This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-658

for the current year.

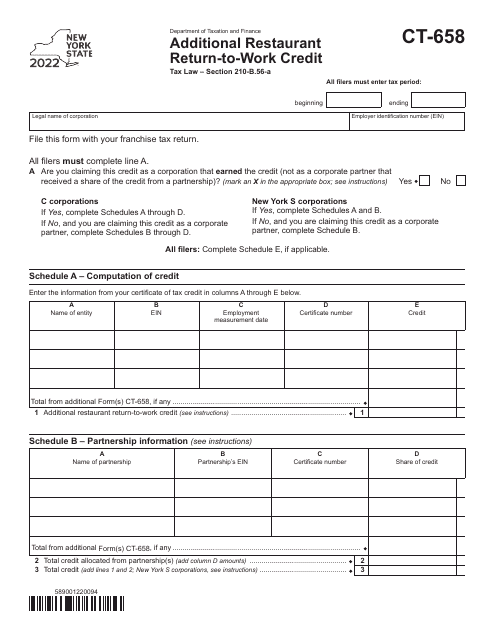

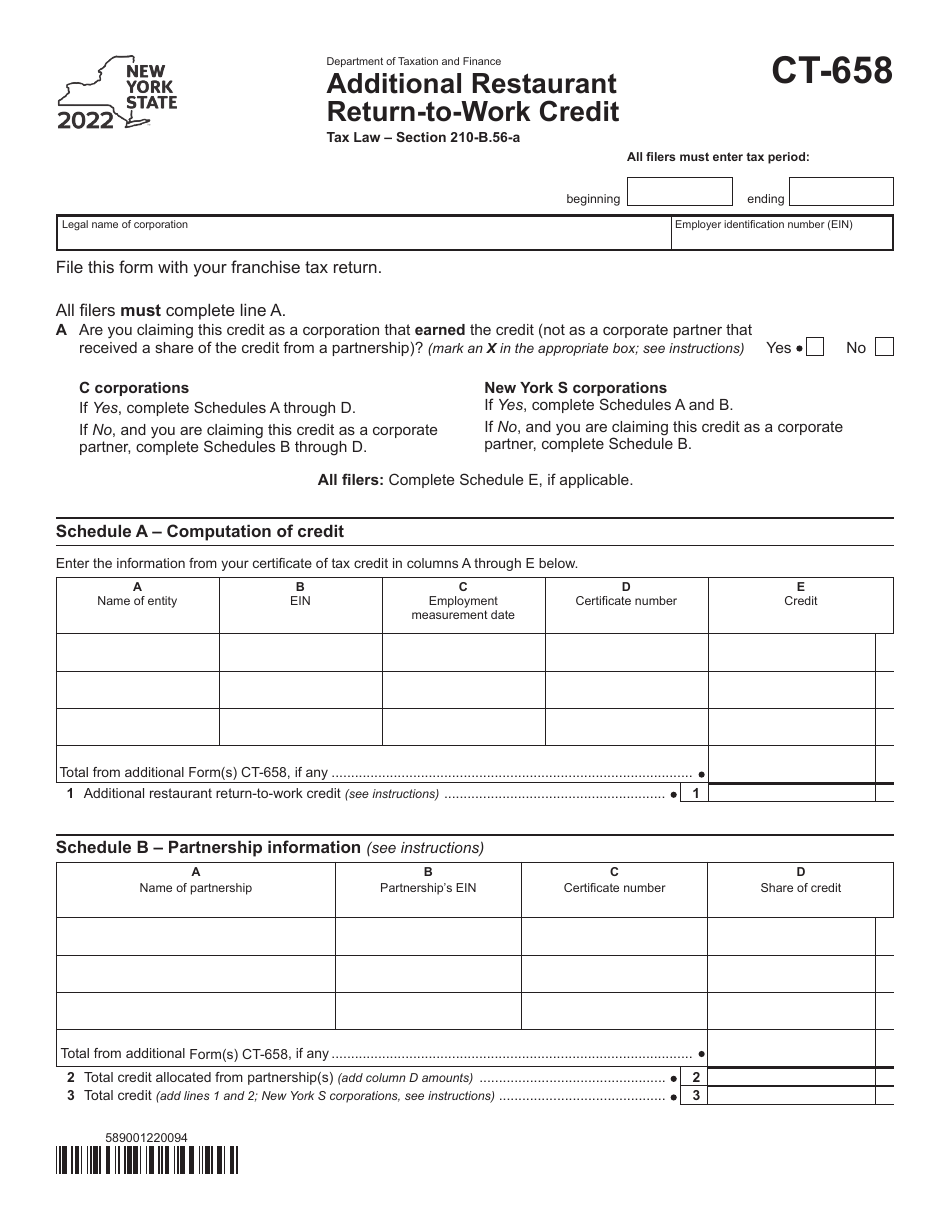

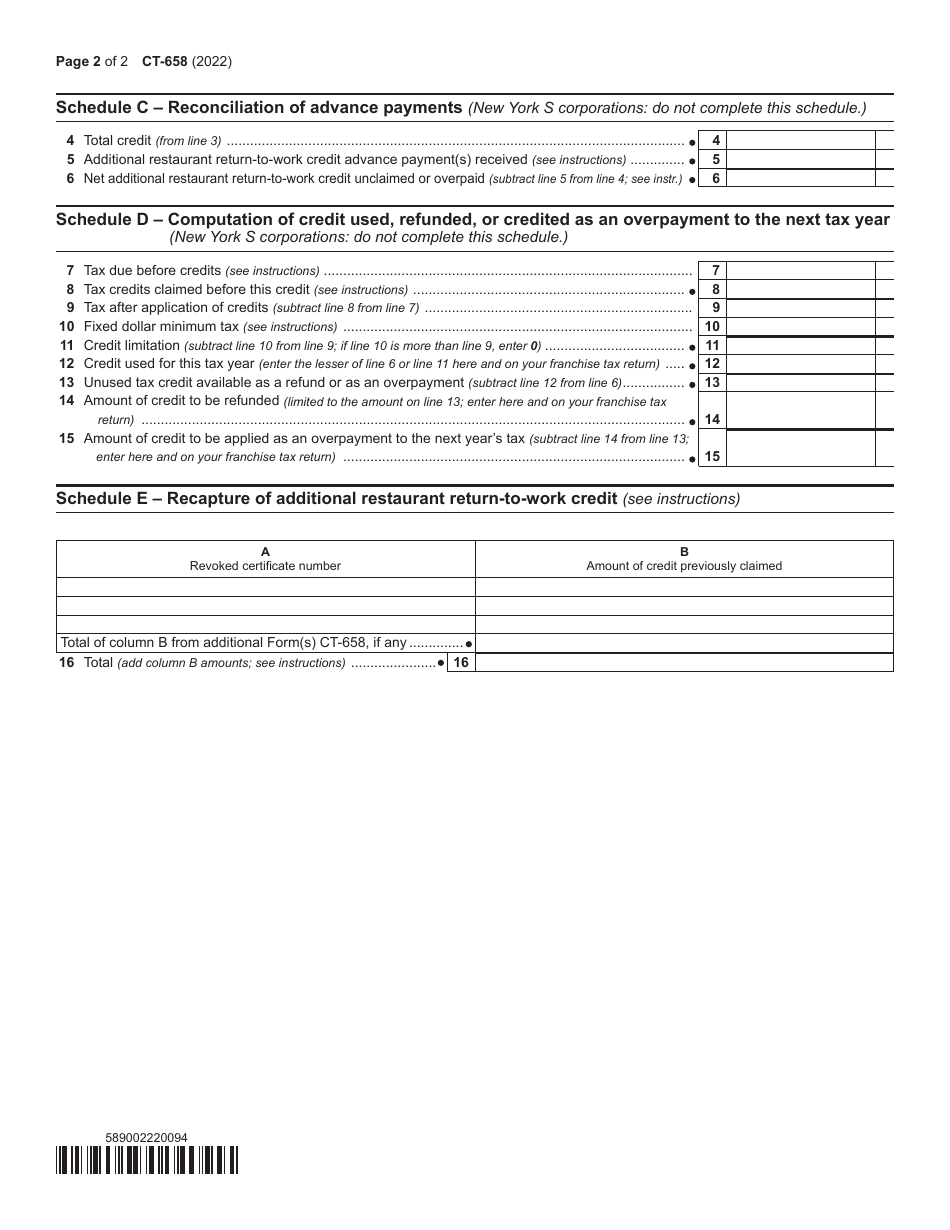

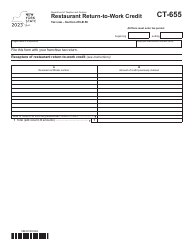

Form CT-658 Additional Restaurant Return-To-Work Credit - New York

What Is Form CT-658?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-658?

A: Form CT-658 is the Additional Restaurant Return-To-Work Credit form used in New York.

Q: What is the purpose of Form CT-658?

A: Form CT-658 is used to claim the Additional Restaurant Return-To-Work Credit in New York.

Q: Who should file Form CT-658?

A: Businesses in the restaurant industry in New York that meet the eligibility criteria should file Form CT-658.

Q: What is the Additional Restaurant Return-To-Work Credit?

A: The Additional Restaurant Return-To-Work Credit is a tax credit introduced in New York to support businesses in the restaurant industry.

Q: What are the eligibility criteria for claiming the credit?

A: The specific eligibility criteria for claiming the Additional Restaurant Return-To-Work Credit can be found in the instructions for Form CT-658.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-658 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.