This version of the form is not currently in use and is provided for reference only. Download this version of

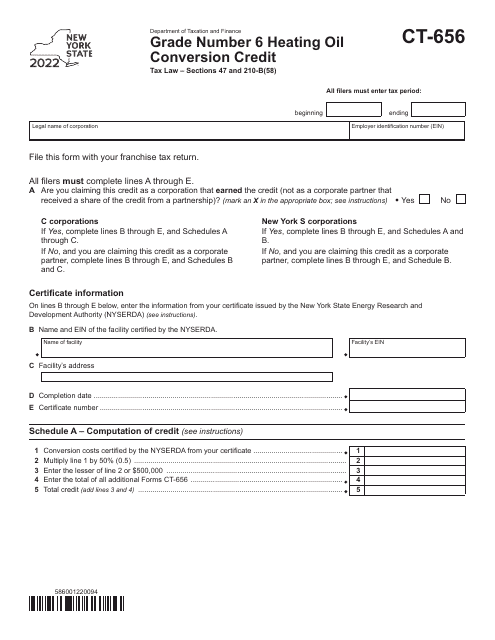

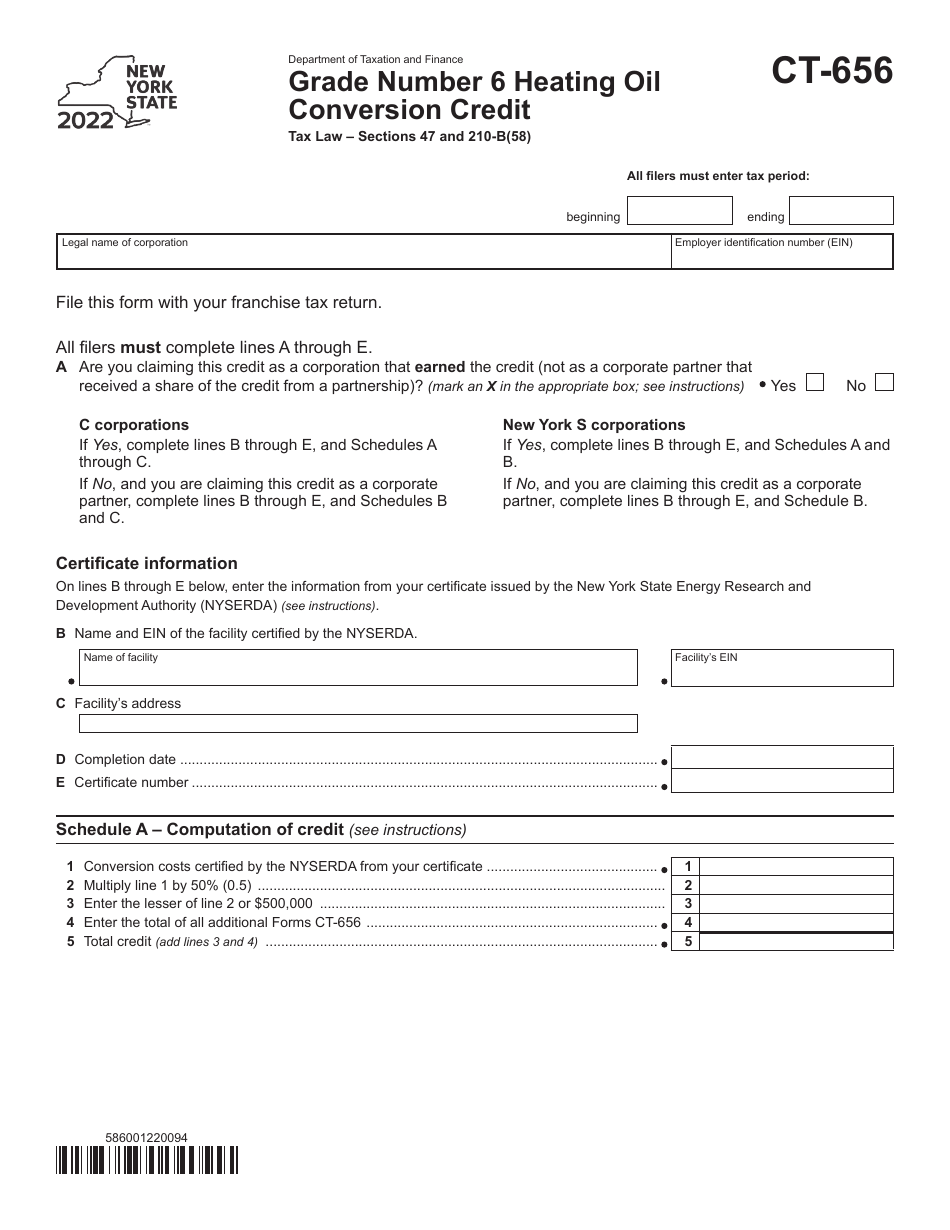

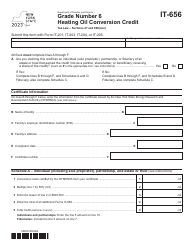

Form CT-656

for the current year.

Form CT-656 Grade Number 6 Heating Oil Conversion Credit - New York

What Is Form CT-656?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-656?

A: Form CT-656 is a form used in New York to claim the Grade Number 6 Heating Oil Conversion Credit.

Q: What is the Grade Number 6 Heating Oil Conversion Credit?

A: The Grade Number 6 Heating Oil Conversion Credit is a tax credit in New York available to eligible taxpayers who converted their heating systems from Grade Number 6 heating oil to another type of fuel.

Q: Who is eligible for the Grade Number 6 Heating Oil Conversion Credit?

A: Eligible taxpayers in New York who converted their heating systems from Grade Number 6 heating oil to another type of fuel may be eligible for this credit.

Q: How can I claim the Grade Number 6 Heating Oil Conversion Credit?

A: To claim this credit, you need to file Form CT-656 with the New York State Department of Taxation and Finance.

Q: Is there a deadline for filing Form CT-656?

A: Yes, there is a deadline for filing Form CT-656. It is usually the same as the deadline for filing your New York State income tax return. It is important to check the current year's instructions for the specific deadline.

Q: Is the Grade Number 6 Heating Oil Conversion Credit refundable?

A: No, the Grade Number 6 Heating Oil Conversion Credit is not refundable. It can only be used to offset your New York State tax liability.

Q: What documentation do I need to support my claim for the Grade Number 6 Heating Oil Conversion Credit?

A: You will need to keep records of the conversion, such as invoices, receipts, and proof of payment for the new heating system and removal or decommissioning of the Grade Number 6 heating oil system.

Q: Can I claim the Grade Number 6 Heating Oil Conversion Credit for multiple years?

A: No, the Grade Number 6 Heating Oil Conversion Credit can only be claimed for the tax year in which the conversion took place.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-656 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.