This version of the form is not currently in use and is provided for reference only. Download this version of

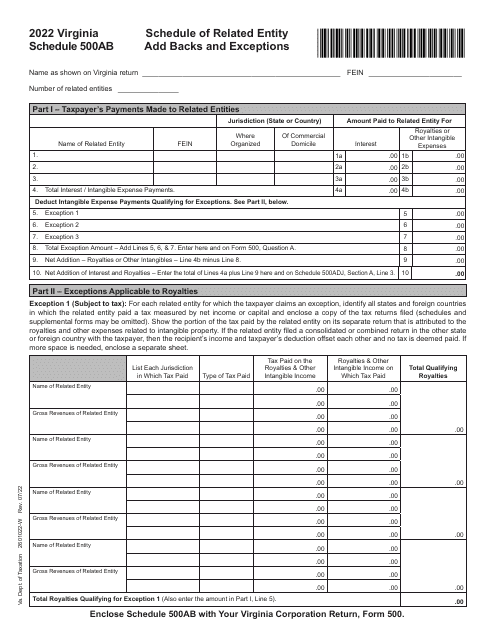

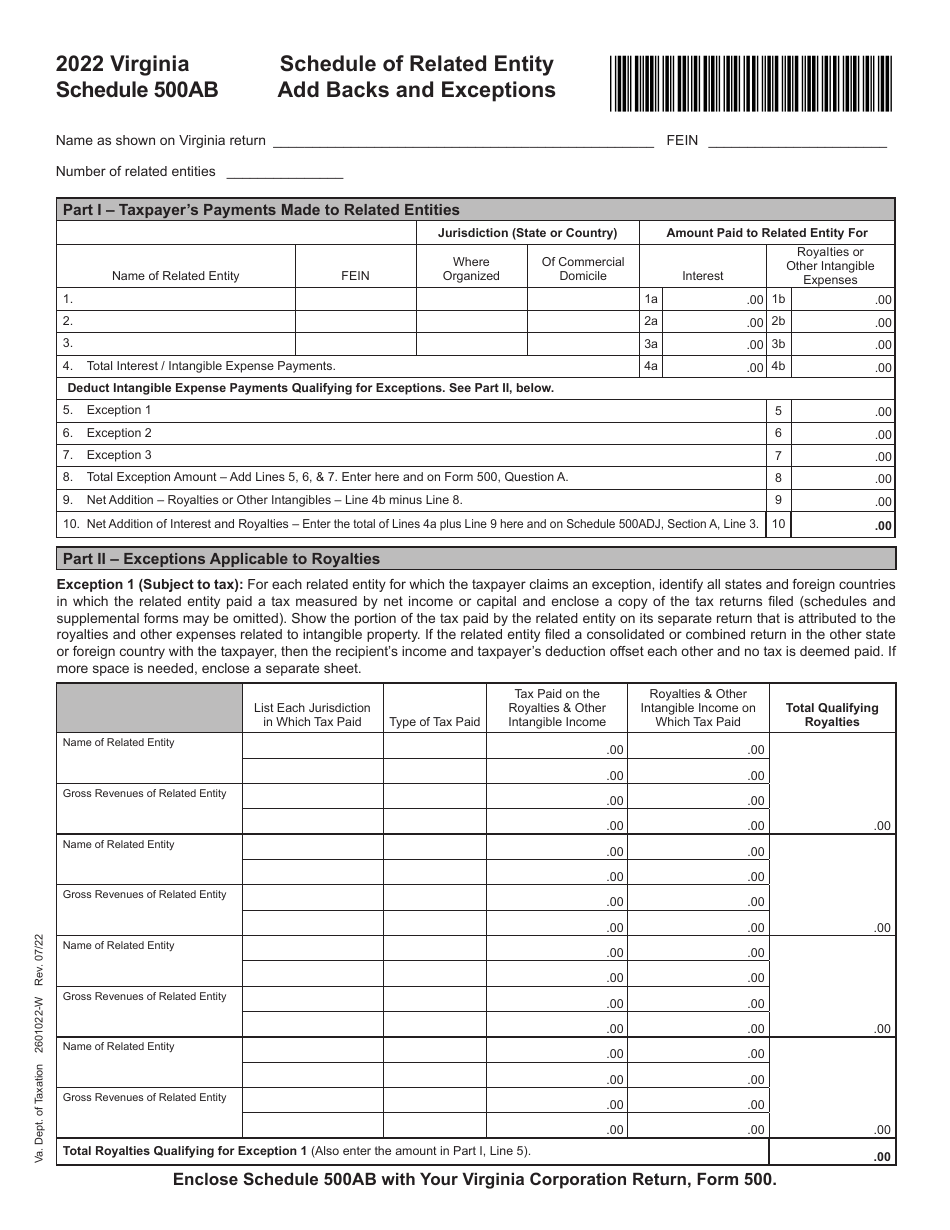

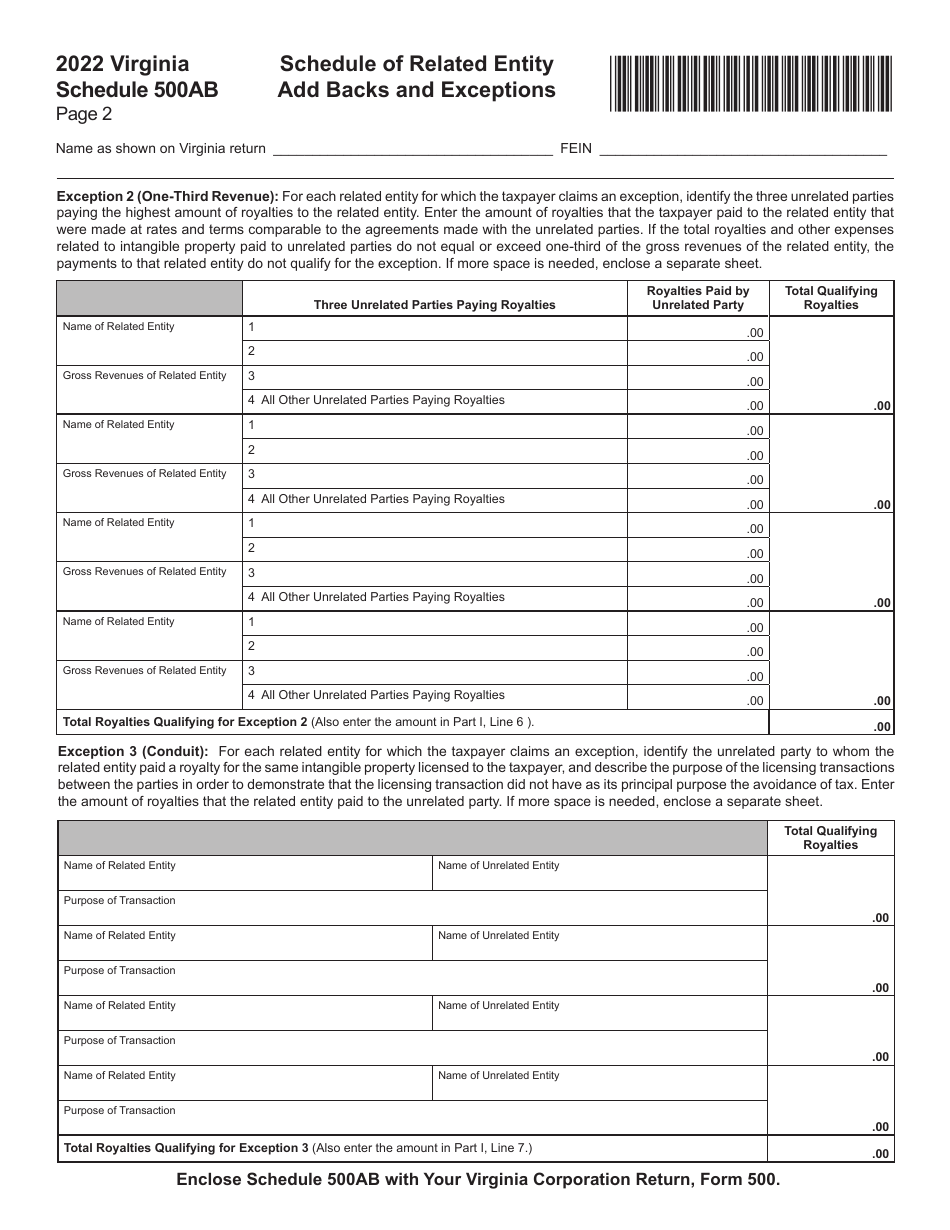

Schedule 500AB

for the current year.

Schedule 500AB Schedule of Related Entity Add Backs and Exceptions - Virginia

What Is Schedule 500AB?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Schedule 500AB?

A: The Schedule 500AB is a document that lists related entityadd backs and exceptions.

Q: What are related entity add backs?

A: Related entity add backs are adjustments made to the financial statements to account for transactions with other entities that are closely related.

Q: What are exceptions on the Schedule 500AB?

A: Exceptions on the Schedule 500AB are circumstances where related entity transactions do not need to be added back.

Q: Why are related entity add backs and exceptions important?

A: Related entity add backs and exceptions are important for accurately reflecting the financial position of a company and ensuring compliance with tax regulations.

Q: What is the purpose of Schedule 500AB?

A: The purpose of Schedule 500AB is to provide transparency and clarity regarding related entity transactions and their impact on the financial statements.

Q: Is the Schedule 500AB specific to Virginia?

A: Yes, the Schedule 500AB is specific to Virginia tax regulations.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 500AB by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.