This version of the form is not currently in use and is provided for reference only. Download this version of

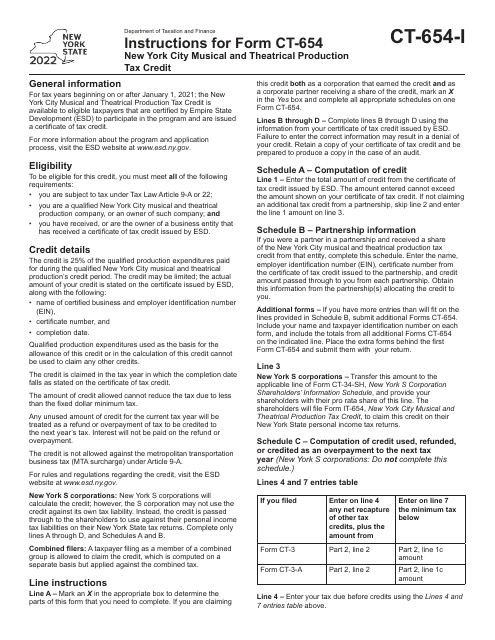

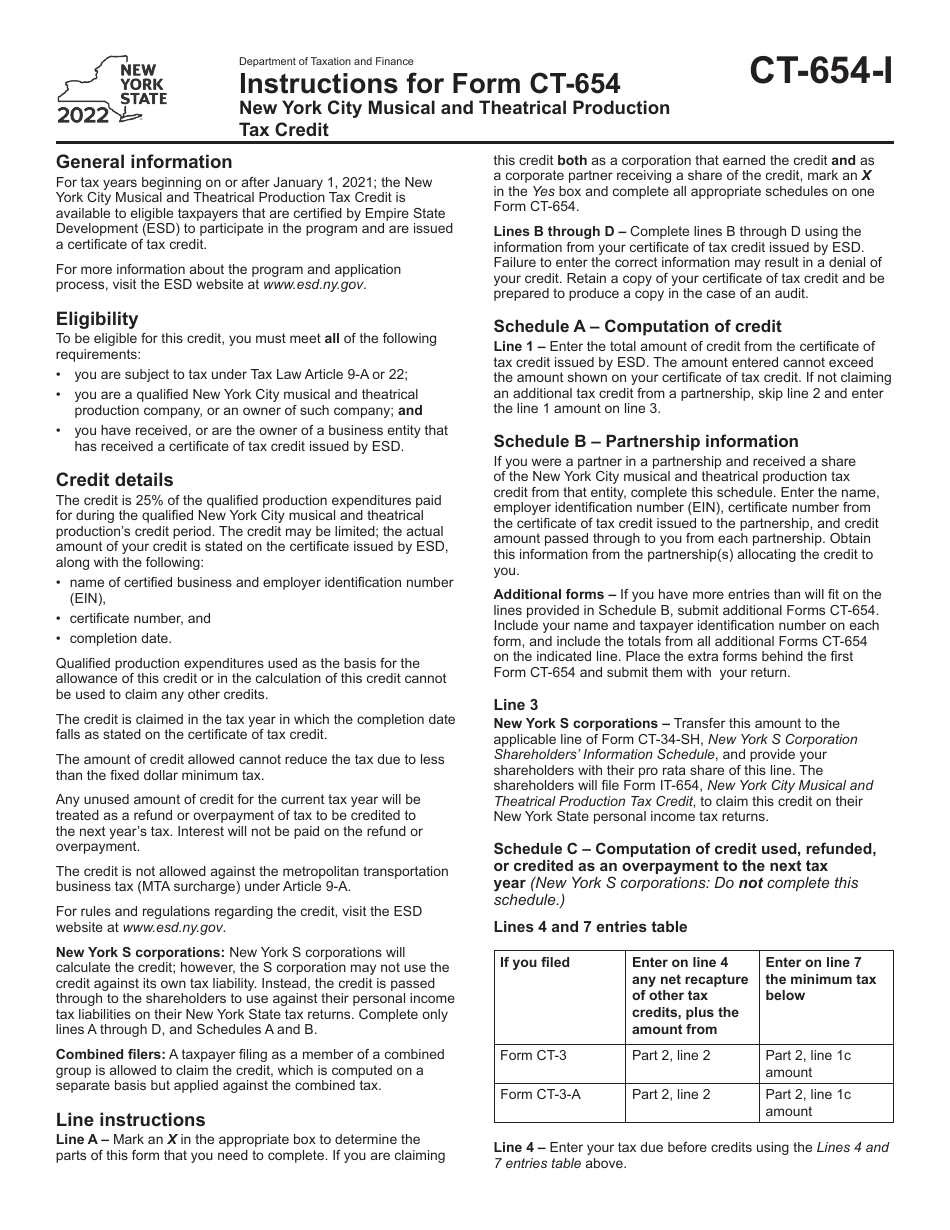

Instructions for Form CT-654

for the current year.

Instructions for Form CT-654 New York City Musical and Theatrical Production Tax Credit - New York

This document contains official instructions for Form CT-654 , New York City Musical and Theatrical Production Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-654 is available for download through this link.

FAQ

Q: What is Form CT-654?

A: Form CT-654 is a tax form used to claim the New York City Musical and Theatrical Production Tax Credit.

Q: Who is eligible for the New York City Musical and Theatrical Production Tax Credit?

A: Eligible individuals or entities include producers of qualifying musical or theatrical productions in New York City that meet certain criteria.

Q: What are the requirements to claim the tax credit?

A: To claim the tax credit, the production must have incurred at least $50,000 in qualified production costs and meet other criteria outlined in the form instructions.

Q: How much is the tax credit?

A: The tax credit is equal to 30% of qualified production costs incurred in New York City.

Q: When is Form CT-654 due?

A: Form CT-654 is generally due within 60 days after the production's first public performance in New York City.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.