This version of the form is not currently in use and is provided for reference only. Download this version of

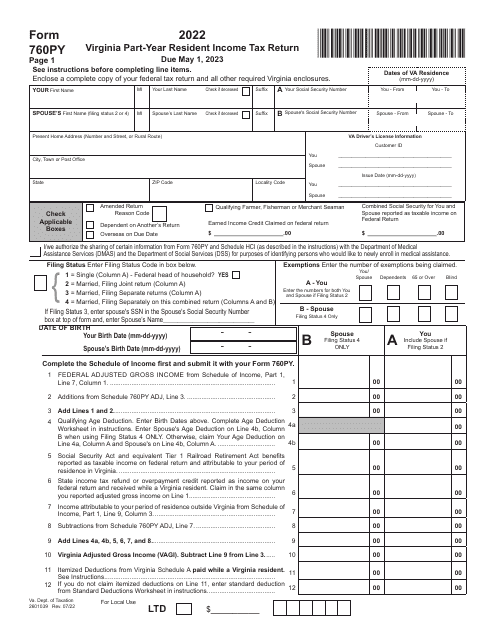

Form 760PY

for the current year.

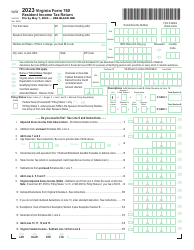

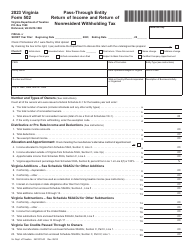

Form 760PY Virginia Part-Year Resident Income Tax Return - Virginia

What Is Form 760PY?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 760PY?

A: Form 760PY is the Virginia Part-Year Resident Income Tax Return.

Q: Who should file Form 760PY?

A: Form 760PY should be filed by Virginia residents who were only residents of the state for part of the year.

Q: What does Part-Year Resident mean?

A: Part-Year Resident refers to someone who was a resident of Virginia for only a portion of the tax year.

Q: What is the purpose of Form 760PY?

A: Form 760PY is used to report income earned while being a part-year resident of Virginia.

