This version of the form is not currently in use and is provided for reference only. Download this version of

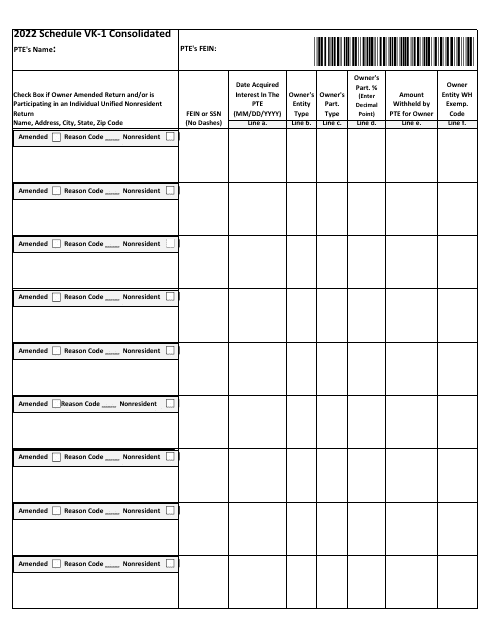

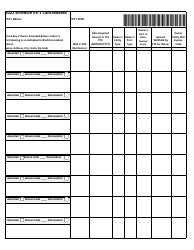

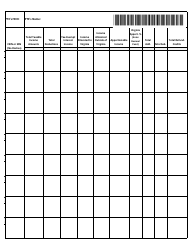

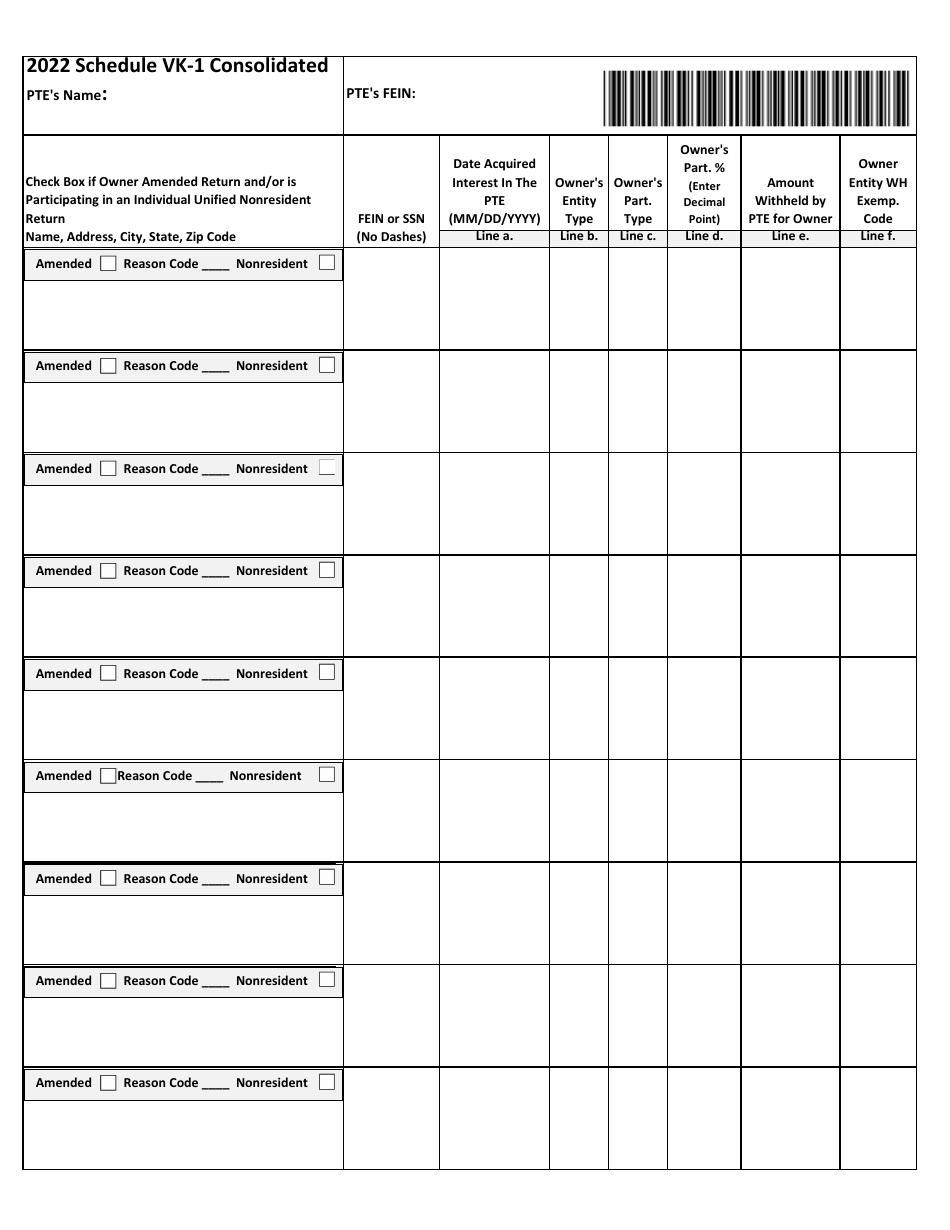

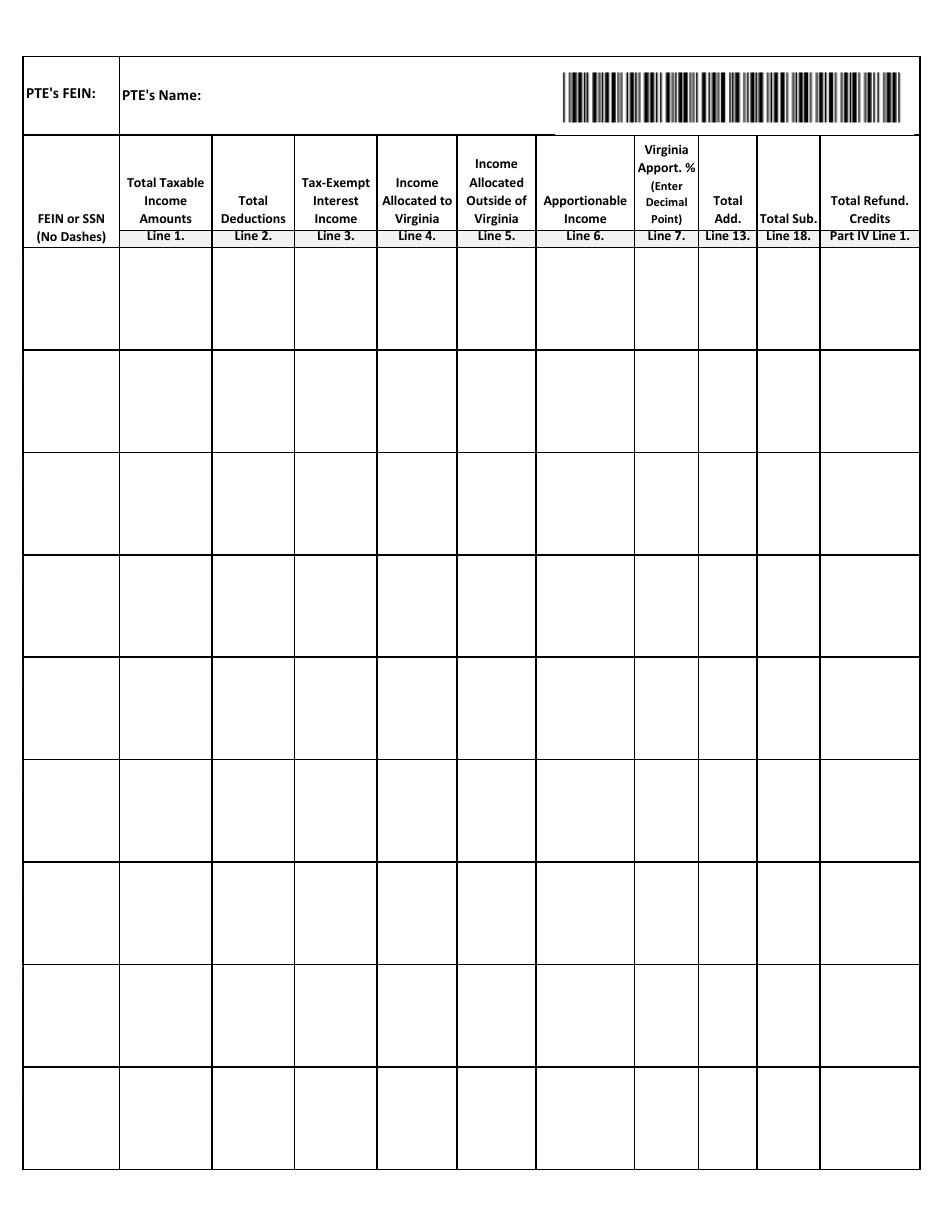

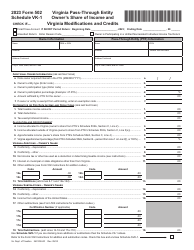

Schedule VK-1 CONSOLIDATED

for the current year.

Schedule VK-1 CONSOLIDATED Allows Reporting of Multiple Owners' Shares of Income and Virginia Modifications and Credits - Virginia

What Is Schedule VK-1 CONSOLIDATED?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule VK-1 CONSOLIDATED?

A: Schedule VK-1 CONSOLIDATED is a form that allows reporting of multiple owners' shares of income and Virginia modifications and credits.

Q: Who needs to file Schedule VK-1 CONSOLIDATED?

A: Owners of a pass-through entity that has multiple owners need to file Schedule VK-1 CONSOLIDATED.

Q: What information is reported on Schedule VK-1 CONSOLIDATED?

A: Schedule VK-1 CONSOLIDATED reports each owner's share of income, modifications, and credits.

Q: What is a pass-through entity?

A: A pass-through entity is a business structure that doesn't pay income taxes itself, but instead passes its income, deductions, and credits to its owners or members for tax reporting.

Q: Why is Schedule VK-1 CONSOLIDATED important?

A: Schedule VK-1 CONSOLIDATED is important for accurately reporting each owner's share of income, modifications, and credits, ensuring compliance with Virginia tax laws.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule VK-1 CONSOLIDATED by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.