This version of the form is not currently in use and is provided for reference only. Download this version of

Form 770ES

for the current year.

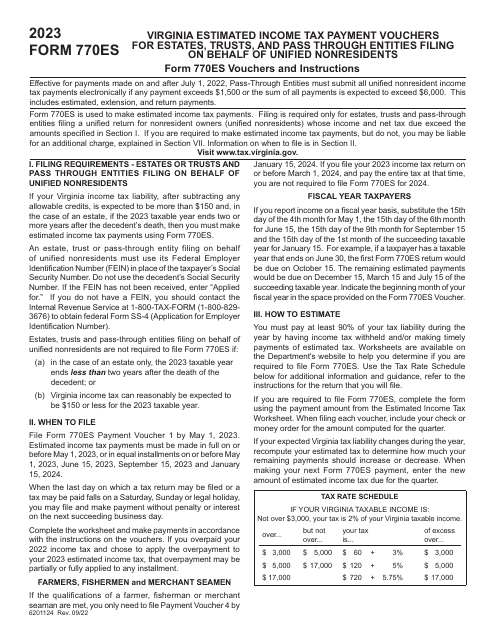

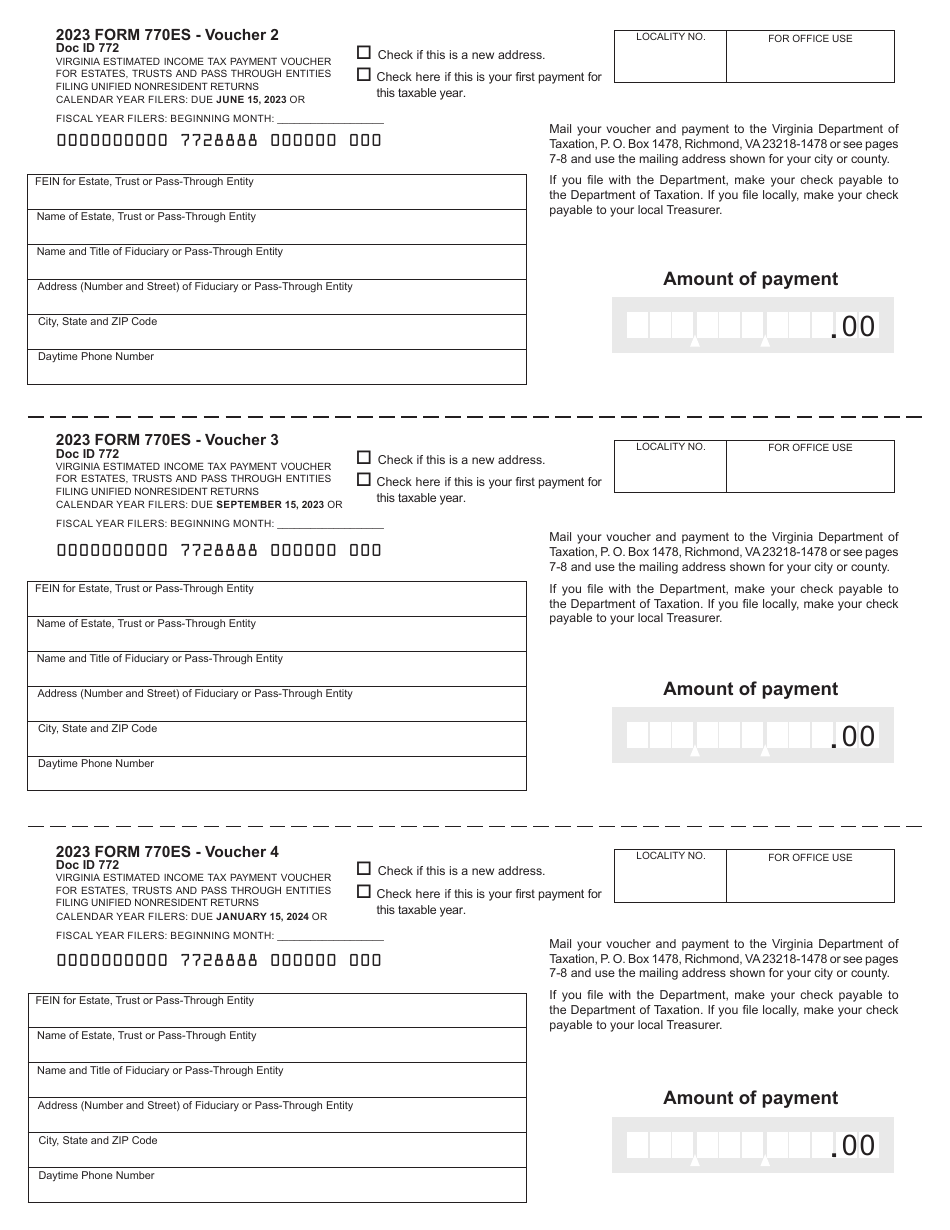

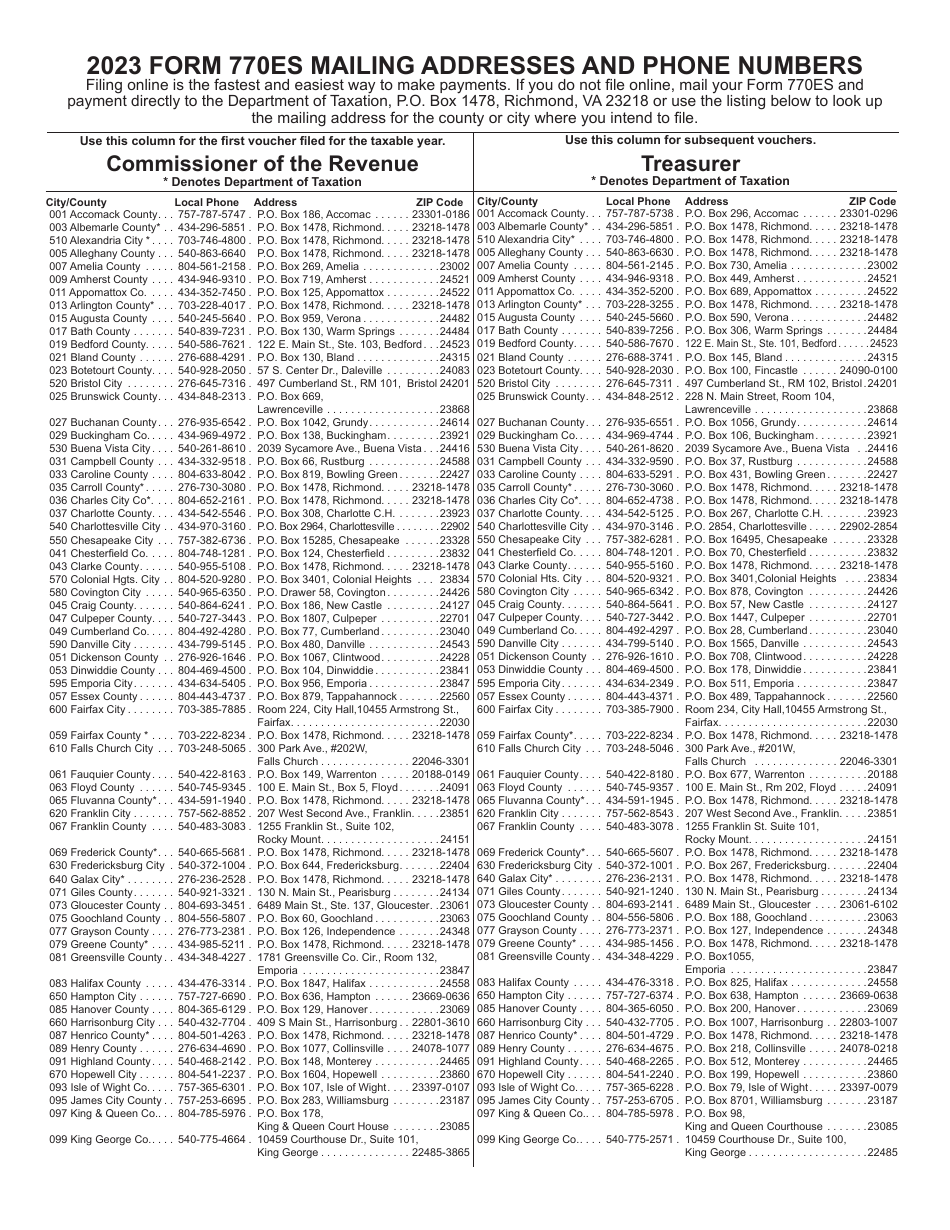

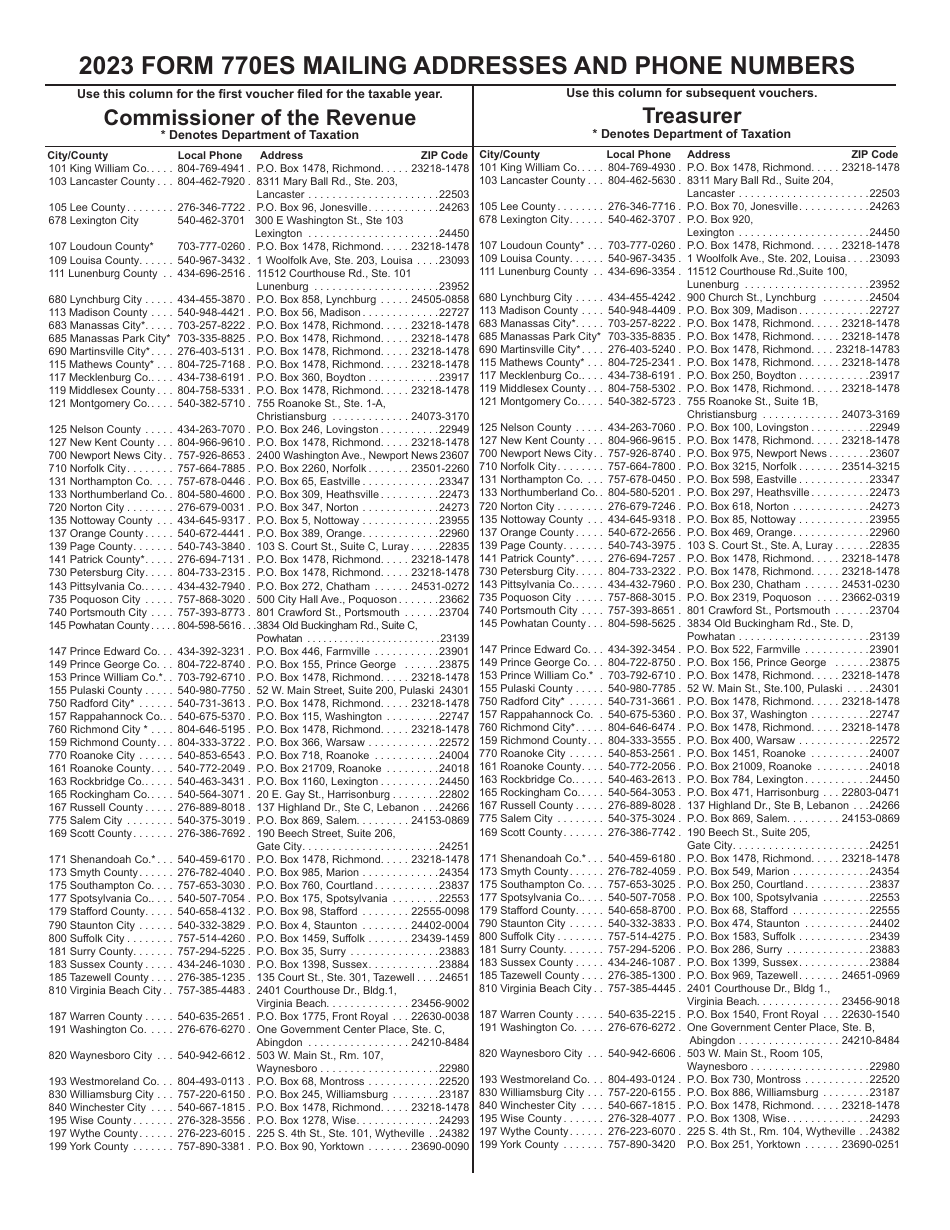

Form 770ES Virginia Estimated Income Tax Payment Vouchers for Estates, Trusts, and Pass Through Entities Filing on Behalf of Unified Nonresidents - Virginia