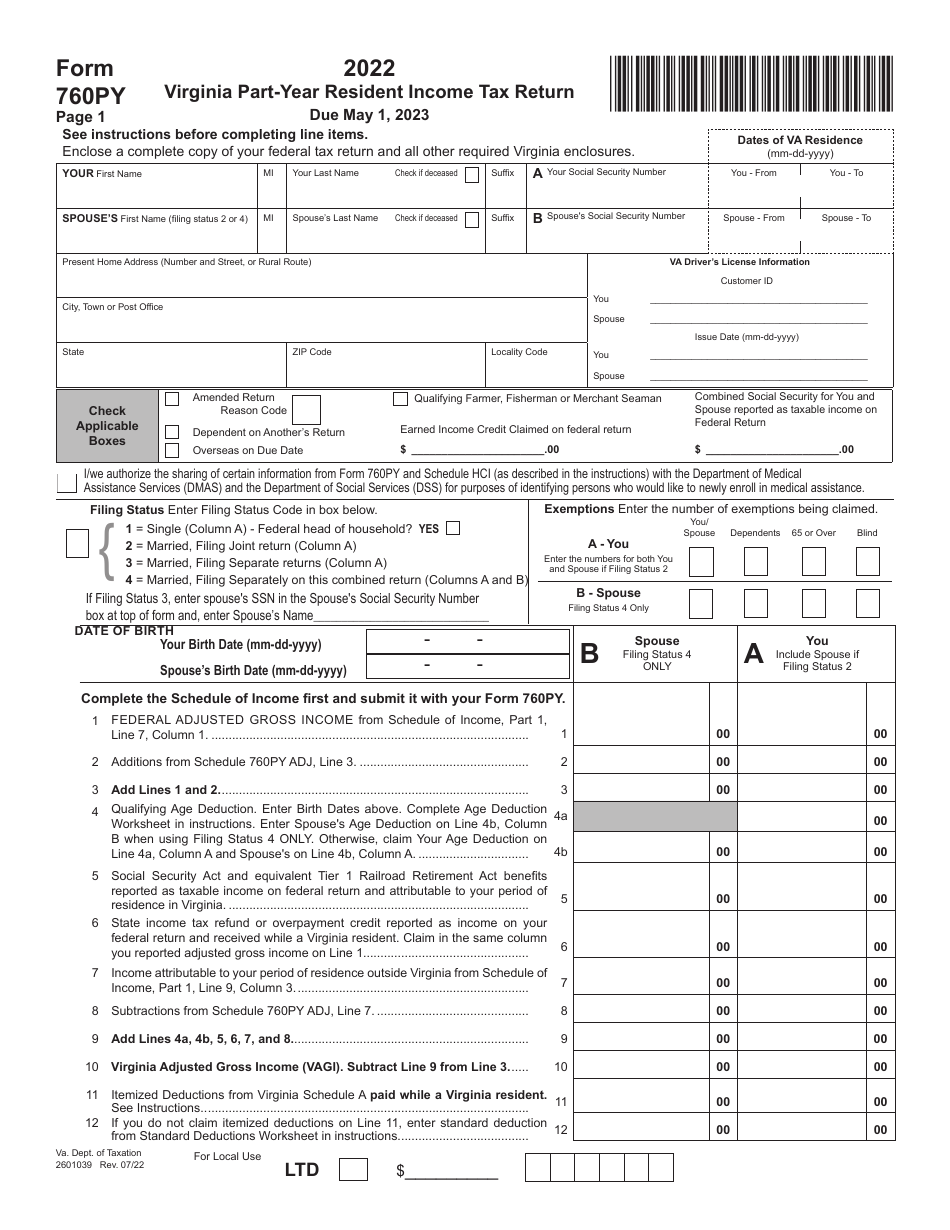

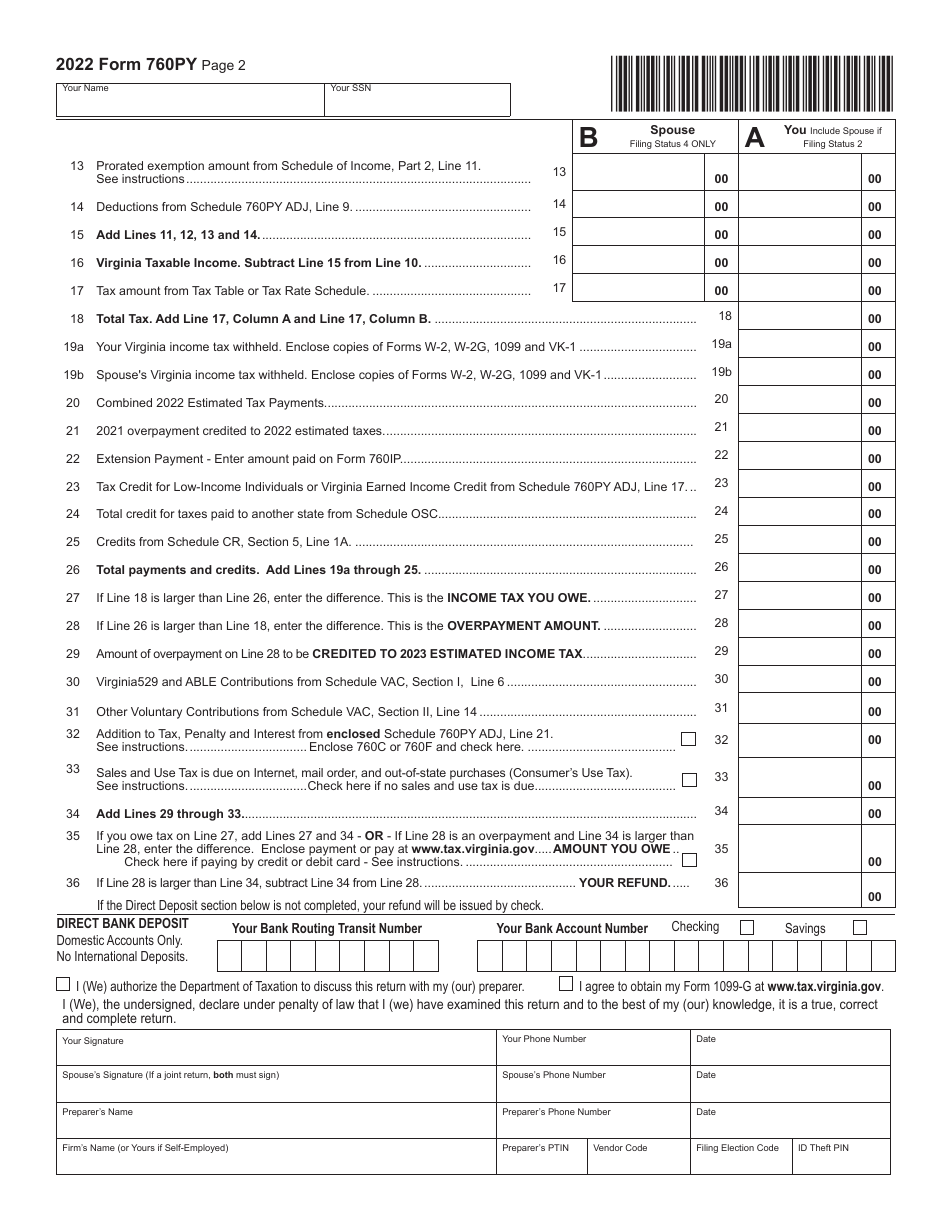

Q: What information do I need to complete Form 760PY?

A: You will need income and deduction information for the period you were a resident of Virginia, as well as information for your total income and deductions for the entire tax year.

Q: What are the deadlines for filing Form 760PY?

A: The deadline to file Form 760PY is May 1st, or the next business day if May 1st falls on a weekend or holiday.

Q: Are there any special considerations for Form 760PY?

A: Yes, if you were a part-year resident of Virginia but earned income in another state, you may need to file a nonresident tax return for that state as well.

Q: Is there a fee to file Form 760PY?

A: No, there is no fee to file Form 760PY.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 760PY by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.