This version of the form is not currently in use and is provided for reference only. Download this version of

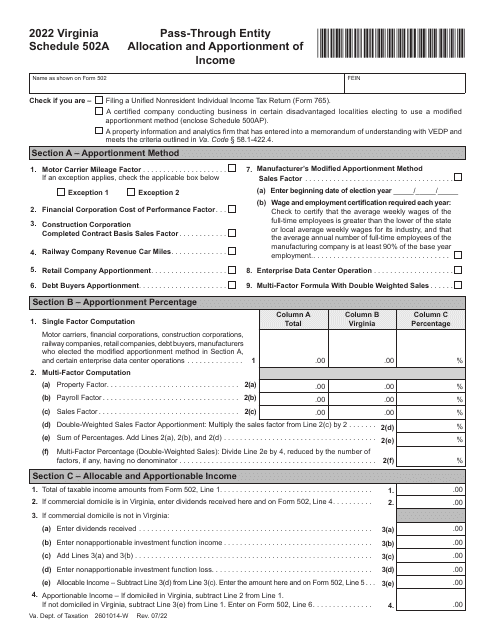

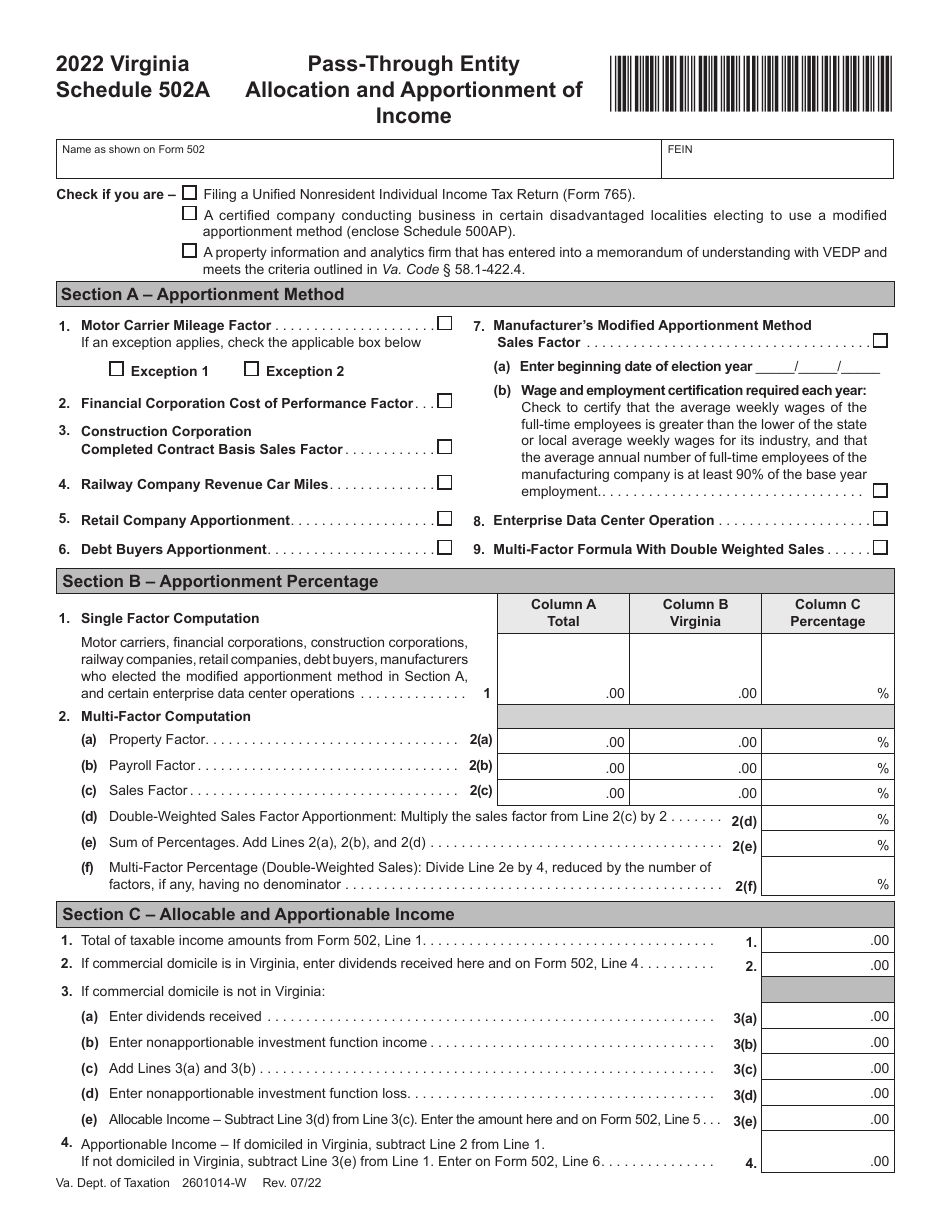

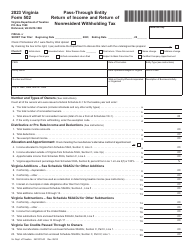

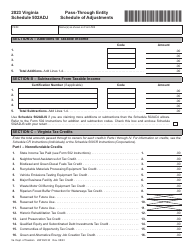

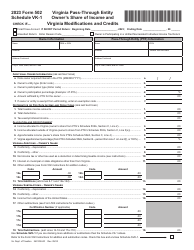

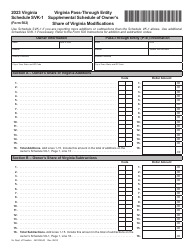

Schedule 502A

for the current year.

Schedule 502A Pass-Through Entity Allocation and Apportionment of Income - Virginia

What Is Schedule 502A?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 502A?

A: Schedule 502A is a form used to allocate and apportion income for pass-through entities in the state of Virginia.

Q: Who needs to file Schedule 502A?

A: Pass-through entities in Virginia, such as partnerships and S corporations, need to file Schedule 502A.

Q: What is the purpose of Schedule 502A?

A: The purpose of Schedule 502A is to determine how much income should be allocated and apportioned to Virginia for tax purposes.

Q: How does Schedule 502A work?

A: Schedule 502A uses various factors, such as sales, property, and payroll, to calculate the Virginia allocation and apportionment percentage.

Q: When is the deadline to file Schedule 502A?

A: The deadline to file Schedule 502A is the same as the deadline for filing the pass-through entity's tax return, which is usually April 15.

Q: Are there any penalties for not filing Schedule 502A?

A: Yes, failure to file Schedule 502A or filing it incorrectly may result in penalties and interest being assessed by the Virginia Department of Taxation.

Q: Can I amend Schedule 502A if needed?

A: Yes, if you need to make changes to your Schedule 502A, you can file an amended return using the appropriate form and following the instructions provided.

Q: Is Schedule 502A only for Virginia residents?

A: No, Schedule 502A is for pass-through entities doing business in Virginia, regardless of whether they are residents or not.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 502A by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.