This version of the form is not currently in use and is provided for reference only. Download this version of

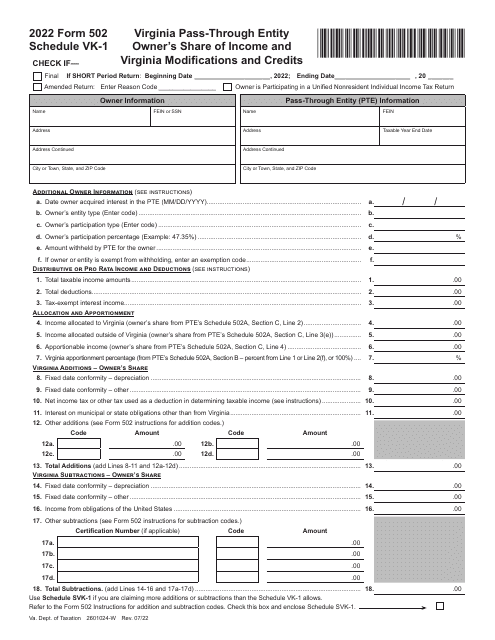

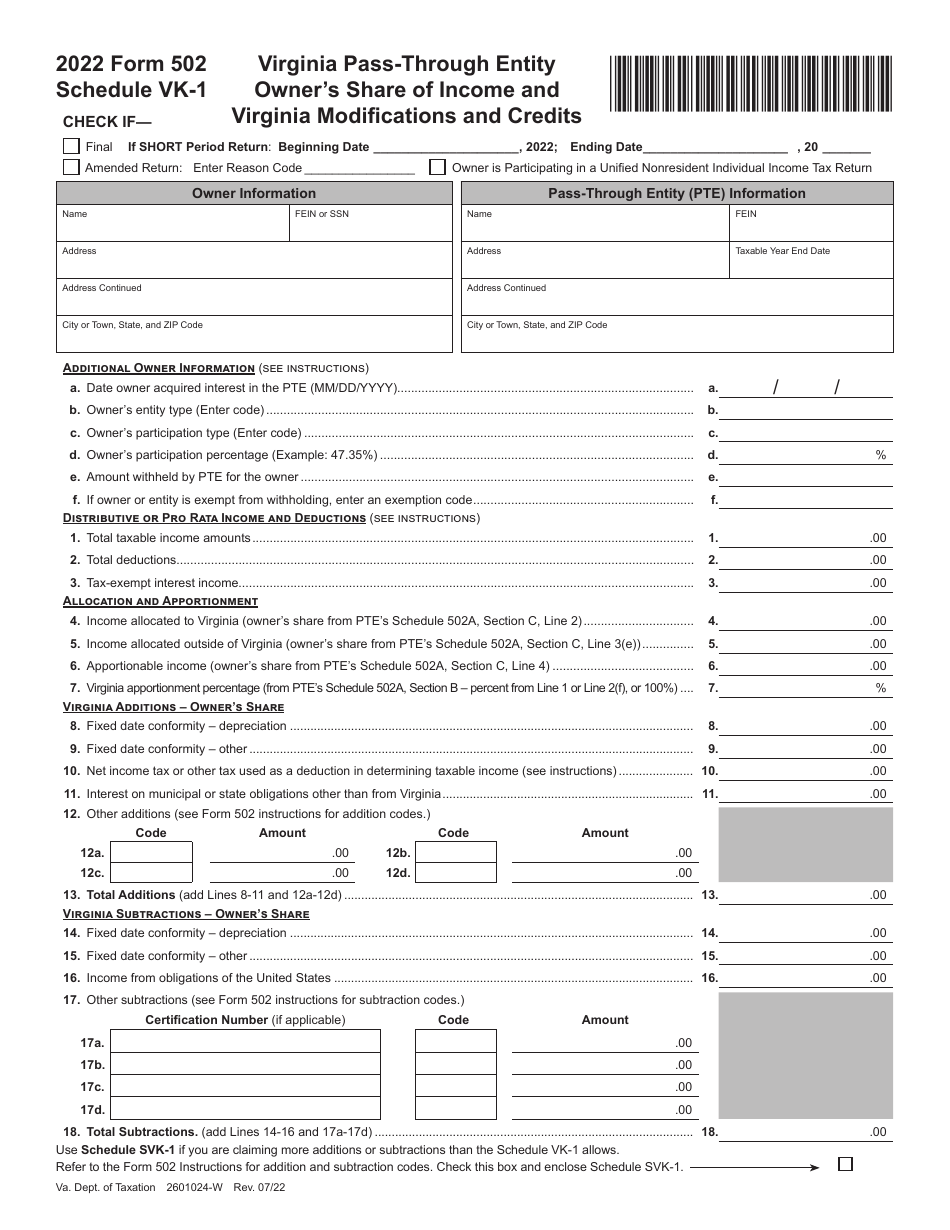

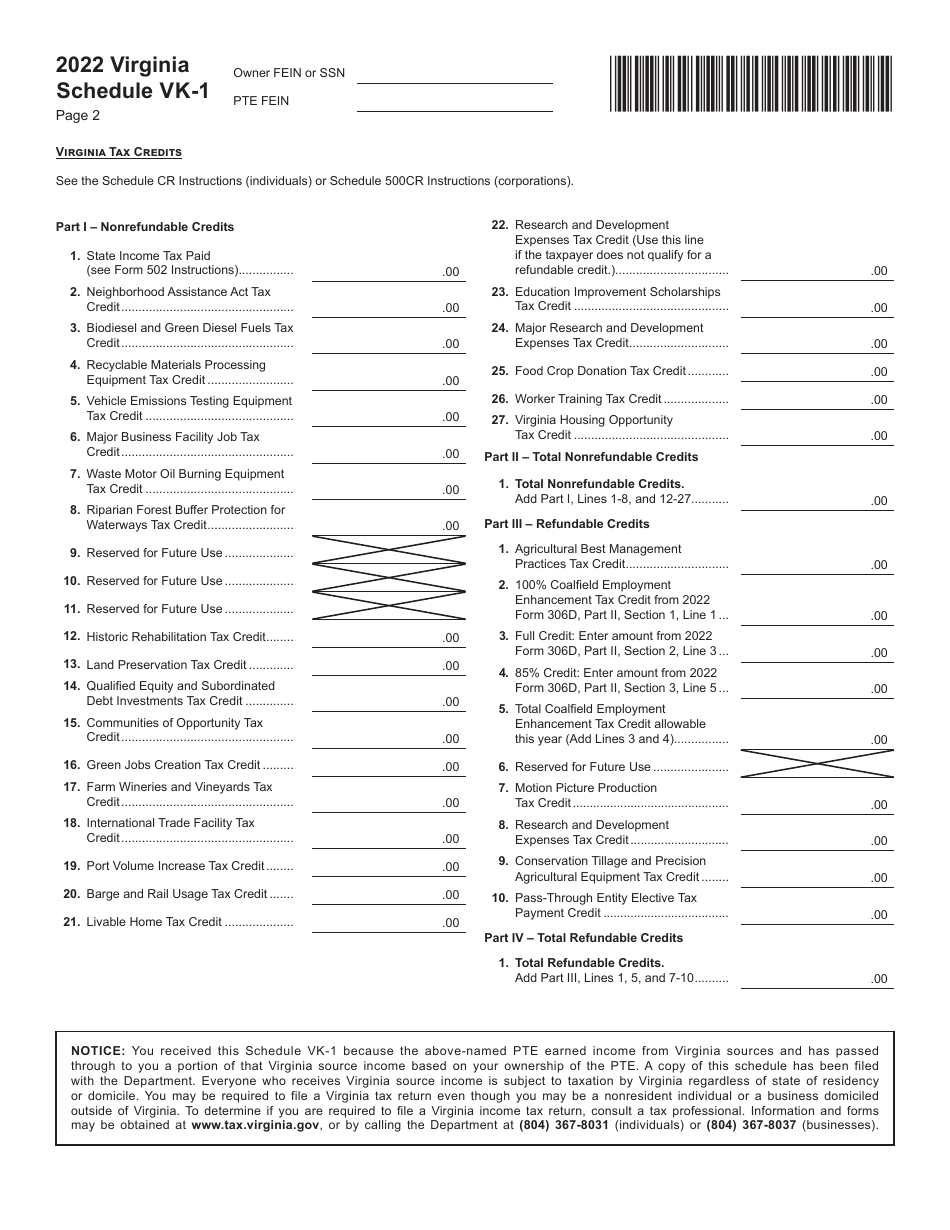

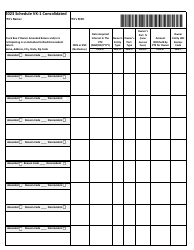

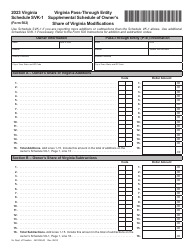

Form 502 Schedule VK-1

for the current year.

Form 502 Schedule VK-1 Virginia Pass-Through Entity Owner's Share of Income and Virginia Modifications and Credits - Virginia

What Is Form 502 Schedule VK-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia.The document is a supplement to Form 502, Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 502 Schedule VK-1?

A: Form 502 Schedule VK-1 is a tax form used in Virginia for Pass-Through Entity Owner's Share of Income and Virginia Modifications and Credits.

Q: Who needs to file Form 502 Schedule VK-1?

A: Pass-Through Entity Owners in Virginia need to file Form 502 Schedule VK-1.

Q: What is the purpose of Form 502 Schedule VK-1?

A: The purpose of Form 502 Schedule VK-1 is to report the owner's share of income and deductions from a pass-through entity in Virginia.

Q: What information is required to fill out Form 502 Schedule VK-1?

A: Information such as the owner's name, social security number, and the pass-through entity's information and income is required to fill out Form 502 Schedule VK-1.

Q: Is Form 502 Schedule VK-1 the only form that needs to be filed for pass-through entity owners in Virginia?

A: No, pass-through entity owners in Virginia also need to file their individual income tax return, Form 760 or Form 760PY, in addition to Form 502 Schedule VK-1.

Q: When is the deadline to file Form 502 Schedule VK-1?

A: The deadline to file Form 502 Schedule VK-1 is generally the same as the individual income tax return deadline, which is typically April 15th.

Q: Are there any penalties for late filing of Form 502 Schedule VK-1?

A: Yes, there may be penalties for late filing of Form 502 Schedule VK-1, including interest and potential late payment penalties.

Q: What should I do if I made an error on my Form 502 Schedule VK-1?

A: If you made an error on your Form 502 Schedule VK-1, you should file an amended return using Form 502X to correct the error as soon as possible.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502 Schedule VK-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.