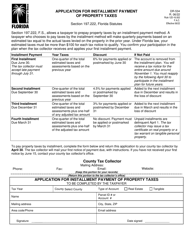

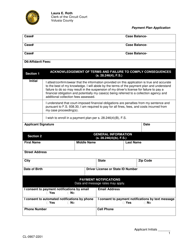

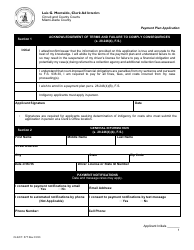

Delinquent Tangible Personal Property Tax Payment Plan Application - Lee County, Florida

Delinquent Tangible Personal Property Tax Payment Plan Application is a legal document that was released by the Tax Collector's Office - Lee County, Florida - a government authority operating within Florida. The form may be used strictly within Lee County.

FAQ

Q: What is the Delinquent Tangible Personal Property Tax Payment Plan Application?

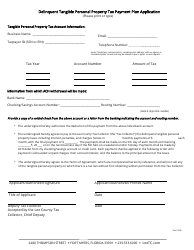

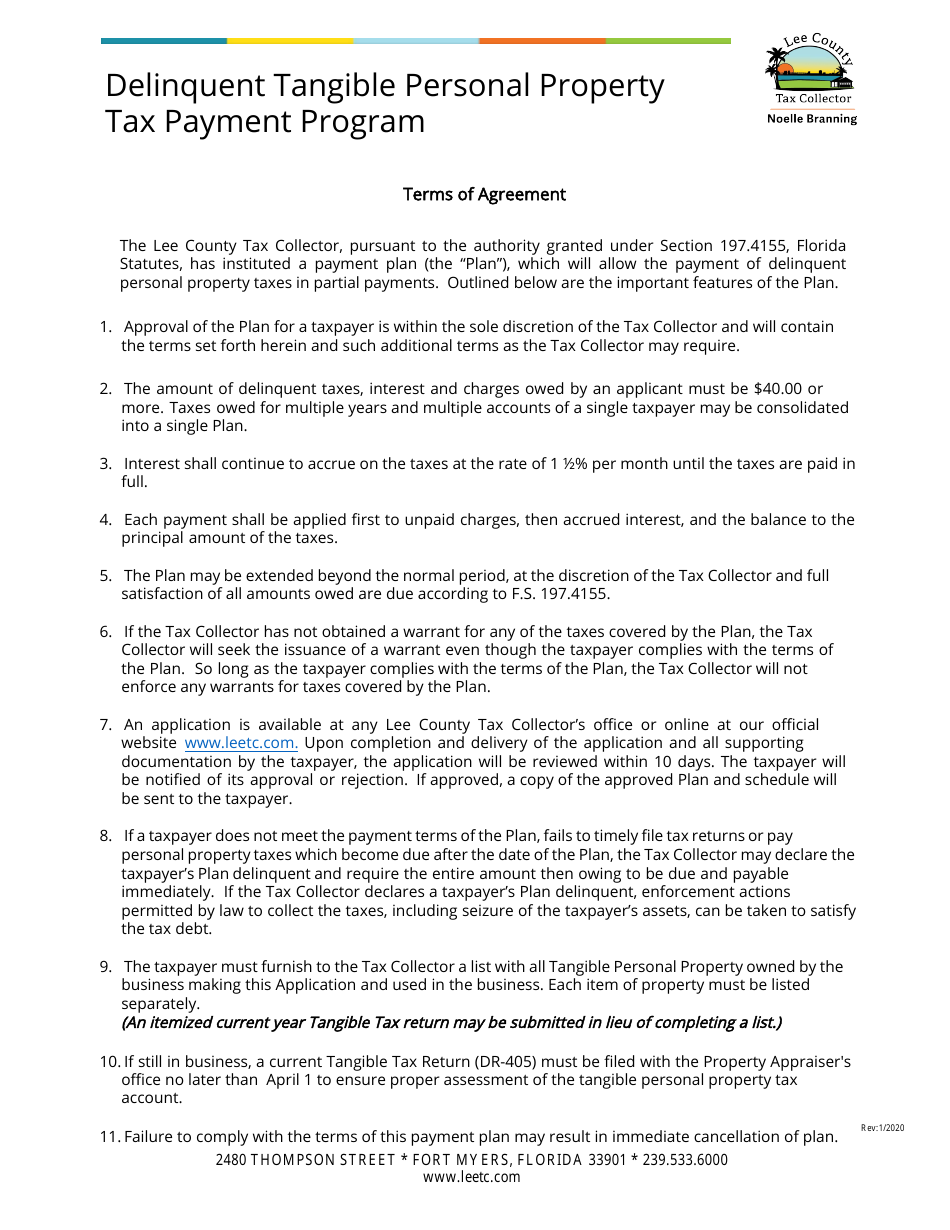

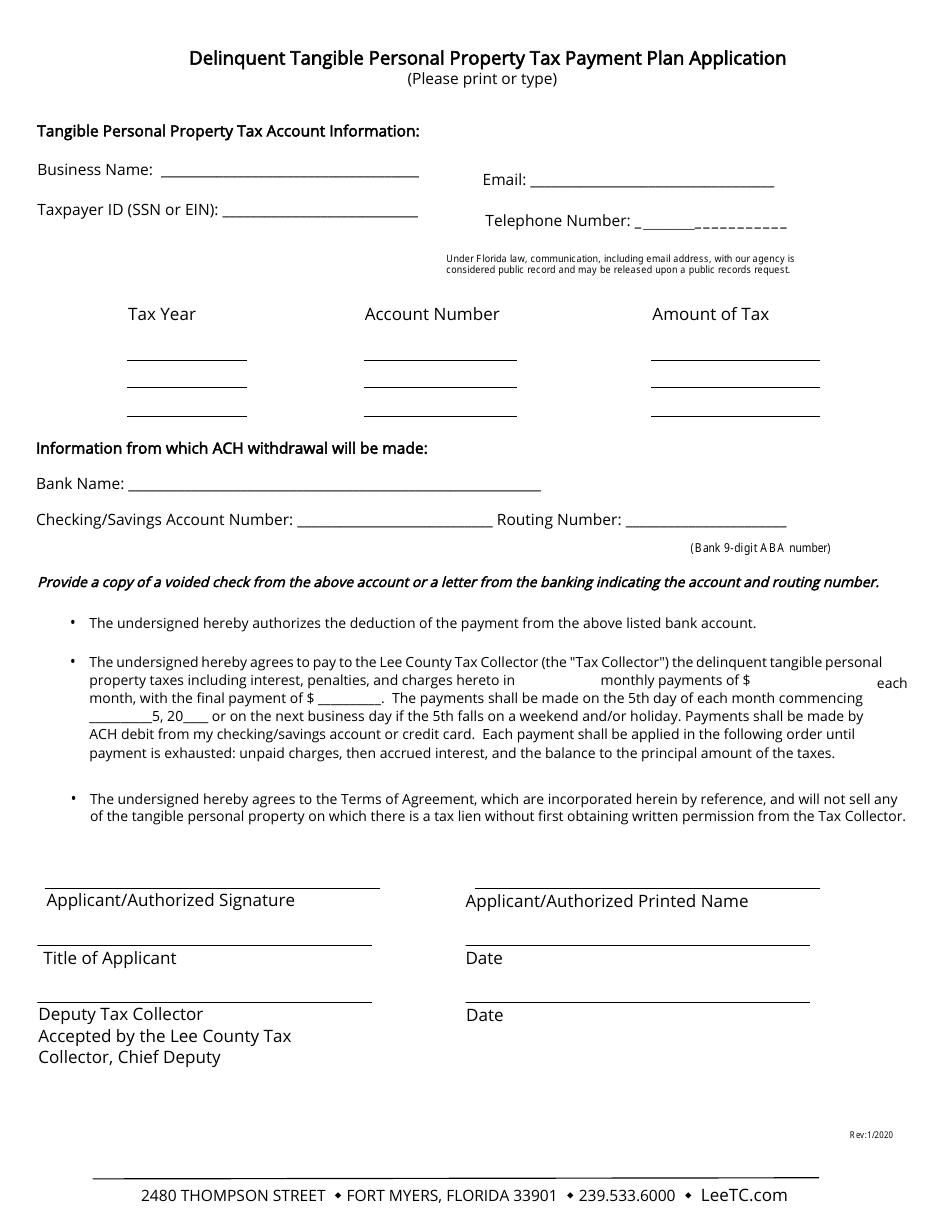

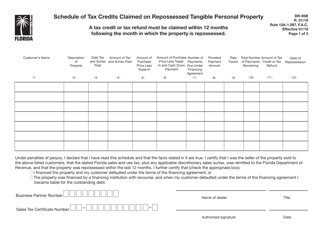

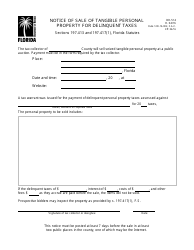

A: The Delinquent Tangible Personal Property Tax Payment Plan Application is a form for taxpayers in Lee County, Florida to apply for a payment plan for delinquent tangible personal property taxes.

Q: Who can use the Delinquent Tangible Personal Property Tax Payment Plan?

A: Taxpayers in Lee County, Florida who have delinquent tangible personal property taxes can use the payment plan.

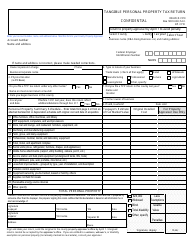

Q: What is tangible personal property?

A: Tangible personal property refers to physical items that can be touched or moved, such as equipment, machinery, and furniture.

Q: How can I apply for the payment plan?

A: You can apply for the payment plan by filling out the Delinquent Tangible Personal Property Tax Payment Plan Application form.

Q: What are the requirements to qualify for the payment plan?

A: To qualify for the payment plan, you must have delinquent tangible personal property taxes and be able to make regular monthly payments.

Q: What happens after I submit the application?

A: After submitting the application, the Lee County Tax Collector's Office will review it and determine if you qualify for the payment plan.

Q: Are there any fees associated with the payment plan?

A: Yes, there may be administrative fees associated with the payment plan.

Q: Can I appeal if my application is denied?

A: Yes, if your application is denied, you have the right to appeal the decision.

Form Details:

- Released on January 1, 2020;

- The latest edition currently provided by the Tax Collector's Office - Lee County, Florida;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Tax Collector's Office - Lee County, Florida.