What Is Form 770ES?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

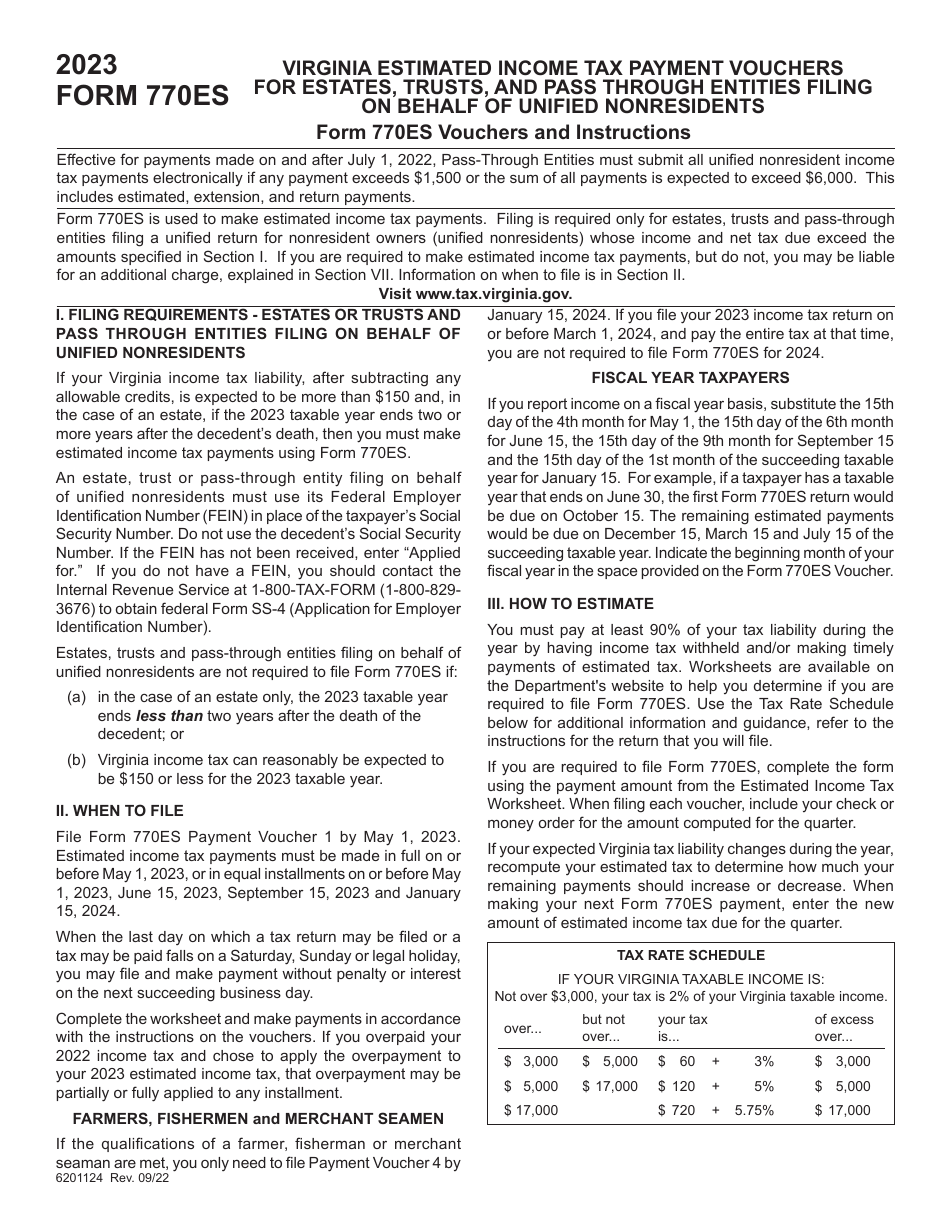

Q: What is Form 770ES?

A: Form 770ES is a Virginia state tax form used by estates, trusts, and pass-through entities to make estimated income tax payments.

Q: Who should use Form 770ES?

A: Estates, trusts, and pass-through entities filing on behalf of unified nonresidents in Virginia should use Form 770ES.

Q: What is the purpose of Form 770ES?

A: The purpose of Form 770ES is to report and pay estimated income tax for estates, trusts, and pass-through entities.

