This version of the form is not currently in use and is provided for reference only. Download this version of

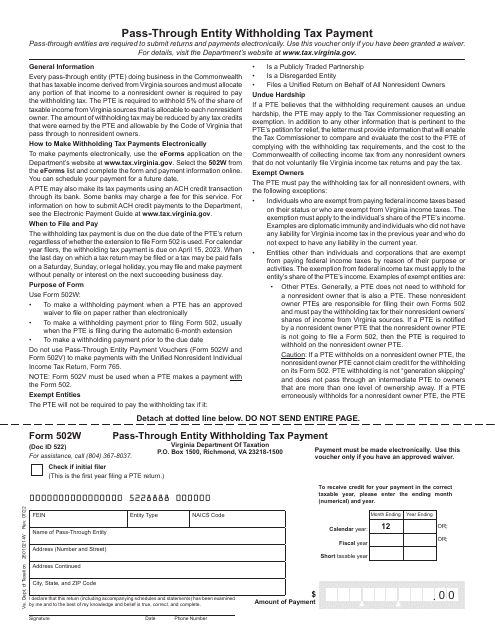

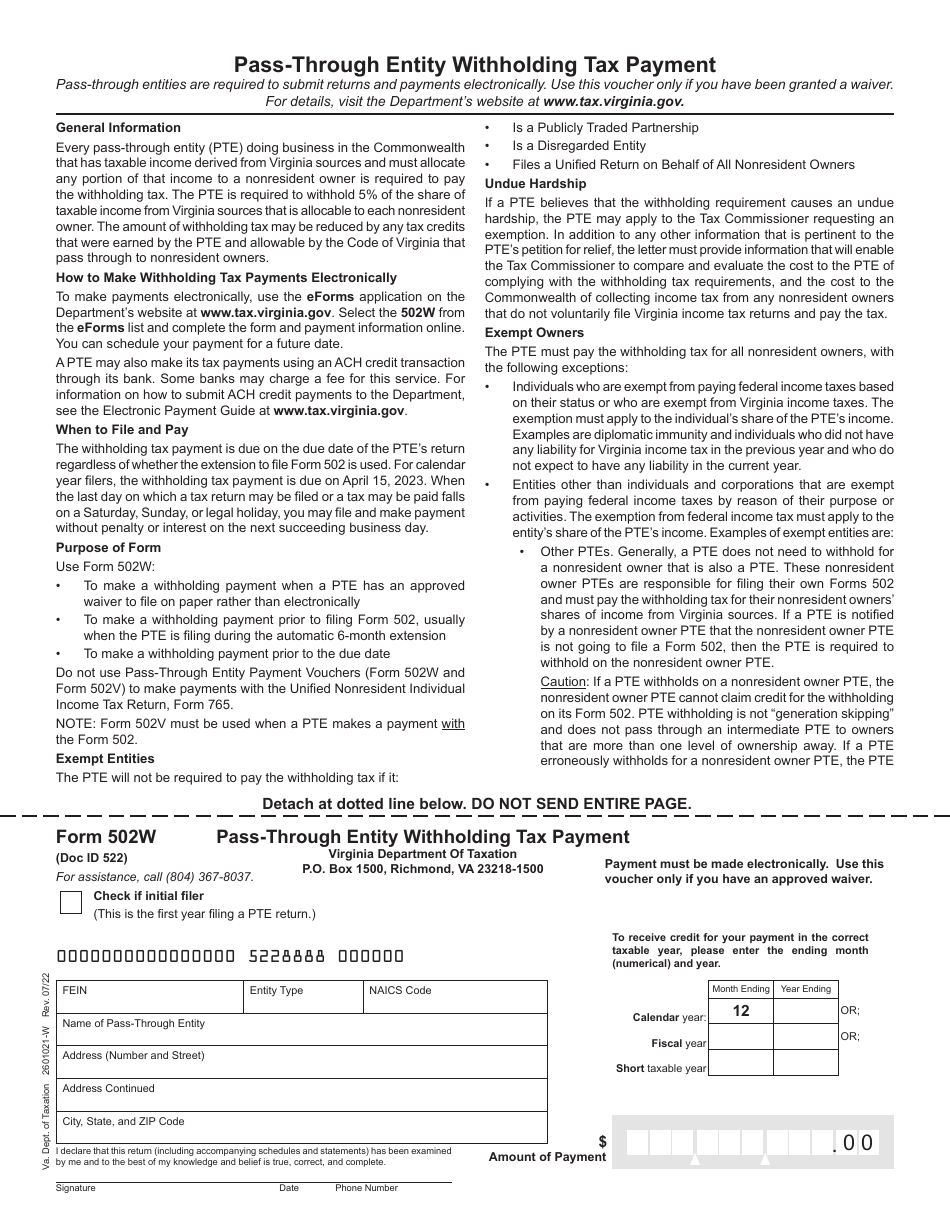

Form 502W

for the current year.

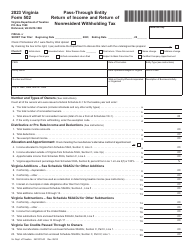

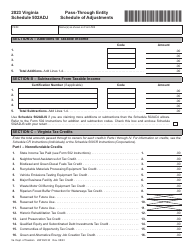

Form 502W Pass-Through Entity Withholding Tax Payment - Virginia

What Is Form 502W?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 502W?

A: Form 502W is the Pass-Through Entity Withholding Tax Payment form in Virginia.

Q: What is the purpose of Form 502W?

A: Form 502W is used by pass-through entities to remit withholding tax payments to the state of Virginia.

Q: Who needs to file Form 502W?

A: Pass-through entities that have employees or payees subject to Virginia withholding tax need to file Form 502W.

Q: How often should Form 502W be filed?

A: Form 502W should be filed quarterly.

Q: What information is required on Form 502W?

A: Form 502W requires information about the pass-through entity, the amount of withholding tax being remitted, and the tax year.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502W by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.