This version of the form is not currently in use and is provided for reference only. Download this version of

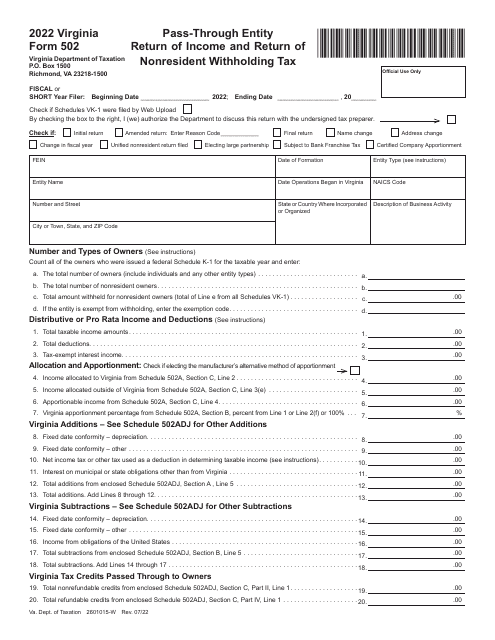

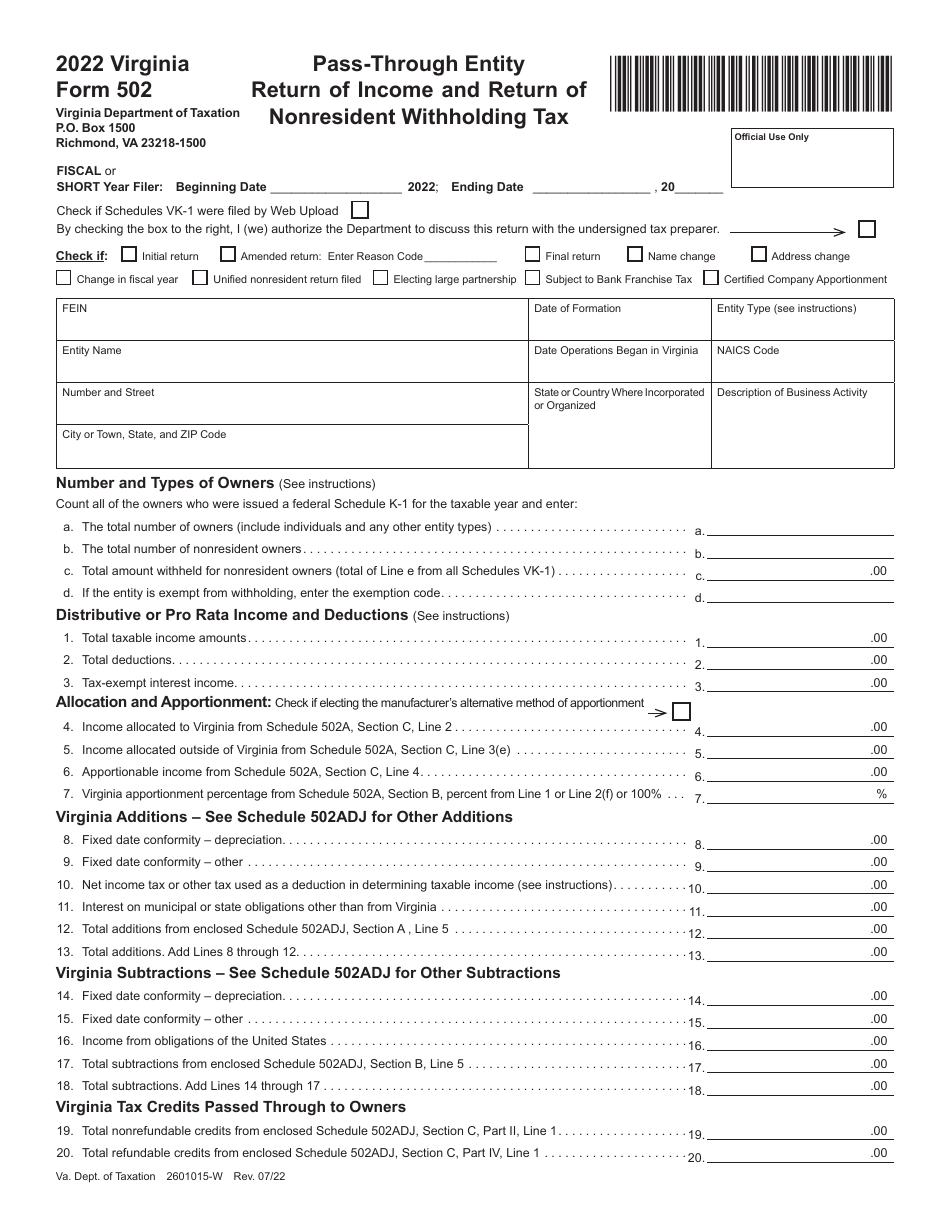

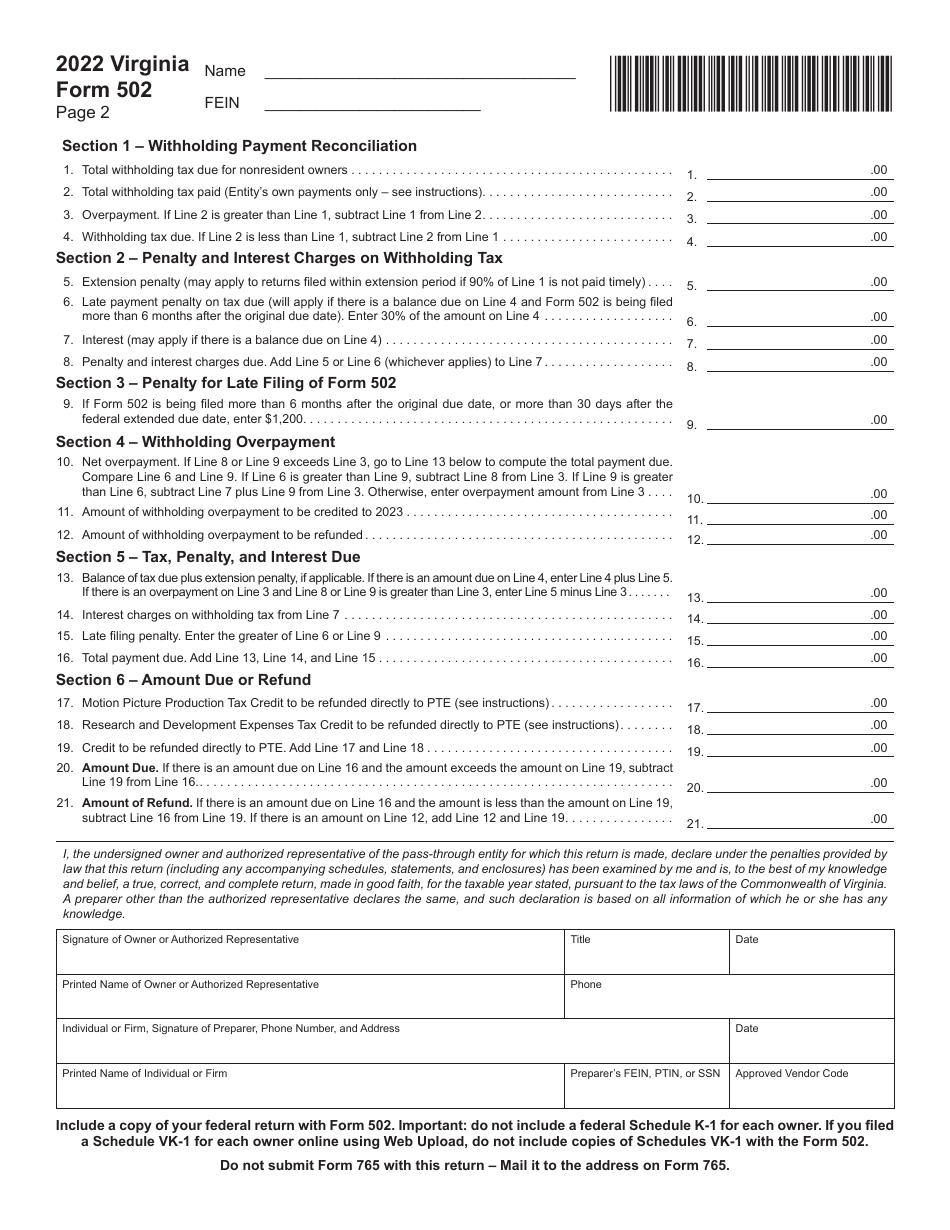

Form 502

for the current year.

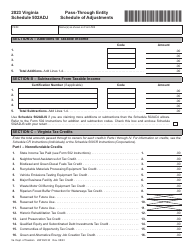

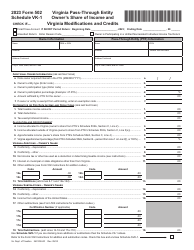

Form 502 Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax - Virginia

What Is Form 502?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 502?

A: Form 502 is the Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax for Virginia.

Q: Who needs to file Form 502?

A: Pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs), that conduct business in Virginia and have income or withholding tax to report.

Q: What information is required on Form 502?

A: Form 502 requires information about the pass-through entity's income, deductions, nonresident withholding tax, and other related information.

Q: When is the deadline to file Form 502?

A: The deadline to file Form 502 is generally the 15th day of the fourth month after the close of the taxable year.

Q: Are there any filing fees for Form 502?

A: No, there are no filing fees for Form 502 in Virginia.

Q: What if I need an extension to file Form 502?

A: You can request an extension to file Form 502 by filing Form 502E.

Q: Are there any penalties for late filing of Form 502?

A: Yes, late filing of Form 502 may result in penalties and interest charges.

Q: Can I amend my Form 502 if I made a mistake?

A: Yes, you can amend your Form 502 by filing Form 502X.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.