This version of the form is not currently in use and is provided for reference only. Download this version of

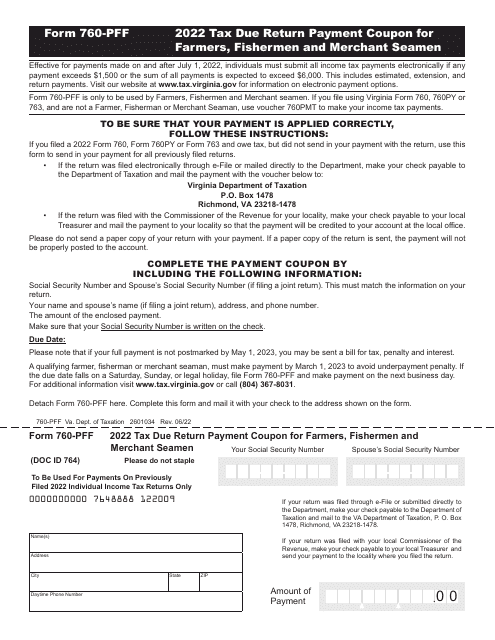

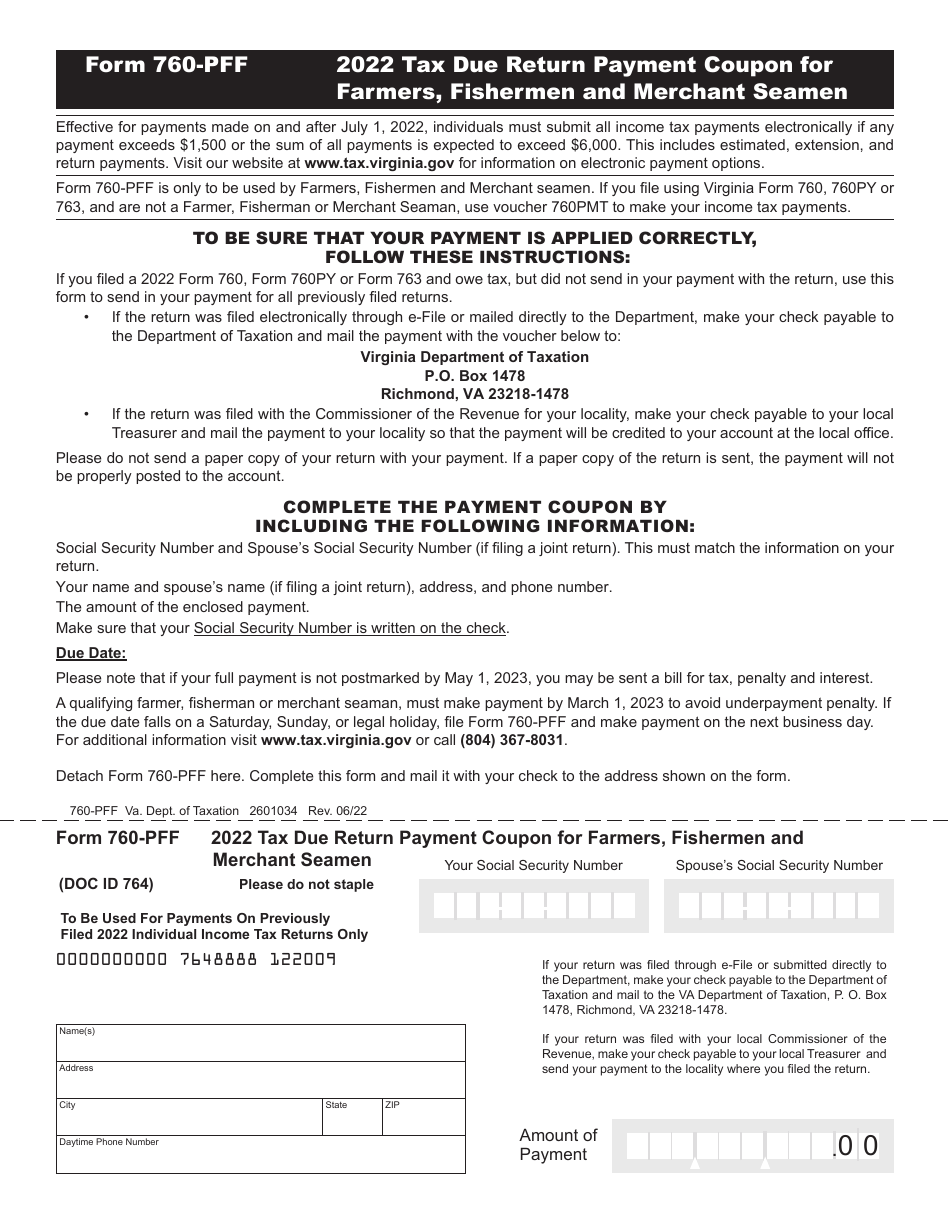

Form 760-PFF

for the current year.

Form 760-PFF Payment Coupon for Previously Filed Individual Income Tax Returns by Farmers, Fishermen and Merchant Seamen - Virginia

What Is Form 760-PFF?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 760-PFF?

A: Form 760-PFF is a payment coupon for farmers, fishermen and merchant seamen to use when paying their individual income tax returns in Virginia.

Q: Who is required to use Form 760-PFF?

A: Farmers, fishermen, and merchant seamen in Virginia who have previously filed their individual income tax returns are required to use Form 760-PFF.

Q: What is the purpose of Form 760-PFF?

A: The purpose of Form 760-PFF is to provide a payment coupon for farmers, fishermen, and merchant seamen to remit the amount of tax due on their previously filed individual income tax returns.

Q: Can Form 760-PFF be used by individuals who are not farmers, fishermen, or merchant seamen?

A: No, Form 760-PFF is specifically designed for farmers, fishermen, and merchant seamen who have previously filed their individual income tax returns in Virginia.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 760-PFF by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.