This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule A

for the current year.

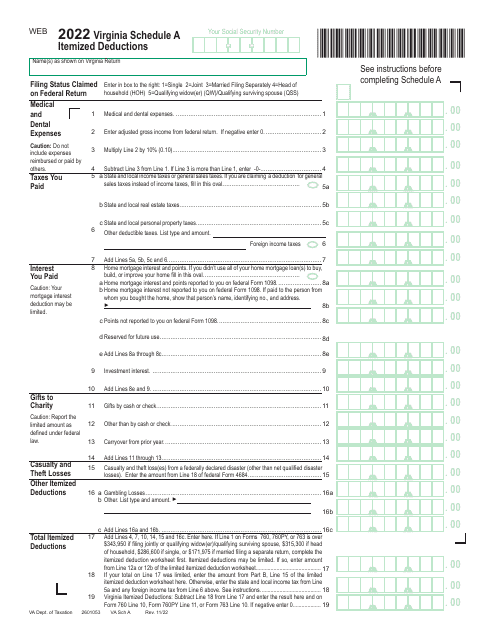

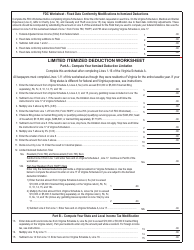

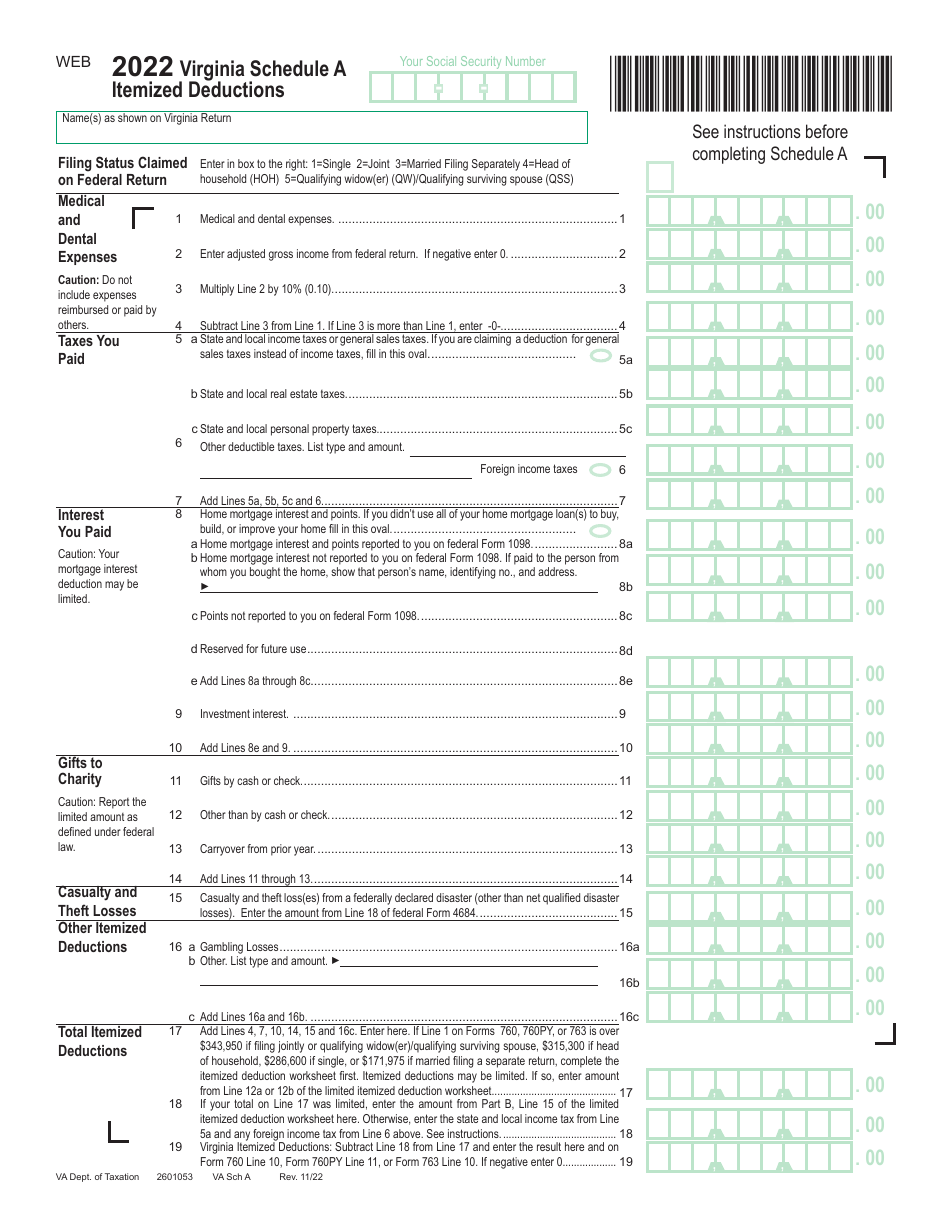

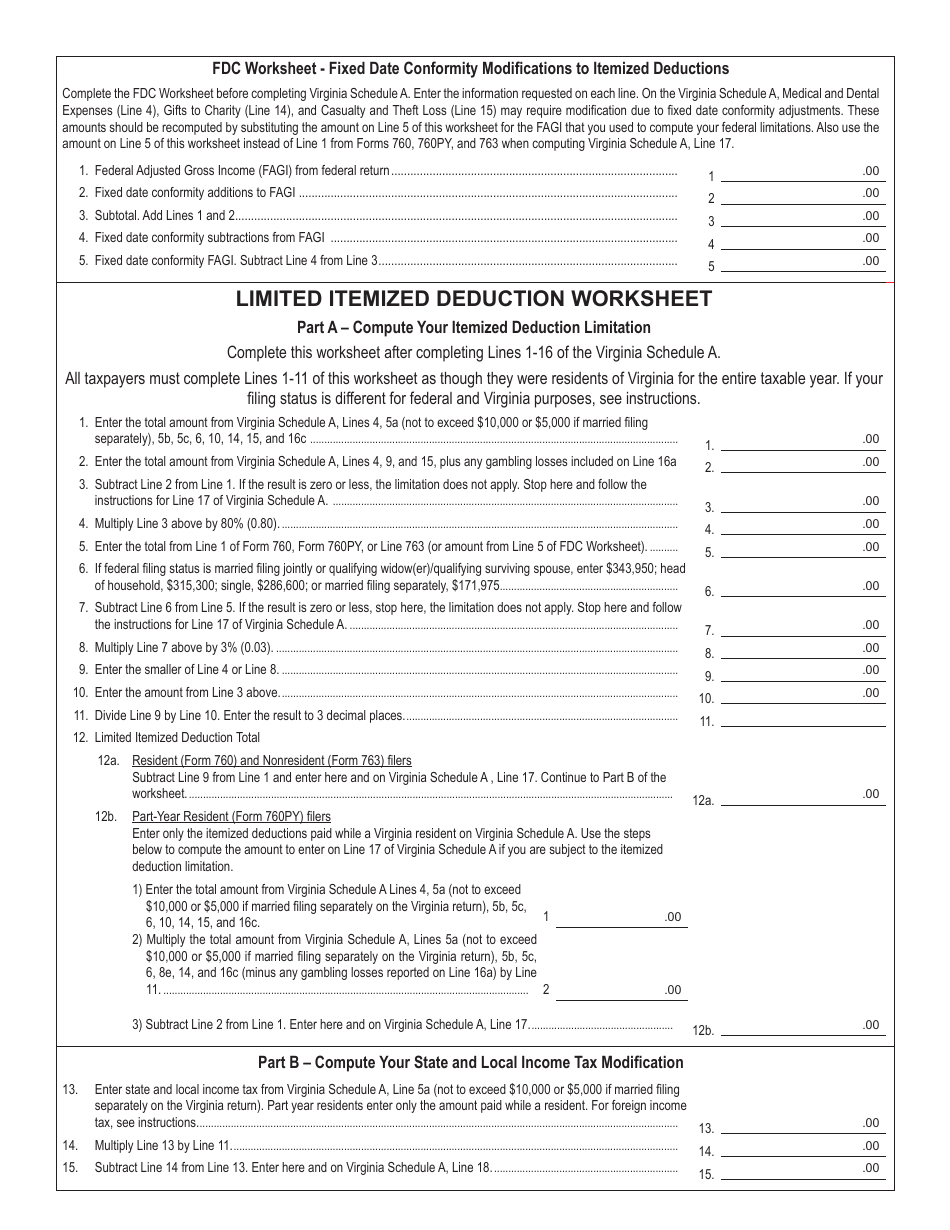

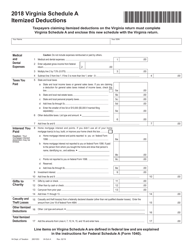

Schedule A Itemized Deductions - Virginia

What Is Schedule A?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What are Schedule A Itemized Deductions?

A: Schedule A Itemized Deductions is a form used to report various deductions that can be made on your federal tax return.

Q: What deductions can be listed on Schedule A Itemized Deductions?

A: Some common deductions that can be listed on Schedule A Itemized Deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions.

Q: Is Schedule A Itemized Deductions applicable for Virginia?

A: No, Schedule A Itemized Deductions is used for federal tax purposes and is not specific to any state. Each state may have its own separate deductions and forms.

Q: What is the purpose of filing Schedule A Itemized Deductions?

A: The purpose of filing Schedule A Itemized Deductions is to potentially lower your taxable income by deducting eligible expenses from your total income.

Q: How do I know if I should itemize deductions on Schedule A?

A: You should consider itemizing deductions on Schedule A if your total eligible deductions exceed the standard deduction set by the IRS.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule A by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.