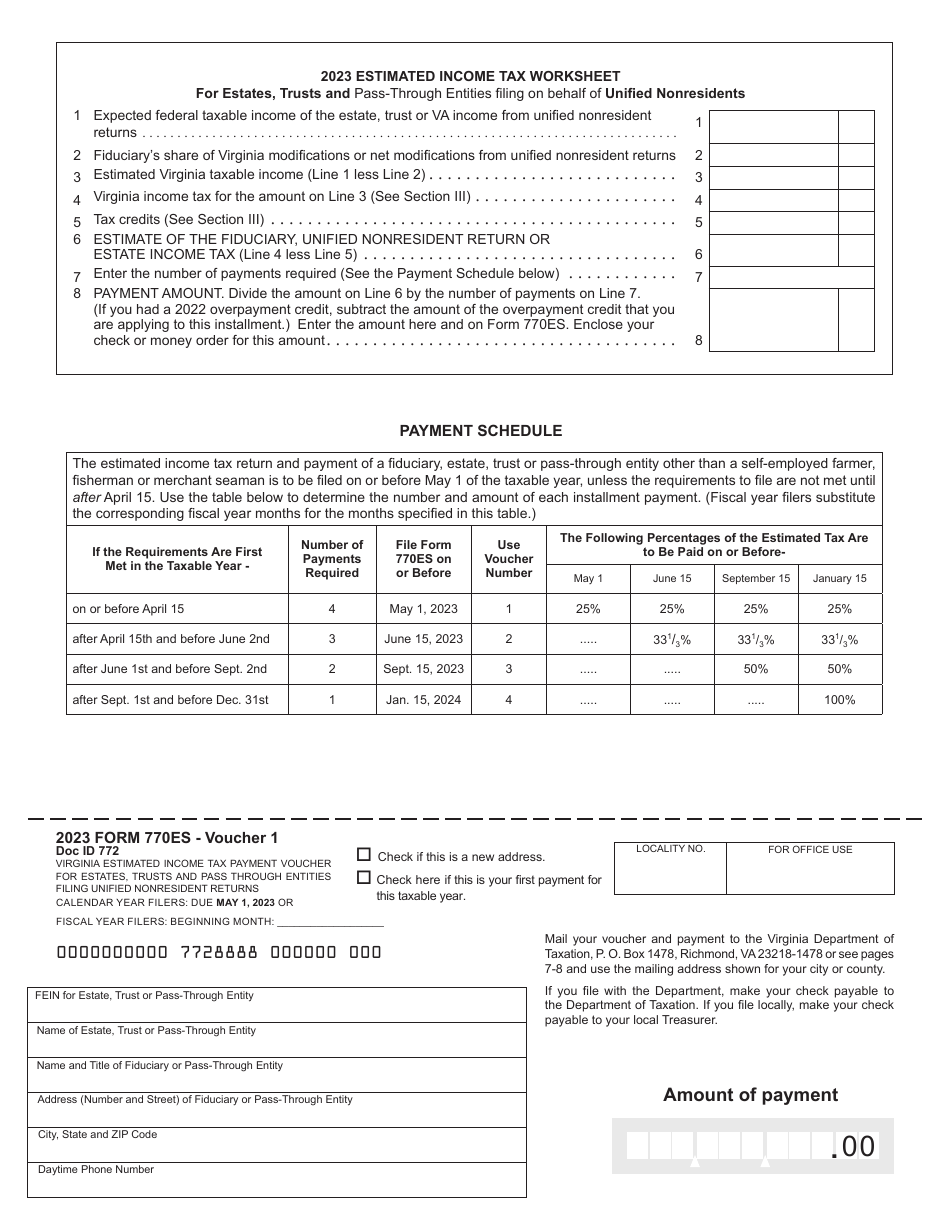

Q: What are estimated income tax payments?

A: Estimated income tax payments are periodic payments made throughout the year to prepay taxes on income that is not subject to withholding.

