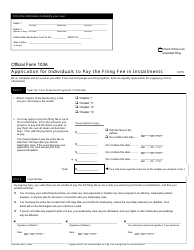

Application for Installment Payment of Property Taxes - Lee County, Florida

Application for Installment Payment of Property Taxes is a legal document that was released by the Tax Collector's Office - Lee County, Florida - a government authority operating within Florida. The form may be used strictly within Lee County.

FAQ

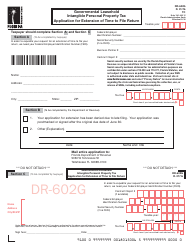

Q: What is the application for?

A: The application is for installment payment of property taxes.

Q: What does the application allow me to do?

A: The application allows you to pay your property taxes in installments.

Q: Can I pay my property taxes in full instead of using the installment option?

A: Yes, you can choose to pay your property taxes in full.

Q: Are there any eligibility requirements for the installment payment program?

A: Yes, there are certain eligibility requirements that you need to meet.

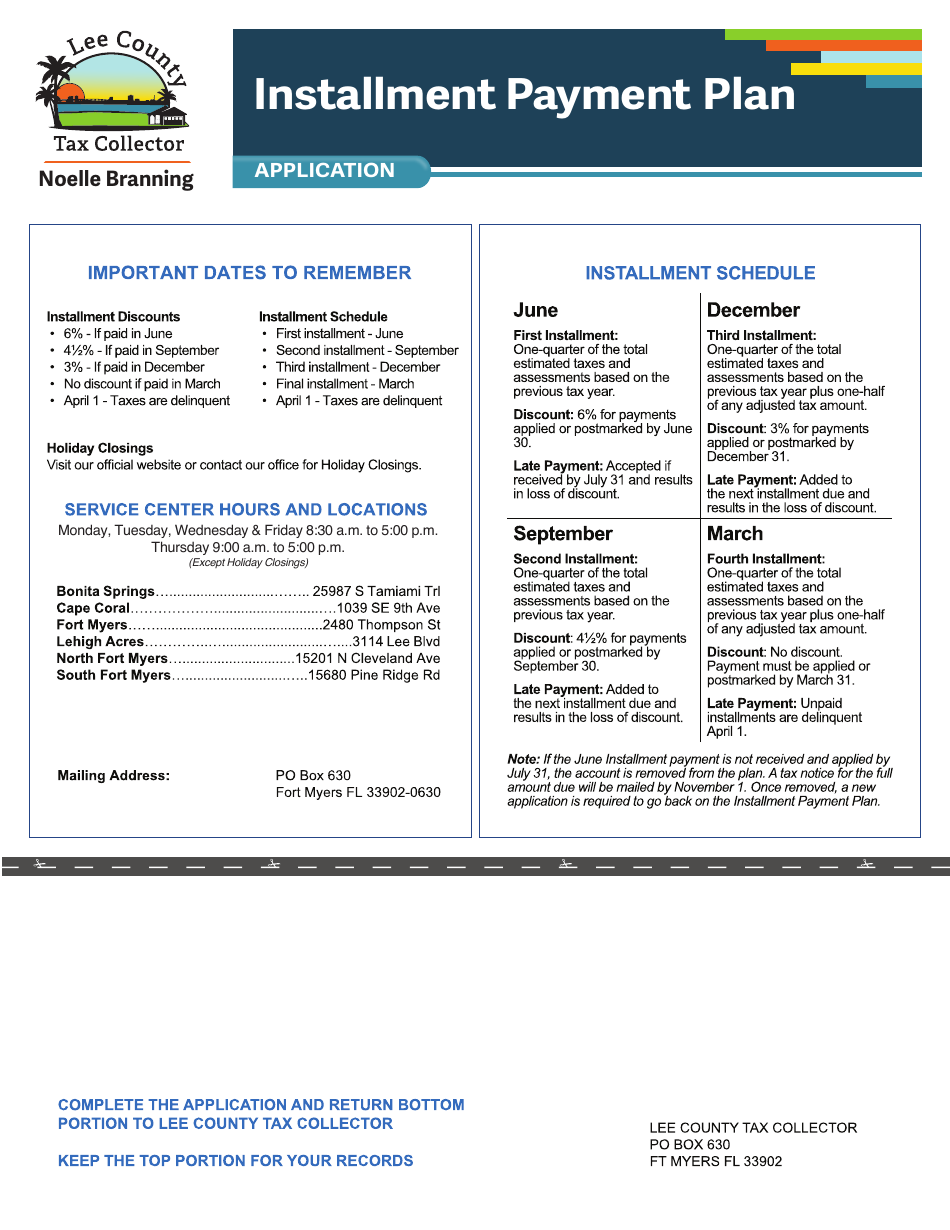

Q: How many installments can I choose to pay my property taxes?

A: You can choose to pay your property taxes in up to four installments.

Q: What is the deadline to submit the application?

A: The deadline to submit the application is typically April 30th of the tax year.

Q: Can I apply for installment payment if I have delinquent taxes?

A: No, you cannot apply for installment payment if you have delinquent taxes.

Form Details:

- Released on October 1, 2022;

- The latest edition currently provided by the Tax Collector's Office - Lee County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Tax Collector's Office - Lee County, Florida.