This version of the form is not currently in use and is provided for reference only. Download this version of

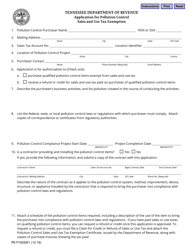

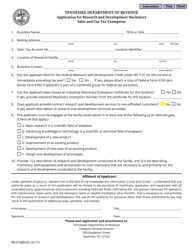

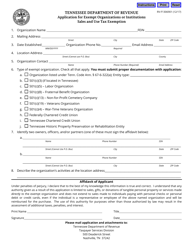

Form RV-F1312101

for the current year.

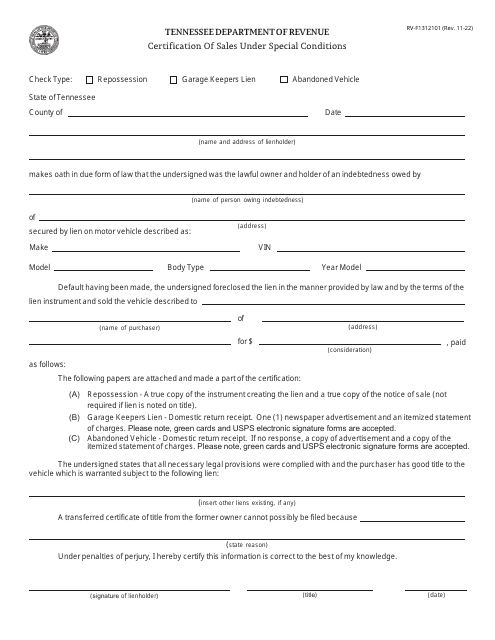

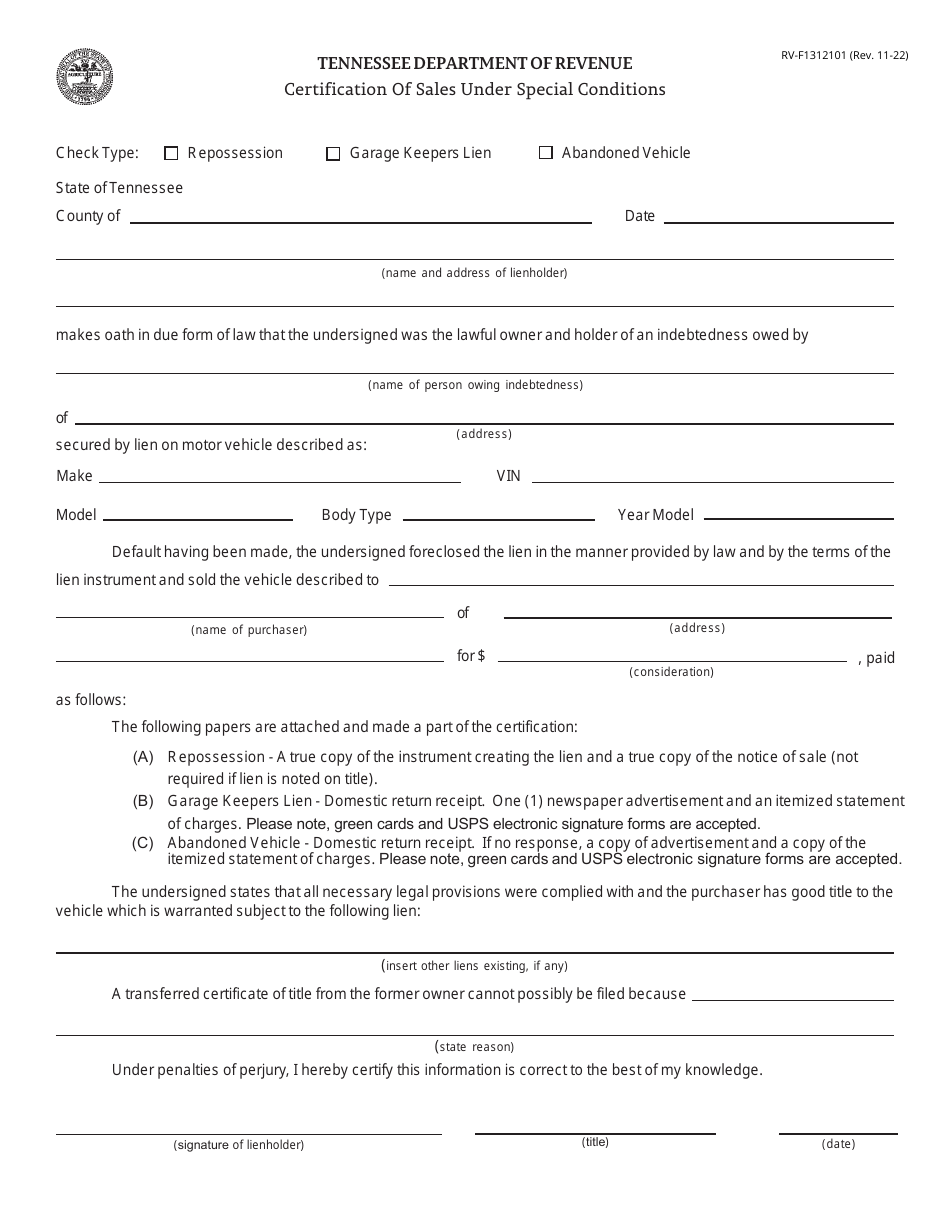

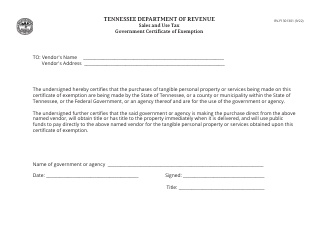

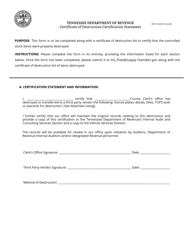

Form RV-F1312101 Certification of Sales Under Special Conditions - Tennessee

What Is Form RV-F1312101?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RV-F1312101 form?

A: The RV-F1312101 form is a Certification of Sales Under Special Conditions in Tennessee.

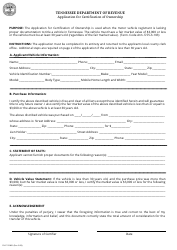

Q: When is the RV-F1312101 form used?

A: The RV-F1312101 form is used when certifying sales under special conditions in Tennessee.

Q: What are the special conditions referred to in the RV-F1312101 form?

A: The RV-F1312101 form is used to certify sales that involve special conditions, such as sales to government entities or non-profit organizations.

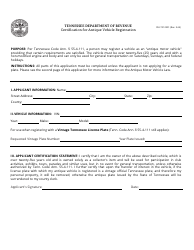

Q: Who should complete the RV-F1312101 form?

A: The RV-F1312101 form should be completed by the seller or their authorized representative.

Q: Is the RV-F1312101 form required for all sales in Tennessee?

A: No, the RV-F1312101 form is only required for sales that meet the special conditions outlined in the form.

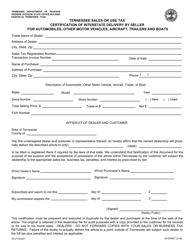

Q: Are there any fees associated with submitting the RV-F1312101 form?

A: There are no fees associated with submitting the RV-F1312101 form.

Q: Is the RV-F1312101 form specific to Tennessee?

A: Yes, the RV-F1312101 form is specific to sales in Tennessee and may not be applicable in other states.

Q: What should I do if I have questions or need assistance with the RV-F1312101 form?

A: If you have questions or need assistance with the RV-F1312101 form, you can contact the Tennessee Department of Revenue for guidance.

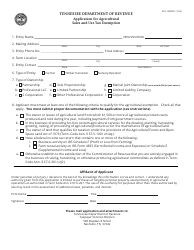

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1312101 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.