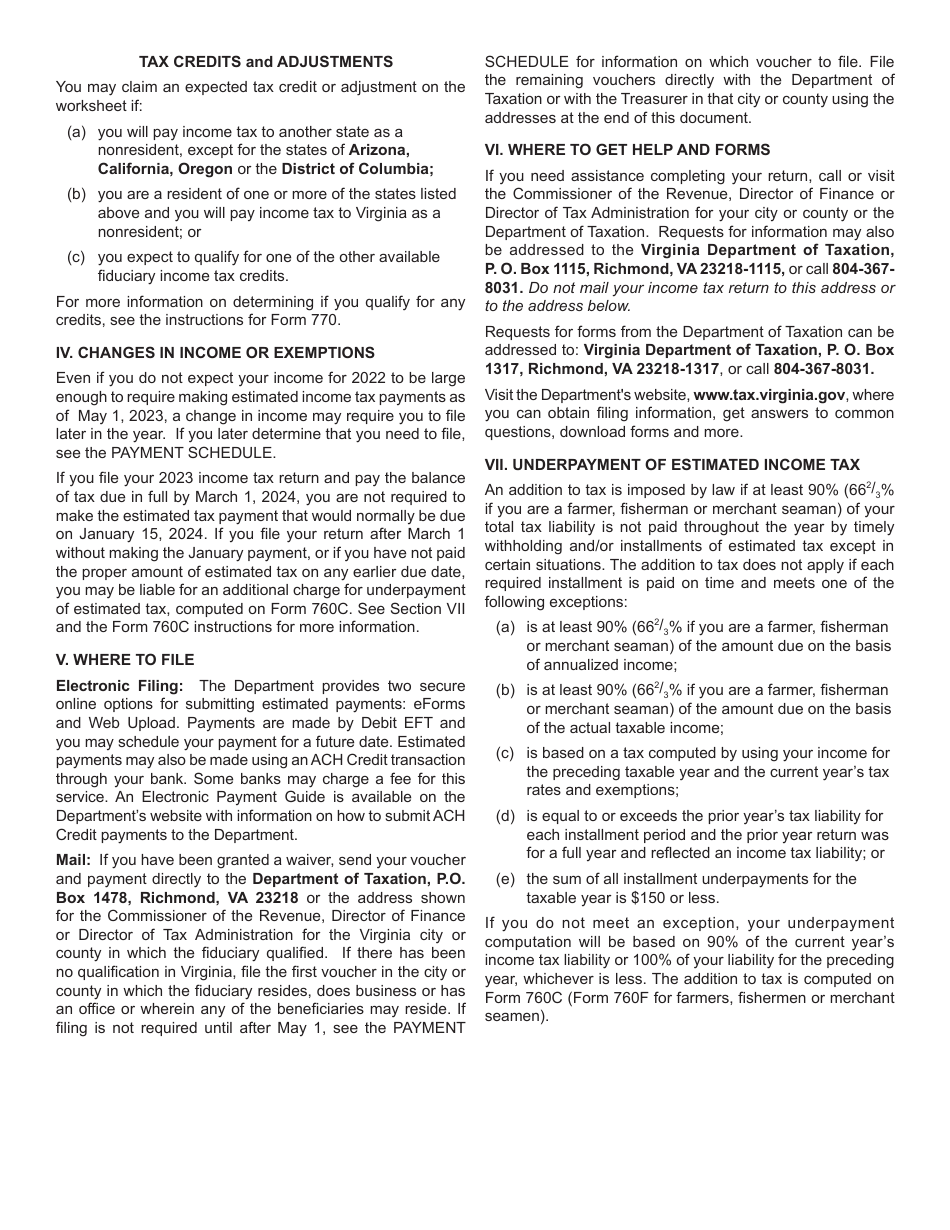

Q: When are Form 770ES payments due?

A: Form 770ES payments are due on a quarterly basis. The due dates are April 15th, June 15th, September 15th, and January 15th of the following year.

Q: What happens if I don't file Form 770ES?

A: If you are required to file Form 770ES and don't do so, you may be subject to penalties and interest on the unpaid taxes.

Q: Are there any exceptions to filing Form 770ES?

A: There may be exceptions for estates, trusts, and pass-through entities that meet certain criteria. You should consult the instructions for Form 770ES or seek professional tax advice.

Q: What other forms and schedules may be required with Form 770ES?

A: Depending on the specific circumstances of the estate, trust, or pass-through entity, additional forms and schedules may be required. You should consult the instructions for Form 770ES or seek professional tax advice.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 770ES by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.